In the fast-paced world of cryptocurrency, presale tokens offer exciting opportunities for early investors to get in on the ground floor of new projects. However, beneath the hype lies a darker side: pump mechanics, often tied to manipulative schemes that can lead to significant losses for unsuspecting participants. This comprehensive guide explores the pump mechanics of presale tokens, breaking down complex concepts into simple terms for crypto novices and experienced traders alike.

By the end of this article, you’ll understand why pump and dump schemes are prevalent in presales, recognize warning signs, and learn strategies to protect your investments. Let’s dive in.

What Are Presale Tokens?

Presale tokens refer to cryptocurrencies sold to investors before they are officially launched on public exchanges. This stage, often part of Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), or token generation events (TGEs), allows blockchain projects to raise funds for development. Buyers typically purchase these tokens at a discounted price, betting on future value growth once the token hits the market.

In a typical presale, a project might allocate a portion of its total token supply—commonly 20–30%—for early sale. This creates scarcity and builds community buzz. According to industry reporting, 2025 saw extremely large token sale volumes on launch platforms, with one widely cited figure being $1.32 billion raised by Pump.fun’s token (source: Yahoo Finance). However, this early access isn’t without risks. Presales often lack regulatory oversight, making them fertile ground for manipulation.

Key Features of Presale Tokens

Discounted Pricing: Tokens are cheaper than post-launch prices to incentivize early adoption and reward risk-taking investors.

Vesting Periods: Some projects lock tokens for months to prevent immediate selling and stabilize post-launch prices.

Tokenomics: Rules governing supply, distribution, and burns (permanent removal of tokens) to influence value over time.

While legitimate presales fund innovative blockchain projects with real utility, others exploit the model for quick profits through pump mechanics. Understanding the broader cryptocurrency landscape, including the fundamental differences between Bitcoin and Ethereum, can help investors make more informed decisions about which presale tokens might have genuine value versus those built on hype alone.

What Is a Pump and Dump Scheme?

A pump and dump scheme is a fraudulent trading strategy where manipulators artificially inflate (pump) a token’s price before selling (dumping) their holdings, causing the price to crash. This leaves late buyers with worthless assets. In cryptocurrency markets, these schemes target low-liquidity tokens, where small trades can cause dramatic price swings.

The U.S. Commodity Futures Trading Commission explicitly warned about virtual-currency pump-and-dumps and how hype on social media can drive them (source: CFTC.gov). For scale, Chainalysis found that 54% of ERC-20 tokens listed on DEXes in 2023 showed patterns suggestive of pump-and-dumps, though they represented only 1.3% of DEX trading volume (source: Chainalysis).

Simply put, it’s like inflating a balloon with hot air (hype) and popping it once it’s full, profiting from the burst while leaving others holding deflated assets. For those new to cryptocurrency markets, understanding what crypto trading entails and how it works is essential before participating in any presale or trading activity.

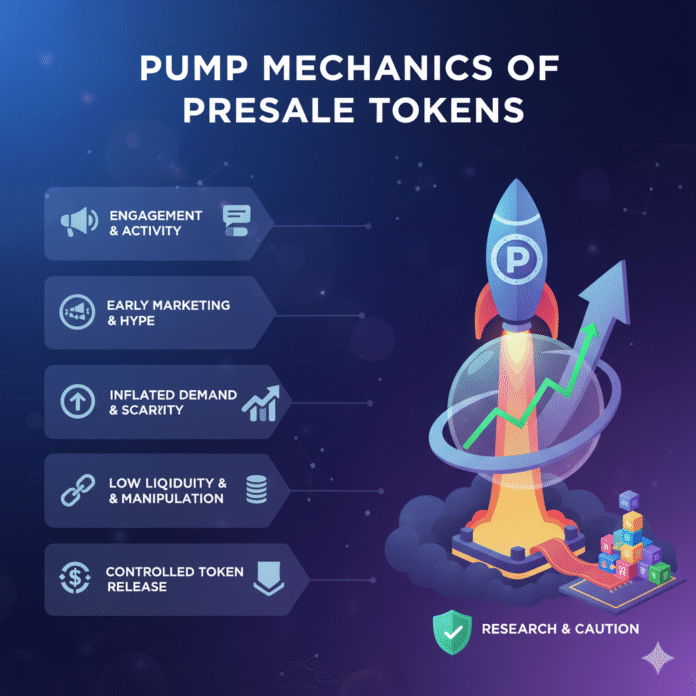

How Pump Mechanics Work in Presale Tokens

Pump mechanics in presale tokens follow a structured playbook. Here’s a step-by-step breakdown based on documented cases and expert analyses.

Phase 1: Accumulation

Schemers buy or receive large quantities of tokens during the presale at low prices. In some projects, insiders get allocations without vesting requirements, allowing quick flips. For a concrete example of launch unlock dynamics, the World Liberty Financial ($WLFI) presale disclosed that 20% of tokens were unlocked at launch, illustrating how even partial unlocks can create early-sell pressure (source: Binance).

For newcomers looking to understand how to safely navigate cryptocurrency exchanges when purchasing presale tokens or trading post-launch, our comprehensive Binance tutorial for 2025 walks through every step from account creation to secure trading practices.

Phase 2: Hype Building

Using social media platforms like X (formerly Twitter), Telegram groups, and influencers, promoters spread exaggerated claims about the token’s potential. In 2024–2025, U.S. authorities ran an undercover operation (NexFundAI) that exposed market makers using wash trading and other tactics to simulate demand and manipulate prices, with multiple criminal and civil cases following (sources: Reuters, The Verge).

Phase 3: The Pump

As retail investors buy in, driven by FOMO (fear of missing out), the price surges. Low-liquidity presale tokens amplify this effect—a few large buys can double the value. Launch platforms like Pump.fun use bonding curves, where price algorithmically increases with each buy, automating early-phase price ascent (source: Phemex).

Some meme-token presales even hardwire external triggers: for instance, PUMPD marketed a mechanism where the token burns or “pumps” when Bitcoin rises, attracting presale buyers (source: TradingView). When evaluating such claims, it’s helpful to examine Ethereum’s actual network statistics and key metrics to distinguish between realistic blockchain-based mechanisms and empty marketing promises. Understanding the difference between spot trading and futures trading is also crucial, as pump schemes often exploit traders unfamiliar with leverage and margin mechanics in futures markets.

Phase 4: The Dump

Once the price hits a target, orchestrators sell their holdings, flooding the market and crashing the price. Sudden volume spikes without news are a classic red flag noted by market guides (source: Brave New Coin).

Phase 5: Post-Dump Tactics

Some schemes rinse and repeat by rebranding or moving to new blockchains. On-chain tools and DEX scanners help trace creator wallets with histories of rug pulls. The importance of blockchain transparency becomes clear when examining projects like Celestia’s modular data availability network, which demonstrated how proper architecture and transparency can build trust—qualities notably absent in pump-and-dump schemes.

Mitigation Mechanisms

In presales, mechanics like vesting can mitigate dumps. Some projects use locked reserves and community approvals for emissions and spending (source: Solana Stack Exchange). However, project-specific claims should always be verified through third-party audits or on-chain proofs before relying on them. Learning from established DeFi practices, such as how legitimate lending protocols manage risk, can help investors recognize which presale projects implement genuine risk mitigation versus those offering only superficial protections.

Signs to Spot a Potential Pump and Dump in Presales

Beginners can avoid traps by watching for these verified indicators:

Unrealistic Promises: Claims like “Guaranteed 100x returns” without substantive utility or business model are major red flags.

Insider Advantages: Team tokens with little or no vesting periods create significant dump risk when insiders can sell immediately after launch.

Low Liquidity and High Volatility: Thin markets are easily manipulated, with small trades causing dramatic price swings.

Social Media Coordination: Sudden buzz from anonymous or bot-like accounts and wash-trade “volume” are common tells (source: Reuters).

No Utility: Meme tokens without real use cases often rely purely on hype and speculation.

Pre-Market Trading Dynamics: New features like Binance’s “Pre-Market” trading (OTC orderbook for not-yet-listed assets) have drawn community criticism about uneven early access (source: Ledger).

Tools like DEXTools, Etherscan, BscScan, and similar on-chain explorers can trace wallet histories and large holder movements, helping you identify suspicious patterns.

Risks and Consequences of Pump Mechanics

Participating in pumped presales carries substantial risks:

Financial Losses: Most victims buy near price tops and sell near lows, resulting in significant capital loss. Unlike traditional investment protections, the cryptocurrency space lacks the insurance mechanisms found in regulated markets, though emerging DeFi insurance protocols like InsurAce and Nexus Mutual are working to address smart contract and protocol risks—though they typically don’t cover losses from pump-and-dump schemes.

Market Instability and Trust Erosion: Documented by analytics firms tracking manipulation trends (source: Chainalysis), these schemes damage the broader crypto ecosystem.

Legal Repercussions: Pump-and-dump schemes are illegal in many jurisdictions, with U.S. agencies (CFTC, SEC, DOJ/FBI) pursuing manipulation cases, including the NexFundAI sting (source: CFTC.gov).

Emotional Toll: FOMO-driven decisions lead to stress, anxiety, and lasting regret.

How to Protect Yourself from Pump Schemes in Presales

Stay safe with these practical steps:

Research Thoroughly: Verify team backgrounds, smart contract audits from reputable firms (CertiK, Hacken, Trail of Bits), and whitepaper claims.

Diversify: Don’t invest more than you can afford to lose. Never put all your capital into a single presale token.

Use Reputable Platforms: Prefer established launchpads with anti-dump features like vesting schedules, cliff periods, and purchase caps.

Monitor On-Chain Data: Track large wallet movements, unlock schedules, and liquidity pool changes using blockchain explorers.

Avoid Hype: If it sounds too good to be true, wait for post-launch stability and real-world adoption signals.

Educate Yourself: Scam-awareness resources from Ledger and Coinbase are useful primers (source: Medium).

Note on launch design innovations: Bonding-curve launches can make pricing more transparent (price increases with buys, decreases with sells), but they do not eliminate manipulation risk and design details matter (source: dYdX).

Legal and Regulatory Aspects

Pump-and-dump schemes can violate securities laws, commodities regulations, and fraud statutes. The CFTC’s 2018 customer advisory specifically warned retail users about virtual-currency pump-and-dumps and urged skepticism toward social-media hype (source: CFTC.gov). In 2024–2025, U.S. authorities executed the NexFundAI operation targeting coordinated manipulation (including wash trading), resulting in criminal charges and civil actions (source: Reuters).

Projects demonstrating transparent tokenomics and locked liquidity can reduce rug-pull risk. One example frequently cited in 2024–2025 media and project docs is The Nation Token ($NATO), which locked Uniswap liquidity until January 1, 2030 and avoided presales—an approach meant to limit insider dumping (source: Block Leaders). As always, verify such claims on-chain and via third-party audits.

Conclusion: Navigating Presale Pumps Wisely

Pump mechanics in presale tokens exploit excitement and patchy regulation, turning potential opportunities into pitfalls. By understanding the accumulation → hype → pump → dump cycle, beginners can spot schemes early and protect their investments. Remember, legitimate projects focus on utility, sustainability, and community value—not quick flips and guaranteed returns.

As cryptocurrency markets evolve, mechanism design innovations like bonding curves, vesting schedules, and locked liquidity aim to reduce manipulation. Yet no mechanism replaces thorough due diligence. Stay informed, invest cautiously, verify claims on-chain, and prioritize long-term value over short-term hype.

With knowledge as your shield, you can navigate the crypto space more safely and make informed investment decisions that align with your financial goals.

Key Takeaways:

- Presale tokens offer early access but carry manipulation risks

- Pump and dump schemes follow predictable patterns across accumulation, hype, pump, and dump phases

- Watch for red flags: unrealistic promises, no vesting, coordinated social media hype, and low liquidity

- Protect yourself through research, diversification, on-chain monitoring, and skepticism toward hype

- Legal authorities actively pursue pump-and-dump perpetrators

- No investment mechanism eliminates the need for thorough due diligence

External Sources Referenced: