Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have evolved from niche digital assets to mainstream financial instruments in 2025. With global crypto market capitalization exceeding $2 trillion, governments worldwide are implementing comprehensive regulatory frameworks to balance innovation with consumer protection.

This definitive guide covers current crypto regulations across major jurisdictions, helping investors, businesses, and developers navigate the complex legal landscape of digital assets in 2025.

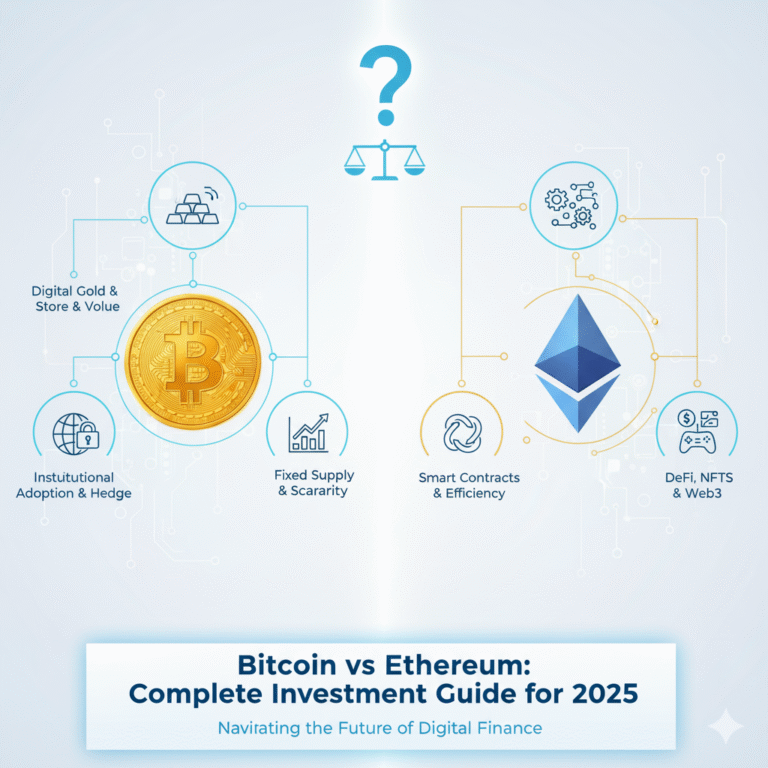

Bitcoin: Digital Gold Standard

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, remains the world’s largest cryptocurrency by market cap. Often called “digital gold,” this pioneering cryptocurrency serves as:

- Store of value asset for long-term wealth preservation

- Peer-to-peer payment system enabling borderless transactions

- Hedge against inflation in uncertain economic climates

- Portfolio diversification tool for institutional and retail investors

Furthermore, Bitcoin’s decentralized nature makes it resistant to government control and censorship. Learn more about Bitcoin’s fundamentals at Bitcoin.org.

