In the world of cryptocurrencies, tokenomics plays a crucial role in determining a project’s success and value. Tokenomics, short for “token economics,” refers to the structure and rules governing how a cryptocurrency or token operates within its ecosystem. Moreover, it includes aspects like supply, distribution, utility, and incentives that influence a token’s price, adoption, and long-term viability. For beginners, think of tokenomics as the blueprint that outlines how tokens are created, used, and managed—like the rules of a game that ensure fairness and excitement for all players.

This article dives into three key elements of tokenomics: token burns, locks, and liquidity provision. These mechanisms help control supply, build trust, and enable smooth trading. Furthermore, we’ll explain each in simple terms, with real-world examples, to help newcomers grasp why they matter. By understanding these, you’ll be better equipped to evaluate crypto projects and make informed decisions.

What Is Tokenomics and Why Does It Matter?

At its core, tokenomics defines the economic model behind a token. Specifically, it answers questions like: How many tokens exist? How are they distributed? What can you do with them? Ultimately, a well-designed tokenomics model creates scarcity, encourages participation, and aligns incentives between users, developers, and investors.

For instance, Bitcoin’s tokenomics is famous for its fixed maximum supply of 21 million coins, which creates scarcity similar to gold. In contrast, this differs from tokens like Ethereum, which has no hard cap but uses mechanisms to manage inflation. Poor tokenomics can lead to price crashes or project failure, while strong ones foster growth. According to experts, tokenomics impacts everything from investor confidence to ecosystem sustainability.

Key components include:

Supply Metrics: Circulating supply (tokens available now), total supply (including locked ones), and max supply (the absolute limit).

Distribution: How projects allocate tokens, such as through mining, staking, or airdrops.

Utility: Real-world uses, like paying fees or voting in governance.

Incentives: Rewards or penalties that projects design to encourage behaviors, like holding or providing liquidity.

Consequently, burns, locks, and liquidity are tools within this framework to manage supply and demand dynamically. Let’s break them down.

Understanding Token Burns: Reducing Supply for Scarcity

Token burning is a deflationary mechanism where projects permanently remove tokens from circulation. As a result, this reduces the overall supply, potentially increasing the value of remaining tokens through basic supply and demand principles—fewer tokens chasing the same demand can drive prices up. It’s like a company buying back its shares to boost stock value.

How Token Burns Work

Projects “burn” tokens by sending them to a special wallet address (often called a “burn address”) with no private key, making them irretrievable. Additionally, this process is transparent and verifiable on the blockchain. Burns can be:

Scheduled: Regular events, like quarterly burns.

Transaction-Based: A portion of fees from each trade that projects burn automatically.

One-Time Events: Large burns that teams execute to adjust supply dramatically.

Therefore, burns counteract inflation from new token minting and signal a project’s commitment to value preservation.

Examples of Token Burns

Ethereum (ETH): Since the 2021 EIP-1559 upgrade, Ethereum burns a portion of transaction fees. During high network activity, burns can exceed new issuance, making ETH temporarily deflationary. To understand how this mechanism works in detail, read our guide on how EIP-1559 makes Ethereum more predictable and when it can help investors. Cumulatively, this has destroyed millions of ETH worth tens of billions of USD since August 2021.

Binance Coin (BNB): Binance runs periodic burns aiming to reduce BNB’s total supply from 200 million to 100 million. Furthermore, they use an auto-burn formula plus gas-fee burns on BNB Chain. For a comprehensive overview of BNB’s tokenomics and burn mechanisms, check out our ultimate guide to Binance Coin.

Shiba Inu (SHIB): In May 2021, Vitalik Buterin burned roughly 410 trillion SHIB, a landmark one-time event. Subsequently, the community has continued smaller burns since. The dollar value fluctuates with price; at the time it was estimated around several billions of USD.

Stellar (XLM): In 2019, the Stellar Development Foundation burned 55 billion XLM, cutting the total supply roughly in half from approximately 105 billion to 50 billion.

