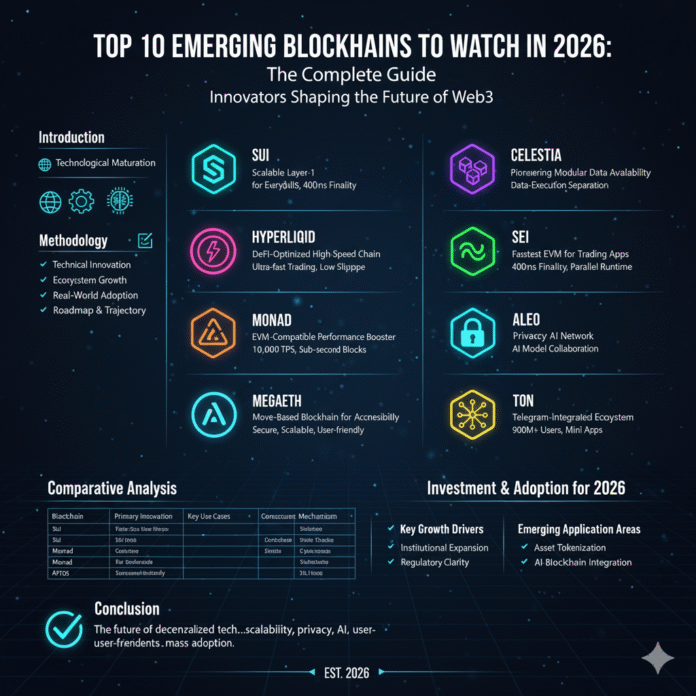

As the blockchain industry evolves, 2026 is poised to be a pivotal year for innovation in decentralized technologies. Emerging blockchains are gaining momentum through unique features, scalability improvements, and real-world applications, distinguishing them from established giants like Bitcoin and Ethereum. These platforms address key challenges such as speed, privacy, cost, and integration with AI or DeFi, making them attractive for developers, investors, and users alike.

This comprehensive guide explores the top 10 emerging blockchains to watch in 2026, based on verified data from industry reports, expert analyses, and recent developments. Whether you’re a beginner curious about crypto or an experienced trader, these insights will help you navigate the rapidly changing landscape of decentralized technology.

1. Sui: The Scalable Layer-1 for Everyday Use

Sui is a Layer-1 blockchain designed to make Web3 as accessible as Web2, delivering high speed and low costs for everyday users. The platform achieves impressive performance metrics, with up to 297,000 transactions per second (TPS) in controlled tests and an average finality time of approximately 400-480 milliseconds, making it ideal for gaming, finance, and decentralized applications.

Key Technical Features:

The blockchain utilizes the Move programming language, which ensures secure smart contracts with less code complexity than traditional alternatives. This design choice reduces vulnerabilities and makes development more accessible to teams building on the platform. To understand how Sui compares to other modern blockchains, check out this detailed comparison of NEAR vs Aptos vs Sui.

Why Watch Sui in 2026?

According to Sui’s official metrics dashboard, the network has surpassed 200 million total active accounts, demonstrating significant user adoption. Strategic partnerships, such as the collaboration with CCP Games for EVE Frontier, signal strong growth potential in the gaming sector. For beginners, think of Sui as a fast highway for digital assets where you can send money or NFTs without waiting or paying high fees.

Recent developments include a flourishing ecosystem with funded projects and grants supporting innovation. As DeFi and NFTs continue to expand, Sui’s affordability and performance position it strongly for mass adoption. Learn more about how Sui and Aptos are revolutionizing blockchain with Move language.

External Resources:

2. Hyperliquid: DeFi-Optimized High-Speed Chain

Hyperliquid is a Layer-1 blockchain laser-focused on decentralized finance (DeFi), offering ultra-fast trading with low slippage. The platform specializes in perpetual futures and other derivatives, processing high volumes with exceptional efficiency.

Unique Funding Model:

Unlike many blockchain projects, Hyperliquid notably eschewed traditional venture capital backing. Instead, the project launched its HYPE token via an airdrop to users, demonstrating a community-first approach to distribution and governance.

Why Hyperliquid is Emerging in 2026:

The team has introduced HyperEVM to broaden application support beyond its initial DeFi focus. With its HYPE token and ecosystem airdrops, Hyperliquid is positioned for expansion, especially in prediction markets and perpetual trading. For newcomers, imagine trading stocks on a blockchain without delays—Hyperliquid makes that possible with near-instant settlement and low costs.

Recent updates have expanded the platform’s capabilities, making it more attractive to developers building sophisticated financial applications.

External Resources:

3. Monad: EVM-Compatible Performance Booster

Monad is an EVM-compatible Layer-1 blockchain targeting approximately 10,000 TPS and sub-second finality while maintaining decentralization. The platform uses optimistic parallel execution and a custom database called MonadDB to handle massive scale without requiring high-end hardware from validators.

Strong Financial Backing:

Monad Labs raised $225 million in April 2024, led by Paradigm, with earlier seed funding secured in 2023. The mainnet and token claims opened in October 2025, marking a significant milestone for the project.

Why Watch Monad in 2026?

Programs like the Monad Founder Residency and a global pitch competition offering $1 million in prizes demonstrate a booming ecosystem. For beginners, think of Monad as Ethereum on steroids—you can run the same applications but faster and cheaper, without sacrificing compatibility with existing tools and infrastructure.

The platform’s approach to parallel execution allows it to process multiple transactions simultaneously, dramatically increasing throughput while maintaining the security guarantees developers expect from EVM-compatible chains. For an in-depth analysis of how Monad compares to other modular approaches, explore this comprehensive comparison of Celestia vs Monad vs EigenLayer.

External Resources:

4. MegaETH: Extreme Throughput for Real-Time Apps

MegaETH is an EVM-compatible Layer-2 solution aiming for approximately 100,000 TPS and roughly 10-millisecond block times, enabling real-time experiences for gaming and high-frequency trading. The platform leverages hardware optimizations and advanced execution techniques to achieve these ambitious targets.

Investment and Development:

MegaETH is backed by prominent investors including Dragonfly and notable angel investors, with reports also mentioning participation from Ethereum co-founder Vitalik Buterin. The testnet has demonstrated very high throughput, generating significant attention in the blockchain community.

Why MegaETH is Emerging:

A public sale and ecosystem growth initiatives are driving momentum for the project. For beginners, MegaETH represents a supercharged network where applications feel instant, eliminating the lag that has historically plagued blockchain-based gaming and trading platforms. Understanding why Ethereum remains popular in emerging markets helps contextualize the importance of Layer-2 solutions like MegaETH.

It’s important to note that the performance figures are based on team targets and testnet numbers; mainnet realities may differ as the network scales with real-world usage patterns.

External Resources:

5. Aptos: Move-Based Blockchain for Accessibility

Aptos is a Move-based Layer-1 blockchain emphasizing security and scalability, with user-friendly tools like Petra Wallet and comprehensive developer SDKs, including Unity integrations for gaming. The platform offers advanced features such as randomness APIs and easy onboarding mechanisms to lower barriers to entry.

Major Partnerships:

Aptos has secured strategic partnerships with technology giants including Microsoft (Azure OpenAI integration), Alibaba Cloud, and NBCUniversal, demonstrating enterprise-level confidence in the platform’s capabilities.

Strong Financial Foundation:

Aptos raised approximately $350 million across 2022 funding rounds, including a $200 million seed round led by a16z and a $150 million Series A led by FTX Ventures and Jump Crypto.

Why Watch Aptos in 2026?

Expansions in the Asia-Pacific region with Alibaba Cloud and initiatives like Backlot Club with NBCUniversal point to significant growth in consumer applications, identity solutions, and DeFi. For beginners, Aptos enables you to log in with familiar accounts to use digital assets securely, bridging Web2 and Web3 experiences. Discover more about how Sui and Aptos are revolutionizing blockchain with the Move language.

External Resources:

- Aptos Network Official Site

- Aptos Developer Documentation

- Aptos Explorer

- Clay.com Coverage

- DoomDroom Analysis

6. Celestia: Pioneering Modular Data Availability

Celestia is the first live modular data availability (DA) network, separating data availability and consensus from execution. This architecture allows anyone to launch rollups more easily and cost-effectively than traditional monolithic blockchain designs.

Funding and Development:

The project raised $55 million across Series A and B rounds to build out the modular blockchain stack, attracting support from prominent crypto investors.

Why Celestia is Emerging:

Celestia serves as the “building blocks” layer for modular chains. The platform’s role is expanding through integrations with projects like Arbitrum Orbit and Rollup-as-a-Service (RaaS) providers that enable teams to deploy custom rollups in minutes rather than months.

For those new to blockchain technology, think of Celestia as the foundation that makes it easier and cheaper for developers to create their own customized blockchains without starting from scratch. Read about Celestia’s mainnet year one and lessons learned from the first modular data availability network. For a deeper understanding of modular architecture, explore this comprehensive comparison of modular blockchains.

External Resources:

7. Sei: Fastest EVM for Trading Apps

Sei positions itself as the fastest EVM Layer-1, citing approximately 400-millisecond finality and targets of 200,000+ TPS with Sei Giga. The chain uses a parallelized EVM and Twin-Turbo consensus to optimize specifically for high-frequency trading applications.

Notable Backing:

Sei has secured investment from major players including Coinbase Ventures, Jump Crypto, Multicoin Capital, and Circle, demonstrating strong institutional confidence.

Technical Note:

Realized mainnet TPS varies based on workload conditions; vendor claims typically reflect laboratory or test settings rather than sustained real-world performance.

Why Sei Matters in 2026:

Upgrades like Sei Giga aim to dramatically boost DeFi trading volumes. For everyday users, this means you can trade like you would on a stock trading app, but in a decentralized environment without intermediaries. The platform’s focus on perpetual contracts positions it advantageously for the next wave of DeFi growth.

External Resources:

8. Aleo: Privacy-First Blockchain

Aleo is a zero-knowledge Layer-1 blockchain designed for private, compliant applications across payments, identity verification, and gaming. The mainnet launched in September 2024, marking the transition from development to production use.

Real-World Integration:

In 2025, Aleo announced an integration with Request Finance, a platform that has processed over $1 billion in payments. This partnership enables private, compliant payroll and business transfers, demonstrating real-world utility for privacy-preserving blockchain technology.

Strong Investor Support:

Aleo secured major funding rounds, including early support from a16z in 2021 and a $200 million Series B in 2022, providing substantial resources for development and ecosystem growth.

Why Watch Aleo?

The platform targets the privacy-compliance gap that has limited blockchain adoption in regulated industries. For beginners, Aleo allows you to send money privately while maintaining compliance with regulatory requirements—a critical balance for enterprise adoption.

External Resources:

9. Bittensor: Decentralized AI Network

Bittensor is a blockchain where artificial intelligence models compete and collaborate for token rewards, creating an “Internet of AI.” The platform incentivizes open AI development through subnets that reward useful model outputs, enabling a marketplace for machine learning capabilities.

The AI-Crypto Convergence:

As the intersection of artificial intelligence and cryptocurrency grows, Bittensor’s design for marketplace-style incentives is attracting builders who see potential in decentralized AI infrastructure.

Why Bittensor is Emerging:

For beginners, think of Bittensor as crowdsourced AI—similar to Wikipedia but for machine learning, with crypto-native incentives rewarding contributors. The platform enables developers to monetize AI models while users access a competitive marketplace of AI services.

The decentralized approach contrasts sharply with centralized AI development dominated by large technology companies, potentially democratizing access to advanced AI capabilities.

External Resources:

10. TON: Telegram-Integrated Ecosystem

The Open Network (TON) integrates seamlessly with Telegram for DeFi, games, and Mini Apps, using Toncoin for transactions. The platform supports stablecoins like USDT on TON inside Telegram’s wallet, enabling frictionless crypto transactions within the messaging app.

Exclusive Integration:

In January 2025, Telegram and the TON Foundation announced TON as the exclusive blockchain for Telegram’s Mini App platform, standardizing wallet connections via TON Connect. This exclusivity arrangement significantly amplifies TON’s distribution potential.

Massive User Base:

Telegram surpassed 1 billion monthly active users in 2025, making TON’s mobile onboarding uniquely powerful. Users can play games or send USDT directly in chat, eliminating the technical barriers that have historically limited crypto adoption. Understanding how blockchain adoption works in emerging markets provides context for TON’s accessibility-first approach.

Why TON Matters in 2026:

This isn’t merely integration—it’s an exclusivity arrangement for Mini Apps that gives TON unparalleled access to a billion-user platform. The combination of familiar interface, massive distribution, and blockchain functionality positions TON for mainstream adoption in ways few other blockchains can match.

External Resources:

Preparing for the Blockchain Boom in 2026

These top 10 emerging blockchains—Sui, Hyperliquid, Monad, MegaETH, Aptos, Celestia, Sei, Aleo, Bittensor, and TON—represent the cutting edge of decentralized technology. They tackle critical challenges including scalability, privacy, AI integration, and user-friendliness, backed by significant funding and rapidly growing ecosystems.

Getting Started:

For beginners, start by exploring wallets associated with these platforms and consider small investments to familiarize yourself with how each ecosystem operates. As regulatory clarity improves and mainstream adoption surges, staying informed about these emerging blockchains could reveal opportunities in trading, development, or early ecosystem participation.

Key Takeaways:

The blockchain landscape in 2026 will be defined by specialization rather than one-size-fits-all solutions. Sui and Monad focus on high-performance general-purpose computing. Hyperliquid and Sei optimize for DeFi and trading. Celestia pioneers modular architecture. Aleo prioritizes privacy. Bittensor bridges AI and blockchain. TON leverages massive distribution through Telegram.

Understanding the unique value proposition of each platform will be essential for anyone looking to participate in the next wave of blockchain innovation, whether as a user, developer, investor, or observer of this transformative technology. To deepen your understanding of modern blockchain architectures, explore these related topics: modular blockchain comparisons, Move-based blockchain innovations, and Celestia’s first-year insights.

Additional Resources: