Have you ever wondered why so many people lose money in crypto? In the first half of 2025 alone, investors lost around $3.1 billion to crypto-related scams and hacks according to industry reports.

Crypto scams are everywhere these days, preying on beginners and even seasoned investors who let their guard down. If you’re new to this world or just dipping your toes in, it’s easy to get excited about quick gains and overlook the dangers. I’ve been writing about crypto for years, and trust me, I’ve seen friends and readers fall victim to these tricks. But here’s the good news: with the right knowledge, you can spot and avoid them entirely.

In this complete protection guide, we’ll break down everything you need to know about crypto scams. We’ll cover the most common types, red flags to watch for, and practical steps to keep your funds safe. Whether you’re a complete beginner or an intermediate investor, this article will equip you with tools to navigate the crypto space confidently.

To kick things off, let’s look at a quick comparison of common crypto scams versus legitimate opportunities. This table will help you spot the differences at a glance.

| Scam Type | Key Characteristics | Legit Counterpart | Risk Level |

|---|---|---|---|

| Phishing Attacks | Fake emails or sites stealing your info | Official exchange apps with 2FA | High |

| Rug Pulls | Projects where devs dump tokens suddenly | Established coins with transparent teams | Very High |

| Pig Butchering | Romance/build trust then invest in fake schemes | Real investments via reputable platforms | High |

| Fake Giveaways | Promise free crypto for sending first | Genuine airdrops from verified projects | Medium |

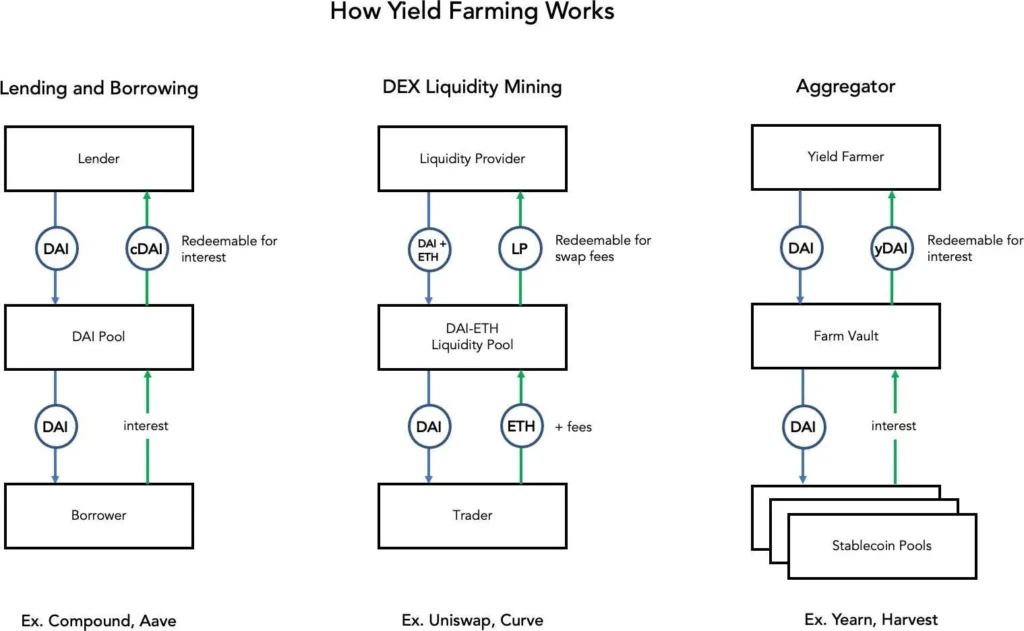

| Ponzi Schemes | Promise high returns from new investors’ money | Sustainable yield farming on DeFi | Extreme |

Understanding the Rise of Crypto Scams

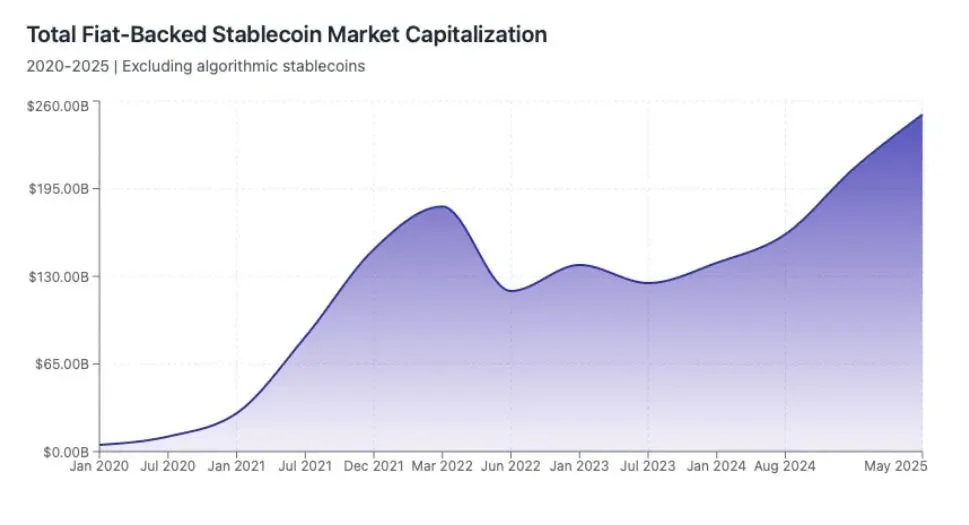

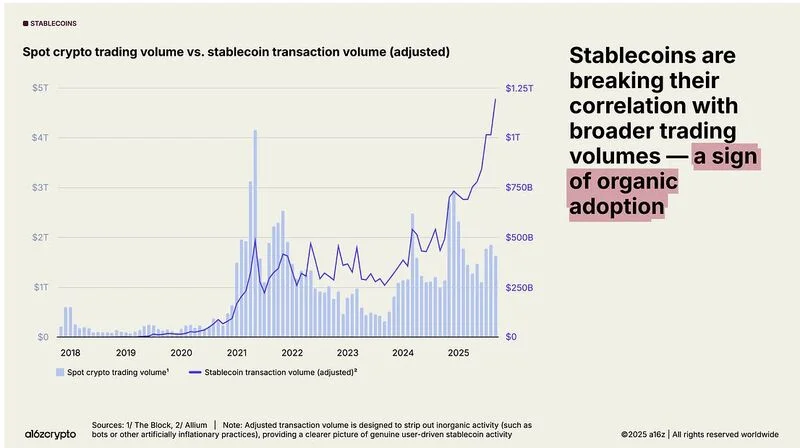

Crypto scams aren’t new, but they’ve exploded in recent years. Back in 2024, Americans lost approximately $9.3 billion to cryptocurrency fraud according to the Federal Trade Commission, and by the first half of 2025, reports already estimate about $3.1 billion gone across Web3 hacks and scams.

Why? Because crypto’s popularity draws in crowds, and where there’s money, scammers follow. Think about it like this: it’s similar to the gold rush days, where con artists sold fake maps to miners. Today, they’re selling fake promises online.

I’ve covered countless stories, and one thing stands out—most victims are beginners who rush in without research. If you’re just starting out and want to learn how to trade crypto safely, it’s crucial to understand these risks first. However, even intermediates get caught if they’re chasing high yields. In fact, scams now use AI for deepfakes and sophisticated bots, making them harder to detect than ever before.

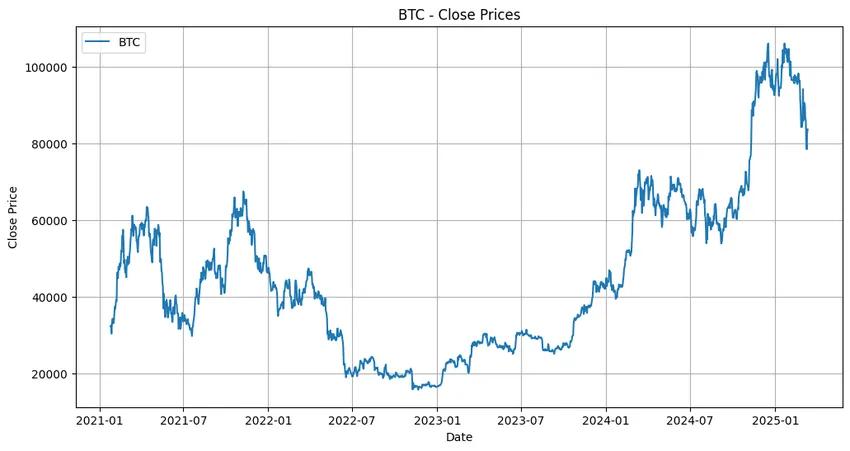

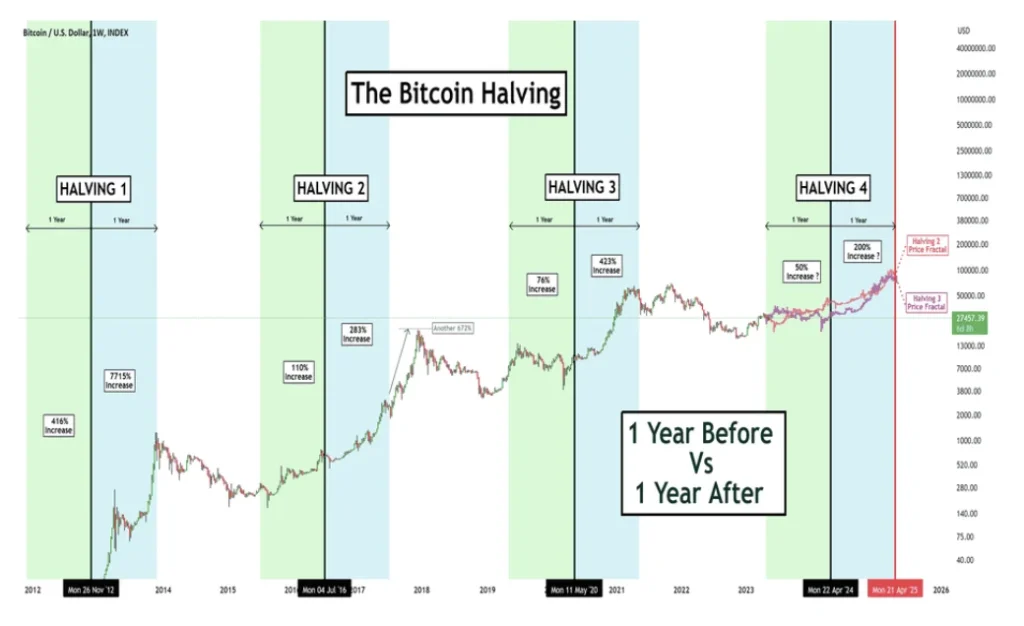

Let’s break it down. Scammers thrive on hype. During bull markets, like the one we’re in now, people get FOMO (fear of missing out) and ignore warnings. Meanwhile, in bear markets, desperation leads to risky “recovery” schemes. Here’s the deal: education is your best defense. By understanding why these scams work, you’ll be less likely to fall for them.

Learning about scams early saves you money and stress while building confidence in real investments. It helps you spot opportunities that are actually legit. The downside? It takes time, but trust me, it’s worth it. I remember my first close call—a fake wallet app that looked real. I double-checked the URL and dodged a bullet. You can too.

What drives this rise? Social media plays a big role. Scammers pose as influencers or use bots to pump fake projects. Plus, with crypto ATMs popping up everywhere, fraudsters exploit them for quick cash grabs. According to law enforcement data, losses tied specifically to crypto ATM scams reached roughly $240 million in 2024, and some 2025 reports suggest a similar amount was lost again just in the first half of the year.

The crypto world is exciting, but scams are part of it. Arm yourself with knowledge, and you’ll navigate safely. Next, let’s dive into the specific types you need to watch out for.

Pro Tip: Always start small. Test with $50 before going big—it’s how I learned without taking big losses.

Common Types of Crypto Scams You Need to Know

Alright, let’s get into the nitty-gritty. There are tons of crypto scams out there, but a few stand out as the most common. Knowing them is like having a roadmap to avoid pitfalls.

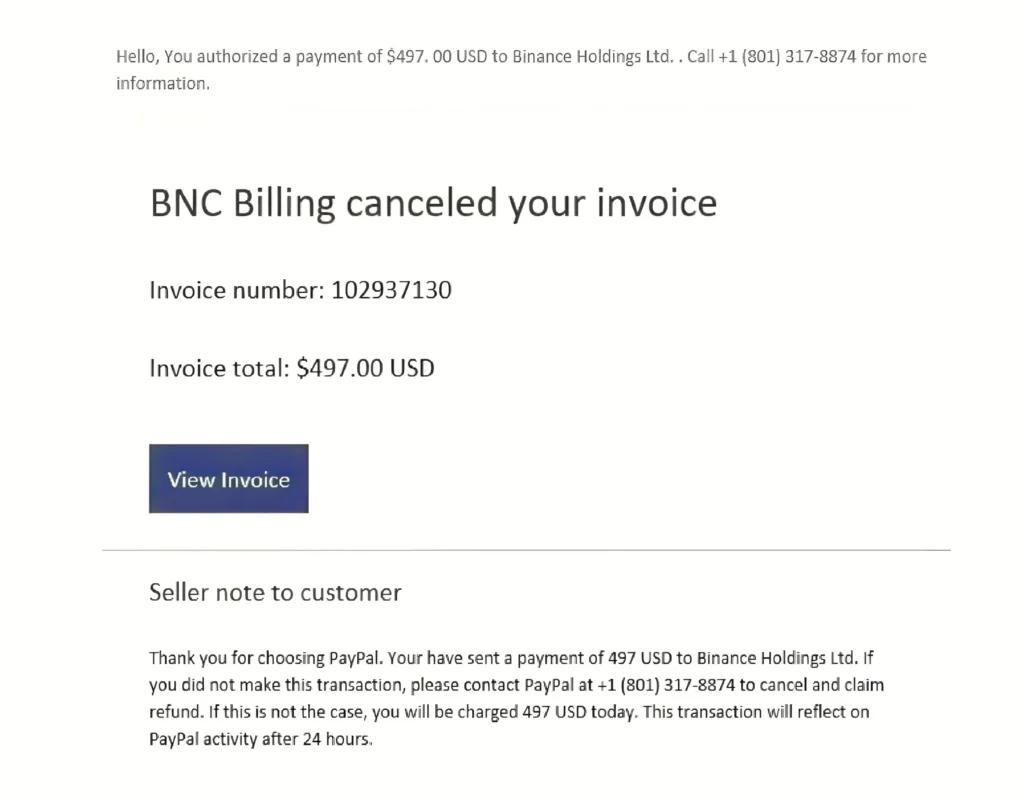

First up: phishing attacks. These are fake emails or websites that mimic real ones, like a bogus Binance login page. They trick you into entering your keys or passwords. In 2025, these have gotten slicker with AI-generated messages. For example, scammers impersonate support teams, saying your account’s at risk. The U.S. Federal Trade Commission and similar regulators regularly warn that urgent emails claiming “account problems” at services like PayPal or wallet providers are classic phishing scams.

Those urgent emails from MetaMask and PayPal are phishing scams / consumer.ftc.gov

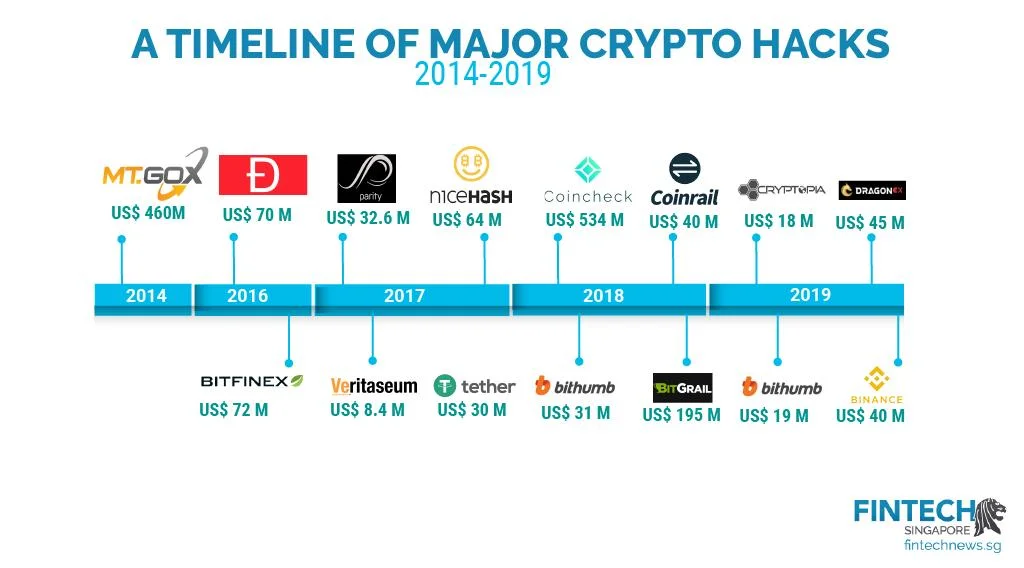

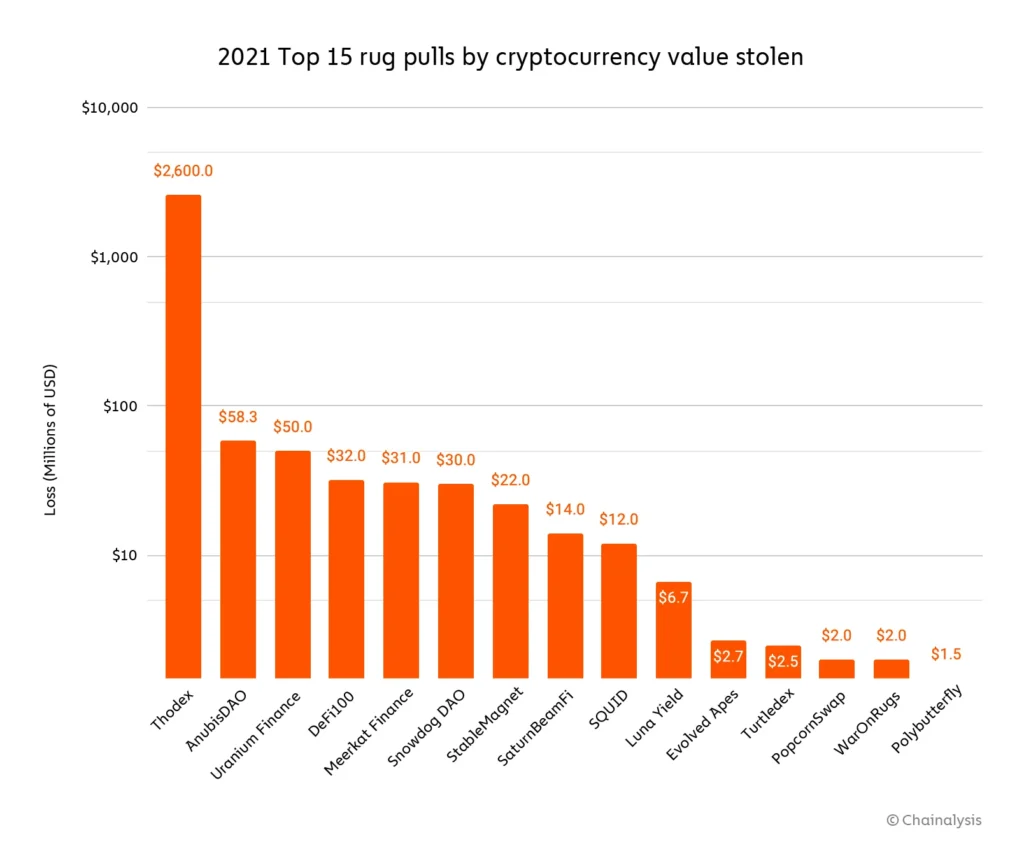

Then there’s rug pulls, where developers hype a new token, attract investors, and suddenly sell off their shares, crashing the price. Remember Squid Game token in 2021? It rugged for millions. Blockchain analytics firms like Chainalysis have shown that rug pulls took in a huge share of scam revenue in 2021 and remain a major problem—especially in 2024–2025 memecoin cycles on platforms like Solana. If you want to learn more about identifying these schemes early, check out our detailed guide on how to spot rug pulls and avoid scams.

Crypto Scams: 2021 Rug Pulls Put Revenues Near All-Time High / chainalysis.com

Pig butchering scams are heartbreaking. Scammers build relationships via dating apps or social media, gain trust, then convince you to invest in fake crypto schemes. It’s called “pig butchering” because they “fatten” you up with small wins before the slaughter. Law enforcement and cybercrime reports now attribute billions of dollars in annual losses to this type of investment fraud.

Other types include fake giveaways (send 1 BTC, get 2 back—yeah, right), Ponzi schemes like Bitconnect from years ago, and wrench attacks where thieves physically threaten you for keys.

From a scammer’s perspective, these schemes are easy to set up with high rewards. For you as an investor, they mean total loss if caught. Real case in point: The FTX collapse in 2022, driven by proven fraud at the exchange, led to billions of dollars in losses for customers and investors and showed how even large centralized platforms can fail catastrophically.

Have you encountered any of these? If not, great—keep reading to stay that way.

These scams evolve constantly, but patterns remain consistent. Spot the type, and you’re halfway to avoiding it.

Warning: Never click unsolicited links. Always type URLs manually into your browser.

Red Flags: How to Spot a Scam Before It’s Too Late

Here’s the thing: crypto scams often wave red flags if you know where to look. Let’s unpack them so you can spot trouble from a mile away.

First, promises of guaranteed returns. If someone says “10x your money in a week,” run. Crypto’s volatile—no guarantees exist. I fell for a similar pitch early on and lost $200. Lesson learned. Cybersecurity companies regularly list “too-good-to-be-true returns” as a top online scam red flag, and it applies perfectly to crypto.

5 online scam red flags | Kaspersky official blog / kaspersky.com

Unsolicited messages? Big red flag. Scammers DM on X or Telegram, pretending to be experts. Real pros don’t cold-call for investments.

Pressure tactics: “Act now or miss out!” Legit projects give you time for research and due diligence.

Fake endorsements: Deepfakes of Elon Musk promising free crypto? Completely fake. Always check official channels directly through verified social media accounts or official websites like Ethereum.org.

Shady websites: Typos, no HTTPS, or copied designs scream scam. Use tools like WHOIS to check domain age—brand-new domains pushing huge “opportunities” are suspicious.

No transparency: Anonymous teams, no whitepaper, or no clear business model? Locked liquidity with no explanation? Rug pull incoming.

Here are some quick checks you can run:

- Verify social proof: Real followers, not bots

- Check audits: Legit projects have third-party reviews from firms like CertiK

- Test small: Send tiny amounts first

You might be thinking, “But it looks real!” Yeah, that’s exactly the point. Scammers invest heavily in making their schemes look legitimate. That’s why you always need to double-check everything.

In my experience, 80% of scams have at least three of these flags. Spot them, and you’ll save yourself grief.

Red flags are your early warning system. Train your eye to recognize them, and scams become obvious before you lose a cent.

Pro Tip: Use browser and wallet features that flag known phishing sites (for example, built-in blocklists and phishing warnings in popular wallets like MetaMask) for real-time alerts.

Securing Your Crypto Wallet: Essential Steps

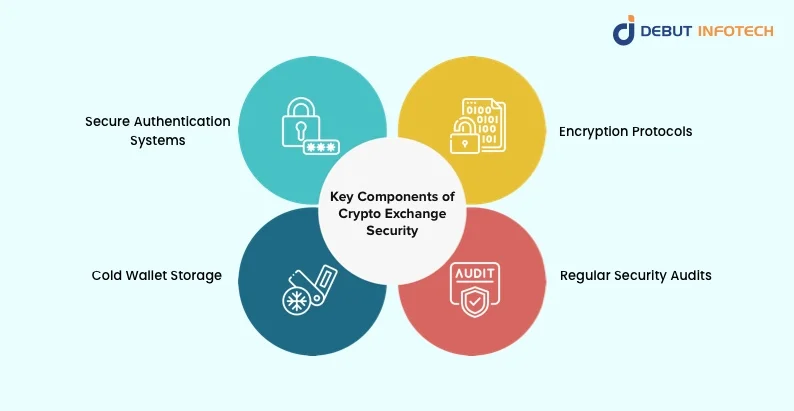

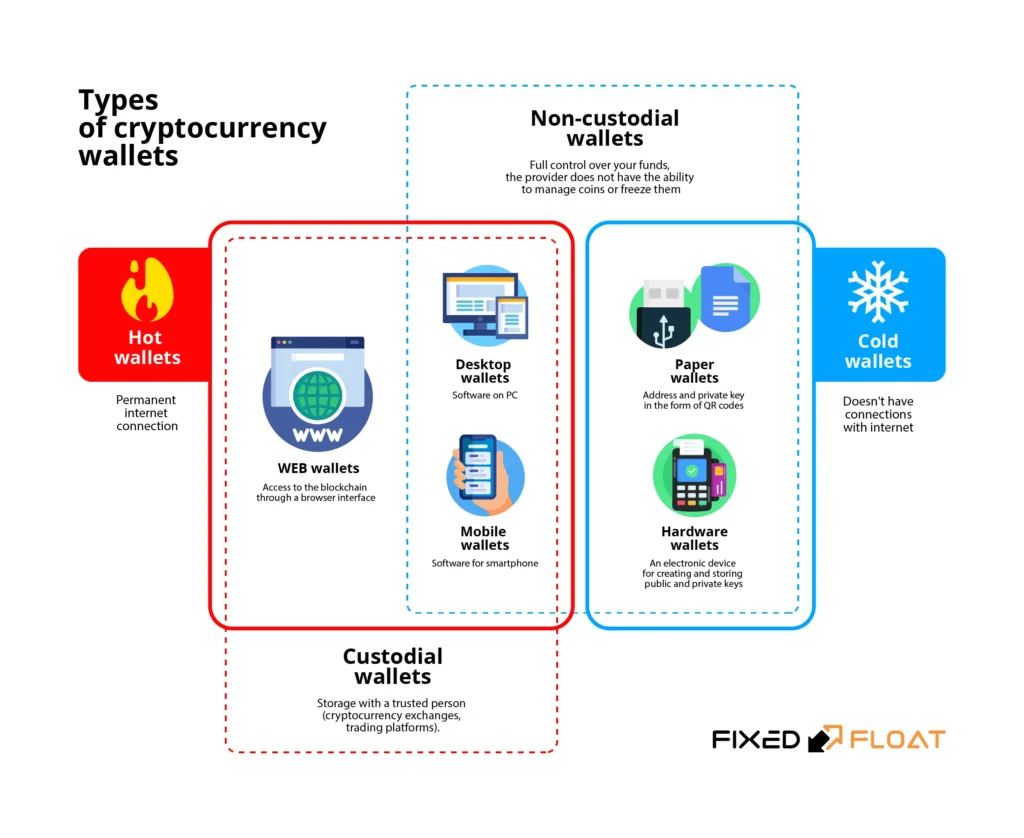

Your wallet is your crypto fortress—secure it right, and scams can’t touch you. Let’s walk through how to lock it down properly. For a comprehensive approach, I recommend reading our ultimate crypto exchange security guide which covers both exchange and wallet security in depth.