Benefits and Risks for Beginners

Burns build investor confidence by demonstrating long-term commitment and can stabilize prices during volatility. However, they’re not a guarantee of success—projects need strong utility too. On the other hand, risks include over-reliance on burns without real demand, leading to hype-driven pumps and dumps. Always check a project’s whitepaper for burn schedules.

In tokenomics, burns are a powerful tool for creating scarcity, but they work best when combined with growing adoption.

The Role of Token Locks: Building Trust Through Restriction

Token locks, or vesting, involve restricting access to tokens for a set period. Importantly, this prevents sudden floods of supply that could crash prices, often called “dumps.” Consequently, locks align incentives by ensuring teams and investors commit long-term, reducing risks like “rug pulls” where creators abscond with funds.

How Token Locks Work

Projects lock tokens via smart contracts, which enforce time-based or milestone-based releases. For example:

Vesting Schedules: Many projects implement multi-year vesting (e.g., 1–4 years) for team and investor allocations. As a result, this discourages immediate selling after token generation events.

Liquidity Locks: In DeFi, LP (liquidity provider) tokens from DEX pools can be locked in third-party lockers like Team Finance or UNCX. Therefore, the project can’t suddenly withdraw the pool—mitigating rug-pull risk. To explore more DeFi protocols and their security mechanisms, visit our guide to the top 10 DeFi protocols across all chains.

Clarification: Uniswap itself does not force “locked” liquidity by default. Instead, LPs deposit into pools and can withdraw unless they voluntarily send the LP tokens to a time-lock. Projects often lock LP tokens post-launch to signal safety.

Examples of Token Locks in DeFi

Uniswap (UNI) Ecosystem: Projects launching on Uniswap commonly lock LP tokens via lockers to prevent liquidity withdrawal and build trust. Learn more about how Uniswap operates in our complete guide to token swapping on Ethereum.

Team & Investor Allocations: Many token launches use vesting for insiders. However, specifics vary by project as teams consider it best practice rather than a universal rule.

Staking Mechanics: On Ethereum, staking reduces liquid supply, but since the Shanghai/Capella upgrade on April 12, 2023, users can now withdraw staked ETH subject to exit queues. Therefore, it is no longer locked until an unknown future upgrade.

Game-Theory-Heavy Models: Some protocols like Olympus DAO use staking/bonding designs that encourage holding. Nevertheless, they’ve also shown that poor risk controls can lead to sharp drawdowns—illustrating that locks alone don’t prevent volatility.

Benefits and Risks for Beginners

Locks prevent volatility from unlocks and signal legitimacy—look for projects with audited locks and transparent schedules that reputable lockers publish. For investors, locked liquidity means safer trading without fear of sudden drains. Conversely, overly long locks can limit flexibility, and poor implementation might trap funds if contracts have bugs. Beginners should verify locks on chain and via locker dashboards.

Locks are essential in tokenomics for stability, turning short-term hype into sustainable growth.

