In the fast-paced world of financial markets, volatility is a constant companion, especially in cryptocurrency trading. Volatile markets, like those for Bitcoin (BTC) or Ethereum (ETH), can see prices swing dramatically in short periods—sometimes 10–20% in a single day. This unpredictability offers opportunities for gains but also poses significant risks to investors’ capital. Effective risk management in volatile markets is crucial for protecting investments and achieving long-term success.

This comprehensive guide explores proven strategies to navigate these challenges, drawing from established practices in crypto trading. Whether you’re a beginner eyeing ETH/USD trades or an experienced trader looking to refine your approach, understanding these principles can help you stay profitable without unnecessary stress. If you’re completely new to the space, consider starting with our complete beginner’s guide to crypto trading to establish foundational knowledge.

Understanding Market Volatility in Cryptocurrency Trading

Market volatility refers to the rate at which asset prices fluctuate. In traditional finance, it’s measured by tools like the Volatility Index (VIX), but in crypto, volatility is amplified by several unique factors. The cryptocurrency market operates 24/7, including weekends, creating continuous price action without the circuit breakers found in traditional markets.

According to Fidelity’s research, cryptocurrencies can experience significant intraday swings that would be considered extreme in traditional markets. For instance, cryptocurrencies can experience rapid price drops due to events like exchange failures or macroeconomic shocks. The FTX collapse in November 2022 coincided with sharp market declines across the entire crypto ecosystem, demonstrating how interconnected risks can materialize suddenly.

High volatility isn’t inherently bad—it can create buying opportunities during dips. However, without proper controls, it can lead to substantial losses. Kraken’s educational resources note that crypto markets are particularly prone to volatility because of their relative youth and fragmented liquidity. Beginners should understand that volatility is influenced by liquidity: low-liquidity altcoins can swing more wildly than established cryptocurrencies like ETH.

The Critical Importance of Risk Management in Volatile Markets

Risk management involves identifying, assessing, and mitigating potential losses. In volatile markets, it’s not about avoiding risks entirely—that would mean missing out on rewards—but about controlling them strategically. Poor risk handling can result in emotional trading, where fear or greed drives decisions, often leading to bigger losses.

To anchor expectations with data: in leveraged retail derivatives such as CFDs (a common retail “on-ramp” to crypto exposure in some jurisdictions), European regulators report that 74–89% of retail accounts typically lose money—underscoring why discipline and risk limits matter. For crypto investors, this statistic is vital because the market’s 24/7 nature amplifies psychological pressures.

Effective risk management preserves capital, allowing traders to survive downturns and capitalize on recoveries. It also promotes consistency, turning trading into a sustainable practice rather than a gamble. The goal is to remain in the market long enough to benefit from the opportunities that volatility presents.

Key Risk Management Strategies for Volatile Cryptocurrency Markets

Here are evidence-based strategies tailored for volatile environments like crypto trading. These draw from professional guidelines and can be applied to pairs like ETH/USD.

1. Diversify Your Cryptocurrency Portfolio

Diversification spreads investments across multiple assets to reduce the impact of any single failure. In crypto, this means allocating funds not just to one coin but across categories: large-caps like BTC and ETH for stability, mid-caps for growth, and a small portion to high-risk altcoins.

For example, a balanced portfolio might include 40% in BTC/ETH, 30% in narrative-driven assets (e.g., AI tokens), 15% in stablecoins like USDC, 10% in yield-generating DeFi projects, and 5% in speculative plays. Understanding the DeFi ecosystem can help you identify legitimate yield opportunities while avoiding high-risk protocols.

For those seeking automatic diversification, several crypto index options exist. The Bloomberg Galaxy Crypto Index (BGCI) and the Bitwise 10 Large Cap Crypto Index/Fund (BITW) are rebalanced and rules-based index products. Some providers like Trakx offer Crypto Tradable Indices (CTIs) for automatic diversification across multiple assets.

Institutional investors and DAOs also apply sophisticated diversification strategies—learn more about how organizations manage diverse crypto holdings in our comprehensive guide to DAO treasury management.

2. Implement Strategic Position Sizing

Position sizing determines how much capital to allocate per trade. A common rule is to risk no more than 1–2% of your total portfolio on any single position—a guideline popularized in risk-management literature by Van K. Tharp.

In volatile markets, this prevents a string of losses from depleting your funds. For ETH/USD trading, if you’re buying ETH at $2,500 with a stop-loss at $2,375 (5% below), calculate your position size so the loss doesn’t exceed your risk limit.

Adjust position sizing based on volatility—use indicators like Average True Range (ATR) to set wider limits for choppy assets. Higher volatility should generally mean smaller position sizes to maintain consistent risk exposure.

3. Use Stop-Loss and Take-Profit Orders Effectively

Stop-loss orders automatically sell an asset when it hits a predetermined price, limiting losses. Take-profit orders do the opposite, securing gains at a target level. In crypto’s volatile swings, these tools enforce discipline and prevent emotional holds during crashes.

For instance, in an ETH/USD long position at $2,500, set a stop-loss at $2,375 (5% loss) and take-profit at $2,750 (10% gain), aiming for a 1:2 risk-reward ratio.

Important consideration: research published on market microstructure shows that stop-loss orders often cluster near round numbers and recent highs/lows, which can accelerate price cascades. Consider placing stops with some buffer away from obvious levels to avoid getting caught in cascading liquidations.

Trailing stops adjust dynamically—if ETH rises to $2,700, the stop moves to $2,565 (5% below the new high), locking in profits while allowing upside potential.

4. Employ Dollar-Cost Averaging (DCA) Strategically

Dollar-cost averaging involves investing fixed amounts at regular intervals, regardless of price. This averages out costs over time and reduces timing risk for long-term holders.

Important nuance: authoritative research from Vanguard finds lump-sum investing historically outperforms DCA about two-thirds of the time. However, DCA reduces short-term downside risk, which is why many investors still prefer it for behavioral and risk-management reasons. The strategy is particularly valuable for reducing the psychological impact of volatility.

Example: Invest $500 monthly in ETH/USD. If ETH is $2,500 one month and drops to $2,000 the next, your average cost is $2,250, positioning you better for recoveries. This disciplined approach removes the pressure of timing the market perfectly.

5. Hedge with Stablecoins and Use Leverage Carefully

Hold 5–15% of your portfolio in stablecoins like USDT or USDC to buffer against downturns and buy dips without selling at lows. This provides dry powder for opportunities during market corrections.

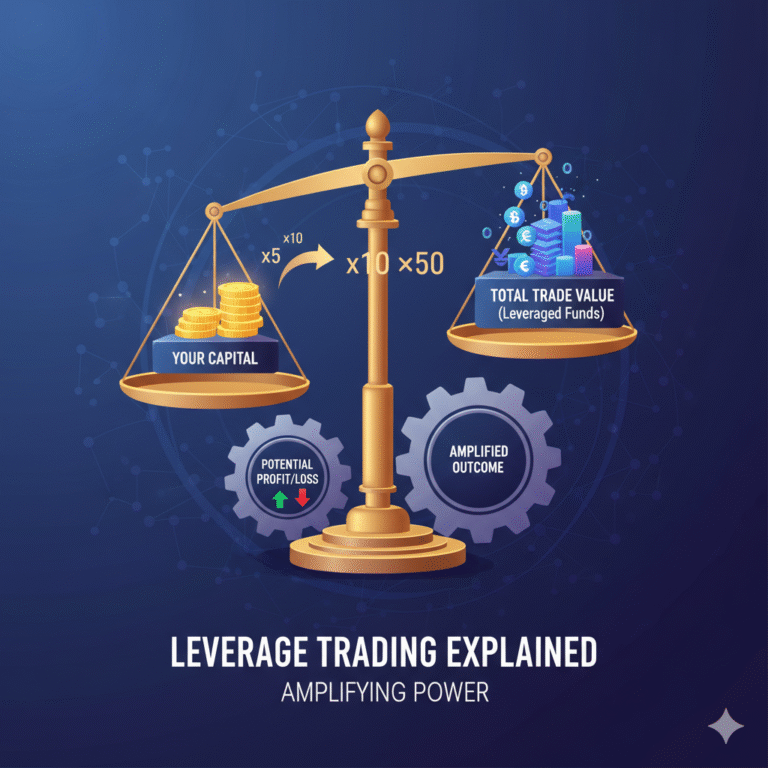

For advanced users, hedging involves taking opposite positions, like shorting BTC futures while long on ETH, to reduce directional risk exposure. However, leverage is a double-edged sword that requires deep understanding—we recommend reviewing our detailed guide on leverage trading before employing these strategies.

Leverage amplifies trades but heightens risks dramatically—stick to modest levels (e.g., 1–3x) and always pair with stop-losses. Critical clarification: a ~10% adverse move can fully wipe out a 10× leveraged position if you don’t maintain additional margin above maintenance requirements. Exact liquidation thresholds vary by exchange and product specifications, so always understand your platform’s margin requirements.

6. Conduct Thorough Technical and Fundamental Analysis

Combine technical analysis (charts, indicators like RSI and moving averages) with fundamental analysis (project team, use cases, regulatory environment). For ETH/USD specifically, stay updated on Ethereum’s technological developments.

Recent developments: Ethereum activated proto-danksharding (EIP-4844) with the Dencun upgrade on March 13, 2024, significantly cutting data costs for Layer 2 rollups. Full danksharding remains on the long-term roadmap. Understanding these technical improvements helps assess long-term value.

Modular blockchain infrastructure is also revolutionizing scalability—projects like Celestia are pioneering data availability solutions that complement Ethereum’s ecosystem. Learn more about lessons from Celestia’s first year as a modular data availability network to understand how infrastructure developments affect market dynamics.

Stay informed via reliable sources, avoiding hype from social media. Cross-reference information across multiple reputable platforms like CoinDesk, Decrypt, and The Block before making trading decisions.

Practical Examples in Crypto Trading

Consider a beginner trading ETH/USD amid volatility from a regulatory announcement. Using diversification, they allocate 20% to ETH, 30% to BTC, and 50% to stablecoins. Position sizing limits risk to 1% per trade. Entering at $2,500, they set a stop-loss at $2,375 and take-profit at $2,750.

If prices drop 10%, the stop-loss triggers, capping loss at 1% of the portfolio. During recovery, DCA adds positions at lower prices, averaging costs down. This disciplined approach turned a potential wipeout into a manageable setback, allowing re-entry at better levels.

Another example: In proprietary trading, a firm enforces 1–2% risk limits and low leverage requirements. When the market experiences a 20% crash, the firm survives with controlled losses while unhedged traders with high leverage face liquidation.

Tools and Best Practices for Cryptocurrency Risk Management

Automated Trading Bots: Use DCA or grid bots on reputable platforms like 3Commas for rule-based execution. Always review API permissions carefully and use read-only API keys when possible to enhance security.

Secure Platforms and Operations: Enable multi-factor authentication, ideally phishing-resistant methods as recommended by NIST. Use hardware wallets with certified Secure Elements for long-term storage of significant holdings. Popular options include Ledger and Trezor devices.

Portfolio Rebalancing: Periodically adjust allocations to maintain your target balance. As certain assets outperform, they’ll represent a larger portion of your portfolio, potentially increasing risk concentration. Tools like CoinTracker and Koinly can help monitor portfolio allocation.

Backtesting and Paper Trading: Test strategies historically or in simulations before deploying real capital. Platforms like TradingView offer robust backtesting capabilities, while exchanges like Binance and Bybit provide testnet environments for paper trading.

Additional best practices include setting realistic profit goals, avoiding emotional decisions, and seeking professional financial advice when needed. Keep a detailed trading journal to review mistakes and continuously improve your approach.

Common Mistakes to Avoid in Volatile Cryptocurrency Markets

Overexposure to Hype: Chasing meme coins or trending tokens without fundamental analysis frequently leads to losses when momentum reverses. Always conduct due diligence using resources like CoinGecko and CoinMarketCap before investing.

Ignoring Security Protocols: Failing to use multi-factor authentication or secure wallets invites hacks and theft. The decentralized nature of crypto means stolen funds are typically unrecoverable.

High Leverage Without Stop-Losses: Amplifies losses dramatically and can trigger liquidation if margin isn’t maintained. Many traders underestimate how quickly leveraged positions can be liquidated in volatile markets.

Emotional Trading: Panic-selling during dips or holding losing positions too long hoping for recovery destroys more capital than almost any other mistake. Developing emotional discipline is as important as technical knowledge.

Lack of Diversification: Putting all capital in one asset, like solely ETH during a network issue or security vulnerability, exposes you to idiosyncratic risk. Even blue-chip cryptocurrencies face project-specific risks.

By steering clear of these common pitfalls, traders can focus on sustainable growth rather than recovery from preventable losses.

Building Long-Term Resilience in Volatile Cryptocurrency Markets

Risk management in volatile markets like crypto is fundamentally about preparation and discipline. Strategies such as diversification, position sizing, stop-loss orders, and dollar-cost averaging provide a safety net, allowing traders to navigate ETH/USD and other volatile pairs confidently.

Remember two final critical nuances: First, DCA manages risk effectively but doesn’t usually outperform lump-sum investing over long periods—its primary value is behavioral and risk-reduction. Second, leverage requires strict margin management because liquidation triggers and maintenance requirements differ significantly by venue and product.

Stay continuously educated through reliable sources like Investopedia, CoinDesk Learn, and Binance Academy, use proven risk management tools, and adapt your strategies as market conditions evolve. With these practices consistently applied, volatile markets transform from threats into opportunities for disciplined traders.

Always invest only capital you can afford to lose completely, and consider consulting with qualified financial advisors before making significant investment decisions in cryptocurrency markets. Organizations like the CFA Institute and Financial Planning Association can help you find credentialed professionals familiar with digital assets.

Key Takeaways for Crypto Risk Management:

- Limit single-position risk to 1-2% of total portfolio capital

- Diversify across large-cap, mid-cap, and stablecoin allocations

- Use stop-loss orders with buffers away from obvious clustering points

- Understand leverage liquidation mechanics before using margin

- Stay informed on technological developments affecting your holdings

- Implement security best practices including MFA and hardware wallets

- Test strategies through backtesting before live deployment

- Maintain emotional discipline through systematic, rule-based trading