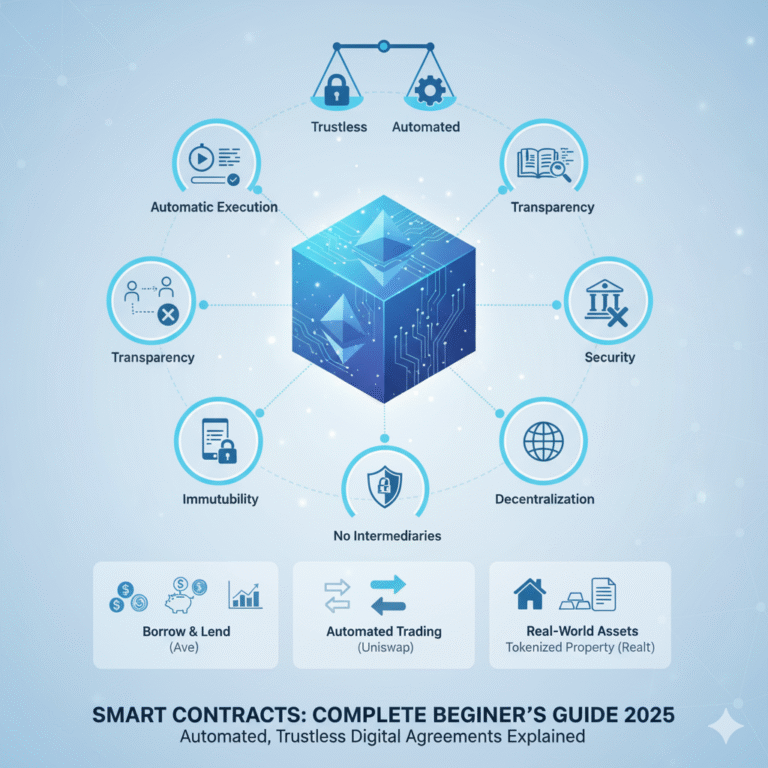

In contrast to Bitcoin’s focus on payments, Ethereum, created by Vitalik Buterin in 2015, extends far beyond simple value transfers. Specifically, it offers:

- Smart contract functionality automating trustless agreements

- Decentralized applications (DApps) powering Web3 services

- DeFi protocol infrastructure enabling permissionless finance

- NFT marketplace backbone supporting digital ownership

Additionally, Ethereum’s programmability has made it the foundation for thousands of innovative blockchain projects. Explore Ethereum’s capabilities at Ethereum.org.

Both cryptocurrencies operate on decentralized networks, meaning no single entity controls their operations—a feature that creates unique regulatory challenges worldwide.

Why Cryptocurrency Regulation Matters

Consumer Protection

Regulatory frameworks serve several critical functions for everyday users. First and foremost, they:

- Prevent fraud and market manipulation in digital asset markets

- Ensure proper custody of digital assets by qualified entities

- Mandate transparent fee structures across platforms

- Provide legal recourse for disputes and losses

Moreover, clear regulations help distinguish legitimate projects from fraudulent schemes, thereby protecting inexperienced investors.

Financial Stability

Beyond individual protection, regulators focus on systemic concerns. Consequently, well-designed crypto regulations:

- Reduce systemic risk to traditional banking systems

- Prevent money laundering and terrorist financing

- Maintain monetary policy effectiveness across jurisdictions

- Protect national currencies from destabilization

In particular, stablecoin regulations address concerns about runs on reserve assets that could trigger broader financial crises.

Innovation Balance

Nevertheless, effective regulation doesn’t stifle innovation. Instead, thoughtful frameworks:

- Encourage technological advancement in blockchain

- Attract institutional investment with clear rules

- Create clear compliance pathways for startups

- Support blockchain entrepreneurship globally

Ultimately, the goal is fostering innovation while maintaining essential safeguards for market participants.

