What is DeFi and Why It Matters in 2025

Decentralized Finance (DeFi) has evolved from an experimental concept into a robust parallel financial system. By late 2025, total value locked (TVL) has surged to over $200 billion across multiple blockchain networks, marking a significant recovery and expansion from previous cycles. If you’re new to DeFi, we recommend starting with our complete beginner’s guide to DeFi on Ethereum.

Understanding the DeFi Ecosystem

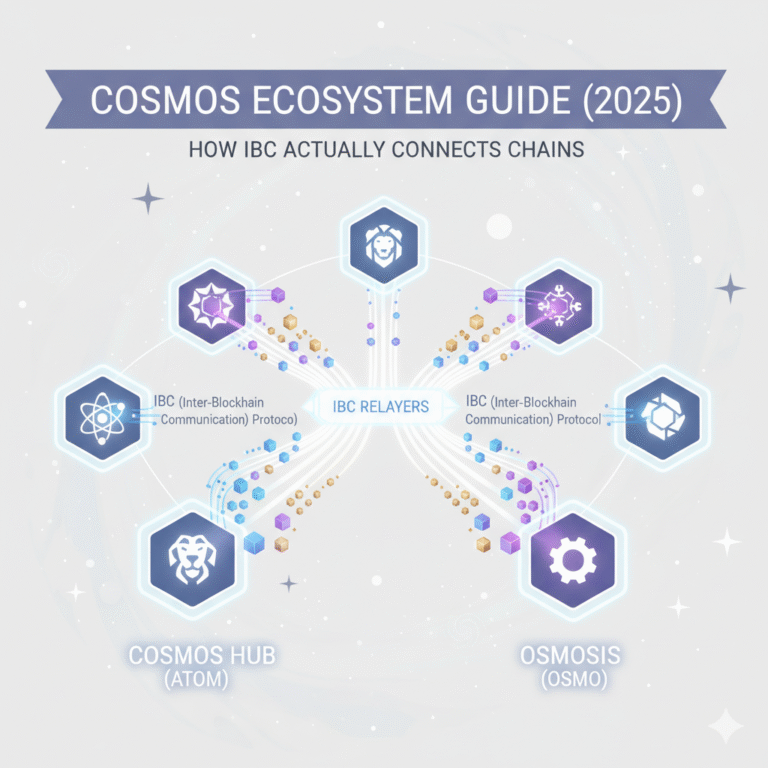

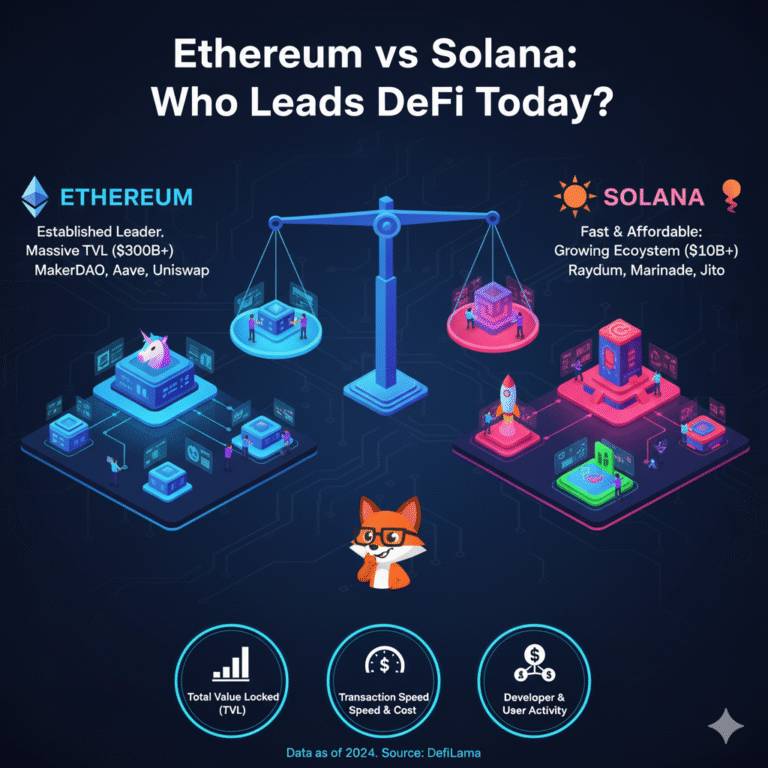

Unlike traditional finance, DeFi protocols operate without intermediaries, using smart contracts on blockchains like Ethereum, Solana, and various Layer 2 networks. In particular, this year’s growth has been driven primarily by several key innovations that are reshaping the landscape.

Key Growth Drivers in 2025

Specifically, the following trends are powering DeFi’s expansion:

- Liquid staking – Stake assets while maintaining liquidity for other opportunities

- Restaking – Reuse staked assets to secure additional protocols and earn multiple yields

- Yield markets – Trade and optimize future yield streams with unprecedented flexibility

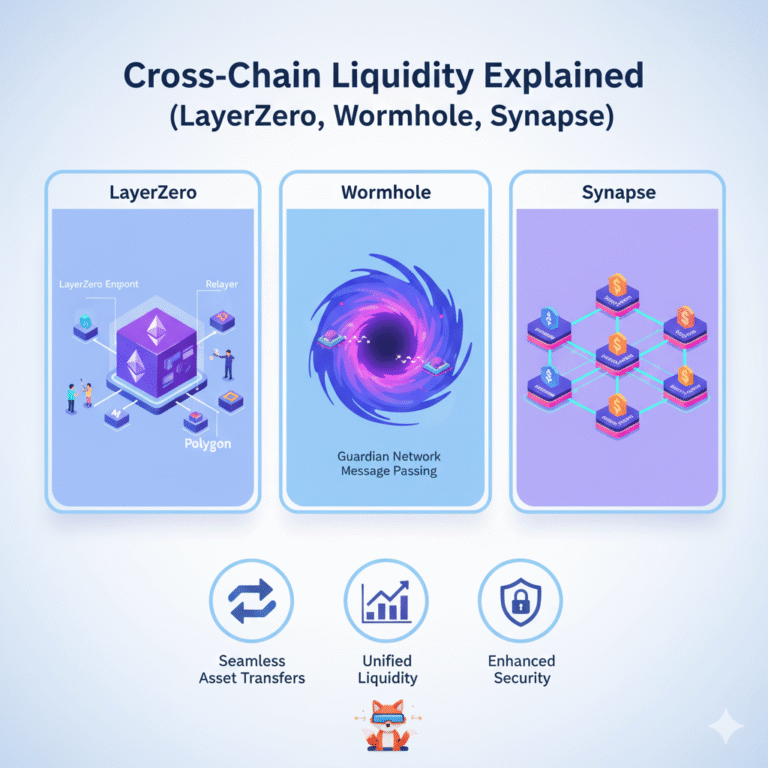

- Cross-chain integration – Seamless asset movement across networks without friction

Additionally, you can learn more about DeFi fundamentals at DeFi Llama and Ethereum.org’s DeFi guide.

How We Ranked the Top DeFi Protocols

Our Five-Factor Evaluation Framework

To ensure objectivity, our ranking methodology considers five critical factors:

- Total Value Locked (TVL) & Capital Flows – Real capital commitment and user trust indicators

- Product-Market Fit – Sustained usage beyond mere speculation

- Multi-Chain Reach – Availability across Layer 1 and Layer 2 networks

- Risk Profile – Smart contract security and historical incident analysis

- Ecosystem Integration – Composability and protocol partnerships

Moreover, all data is sourced from DeFiLlama, The Block, and official protocol documentation to ensure accuracy.

Top 10 DeFi Protocols in 2025

1. Lido – The Liquid Staking Leader

Protocol Type: Liquid Staking

Primary Chain: Ethereum

Current TVL: ~$37 billion

Official Site: lido.fi

What Makes Lido the Industry Standard

Lido revolutionized Ethereum staking by allowing users to stake ETH and receive stETH (or wrapped wstETH) tokens that remain liquid and usable across DeFi. Consequently, this means you can stake ETH to earn validator rewards while simultaneously using your staked position as collateral or in liquidity pools.

Core Advantages and Features

The protocol offers several compelling benefits:

- Deep liquidity – Not only does it maintain the largest liquidity pools across major DEXs, but it also ensures minimal slippage

- Wide integration – Moreover, it’s accepted as collateral on Aave, Maker, and dozens of other leading protocols

- Multi-chain presence – In addition, stETH/wstETH is bridged to Arbitrum, Optimism, Base, and other L2s

Critical 2025 Update

⚠️ Important: Lido discontinued Solana and Polygon staking operations. While you can still find bridged wstETH on these networks, native SOL or MATIC staking through Lido is no longer available. Therefore, users seeking to stake these assets must explore alternative platforms.

Understanding the Risk Landscape

Despite its dominance, several risks merit consideration:

- On one hand, validator concentration risk across the network remains a concern

- Additionally, potential depeg scenarios during severe market stress could affect holdings

- Furthermore, smart contract vulnerabilities inherent to complex systems pose ongoing challenges

Learn More: Lido Documentation | DeFiLlama Lido Stats

2. Aave – Institutional-Grade Lending Protocol

Protocol Type: Money Market / Lending

Supported Chains: Ethereum, Polygon, Arbitrum, Optimism, Avalanche, Base

Current TVL: ~$74 billion

Official Site: aave.com

Why Aave Dominates the Lending Sector

Aave V3 represents the gold standard for decentralized lending, offering advanced features that both institutional and retail users demand. Indeed, its sophisticated architecture has attracted massive capital inflows throughout 2025, and you can learn how to earn interest with your crypto on Aave through our detailed guide.

Revolutionary V3 Features

The platform’s latest iteration introduces groundbreaking capabilities:

E-Mode (Efficiency Mode): This feature enables higher loan-to-value ratios for correlated assets (e.g., stablecoins or ETH/stETH pairs), offering up to 97% LTV in certain cases.

With Isolation Mode, the protocol allows testing of new assets with limited risk exposure, thereby protecting the main protocol from potential exploits.

The Portals feature facilitates seamless cross-chain borrowing and lending without requiring users to manually bridge assets.

Explosive 2025 Growth Trajectory

Remarkably, Aave’s TVL exploded from ~$12 billion in early 2025 to surpass $40 billion by August and currently stands around $74 billion—cementing its position as the undisputed largest lending protocol in the ecosystem.

Beginner-Friendly Entry Strategy

For newcomers to the platform, we recommend:

- As a starting point, supply stablecoins (USDC/USDT) to earn conservative yield

- Before borrowing, take time to understand health factors and their implications

- Most importantly, use conservative loan-to-value ratios (50-60% maximum) to avoid liquidation

Resources: Aave V3 Documentation | Aave Risk Dashboard

3. EigenLayer – Restaking Infrastructure

Protocol Type: Restaking / Shared Security

Primary Chain: Ethereum

Total Value Locked: ~$19-20 billion

Governance Token: EIGEN

Official Site: eigenlayer.xyz

The Restaking Revolution Explained

EigenLayer created an entirely new DeFi primitive: restaking. Specifically, users can restake their ETH or liquid staking tokens (LSTs) to provide economic security to multiple services simultaneously, thereby earning additional rewards beyond standard staking yields.

Understanding the Mechanism

The protocol operates through a straightforward process:

- To begin with, stake ETH directly or deposit LSTs (stETH, rETH, etc.)

- After that, opt into “Actively Validated Services” (AVSs)—new protocols that require security

- As a result, earn native staking rewards plus additional AVS rewards

- However, be prepared to accept potential slashing risk from AVS validation activities

Thriving Ecosystem Development

Currently, AVSs include oracles, data availability layers, bridges, and rollup sequencers. By October 2025, dozens of AVSs have already launched or are actively in development, demonstrating strong market demand.

Critical Risk Considerations

However, users must understand several important risks:

- Slashing contagion – Most critically, penalties can cascade across multiple AVSs simultaneously

- AVS quality variance – In reality, not all services are equally secure or economically valuable

- Complexity – Above all, restaking inherently adds multiple risk layers to your position

Learn More: EigenLayer Docs | Restaking Explained

4. Uniswap – The DEX Standard

Protocol Type: Decentralized Exchange (DEX)

Available On: Ethereum, Polygon, Arbitrum, Optimism, Base, Celo

Current TVL: Mid-single-digit billions

Official Site: uniswap.org

Continued DEX Dominance

Uniswap pioneered automated market makers (AMMs) and continues to lead DEX innovation. Notably, Uniswap v4, launched January 31, 2025, introduced Hooks—customizable smart contracts that attach to liquidity pools and unlock unprecedented flexibility.

Game-Changing V4 Hook Capabilities

Consequently, these programmable pools enable:

- Custom fee structures including dynamic fees and referral mechanisms

- Time-weighted average price (TWAP) oracles built directly into pools

- Limit orders and advanced order types previously impossible on AMMs

- Automated rebalancing and sophisticated loss protection strategies

Unmatched Market Position

Despite fierce competition from Curve, Balancer, and other platforms, Uniswap consistently captures the largest share of DEX trading volume. Moreover, V4 surpassed $1 billion in TVL within months of launch, demonstrating immediate market acceptance.

Optimal Usage Strategies

For best results, consider these approaches:

- First and foremost, utilize V3 concentrated liquidity specifically for stable pairs

- Before diving in, thoroughly understand impermanent loss before committing to provide liquidity

- On an ongoing basis, monitor pool fees and volume to identify profitable liquidity positions

Resources: Uniswap V4 Docs | Understanding Impermanent Loss

5. Curve Finance – Stablecoin Specialist

Protocol Type: Decentralized Exchange (Stableswap AMM)

Deployed On: Ethereum, Arbitrum, Optimism, Polygon, Avalanche

Current TVL: ~$4-5 billion

Official Site: curve.fi

The Stablecoin DEX Pioneer

Curve Finance specializes in low-slippage stablecoin and pegged-asset swaps using its proprietary StableSwap algorithm. This design makes Curve the optimal platform for large stablecoin trades and liquidity provision with minimal impermanent loss risk.

Why Curve Remains Essential

The protocol’s enduring relevance stems from several key advantages:

- Superior stablecoin efficiency – To illustrate, it handles $10M+ stablecoin trades with minimal slippage

- Capital efficiency – As a result, liquidity providers earn trading fees with lower impermanent loss

- Deep liquidity incentives – Furthermore, CRV token rewards boost yields for providers

- Integration backbone – Importantly, it powers many other protocols’ stablecoin infrastructure

Recent Developments and Concerns

While Curve remains fundamentally strong, the protocol faced challenges in 2023 with a major exploit that required significant community coordination to resolve. Additionally, the CRV token has experienced significant volatility related to founder liquidation concerns.

Best Use Cases

Curve excels particularly for:

- In the first place, large stablecoin swaps with minimal price impact

- Secondly, conservative yield farming on stable pairs (USDC/USDT/DAI)

- Last but not least, providing liquidity to pegged asset pairs (ETH/stETH)

Resources: Curve Documentation | DeFiLlama Curve Analytics

6. Pendle – Fixed Yield Markets

Protocol Type: Yield Trading / Fixed-Rate Protocol

Operating On: Ethereum, Arbitrum

Current TVL: ~$6-7 billion

Official Site: pendle.finance

Revolutionizing Yield Trading

Pendle created a sophisticated marketplace for trading future yields by splitting yield-bearing tokens into Principal Tokens (PT) and Yield Tokens (YT). This innovative mechanism allows users to either lock in fixed yields or speculate on future yield rates.

How Pendle Works

The protocol enables unique strategies:

- Fixed yield seekers – On the one hand, buy PT tokens to lock in predictable returns, similar to bonds

- Yield speculators – On the other hand, purchase YT tokens for leveraged exposure to variable yields

- Liquidity providers – Meanwhile, supply liquidity to earn trading fees from both sides

Explosive 2025 Growth

Pendle’s TVL surged dramatically in 2025, driven primarily by:

- First of all, growing demand for fixed-rate products in DeFi

- In addition to this, high yields available on liquid staking derivatives

- At the same time, sophisticated users seeking yield optimization strategies

- Not to mention, integration with major LST protocols like Lido and EigenLayer

Risk and Reward Balance

Understanding the trade-offs is critical:

PT (Principal Token) Risks: Lower but guaranteed yields; opportunity cost if variable yields surge unexpectedly.

YT (Yield Token) Risks: High volatility; can lose value rapidly if underlying yields decline; acts as leveraged exposure.

Resources: Pendle Documentation | Yield Trading Explained

7. MakerDAO – Decentralized Stablecoin

Protocol Type: CDP / Stablecoin Issuance

Primary Chain: Ethereum

Total Value Locked: ~$6-8 billion

Official Site: makerdao.com

The Original DeFi Blueprint

MakerDAO pioneered decentralized stablecoin creation with DAI, allowing users to mint stablecoins against crypto collateral without intermediaries. Since 2017, MakerDAO has remained one of DeFi’s most critical infrastructure pieces.

How DAI Maintains Stability

The protocol employs sophisticated mechanisms:

- Over-collateralization – To begin with, users must deposit more value than they mint

- Liquidation systems – Subsequently, the protocol automatically sells collateral if positions become undercollateralized

- Stability fees – In parallel, interest rates balance supply and demand

- PSM (Peg Stability Module) – As a final safeguard, direct USDC/DAI swaps maintain the $1.00 peg

2025 Strategic Evolution

MakerDAO underwent significant transformation, including:

- To start with, rebranding discussion to “Sky Protocol” with new token launches

- Beyond that, increased exposure to real-world assets (RWAs) including US Treasury bonds

- Similarly, expanded collateral types beyond just crypto assets

- At the same time, governance debates around centralization versus efficiency

Practical Applications

Users commonly employ MakerDAO to:

- In the first instance, generate DAI liquidity without selling crypto holdings

- Alternatively, leverage long crypto positions (not recommended for beginners)

- Moreover, access overcollateralized stablecoin alternatives to centralized options

Resources: Maker Documentation | DAI Statistics

8. Jito – Solana Liquid Staking with MEV

Protocol Type: Liquid Staking (Solana)

Native Chain: Solana

Current TVL: ~$3-4 billion

Official Site: jito.network

Why Jito Leads Solana Staking

While Ethereum dominates DeFi in terms of total value locked, Solana’s growing ecosystem has made Jito the premier liquid staking solution on the network. Jito combines traditional staking rewards with additional MEV (Maximal Extractable Value) revenue.

The MEV Advantage Explained

Jito’s validators run specialized software that captures MEV opportunities, distributing these profits to JitoSOL holders. Consequently, JitoSOL often yields 1-2% higher APY than standard SOL staking.

How It Works

The process is straightforward:

- To start, deposit SOL and receive JitoSOL (liquid staking token)

- Immediately after, earn base Solana staking rewards (~7-8% APY)

- On top of that, receive additional MEV rewards (~1-2% extra APY)

- Best of all, use JitoSOL across Solana DeFi protocols while earning

Solana’s Competitive Position

Despite Solana’s technological advantages and rising popularity, the network still faces questions about long-term sustainability compared to Ethereum. However, Jito has established itself as the clear leader in Solana liquid staking.

Important Considerations

Keep these factors in mind:

- Solana network risk – First and foremost, historical outages and stability concerns

- Validator centralization – In addition, MEV extraction favors larger operators

- Liquidity depth – It’s worth noting that JitoSOL liquidity is lower than stETH on Ethereum

Resources: Jito Documentation | Solana Staking Guide

9. Ethena – Synthetic Dollar Protocol

Protocol Type: Synthetic Stablecoin

Primary Chain: Ethereum (multi-chain expanding)

Total Value Locked: ~$3-4 billion

Native Token: USDe (synthetic dollar)

Official Site: ethena.fi

The Synthetic Dollar Innovation

Ethena introduced a novel approach to stablecoin creation through delta-neutral hedging strategies. Unlike traditional stablecoins backed by fiat or crypto collateral, USDe maintains its peg through perpetual futures positions.

How Ethena Generates Yield

The protocol’s yield comes from multiple sources:

- Staking rewards – Primarily, from underlying stETH collateral

- Funding rates – Additionally, from perpetual futures positions

- Basis trading – Furthermore, arbitraging spot-futures spreads

Consequently, Ethena has offered some of the highest sustainable yields in DeFi, frequently exceeding 15-25% APY.

Understanding the Mechanism

The system operates through:

- To begin, users deposit collateral (typically stETH) to mint USDe

- Next, the protocol opens offsetting short positions on derivatives exchanges

- As a result, the delta-neutral strategy maintains stable $1.00 peg regardless of ETH price

- Ultimately, funding rate income flows to USDe and sUSDe (staked USDe) holders

Critical Risk Assessment

This innovative model carries unique risks:

- Funding rate volatility – Yields can swing dramatically or turn negative

- Exchange counterparty risk – Relies on centralized derivatives platforms

- Basis trade risk – Strategy breaks down during extreme market dislocations

- Regulatory uncertainty – Novel structure may attract regulatory scrutiny

When to Consider Ethena

Ethena works best for:

- Primarily, sophisticated users comfortable with derivatives mechanisms

- Additionally, those seeking high yields with moderate risk tolerance

- Furthermore, portfolios already diversified across multiple stablecoin types

Resources: Ethena Documentation | USDe Risk Analysis

10. JustLend – TRON’s Lending Giant

Protocol Type: Money Market / Lending

Native Blockchain: TRON

Total Value Locked: ~$6-7 billion

Official Site: justlend.org

TRON’s DeFi Cornerstone

JustLend represents the largest lending protocol on the TRON blockchain, operating as a fork of Compound Finance. Despite TRON’s controversial reputation, JustLend processes billions in lending volume with remarkably low transaction costs. For a detailed comparison of TRON with other emerging blockchains, check out our TON vs TRON analysis.

Why TRON DeFi Matters

The platform offers compelling advantages:

- Ultra-low fees – Transactions cost cents instead of dollars

- USDT dominance – TRON hosts the largest USDT circulation globally

- High efficiency – Ideal for frequent traders and yield farmers

- Established infrastructure – Years of proven operation

Governance and Mechanism

Important technical details:

- The protocol uses JST tokens for governance (not TRX)

- It supports TRON’s major assets: TRX, USDT, USDC, BTT

- Risk parameters are similar to Compound and Aave

- Liquidation mechanisms actively protect lender capital

Honest Risk Evaluation

TRON’s ecosystem carries specific concerns:

- Centralization – Justin Sun’s significant influence over network decisions

- Regulatory scrutiny – TRON faces ongoing legal questions

- Exit liquidity – Bridging assets off TRON can be expensive or slow

- Reputation risk – Association with controversial projects

Best Use Cases

JustLend excels for:

- In particular, USDT holders seeking yield with minimal fees

- Equally important, frequent traders minimizing transaction costs

- Not to forget, users already operating within TRON’s ecosystem

Resources: JustLend Documentation | TRON DeFi Overview

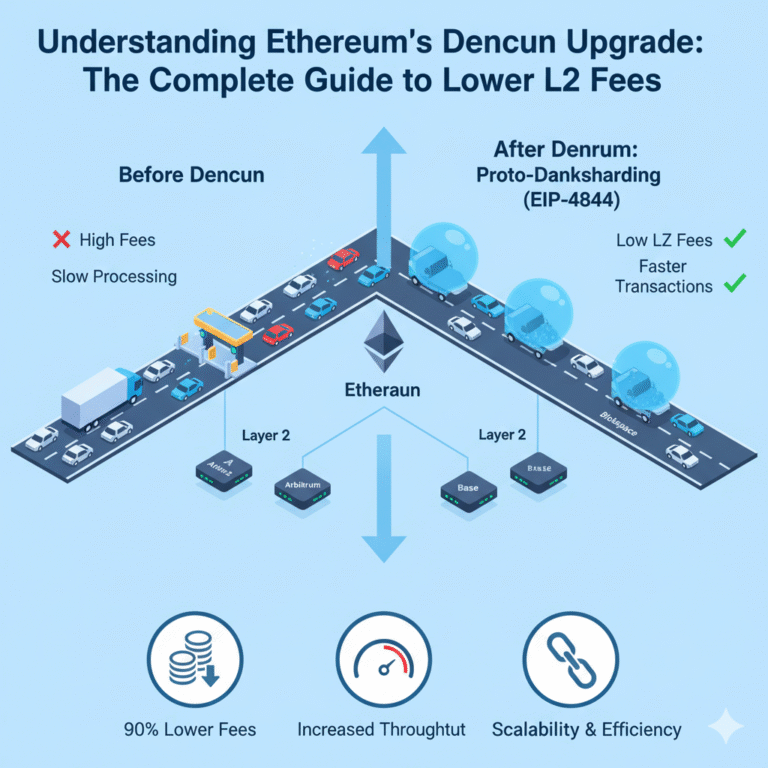

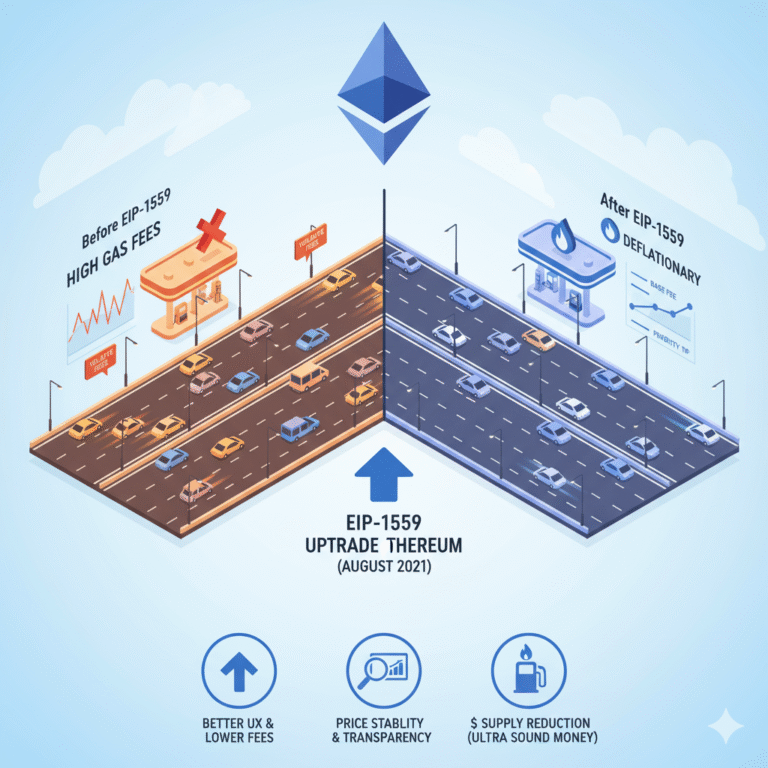

Cross-Chain Comparison: Where to Deploy Your Capital

Transaction Cost Analysis

Understanding fee structures across chains is essential for optimizing returns:

Ethereum Mainnet:

- In terms of single transactions: $5-50+ (depending on network congestion)

- For complex DeFi interactions: $20-200+

- Optimal use case: Large capital deployments ($10,000+)

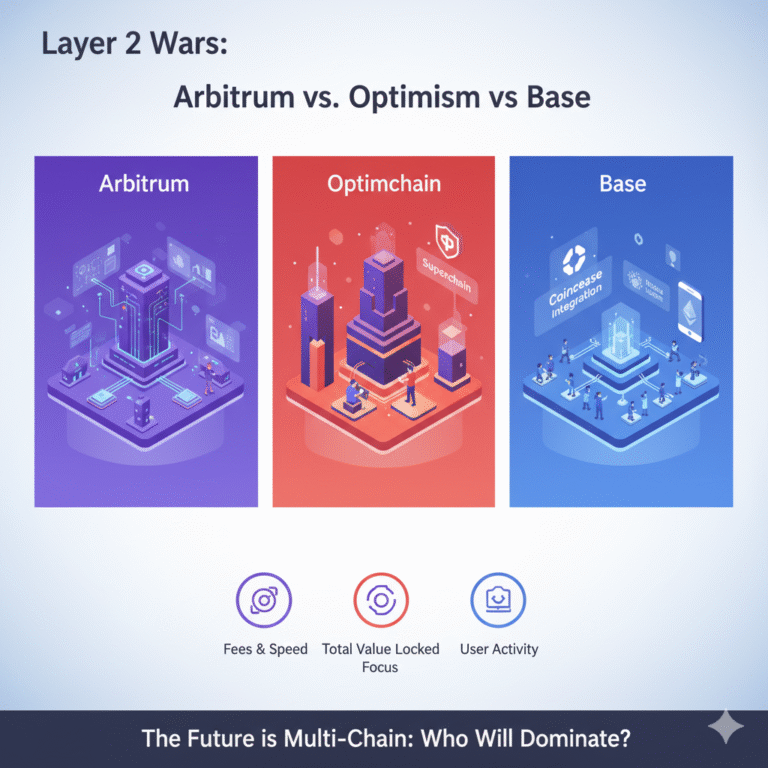

Layer 2 Networks (Arbitrum, Optimism, Base):

- Single transaction costs: $0.10-2

- More complex interactions: $0.50-10

- Ideal for: Medium capital ($1,000-10,000)

Solana:

- Typical single transaction: $0.0001-0.01

- DeFi interaction fees: $0.01-0.50

- Perfect for: Frequent trading and smaller amounts ($100+)

TRON:

- Basic transaction cost: $0.01-0.10

- Advanced DeFi operations: $0.05-0.50

- Best suited for: USDT operations and cost-sensitive strategies

Security and Decentralization Spectrum

Ranking chains by security characteristics:

- Ethereum – Highest security, maximum decentralization, most battle-tested

- Layer 2s – Inherit Ethereum security with minor trust assumptions

- Solana – Strong but newer; history of network outages

- TRON – Functional but more centralized; higher protocol risk

Liquidity Depth Comparison

Where capital flows matter most:

- Ethereum: Without question, the deepest liquidity across all asset types

- Arbitrum/Optimism: Showing growing liquidity, especially for newer protocols

- Base: Currently experiencing rapid expansion, backed by Coinbase ecosystem

- Solana: Notably strong for SOL-native assets, though thinner for bridged assets

- TRON: Particularly excellent for USDT, yet limited for other assets

How to Get Started with DeFi in 2025

Essential Prerequisites

Before interacting with any protocol, ensure you have:

- Hardware wallet – First priority: Ledger or Trezor for significant funds

- Software wallet – For daily use: MetaMask, Phantom, or Rabby for regular operations

- Gas tokens – Depending on your chain: ETH, SOL, or TRX as needed

- Basic understanding – Most importantly: Spend 2-3 hours learning fundamentals

Choose Your Entry Point Based on Risk Tolerance

Conservative Beginners Should Consider:

- Stablecoin lending on Aave – Supply USDC/USDT for stable 3-8% APY

- Wrapped staked ETH (wstETH) – Earn ETH staking rewards passively through Lido

- Liquidity provision on Curve – Provide stablecoin liquidity with minimal impermanent loss risk

Moderate Risk-Takers Can Explore:

- Restaking on EigenLayer – Stack rewards but thoroughly understand slashing risks

- Pendle fixed yields – Lock in predictable returns on LSTs with known maturities

- JitoSOL on Solana – Higher base yields with MEV boosts for added returns

Advanced Users May Pursue:

- Ethena yield strategies – Variable but potentially high yields (understand funding rate mechanics)

- Pendle YT speculation – Leveraged yield exposure for sophisticated users

- Multi-protocol yield farming – Combine multiple protocols for optimized risk-adjusted returns

Essential Safety Principles to Follow

Importantly, adhering to these guidelines will significantly reduce your risk:

Rule #1: Start Small – Always test with amounts you can afford to lose completely

Critical: Understand Smart Contract Risk – Even audited protocols can have critical vulnerabilities

Monitor: Watch Correlations – LST + LRT + restaking = dangerously stacked risk layers

Essential: Monitor Health Factors – Keep loan positions well-collateralized (>2.0 health factor minimum)

Security First: Verify Addresses – Always check official websites and contract addresses carefully

Protection: Use Hardware Wallets – Store significant funds in cold storage devices

Stay Alert: Expect Volatility – APYs and TVL change rapidly—recheck immediately before acting

Common Mistakes to Avoid at All Costs

Learning from others’ errors is crucial:

Mistake #1: Aping into high APYs without thoroughly understanding the underlying risks

Error #2: Over-leveraging loan positions beyond your ability to manage

Pitfall #3: Ignoring gas fees on Ethereum mainnet that can eat into profits

Warning #4: Failing to diversify adequately across protocols and chains

Common Error: Not reading documentation before using complex protocols

Critical Mistake: Leaving funds on centralized exchanges for extended DeFi operations

Frequently Asked Questions

What is Total Value Locked (TVL)?

TVL represents the total dollar value of assets deposited in a DeFi protocol. Essentially, it’s the primary metric for measuring protocol size and user trust. However, it doesn’t directly indicate profitability or security levels.

Are DeFi protocols safe to use?

Frankly, no DeFi protocol is completely safe. Risks include smart contract bugs, economic exploits, oracle manipulation, and market volatility. Therefore, always:

- First and foremost, use audited protocols with strong track records

- Above all else, never invest more than you can afford to lose completely

- Most importantly, thoroughly understand the specific risks of each protocol

What’s the difference between liquid staking and regular staking?

Regular staking: You lock assets to secure a blockchain and earn rewards, but assets remain illiquid.

Liquid staking: Conversely, you receive a liquid token (like stETH) representing your stake, allowing you to use it in DeFi while still earning staking rewards.

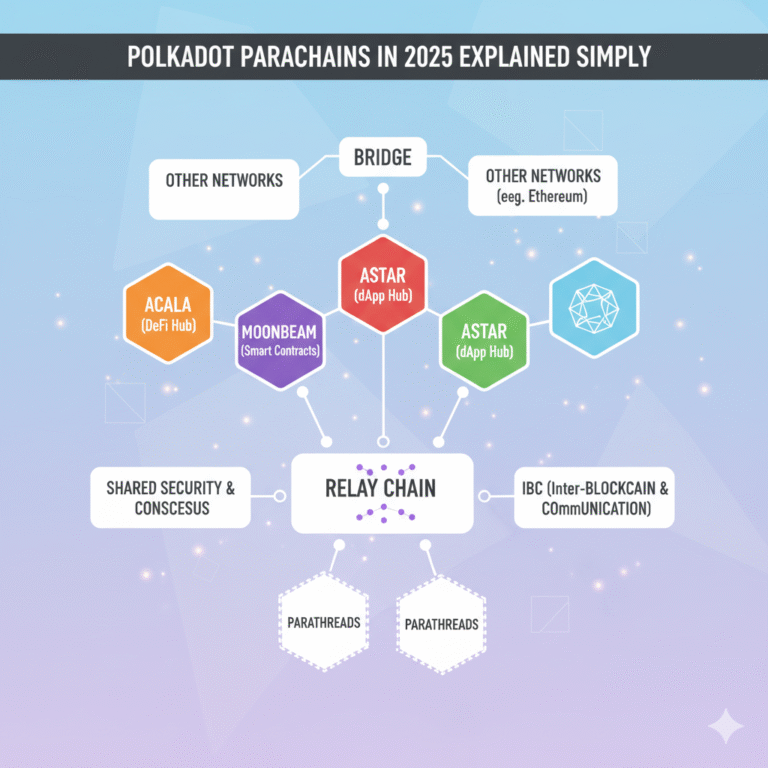

How do I choose between Ethereum and Layer 2 networks?

Ethereum Mainnet: Offers highest security and liquidity, but involves expensive gas fees ($10-100+ per transaction).

Layer 2s (Arbitrum, Optimism, Base): Alternatively, these provide lower fees ($0.10-5 per transaction), but with slightly reduced security and fragmented liquidity.

What are the tax implications of DeFi activities?

In most jurisdictions, DeFi activities create taxable events:

- When you swap tokens, this triggers capital gains or losses

- Yield earned from staking or lending counts as ordinary income

- Providing liquidity can involve potentially complex tax treatment

Consequently, consult a crypto-specialized tax professional. Additionally, use tracking tools like Koinly or CoinTracker.

Can I lose money in DeFi even without prices dropping?

Yes, unfortunately through several mechanisms:

- One common risk is impermanent loss from providing liquidity to volatile pairs

- Another threat comes from liquidations due to over-leveraged borrow positions

- Additionally, smart contract exploits or hacks can drain protocol funds

- Furthermore, depeg events may cause stablecoins to lose their peg

- Not to mention, gas fees sometimes exceed your actual profits

What’s the minimum to start using DeFi?

For Ethereum, you’ll need $500-1000 minimum (due to high gas fees)

On Layer 2 networks, $100-200 minimum is sufficient (much more accessible)

With Solana or TRON, just $50-100 minimum works (very low fees make small amounts viable)

However, always factor in gas fees when calculating potential returns on smaller amounts.

Key Corrections: Common DeFi Misconceptions

Myth #1: Lido Still Offers Multi-Chain Staking

The Truth: Lido discontinued Solana and Polygon staking. Consequently, only bridged wstETH exists on these chains—not native staking services.

Common Misunderstanding: EigenLayer Has No Token

What’s Real: The EIGEN token exists and airdrops began in 2024 for early users.

Outdated Information: Aave’s TVL is Around $12B

Current Reality: Aave surpassed $40B in August 2025 and currently sits at approximately $74B—far exceeding outdated figures.

False Claim: JustLend Uses TRX for Governance

Actual Fact: JustLend governance specifically uses JST tokens, not TRX, despite both being in the TRON ecosystem.

Incorrect Assumption: Ethena’s USDe is Backed by Fiat

Reality Check: USDe is a synthetic dollar maintained through delta-neutral derivatives strategies, not fiat reserves in bank accounts.

Additional Resources for Deeper Learning

Educational Resources and Guides

- DeFi Safety – Independent protocol security ratings

- Rekt News – Detailed DeFi exploit analysis

- Code4rena – Audit competitions and detailed reports

Conclusion: Navigating DeFi’s Mature Ecosystem

The DeFi landscape in 2025 represents a maturing ecosystem with legitimate use cases beyond mere speculation. Indeed, these top 10 protocols demonstrate product-market fit, sustained usage, and genuine innovation—but every protocol carries inherent risk.

Keys to Success in DeFi

Achieving sustainable success requires:

- Continuous learning – Above all, protocols evolve rapidly and staying informed is essential

- Risk management – Equally critical, never overexpose to single protocols or concentrated strategies

- Due diligence – In addition, verify TVL, audit status, and community sentiment before investing

- Patience – Ultimately, sustainable yields beat risky yield-chasing over the long term

The Path Forward

The parallel financial system is here and growing. Nevertheless, participate wisely, start conservatively, and scale your involvement as your understanding deepens. Furthermore, remember that the most successful DeFi users are those who prioritize capital preservation over maximum yields.

Ultimately, DeFi offers unprecedented financial opportunities—but only for those who approach it with proper education, caution, and respect for the risks involved.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. DeFi protocols carry significant risks including total loss of capital. Always do your own research and consult with financial professionals before investing.