Start with hardware wallets like Ledger or Trezor. They’re offline, so hackers can’t reach them remotely. I use one for big holdings; it’s like comparing a safe to a piggy bank.

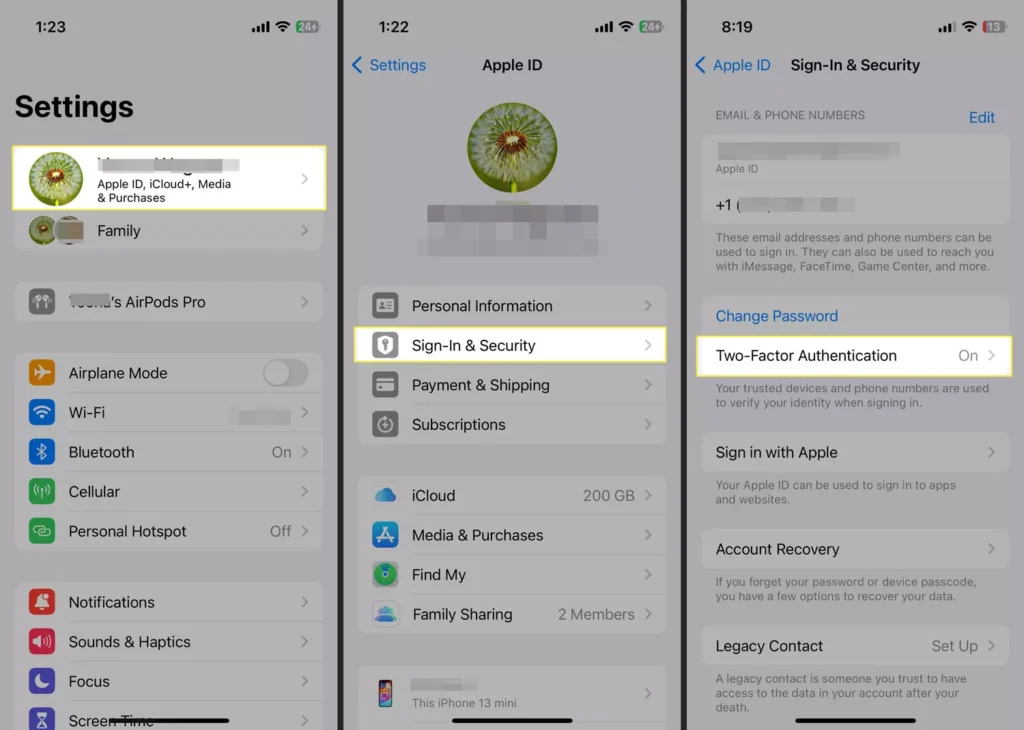

Enable 2FA everywhere. Not just email—use authenticator apps like Google Authenticator or Authy. Avoid SMS; it’s hackable through SIM-swapping attacks.

Never share private keys. That’s like giving away your bank PIN. Scammers phish for them constantly through fake support requests.

Secure bitcoin wallet / shutterstock.com

Use strong passwords: Mix letters, numbers, and symbols. A reputable password manager like 1Password or Bitwarden can help generate and store complex passwords securely.

Backup seeds securely: Write them down on paper, store offline in multiple secure locations. Don’t screenshot or store digitally!

For intermediates: Multisig wallets require multiple approvals for transactions, adding an extra layer of security that makes unauthorized access nearly impossible.

The benefits of secure wallets include peace of mind and protection from many types of hacks and account takeovers. The slight inconvenience is worth it when you consider the alternative.

Real example: In 2025, blockchain analytics showed that over $2.17 billion was stolen from cryptocurrency services in just the first part of the year, much of it through large exchange and service hacks. That’s a sobering reminder to minimize how much you keep on centralized platforms and to harden your own setup.

What if you’re a beginner? Start with Coinbase’s built-in wallet—it’s user-friendly and reasonably secure for small to medium amounts if you use strong security settings. If you’re specifically working with Ethereum, our Ethereum security guide provides ten essential rules to protect your assets.

A secure wallet turns potential losses into non-issues. Take the time to set it up properly today.

Warning: Fake wallet apps are common. Download only from official sites or verified app stores, and double-check the publisher before installing.

Verifying Legitimate Crypto Projects and Exchanges

Not all that glitters is gold—or Bitcoin. Here’s how to verify projects and platforms before investing a single dollar.

Research the team: Look for LinkedIn profiles, past projects, and track records. Anonymous teams? Skip it, unless you’re experienced and know how to evaluate anonymous projects properly. Check GitHub repositories to see if the project has active development.

Check the community: Join Discord, Reddit, and Telegram channels. Is there real, organic discussion or just bots and “gm” spam? Active, engaged communities are a good sign.

Look for audits: Use sites like CertiK or other reputable auditors for code reviews. No audit doesn’t always mean “scam,” but it raises the bar for your due diligence significantly.

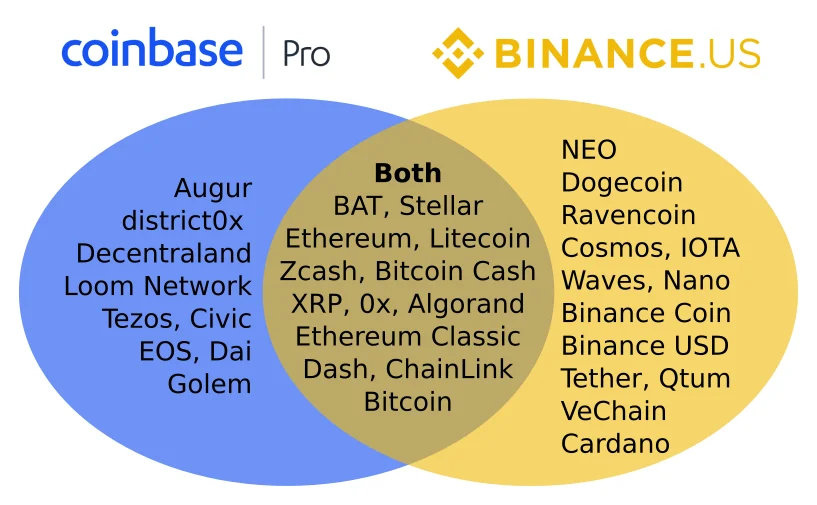

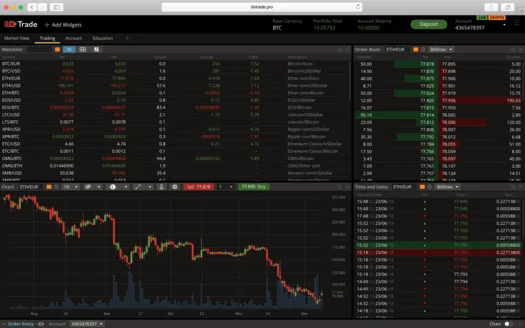

Exchanges: Prefer well-regulated, reputable platforms and check their licenses and jurisdictions. Some large exchanges, like Binance or Coinbase, maintain insurance funds or other protections against certain types of losses, but that does not mean all customer funds are fully insured or guaranteed.

How To Spot Fake Crypto Apps? – YouTube / youtube.com

Analyze tokenomics: Is there fair distribution? Reasonable vesting schedules for team tokens? Locked liquidity on DEXes with transparent terms? Tools like DexTools can help you analyze token contracts and liquidity.

For beginners: Use data aggregator sites like CoinMarketCap or CoinGecko for basic stats—market cap, volume, exchange listings, and social media presence.

You might object that this process is time-consuming. Sure, but losing money hurts a lot more than spending an hour on research. I’ve vetted hundreds of projects over the years; it gets easier with practice.

If you’re particularly interested in NFT projects, the security principles are similar but with unique considerations. Our NFT security best practices guide covers comprehensive verification steps for NFT collections and marketplaces.

Verification separates winners from losers in crypto. Do your homework before putting money on the line.

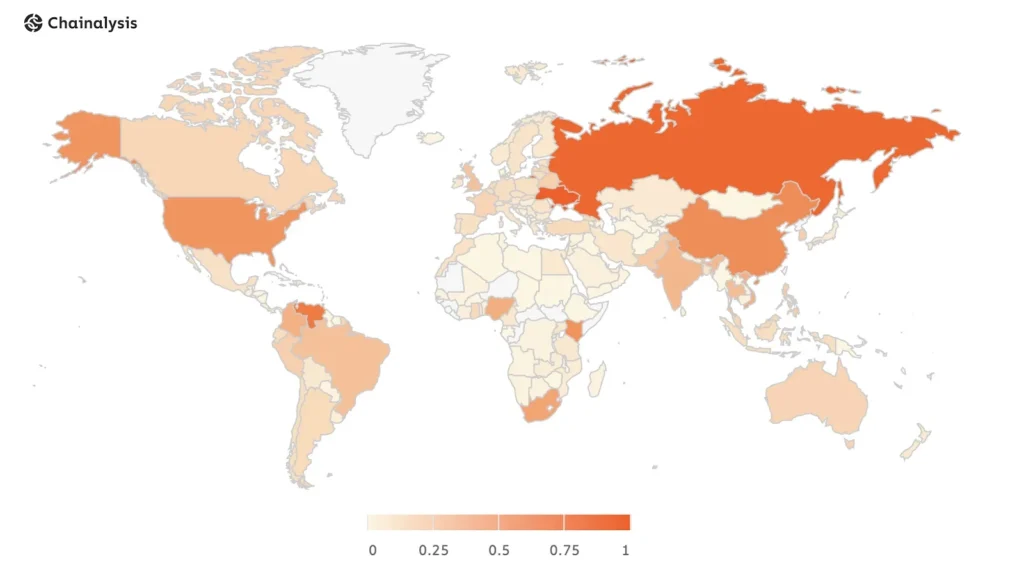

Pro Tip: Follow trusted sources like Chainalysis or official FBI IC3 advisories for alerts on emerging scam patterns and compromised platforms.

What to Do If You’ve Fallen Victim to a Crypto Scam

It happens to the best of us. Don’t panic—but do act fast, because time matters in these situations.

Report to authorities: In the U.S., that means the FTC and the FBI’s IC3 portal. Other countries have similar cybercrime units. They track patterns and sometimes coordinate large recoveries across jurisdictions.

Contact your bank or exchange: Sometimes, if fiat payments or centralized exchanges were involved and you move quickly, funds can be frozen before withdrawal.

Be wary of “recovery services”: Many so-called crypto recovery firms are secondary scams that charge upfront fees and do nothing. Only work with law enforcement or verified legal and cybersecurity professionals.

Document everything: Take screenshots, save transaction hashes, emails, and chat logs. This evidence helps investigations and may be necessary for any potential legal action. Use block explorers like Etherscan or Blockchain.com to track your transaction history.

Learn from it: Update your security practices, change passwords across all accounts, and educate friends and family so they don’t get hit the same way.

Case study: In large schemes like PlusToken, investigators used blockchain tracing to follow stolen funds and help authorities seize significant amounts of the proceeds, even across borders—though many victims still did not recover everything they lost.

Reporting helps catch scammers and can contribute to future recoveries or restitution pools, even if your personal recovery is unlikely.

Recovery is tough, but taking fast, proper steps can mitigate damage and sometimes lead to partial recovery down the line.

Advanced Protection Tips for Intermediate Investors

For you intermediate investors who want to go deeper, here are some advanced tactics.

Use VPNs on public Wi-Fi to reduce some network-level risks and hide your IP address from potential attackers. Services like NordVPN or ProtonVPN offer solid protection.

Monitor on-chain activity with tools like Etherscan, Solscan, or similar block explorers for your chains of interest.

Diversify: Don’t go all-in on one project, platform, or blockchain. Spread risk across multiple investments.

Cold-store long-term holdings: Keep the majority offline while trading with a smaller “hot” stack for active use.

Set alerts for unusual wallet activity via portfolio trackers like Zapper and block explorer notifications so you know immediately if something moves.

Stay updated via security newsletters and crypto-crime reports from firms like Chainalysis and CipherTrace.

I personally use alerts for unusual wallet activity—if something moves when I didn’t touch it, I know immediately and can respond fast.

Advanced tools don’t replace the basics; they amplify your protection if you’re already doing the fundamentals right.

Tools and Resources to Stay Safe

Here are some essential tools and resources to keep you ahead of scammers:

Wallet and address scanners: Services like Etherscan’s Token Approval Checker flag known scam addresses before you send funds, potentially saving you from irreversible transactions.

Phishing checkers: Browser add-ons and security tools that warn about known bad domains before you visit them. The MetaMask wallet has built-in phishing detection.

Education hubs: Official resources from regulators like the FTC and SEC’s Investor.gov explaining current scam tactics as they emerge.

Communities: Subreddits like r/cryptocurrency and r/CryptoScams where users flag active scams in real time.

You’ll also find video resources on platforms like YouTube that walk through real examples of malicious apps and websites with visual demonstrations.

Leverage these tools and communities for ongoing safety. Staying informed is an active, continuous process, not a one-time task.

FAQ

What are the signs of a crypto scam?

Look for guaranteed returns, pressure to act fast, unsolicited offers, vague or anonymous teams, and requests to move money off a reputable platform “for safety” or “to avoid tax.” Multiple red flags together are a strong indicator.

How do crypto scams work?

Scammers use phishing, fake sites, bogus apps, or long-term relationship building to steal funds or sensitive information, often funneling everything into wallets and platforms they control before disappearing.

What is the most common crypto scam?

One of the most common and damaging types today is pig butchering—long-term relationship or “mentorship” scams that combine social engineering and fake investment platforms to extract maximum funds.

Can you get money back from crypto scams?

Sometimes, especially if banks or regulated platforms were involved and you report quickly, but recovery is still rare. Occasionally, law enforcement seizures lead to partial restitution for victims.

How to report a crypto scam?

In the U.S., use FTC.gov and IC3.gov. In other countries, report to your national cybercrime or consumer protection agency. Also inform any bank or exchange used in the transaction.

Are crypto ATMs safe?

They can be for legitimate use, but scammers increasingly abuse them. Data from law enforcement shows crypto ATM fraud losses of over $240 million in 2024, and 2025 is on track to meet or exceed that level. If anyone tells you to pay a fee, tax, or “verification deposit” via a crypto ATM, it’s a scam.

What is a rug pull in crypto?

A rug pull occurs when developers or insiders pump a token through marketing and hype, then suddenly dump their holdings or drain liquidity, abandoning the project and crashing the price to near zero.

How to avoid phishing in crypto?

Never click links from unsolicited messages. Type URLs manually into your browser, verify domains carefully, and use wallets and browsers that block known phishing sites automatically.

Is Bitcoin a scam?

No. Bitcoin itself is an open-source protocol and legitimate cryptocurrency. However, scammers often use Bitcoin and other legitimate assets as bait in their fraudulent schemes.

What are AI crypto scams?

Fraudsters use AI to generate deepfakes, fake influencer endorsements, realistic support chats, and convincing websites or bots to push fake projects or trick you into signing malicious transactions.

Conclusion

We’ve covered a lot—from spotting crypto scams to securing your setup properly. Remember, knowledge is power in this space. Stay vigilant, research thoroughly, and you’ll avoid most pitfalls that trap other investors.

Here are your next steps:

First, audit your current setup for weaknesses. Check passwords, 2FA settings, backup procedures, and review what’s on exchanges versus cold storage. Second, if you’re just starting out, open an account with a reputable, well-regulated exchange like Coinbase or Kraken and enable all security features before depositing anything. Third, educate a friend—scams thrive on ignorance, and helping others stay safe also reinforces your own good habits.

Disclaimer: This isn’t financial advice. Invest only what you can afford to lose, and always conduct your own research before making investment decisions.

Last Updated: December 08, 2025