Introduction to Web3 Gaming

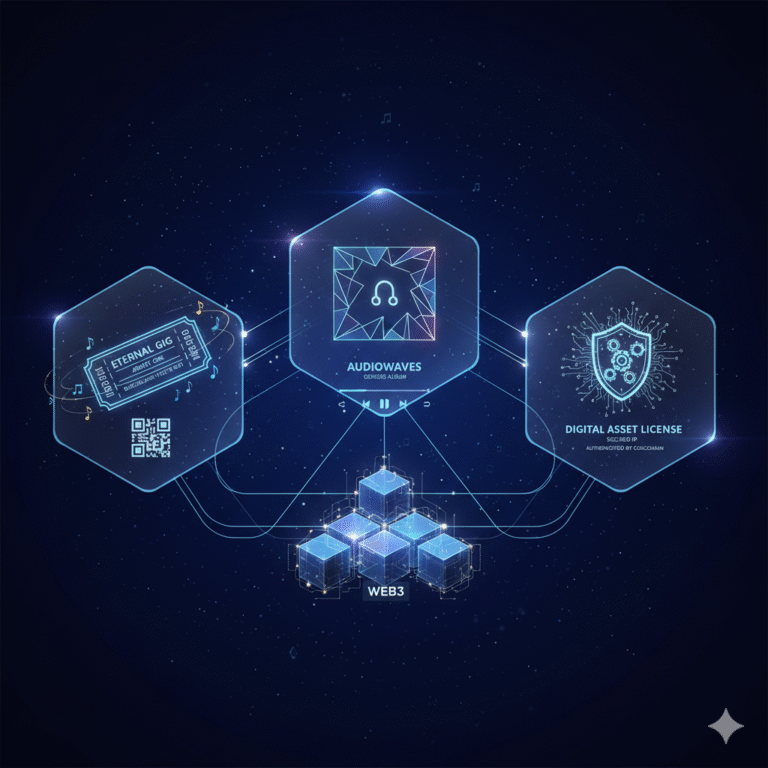

Web3 gaming is transforming the way we play video games by integrating blockchain technology, allowing players to truly own digital assets like characters, items, and land. Unlike traditional games where everything stays locked within the game’s ecosystem, Web3 games use non-fungible tokens (NFTs) and cryptocurrencies to create open, player-driven economies. This means you can buy, sell, or trade in-game items on global marketplaces, turning virtual fun into real-world value.

To understand how this technology works under the hood, check out our detailed guide on Ethereum gaming and how blockchain games actually work.

At the heart of this revolution are Web3 gaming guilds and economies. Guilds are organized communities of players who pool resources to maximize earnings and experiences in blockchain games. They act like modern-day cooperatives, investing in assets and sharing profits. Meanwhile, Web3 gaming economies refer to the financial systems within these games, often built around models like play-to-earn (P2E), where players can make money through gameplay.

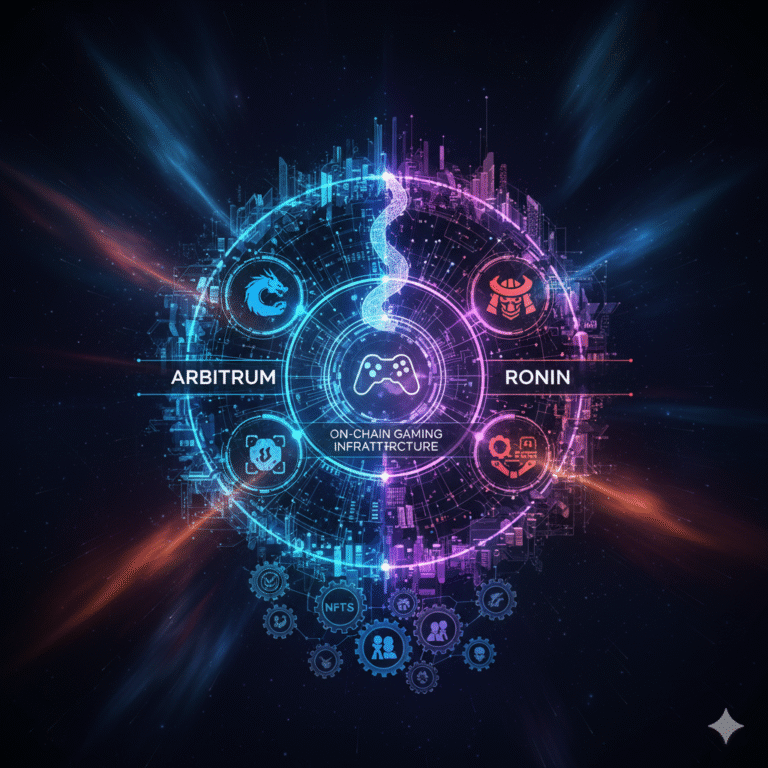

The rise of Web3 gaming guilds began with the play-to-earn boom during the COVID-19 pandemic, particularly in regions like the Philippines, where games like Axie Infinity provided income for jobless individuals. Guilds lowered entry barriers by lending expensive NFTs to new players, known as “scholars,” who then shared earnings with the guild. This model has evolved, with guilds now focusing on sustainable strategies amid market fluctuations.

Today, Web3 gaming is attracting big investors due to its ownership economy. Players spend roughly $189 billion per year on games in 2025 (Newzoo), and historically they owned none of the items they purchased—Web3 changes that by making many assets transferable outside a single publisher’s servers. Important nuance: assets can remain tradable even if a game shuts down, but their utility and resale value depend on market demand and whether other games or markets support them.

As of 2025, the sector is maturing from hype to polished experiences, with guilds playing a key role in community building and economic stability. For insights into the P2E revival, read our analysis on the return of play-to-earn in 2025. This article explores what Web3 gaming guilds are, how their economies work, real-world examples, benefits, challenges, and future trends—all in simple terms for beginners.

What Are Web3 Gaming Guilds?

Web3 gaming guilds are decentralized organizations that bring together players, investors, and enthusiasts to collaborate in blockchain games. Think of them as teams or clubs in traditional MMORPGs (massively multiplayer online role-playing games), but supercharged with crypto economics. Instead of just grouping up for raids, these guilds invest in NFTs, manage digital assets, and create income streams for members.

How Web3 Gaming Guilds Operate

Guilds raise funds by selling governance tokens, which give holders voting rights on decisions like which games to invest in. They use this capital to buy in-game assets, such as virtual land or characters, and lend them to players via “scholarships.” Scholars play the game, earn rewards, and split profits—often 50/50 or similar—with the guild. This lowers the high entry costs of Web3 games, where starting NFTs can cost hundreds of dollars.

To understand the broader context of how tokens power gaming economies, explore our comprehensive guide on game tokens economy: demystifying SAND, MANA, GALA, and IMX.

For beginners, joining a guild is like getting a starter kit. Guilds provide education on setting up wallets, managing assets, and navigating blockchain transfers. They also organize communities for strategy sharing, esports, content creation, and marketing, adding value to the games themselves. In essence, guilds are crypto-native structures creating real economic opportunities, especially in emerging markets (Chainlink).

Why Join a Web3 Gaming Guild?

For new players, guilds reduce risks and amplify rewards. They handle investments, allowing you to focus on playing. Guilds also foster social bonds, turning solo gaming into collaborative adventures. In games like Big Time, guilds interact with player-driven economies featuring cosmetic NFTs, Time Crystals, and event access rather than pure “mint-more-tokens” loops, which is one reason these models are seen as more sustainable than early P2E designs (Big Time).

As Web3 matures, guilds are evolving beyond simple asset rental. Automation tools for guild operations are emerging, such as platforms like KWALA, but they’re still early and adoption varies by guild—treat them as experimental infrastructure for now.

Understanding how communities create economic value is crucial to guild dynamics. Learn more about how social tokens turn communities into economies to see the broader picture of Web3 community monetization.

Key Examples of Web3 Gaming Guilds

Several standout guilds illustrate the power of this model and demonstrate different approaches to blockchain gaming communities.

Yield Guild Games (YGG)

Yield Guild Games (YGG) is a pioneer, founded by Gabby Dizon. YGG invests in NFTs across games like Axie Infinity and builds global communities for economic empowerment. With sub-DAOs (decentralized autonomous organizations) for specific regions or games, YGG has expanded to Southeast Asia via W3GG, focusing on adoption in fast-growing markets (CoinDesk Consensus Hong Kong 2025).

Merit Circle and BEAM

Merit Circle started with Axie Infinity but broadened to various games and investments. Important update: in late 2023 the DAO migrated the MC token to BEAM. Today the ecosystem is commonly referenced via BEAM, with a market cap around $250M as of November 2025, though figures vary slightly by data provider (Medium).

Avocado DAO

Avocado DAO built large scholarship programs during the P2E wave and continues to run education and onboarding for players. Scale fluctuates with markets, but the model remains active (Avocado DAO).

Regional Sub-DAOs: IndiGG and W3GG

IndiGG is YGG’s India-focused sub-DAO, created with Polygon, while W3GG is a Southeast Asia hub that runs open quests, leagues, and partnerships. Both have featured in community awards lists and events in 2023–2024, including PlayToEarn’s community awards and the GAM3 Awards ecosystem (Decrypt, Medium, Scopely).

These examples show guilds’ diversity: from regional focuses to broad ecosystems. Beginners can start by joining via Discord or Telegram, often after passing simple applications. Many guilds are also leveraging memecoins as marketing tools to conquer Web3, creating engaging community experiences.

Understanding Web3 Gaming Economies

Web3 gaming economies are the financial backbones of these games, powered by blockchain for transparency and ownership. These economies represent a fundamental shift in how value is created, distributed, and owned in gaming.

Play-to-Earn (P2E) Model

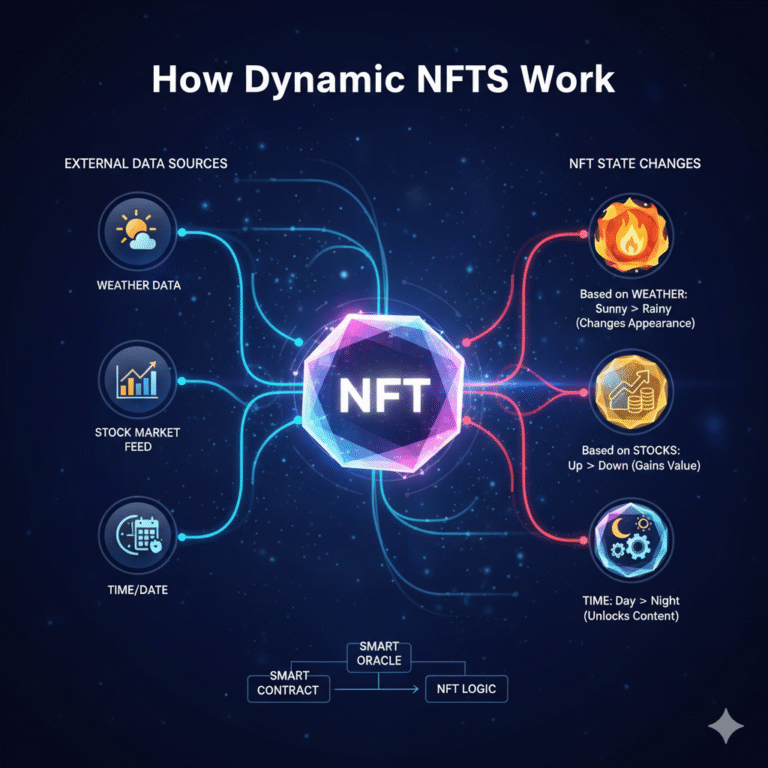

The most common model is play-to-earn (P2E), where players earn tokens or NFTs through gameplay, like battling in Axie Infinity to gain SLP tokens. These can be sold for real money, creating a borderless economy accessible via smartphones (SpringerLink).

However, P2E has challenges like inflation: too many tokens from grinding can devalue them. To counter this, games use dual-token systems—one for governance (e.g., AXS) and one for utilities (e.g., SLP)—plus burn mechanisms to reduce supply.

Play-to-Own (P2O): The Sustainable Evolution

Enter play-to-own (P2O), a more sustainable evolution. Here, focus shifts to long-term asset ownership rather than quick earnings. Players truly control NFTs, which can be used across games or held for value appreciation. Unlike P2E’s reward focus, P2O emphasizes interoperability and community-driven economies (Sequence).

How Guilds Enhance Gaming Economies

Guilds enhance these economies by providing asset lending, staking, and trading. For example, in Alien Worlds, players can stake TLM to participate in planetary governance and certain reward mechanisms, including voting power and planet-level incentives, though staking here is primarily tied to governance and gameplay features rather than guaranteed passive yield (Medium).

Free-to-Play Entry Points

For beginners, free-to-play options like Loot Legends exist, where you can earn tradable items and NFTs through gameplay and events without upfront NFT purchases (PlayToEarn).

Benefits and Challenges of Web3 Gaming Guilds and Economies

The Benefits: Economic Empowerment and True Ownership

The benefits are clear: economic empowerment, especially in developing regions, where guilds create jobs through gaming. Players gain true ownership, turning hobbies into income streams. Guilds build vibrant communities, driving game adoption and innovation. Economies foster global participation, with no need for traditional banks.

Web3 gaming guilds have demonstrated particular success in countries like the Philippines, where they’ve provided alternative income sources during economic uncertainty. The scholarship model has enabled thousands of players to access blockchain games without significant capital investment.

The Challenges: Volatility and Sustainability

Challenges include volatility—token values can crash due to speculation. Early P2E games like Axie Infinity faced bubbles and engagement drops when rewards dried up. Regulatory hurdles and scams also pose risks. Beginners should research guilds’ track records and start small (SpringerLink).

The sustainability question remains central to Web3 gaming’s future. Many early models proved unsustainable when new player growth slowed, leading to the evolution toward P2O and more balanced economic designs.

Future Trends in Web3 Gaming

Looking ahead, Web3 gaming will integrate AI, VR, and cross-game economies for seamless asset transfers. Guilds may become “digital nations,” influencing governance across multiple gaming platforms and metaverse environments.

Emerging Technologies and Models

Sustainable models like P2O are gaining traction, and guild-operations automation is emerging but still in early stages. Expect growth in emerging markets, with guilds leading education initiatives.

New “learn-to-earn” course platforms such as Olympus Insights are emerging as on-ramps for players, providing structured education about blockchain gaming, wallet management, and NFT trading (Blockchain App Factory, KWALA Network).

Cross-Game Interoperability

The future of Web3 gaming likely involves greater interoperability, where assets and identities can move seamlessly between different games and platforms. Guilds are positioning themselves to manage these complex, multi-game portfolios for their members.

Conclusion: Getting Started in Web3 Gaming

Web3 gaming guilds and economies are democratizing play, blending fun with finance. From YGG’s global reach to P2O’s ownership focus, this space offers exciting opportunities for beginners. The combination of blockchain technology, community organization, and economic incentives is creating new possibilities for gamers worldwide.

Start by exploring free games, joining a guild, and always verify sources. Research guild reputations on platforms like Discord and Twitter, and never invest more than you can afford to lose. As the industry grows, it promises a more equitable gaming future—where your time and skills truly pay off.

The key to success in Web3 gaming is education, community involvement, and patience. Whether you’re looking to earn supplemental income or simply explore the future of gaming, Web3 guilds provide the support structure and resources to begin your journey safely.

Related Reading:

- The Return of Play-to-Earn in 2025: Top Games, Trends, and How Beginners Can Start Earning

- Ethereum Gaming: How Blockchain Games Actually Work

- Game Tokens Economy: Demystifying SAND, MANA, GALA, and IMX for Beginners

- How Social Tokens Turn Communities into Economies

- Memecoins as Marketing: How Brands Are Conquering Web3

This article provides educational information about Web3 gaming and should not be considered financial advice. Always conduct your own research before participating in blockchain gaming or investing in digital assets.