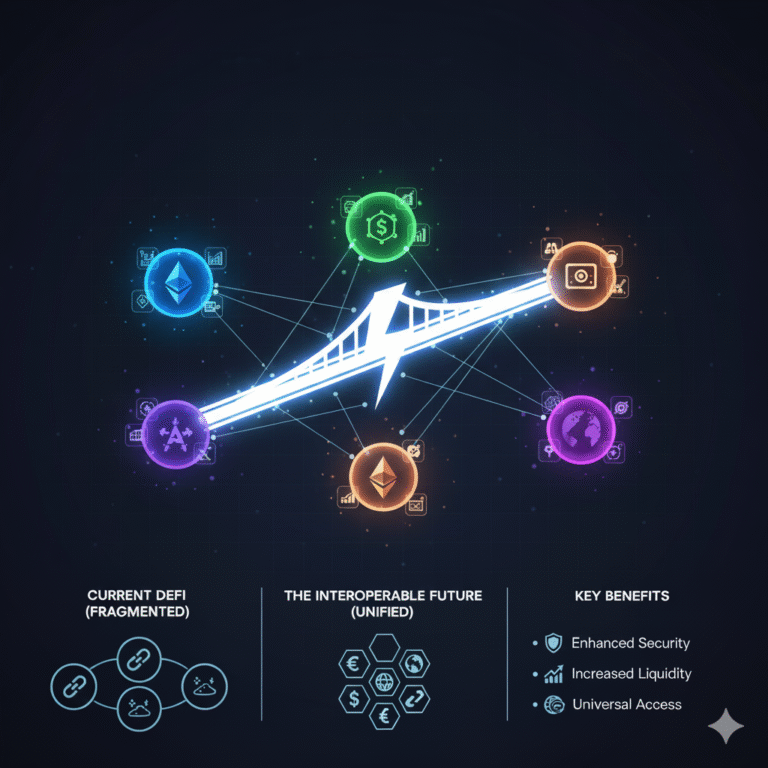

Liquidity Provision: Enabling Smooth Trading

Liquidity refers to how easily tokens can be bought or sold without big price swings. In crypto, liquidity provision means supplying tokens to pools on decentralized exchanges (DEXs) like Uniswap, allowing trades. Subsequently, providers earn fees from swaps, making it a passive income source.

How Liquidity Provision Works

In automated market makers (AMMs), users deposit equal values of two tokens (e.g., ETH/USDC) into a pool. Then, they receive LP tokens representing their share. When someone trades, they pay a fee that the protocol distributes to providers. Uniswap v3 introduced concentrated liquidity, letting providers choose price ranges for higher capital efficiency. Additionally, common fee tiers on Uniswap are 0.01%, 0.05%, 0.3%, and 1% (v3 added multiple tiers; v2 used 0.3% by default).

Moreover, as Layer 2 solutions like Base continue to scale Ethereum, liquidity provision becomes more cost-effective for smaller investors. Discover more about how Base by Coinbase scales Ethereum in our beginner’s guide to Layer 2 blockchain solutions.

Examples of Liquidity Provision

Uniswap Pools: A beginner might provide $500 ETH and $500 USDC to the ETH/USDC pool. If trades occur, they earn fees proportional to their share.

Yield Farming: Providers can stake LP tokens in additional contracts to earn extra rewards.

Liquid Staking: Services like Lido issue liquid staking tokens (e.g., stETH) that users can trade or pair in pools—providing liquidity while staking.

Benefits and Risks for Beginners

Liquidity provision boosts ecosystem health by reducing slippage (price impact on large trades). However, the main risk is impermanent loss—when the relative price of the two assets diverges compared with simple holding. Understand impermanent loss before providing liquidity; it’s a fundamental AMM trade-off, not a bug.

Note: Returns (APY) vary widely by pair, volume, and price range. Therefore, avoid relying on fixed “typical” ranges; always review current pool data and fees for the specific pair on platforms like Uniswap Analytics.

Why Burns, Locks, and Liquidity Shape Successful Tokenomics

These mechanisms work together to create balanced ecosystems. Specifically, burns reduce supply for scarcity, locks prevent dumps for stability, and liquidity enables trading for utility. For example, a project might burn fees, lock team tokens, and incentivize liquidity provision to attract users.

For beginners, evaluate tokenomics by checking supply caps, burn rates, lock durations, and liquidity depth on reputable dashboards and explorers like Etherscan or CoinGecko. Strong tokenomics, like Bitcoin’s supply schedule or Ethereum’s fee-burn plus staking dynamics, can support enduring value. Nevertheless, no mechanism guarantees success. Look for real utility, transparent governance, and an engaged community.

In summary, mastering these concepts empowers you to navigate crypto confidently. Whether investing or building, tokenomics is the foundation of blockchain innovation.

Related Resources: