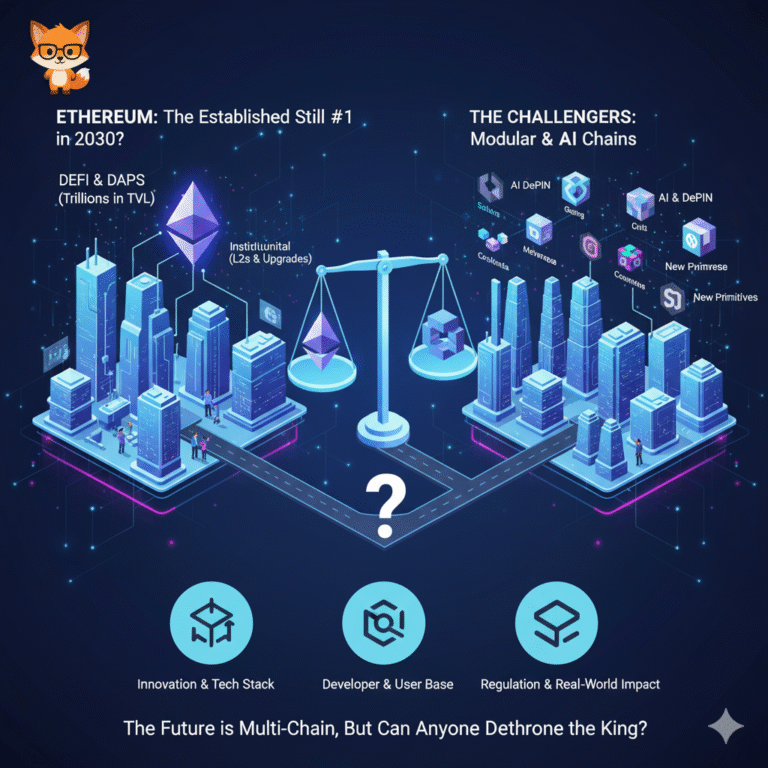

Ethereum has been crypto’s Swiss Army knife since 2015: money, smart contracts, tokens, DeFi, NFTs—the works. Today it leads on mindshare and infrastructure, but 2030 is not a gimme. Below is a clear, no-nonsense look at why Ethereum could remain on top—and what could knock it down a peg.

What Makes Ethereum Different

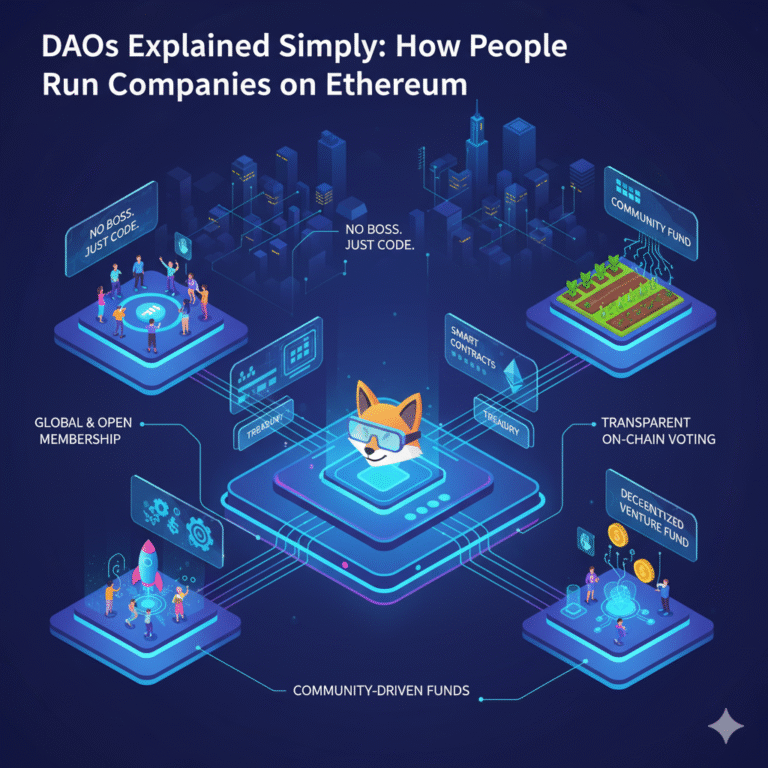

Unlike Bitcoin’s narrow “digital gold” role, Ethereum is a programmable blockchain platform. In fact, smart contracts execute automatically, powering decentralized applications (dApps) from lending markets to on-chain games. Moreover, that breadth—plus a huge developer ecosystem and network effects—explains its staying power so far. Indeed, developer data consistently shows Ethereum leading by total developer share globally.

Why Ethereum Could Stay #1 in 2030

The Developer Moat

Developers are the lifeblood of any blockchain platform. As a result, independent tracking shows Ethereum remains the top ecosystem by total developer activity globally, even as rivals grow. This means more tooling, security audits, integrations, and libraries—the boring, durable infrastructure that compounds over years and creates strong network effects.

Why Developer Activity Matters

Furthermore, when developers commit to a platform, they build entire ecosystems around it. Consequently, this creates a powerful moat that’s difficult for competitors to overcome, even with superior technology.

Sustainability and Credibility Upgrades

The Merge (September 2022) slashed Ethereum’s energy consumption by approximately 99.95% by transitioning from proof-of-work to proof-of-stake. As a result, this removed a major ESG (Environmental, Social, and Governance) concern for institutional investors. Both the optics and the reality helped position Ethereum as an environmentally sustainable blockchain.

Environmental Impact Post-Merge

In addition to energy savings, the transition has made Ethereum significantly more attractive to environmentally-conscious investors and institutions. Therefore, this shift has opened doors to capital that was previously unavailable due to ESG restrictions.

Scaling Solutions That Actually Ship

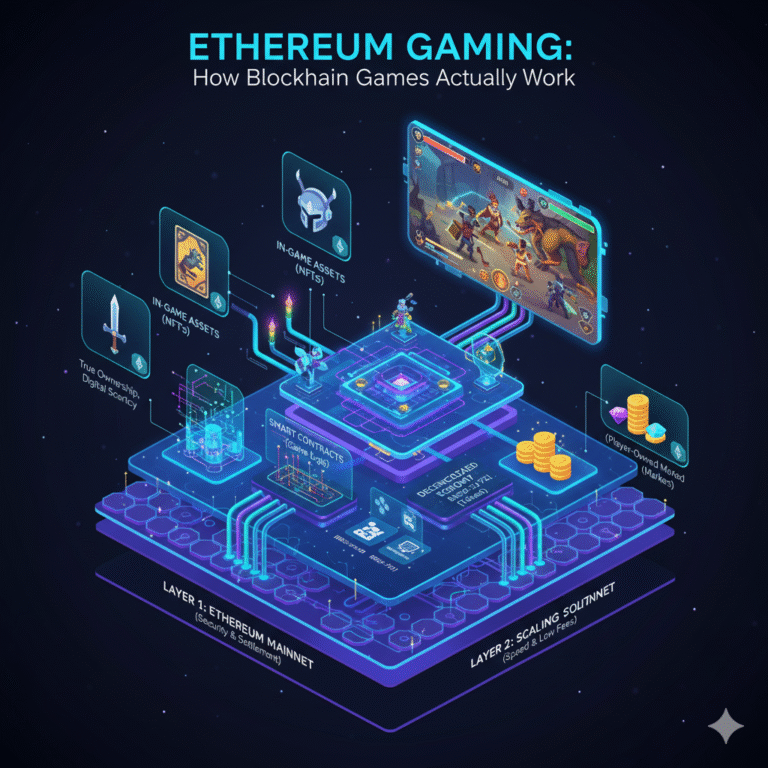

Ethereum’s 2024 Dencun upgrade (EIP-4844 “proto-danksharding”) dramatically reduced Layer-2 transaction fees—often down to just cents—which is where most user activity is migrating. Furthermore, full “danksharding” remains on the Ethereum roadmap, but the fee relief today is tangible and measurable.

Layer-2 Ecosystem Growth

Meanwhile, Layer-2 solutions like Arbitrum, Optimism, and Base are experiencing explosive growth. Consequently, these networks process millions of transactions daily while maintaining security through Ethereum’s mainnet. For those exploring advanced scaling technologies, comparing zkSync vs StarkNet reveals how zero-knowledge rollups are pushing the boundaries of what’s possible.

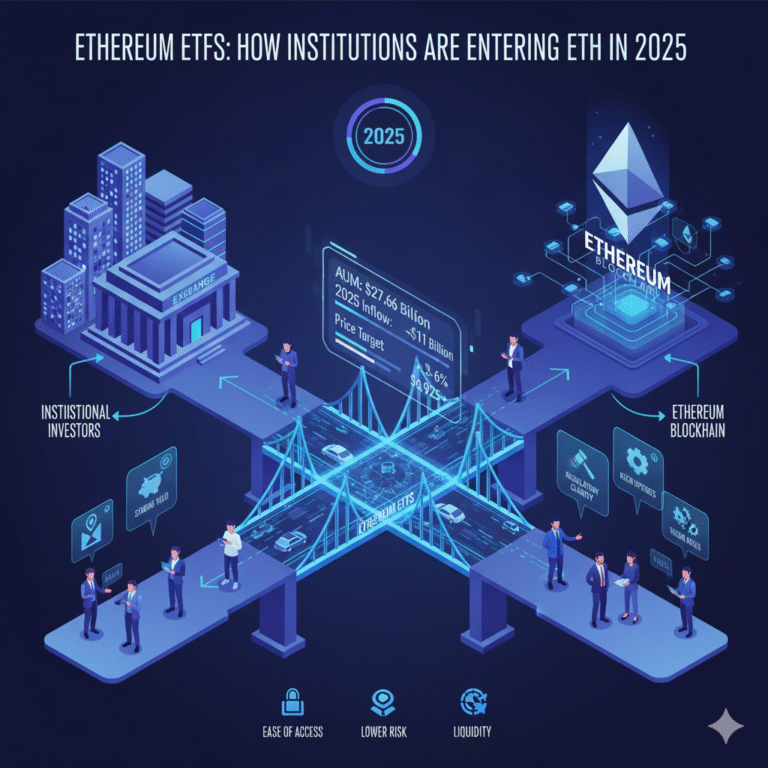

Brand Recognition, Liquidity, and Institutional Access

“Ethereum” is a recognized brand for enterprises, developers, and regulators. Notably, in the United States, spot Ether ETFs began trading in July 2024—a significant credibility milestone that broadened retail and institutional access. As a result, ETH has moved further into mainstream investment portfolios.

ETF Impact on Market Maturity

Moreover, the approval of spot Ether ETFs signals regulatory acceptance and legitimacy. Subsequently, this has encouraged traditional financial institutions to explore Ethereum-based products and services.

Real-World Usage and Integration

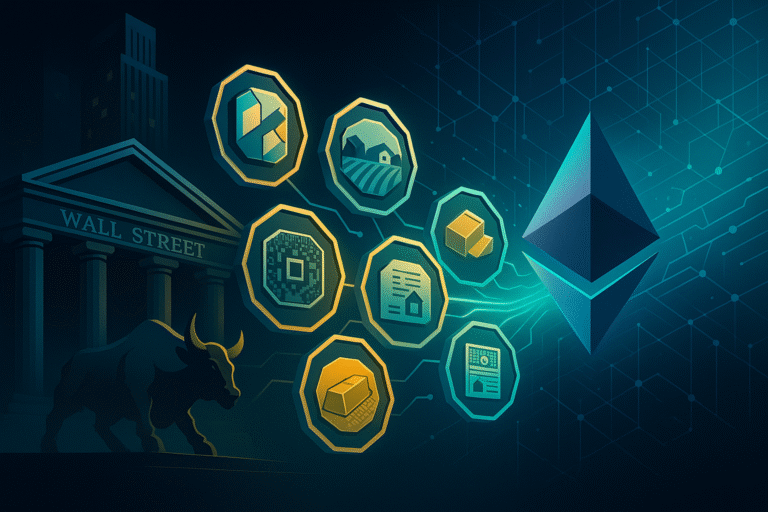

From DeFi protocols to stablecoin settlement on EVM-compatible chains, Ethereum’s technology stack is embedded across cryptocurrency exchanges, custodians, data providers, Layer-2 solutions, and compliance tools. Therefore, this institutional inertia matters significantly when serious capital and enterprise risk teams are involved.

Enterprise Adoption Trends

In addition, major corporations are increasingly exploring Ethereum for supply chain management, tokenized assets, and programmable finance. Consequently, this enterprise interest reinforces Ethereum’s position as the go-to platform for serious blockchain applications.

What Could Push Ethereum Down

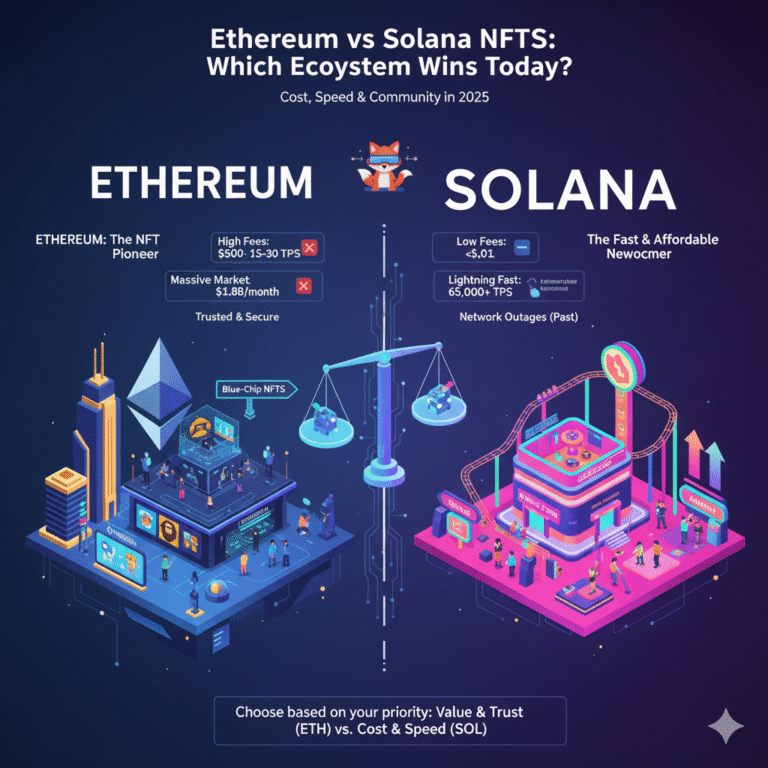

Faster, Cheaper Layer-1 Rivals

“Ethereum killers” like Solana, Avalanche, and others compete aggressively on throughput, latency, and transaction costs. In fact, some can process thousands of transactions per second at minimal fees. Consequently, if developers and users consistently find better experiences elsewhere, market share will inevitably shift.

Performance Comparison with Competitors

Nevertheless, raw speed isn’t everything—security, decentralization, and ecosystem maturity also matter. However, user experience ultimately drives adoption, and competitors are steadily improving on all fronts.

User Experience and Fee Volatility

Layer-1 gas fees can still spike during network congestion. Furthermore, if Layer-2 solutions experience technical issues—congestion, outages, or bridge vulnerabilities—users will migrate to blockchains where everything “just works.” Therefore, Ethereum’s Layer-2-first strategy must deliver seamless UX: fund once, bridge once, forget about it.

The UX Challenge

Moreover, newcomers to crypto often find Ethereum’s multi-layer architecture confusing. As a result, competitors with simpler onboarding processes gain an advantage in attracting mainstream users.

Regulatory Uncertainty

Cryptocurrency regulation can stifle certain use cases, particularly in DeFi. While ETF approvals signal mainstream acceptance, the regulatory framework continues evolving across the U.S., EU, and emerging markets. Generally, clarity favors incumbents—until disruptive policy changes occur.

Global Regulatory Landscape

In addition, different jurisdictions are taking vastly different approaches to crypto regulation. Consequently, this creates compliance challenges for global Ethereum-based projects.

Technological Leapfrogs

A breakthrough architecture or mature zero-knowledge proof technology with superior user experience could disrupt the landscape. Projects like StarkNet are actively developing next-generation scaling solutions that could reshape the competitive landscape. However, Ethereum’s defense is its consistent upgrade cadence and ability to integrate innovations into its rollup-centric roadmap.

Innovation and Adaptation

Nevertheless, staying ahead requires constant innovation. Therefore, Ethereum must continue absorbing cutting-edge developments while maintaining backward compatibility and security.

Ethereum 2030 Scenarios

Scenario A: Ethereum Maintains Leadership

Danksharding successfully deploys, Layer-2 solutions mature, fee and latency metrics become “good enough,” and developer momentum holds strong. In this scenario, ETH remains the default smart-contract platform for both institutions and retail users.

What Success Looks Like

Furthermore, in this optimistic scenario, Ethereum becomes the settlement layer for global finance, with Layer-2s handling everyday transactions seamlessly.

Scenario B: Multi-Chain Equilibrium

Ethereum remains significant, but rival Layer-1 blockchains and some Layer-2 solutions dominate specific verticals—analogous to the “iOS + Android” dynamic in mobile. Meanwhile, cross-chain tooling and interoperability protocols normalize this multi-chain reality.

The Coexistence Model

In this case, Ethereum maintains its position as the most secure and decentralized option, while other chains serve niche markets with specific performance requirements.

Scenario C: Market Share Decline

Upgrades underdeliver, user experience remains fragmented, or regulation constrains core use cases while a competitor offers meaningfully superior performance and compliance. In this scenario, Ethereum stays relevant but loses its leadership position.

Warning Signs to Watch

Moreover, declining developer activity, sustained high fees, or major security incidents could accelerate this decline. Therefore, execution on the roadmap is absolutely critical.

Critical Factors That Will Decide Ethereum’s Future

Roadmap Execution

Dencun delivered measurable fee relief; however, full danksharding and continued Layer-2 improvements must follow through on Ethereum’s scaling roadmap. Without consistent progress, competitors will gain ground.

Developer Retention

If Ethereum maintains the #1 position in blockchain developer activity, it will likely sustain its ecosystem flywheel effect. Indeed, developers build the applications that attract users, who in turn attract more developers.

Institutional Adoption

ETF access lowered barriers; furthermore, broader integration—including corporate treasuries, tokenized real-world assets (RWAs), and regulated securities—can further entrench Ethereum’s position. Consequently, institutional money brings stability and legitimacy.

Competitive Pressure on UX and Costs

Rival blockchains with consistently lower fees and better latency will continue pressuring Ethereum to innovate and simplify. Therefore, complacency is not an option in this rapidly evolving landscape.

Quick Reality Checks for 2025

Energy Efficiency

Post-Merge energy consumption decreased by approximately 99.95%. As a result, this is excellent for institutional ESG compliance and public perception.

Transaction Fees

Post-Dencun upgrade, Layer-2 fees often cost just cents; meanwhile, mainnet remains premium blockspace for high-value settlements.

Global Adoption

Grassroots cryptocurrency adoption remains robust in emerging markets, with Nigeria and the Philippines among leading countries. Moreover, this demand frequently flows through EVM-compatible infrastructure.

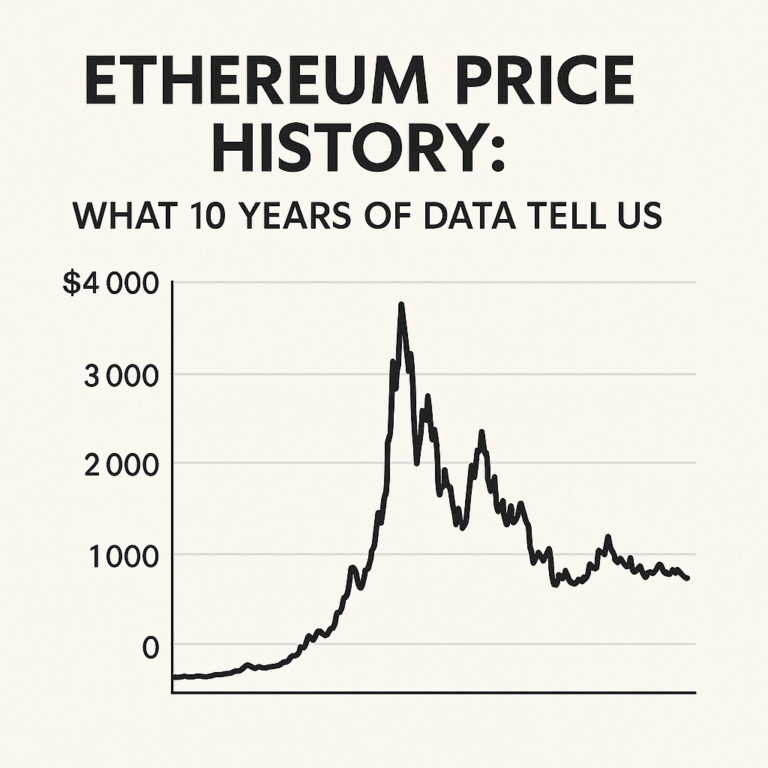

Market Position

Despite competition, Ethereum continues to lead in total value locked (TVL) across DeFi protocols. Furthermore, its market capitalization remains firmly in second place behind Bitcoin.

Bottom Line: Will Ethereum Be #1 in 2030?

Ethereum enters the second half of the decade ahead—but not untouchable. In conclusion, if it maintains its developer leadership, continues making Layer-2 user experience seamlessly simple, and successfully ships the remaining scaling roadmap, Ethereum will be extremely difficult to dislodge by 2030. However, competition is fierce and very real. Ultimately, in blockchain, the crown is rented, not owned.

Related Resources: