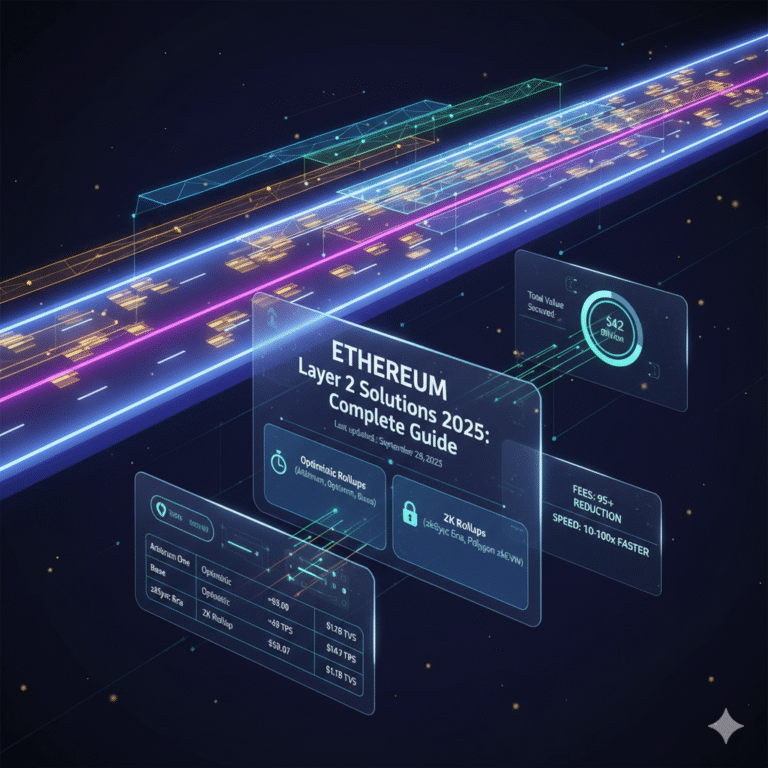

What Are Ethereum Layer 2 Solutions?

Ethereum Layer 2 solutions are scaling networks that process transactions off the main Ethereum blockchain while maintaining its security. Think of them as express lanes that reduce traffic on the main highway.

As the world’s largest smart contract platform, Ethereum processes only ~15 transactions per second (TPS). Consequently, when demand spikes, gas fees can reach $50+ per transaction, making simple swaps prohibitively expensive for most users.

Fortunately, Layer 2 (L2) networks solve this by:

- Processing transactions off-chain in batches

- Settling final results on Ethereum’s main network

- Reducing fees by 95%+ compared to Ethereum mainnet

- Increasing transaction speed by 10-100x

By September 2025, these networks secure over $42 billion in total value locked (L2BEAT data), thereby proving their critical role in Ethereum’s ecosystem.

How Layer 2 Networks Work

To understand the mechanics behind these scaling solutions, it’s helpful to explore how Ethereum Layer 2 works in detail. Layer 2 solutions use two primary approaches to scale Ethereum:

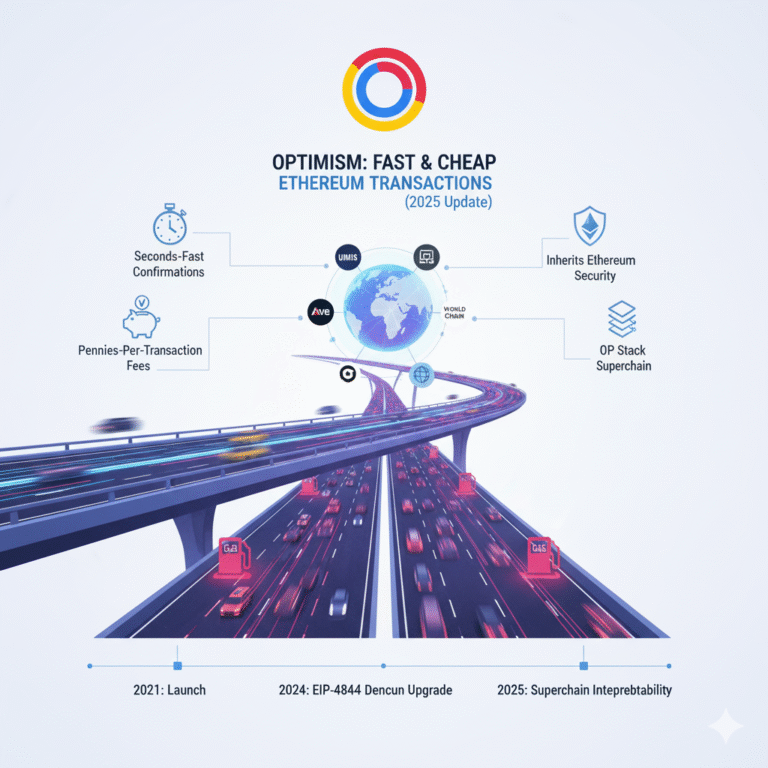

Optimistic Rollups

Examples: Arbitrum, Optimism, Base

These rollups assume transactions are valid unless challenged. Moreover, they feature a 7-day withdrawal period for security (unless using fast bridges). In addition, this battle-tested technology offers extensive DeFi ecosystems with lower technical complexity for developers.

If you’re curious about how Optimism delivers fast and cheap Ethereum transactions, it leverages this optimistic approach to achieve significant cost reductions while maintaining security.

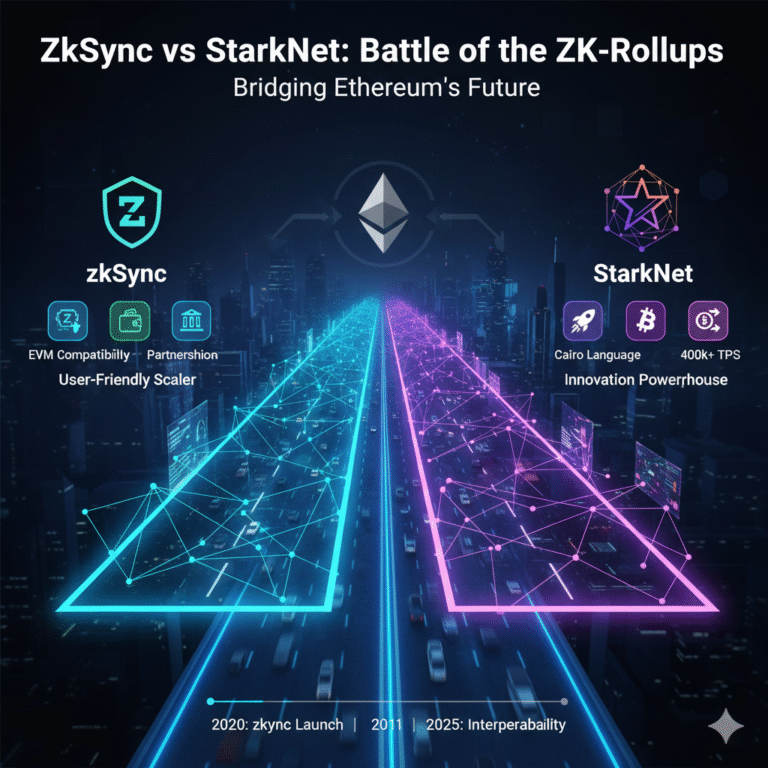

Zero-Knowledge (ZK) Rollups

Examples: zkSync Era, Starknet, Polygon zkEVM

In contrast, ZK rollups use cryptographic proofs to verify transaction validity. As a result, they provide instant finality and faster withdrawals. However, while more complex, they’re theoretically more efficient. Nevertheless, this newer technology comes with evolving developer tools.

For those new to this concept, understanding ZK rollups starts with grasping how zero-knowledge proofs enable scalability without compromising security. Meanwhile, if you want to dive deeper into the technical details, our complete guide to ZK rollups in 2025 covers everything from cryptographic fundamentals to real-world implementations.

Importantly, both approaches inherit Ethereum’s security while dramatically improving performance and cost efficiency.

Key Metrics for Comparing Layer 2 Networks

When choosing a Layer 2 network, focus on these three critical metrics:

Transaction Fees

This metric represents what it costs to use the network:

- ETH transfers: $0.05-$0.20 typical range

- Token swaps: $0.15-$0.50 typical range

- Complex DeFi operations: $0.30-$1.00 typical range

Notably, fees fluctuate based on network congestion and blob space costs after EIP-4844.

Transaction Speed (TPS)

Actual throughput matters more than theoretical maximums. For instance:

- Live TPS varies significantly from marketing claims

- Real-world usage patterns affect performance

- Peak capacity differs from sustained throughput

Total Value Secured (TVS)

Total value locked serves as an indicator of adoption and trust:

- Amount of crypto assets locked in the network

- Reflects ecosystem maturity and user confidence

- Correlates with available DeFi protocols and liquidity

Best Layer 2 Networks in 2025

Complete Performance Comparison

| Layer 2 Network | Type | Send Fee | Swap Fee | Live TPS | Total Value Secured | Key Strengths |

|---|---|---|---|---|---|---|

| Arbitrum One | Optimistic | ~$0.09 | ~$0.27 | ~48 | $19.7B | Largest DeFi ecosystem, proven stability |

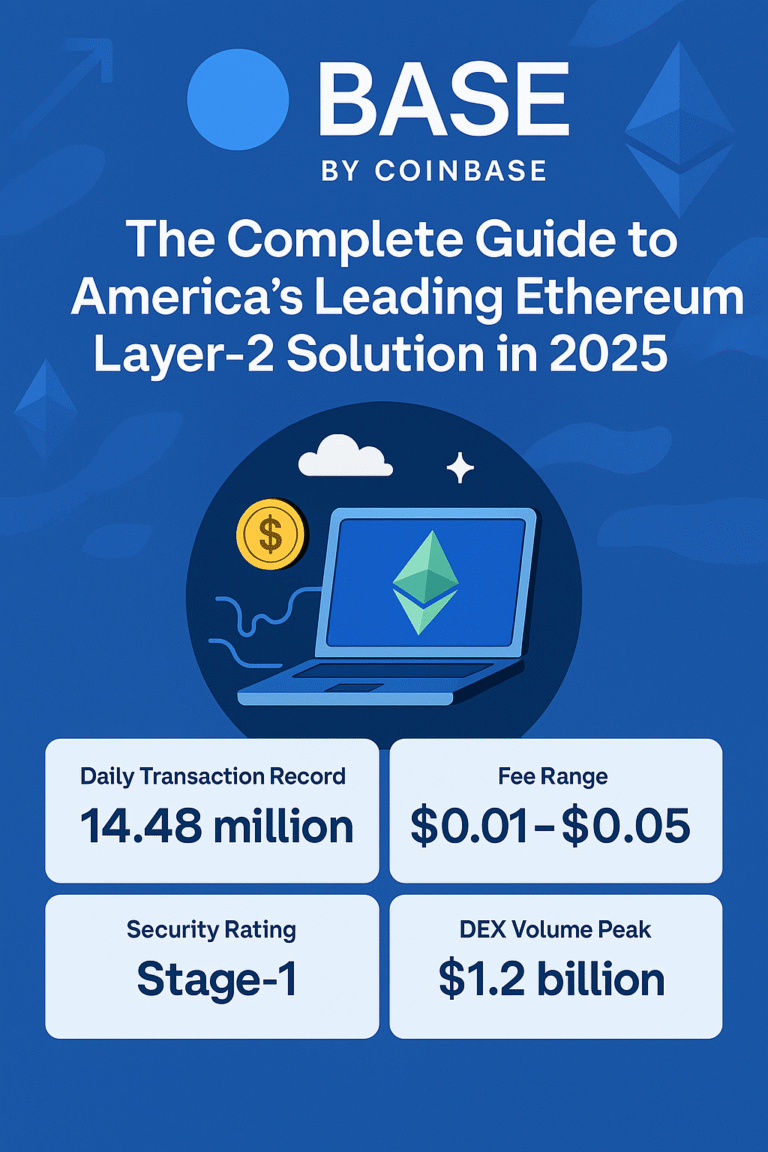

| Base | Optimistic | ~$0.10 | ~$0.20 | ~129 | $14.7B | Coinbase integration, high activity |

| Optimism | Optimistic | ~$0.14 | ~$0.18 | ~14 | $3.6B | Superchain foundation, developer focus |

| zkSync Era | ZK Rollup | ~$0.07 | Variable | ~0.3 | $1.1B | Account abstraction, native zkEVM |

| Starknet | ZK Rollup | ~$0.19 | ~$0.57 | ~7.5 | $0.6B | Cairo language, innovative VM |

| Polygon zkEVM | ZK Rollup | ~$0.19 | ~$2.75 | ~0.07 | $0.02B | EVM compatibility, Polygon ecosystem |

Data sources: L2BEAT, l2fees.info, September 28, 2025

Real-World Performance Analysis

Fee Structure Deep Dive

Several factors explain why fees vary across networks:

- Blob space demand (post-EIP-4844 upgrade affects all L2s)

- Network congestion during high-activity periods

- Transaction complexity (simple transfers vs. multi-step DeFi operations)

Current fee leaders:

- Cheapest sends: zkSync Era (~$0.07)

- Cheapest swaps: Optimism (~$0.18)

- Most consistent: Arbitrum One (stable across operations)

Transaction Throughput Reality

Impressively, Base leads in live TPS (~129) due to several factors:

- Coinbase’s retail user onboarding

- High-frequency trading and memecoin activity

- Optimized OP-stack implementation

Meanwhile, Arbitrum maintains steady performance despite having the highest TVL. Such stability results from:

- Mature load balancing

- Established DeFi protocols optimizing gas usage

- Consistent ~50 TPS with burst capacity

Ecosystem Maturity Rankings

- Arbitrum: Most mature DeFi ecosystem, highest liquidity

- Base: Fastest growing, strong retail adoption

- Optimism: Developer-focused, powering Superchain expansion

- zkSync Era: Leading ZK innovation, improving tooling

- Starknet: Unique Cairo ecosystem, growing developer interest

Which Layer 2 Should You Choose?

For DeFi Trading and Lending

Recommended: Arbitrum One

When it comes to DeFi, Arbitrum One offers unmatched liquidity depth across major DEXs like Uniswap and SushiSwap. The platform also hosts battle-tested lending protocols including Aave and Compound. During periods of market volatility, its proven stability provides traders with confidence. Extensive yield farming opportunities make it the go-to choice for DeFi power users.

For Retail Users and Beginners

Recommended: Base

Built with user experience in mind, Base delivers seamless Coinbase wallet integration from the start. New users benefit from simplified fiat on-ramps that eliminate common onboarding friction. Transaction throughput reaches impressive levels, ensuring responsive interactions across all dApps. Consumer-focused applications continue growing on the platform, creating an expanding ecosystem for everyday users.

For Developers and Innovation

Recommended: Optimism or zkSync Era

Two excellent options serve the developer community. Optimism features the Superchain ecosystem with standardized tools, and you can learn more about how Optimism explained its approach to fast and cheap Ethereum transactions through its innovative OP-stack architecture.

Alternatively, zkSync Era provides native account abstraction with advanced features. The platform has seen remarkable growth recently, and tracking zkSync Era’s latest updates and adoption trends in 2025 reveals impressive ecosystem expansion and technical improvements.

Both platforms additionally offer developer grants and ecosystem support, making them ideal choices for building next-generation applications.

For Cost-Sensitive Applications

Recommended: zkSync Era

Cost efficiency defines zkSync Era’s value proposition, with the platform delivering the lowest typical transaction fees in the ecosystem. Batch processing happens efficiently, reducing costs even further for high-volume applications. Thanks to native account abstraction, multi-transaction operations become significantly more economical compared to traditional approaches.

Security and Bridge Considerations

Official Bridges (Recommended)

For maximum security, consider these official bridges:

- Arbitrum Bridge offers 7-day withdrawal with the highest security standards

- Base Bridge utilizes the OP-stack standard bridge protocol

- Optimism Bridge provides Superchain-compatible transfers

- zkSync Bridge leverages fast finality through ZK proofs

Third-Party Fast Bridges

Alternatively, these fast bridges offer quicker transfers:

- Across Protocol enables cross-chain transfers in minutes

- Hop Protocol specializes in multi-hop bridging

- Synapse functions as a cross-chain DeFi hub

Important reminder: Always verify contract addresses and start with small amounts.

Future of Ethereum Layer 2 Scaling

What’s Coming in 2025-2026

Technical Improvements:

Major upgrades are reshaping the L2 landscape. Blob space expansion through EIP-4844 extensions will drive blob costs significantly lower. Interoperability protocols under development will enable seamless asset transfers between different L2 networks. Developer tooling for ZK rollups continues maturing toward production-ready quality. On the UX front, account abstraction will simplify blockchain interactions for mainstream users.

Ecosystem Growth:

Beyond technical advancement, ecosystem expansion accelerates across multiple dimensions. Additional OP-stack networks will join the Superchain, creating new use case opportunities. Privacy and computational capabilities will advance through continued ZK innovation. Payment and supply chain solutions are attracting growing enterprise interest across industries. Mobile-first applications will leverage the combination of low fees and instant finality to reach new user segments.

Key Takeaways

Several critical insights emerge from this comprehensive analysis:

Essential technology: Layer 2 has evolved from optional to essential for practical Ethereum usage. ✅

Value leader: With the most mature ecosystem, Arbitrum currently leads in total value secured. ✅

Activity champion: Base demonstrates the highest transaction throughput, driven by retail adoption. ✅

Future potential: ZK rollups continue emerging with compelling long-term efficiency advantages. ✅

Affordable operations: Standard operations now cost under $0.50 on most networks. ✅

Choose your Layer 2 based on your priority:

- Maximum DeFi options: Arbitrum One delivers the richest ecosystem

- Best user experience: Base provides the smoothest onboarding

- Lowest fees: zkSync Era offers the most economical transactions

- Developer innovation: Optimism or Starknet enable cutting-edge development

Frequently Asked Questions

Q: Are Layer 2 networks safe?

A: Yes, they inherit Ethereum’s security model. Specifically, your funds are protected by Ethereum’s consensus. However, there are different trust assumptions for Optimistic vs. ZK rollups.

Q: Can I move between Layer 2 networks?

A: Yes, using bridges or cross-chain protocols. Furthermore, direct L2-to-L2 transfers are becoming more common. As a result, interoperability continues to improve.

Q: Do I need ETH for gas on Layer 2?

A: Yes, most Layer 2s use ETH for gas fees. However, some networks support fee payment in other tokens. Therefore, check your specific network’s options.

This guide is updated regularly with the latest data from L2BEAT, l2fees.info, and official network sources. Consequently, bookmark this page for the most current Layer 2 comparison.