The blockchain world has grown into a maze of separate networks — each fast, secure, and innovative, yet mostly isolated. Cosmos set out to change that. Instead of one monolithic chain handling everything (and choking on its own traffic), Cosmos builds a web of independent yet interconnected blockchains.

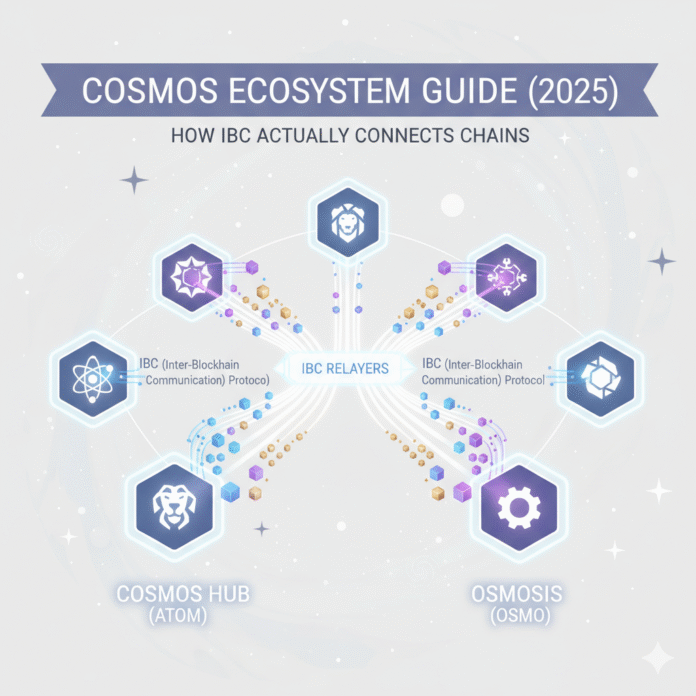

At the center of this design lies IBC — the Inter-Blockchain Communication protocol, a system that lets different blockchains exchange data and assets safely, instantly, and without centralized bridges.

In this guide, we’ll break down how the Cosmos ecosystem works, how IBC connects chains under the hood, and why it’s becoming the backbone of multi-chain interoperability in 2025.

What Is the Cosmos Ecosystem?

Cosmos isn’t a single blockchain — it’s a framework for creating many of them. Launched in March 2019, the Cosmos Hub (powered by the ATOM token) was the first zone built using the Cosmos SDK, an open-source toolkit that lets developers build their own app-specific blockchains, often called appchains.

Each appchain runs independently — it chooses its own governance, tokenomics, and upgrade cycle — but can still communicate with others through IBC. This design addresses three fundamental blockchain challenges:

Scalability: Instead of one congested chain, many appchains share the load.

Interoperability: IBC connects them seamlessly.

Sovereignty: Each chain rules itself.

Cosmos chains use CometBFT (the successor to Tendermint BFT) for consensus, giving instant finality within seconds and low fees, usually fractions of a cent. By mid-2025, the Cosmos ecosystem includes over 110 active IBC-connected chains and handles tens of billions of dollars in cross-chain transfers annually.

Understanding IBC: The Internet Protocol for Blockchains

Think of IBC as the TCP/IP of blockchains — a universal communication layer that lets separate blockchains send authenticated, ordered data packets to each other.

Launched in production on the Cosmos Hub in 2021, IBC has since evolved into a mature standard maintained by the Interchain Foundation and Cosmos SDK community. When comparing approaches to blockchain interoperability, Cosmos vs Polkadot take fundamentally different paths, with Cosmos favoring sovereignty and Polkadot emphasizing shared security.

How IBC Works Under the Hood

Every IBC connection follows the TAO model — Transport, Authentication, and Ordering:

Transport: Moves packets of data between blockchains.

Authentication: Uses light clients to verify each other’s state cryptographically — no need for trust or third-party custodians.

Ordering: Ensures messages arrive in the correct sequence.

In simple terms, IBC is like a secure postal service between sovereign countries. Each country (chain) has its own rules, but IBC provides the shared logistics — trusted customs, verified stamps, and guaranteed delivery.

Learn more about IBC specifications at the IBC Protocol documentation.

Step-by-Step: What Happens During an IBC Transfer

Let’s say you’re moving ATOM tokens from the Cosmos Hub to Osmosis, the leading DEX chain in the ecosystem.

The sender locks ATOM in an escrow account on the Cosmos Hub, a data packet is generated with transfer details, and an off-chain relayer picks up the packet and delivers it to Osmosis. Osmosis checks the packet’s validity using its light client of the Hub and mints an equivalent IBC token (a traceable voucher of ATOM) for the recipient.

When tokens move back, Osmosis burns the voucher and the Cosmos Hub releases the original ATOM. This mechanism — defined under the ICS-20 standard — keeps transfers atomic and trust-minimized. If you’re new to moving assets between chains, understanding crypto trading fundamentals can help you navigate these cross-chain operations more confidently.

Key Components of the IBC Architecture

Understanding IBC requires familiarity with its core components:

Light Clients: On-chain verifiers that confirm another chain’s headers and proofs without downloading the whole blockchain.

Connections: Handshakes between two chains that confirm mutual verification.

Channels: Logical tunnels for specific data types — for example, token transfers (ICS-20) or interchain accounts (ICS-27).

Packets: The actual data units that carry messages or token information.

Relayers: Off-chain operators that transport packets between chains — incentivized via fees or community rewards.

Additional modules like ICS-29 (fee middleware) and ICS-27 (Interchain Accounts) extend IBC’s functionality, enabling not just token transfers but also remote control of accounts across chains.

Real-World IBC Use Cases in 2025

Osmosis DEX allows users to move ATOM, USDC, and other assets via IBC to trade or provide liquidity, processing billions in IBC volume monthly. The v4 version of dYdX runs as a Cosmos appchain, connected via IBC to Noble (which issues native USDC), enabling traders to deposit or withdraw seamlessly across chains.

Celestia, a data-availability network, uses IBC to share data with other chains and rollups, while Akash Network, a decentralized cloud marketplace, allows users to pay for compute using IBC transfers of AKT or USDC.

In all these examples, IBC enables real-time, permissionless communication without centralized bridges or wrapped tokens — a significant security improvement compared with earlier cross-chain systems. For a comprehensive comparison of the most secure cross-chain bridges in 2025, IBC-based solutions consistently rank among the safest options.

Security and Reliability of IBC

IBC’s security model is based on light-client verification, not trust in intermediaries. Each chain directly validates proofs of the other’s state, removing the single-point-of-failure risk common in custodial bridges.

However, like any protocol, IBC isn’t immune to bugs. In 2023, Cosmos temporarily paused IBC after discovering a vulnerability in ICS-20. The issue was patched within days, proving both the protocol’s transparency and the community’s responsiveness.

As of 2025, IBC has transferred tens of billions of dollars without a single major exploit — a record unmatched among cross-chain systems.

Beyond Token Transfers: Interchain Accounts and Advanced Features

The ICS-27 Interchain Accounts (ICA) standard allows one blockchain to control an account on another chain. That means a DeFi protocol could, for instance, stake ATOM on the Hub, trade on Osmosis, and vote in governance — all from one controlling chain.

These features unlock cross-chain decentralized applications, automated strategies, and shared liquidity networks where assets and logic move freely between zones. When evaluating cross-chain liquidity solutions like LayerZero vs Wormhole vs Synapse, IBC’s native approach offers distinct advantages in trustlessness and composability.

IBC v2 Eureka and the Expansion Beyond Cosmos

In 2025, Cosmos developers unveiled IBC v2 (Eureka) — a major upgrade expanding interoperability beyond the Cosmos ecosystem.

New projects using IBC v2 architecture include Polymer Labs, which is building an IBC-based hub on Ethereum and its rollups, connecting EVM chains through verified light clients; Picasso Network (Composable Finance), deploying ZK light clients to extend IBC to Solana and Ethereum; and TOKI, the first IBC connection to OP Mainnet, launched in September 2025, linking Cosmos with Optimism-based networks.

Together, these initiatives push IBC toward becoming a universal standard for blockchain communication, not just a Cosmos-only feature. As scaling solutions like zkSync and StarkNet continue to evolve, IBC v2’s ZK light client integration positions it to connect these advanced Ethereum rollups seamlessly.

Common Misconceptions and Limitations

Understanding IBC requires clarity on its limitations:

One-click connectivity is marketing. Every new ecosystem needs an audited light client, relayers, and governance approval before it’s fully IBC-ready.

Security differs per domain. Cosmos, Ethereum rollups, and Solana each use different consensus assumptions. Verify the exact trust model before bridging.

Version lag can be risky. Chains that delay upgrading ibc-go may expose old bugs. Most active networks now run v10 or later.

Token tracing matters. Each IBC path (port/channel) creates a unique token trace. Using the wrong channel can produce confusing duplicates.

Numbers fluctuate. Chain counts and total IBC volume change monthly — always refer to live IBC dashboards for the latest metrics.

Monitor real-time IBC activity at Map of Zones.

Why IBC Matters for the Future of Blockchain

Scalability through modularity: Each appchain processes its own workload but remains connected to others.

Security through verification: No trusted multisigs or wrapped assets; everything is validated on-chain.

Composability: Developers can combine multiple chains’ strengths — liquidity on Osmosis, data on Celestia, compute on Akash — into a single experience.

Efficiency: Transactions finalize in seconds with minimal fees.

Sovereignty with collaboration: Chains remain independent yet part of a larger economy.

In short, Cosmos combined with IBC is the practical path to the long-promised Internet of Blockchains.

Conclusion

The Cosmos ecosystem, powered by IBC, has quietly become one of the most advanced interoperability networks in cryptocurrency. It combines speed, sovereignty, and security in a way that no centralized bridge or monolithic chain can match.

With IBC v2 (Eureka) bridging Cosmos to Ethereum, Solana, and OP chains, 2025 marks the year IBC truly steps beyond its origin — transforming from an internal transport protocol into the de facto open standard for cross-chain communication.

If you want to understand the future of blockchain, start with Cosmos — and watch how IBC turns isolated ecosystems into one connected web.