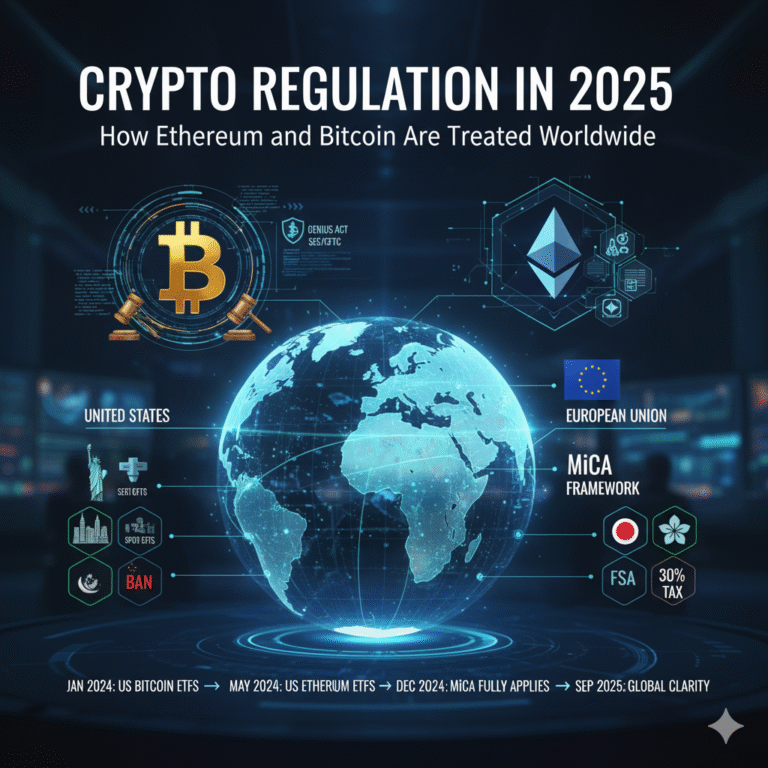

United States Crypto Regulations 2025

The US crypto regulatory landscape has significantly matured since 2024, with multiple agencies coordinating oversight. As a result, market participants now have clearer guidance than ever before.

Bitcoin Regulations in America

Legal Classification

First and foremost, the Commodity Futures Trading Commission (CFTC) classifies Bitcoin as a commodity, and US courts have reaffirmed that status in recent rulings. This classification provides important legal clarity for market participants. View official guidance at CFTC.gov.

Bitcoin ETF Revolution

Meanwhile, the Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETFs in January 2024, including products from BlackRock (IBIT), Fidelity (FBTC) and others. Subsequently, these funds have attracted very large assets under management through 2025, with IBIT alone nearing the $100B AUM mark. This milestone represents unprecedented mainstream adoption. Read more at The Wall Street Journal and BlackRock.

Strategic Bitcoin Reserve

Furthermore, a March 6, 2025 Executive Order established a federal Strategic Bitcoin Reserve framework, with subsequent congressional efforts to codify it through the BITCOIN Act. This initiative signals government recognition of Bitcoin’s strategic importance. Track legislative developments at Congress.gov.

Ethereum Regulations in the US

Status and ETFs

Similarly to Bitcoin, the CFTC and federal courts have treated Ether as a commodity in enforcement and litigation contexts. However, the SEC allowed spot ETH ETFs to launch in July 2024 but has not issued a definitive rule universally declaring ETH a commodity or security. Therefore, some regulatory ambiguity remains. Check current status at CFTC.gov.

Smart Contract / DeFi Oversight

Additionally, the SEC’s internal “Project Crypto” has featured DeFi roundtables and staff workstreams aimed at policy development. Nevertheless, these are exploratory and consultative rather than a finalized rulebook for all dApps.

Federal Stablecoin Legislation

GENIUS Act (Enacted July 18, 2025)

Notably, the GENIUS Act provides a federal regime for payment stablecoins, including 1:1 reserve requirements, regular independent audits, consumer protections, and a pathway to deposit-insurance eligibility. Consequently, this legislation brings much-needed clarity to the stablecoin sector. Full text available at Congress.gov.

STABLE Act

On the other hand, the STABLE Act is under consideration as a complementary proposal and has not been enacted as of October 2025. Follow updates at Sidley.com.

European Union MiCA Regulation

The Markets in Crypto-Assets (MiCA) Regulation became fully applicable on December 30, 2024, with the stablecoin title taking effect earlier in June 2024. As a result, Europe now has the world’s most comprehensive crypto framework. Read about MiCA at Wikipedia – MiCA.

Bitcoin Under MiCA

Classification and Requirements

Under this framework, Bitcoin is classified as a “crypto-asset” under MiCA. Furthermore, Crypto-asset service providers (CASPs) face authorization and conduct rules under MiCA and must meet EU AML/KYC obligations under the EU anti-money laundering framework. More details at The Block.

Investment Products

Accordingly, European Bitcoin exposure commonly occurs via exchange-traded products (ETPs), exchange-traded notes (ETNs), and other structures permitted at the Member State level within MiCA’s perimeter.

Ethereum and Smart Contracts Under MiCA

DeFi Regulatory Gap

Interestingly, MiCA does not comprehensively regulate fully decentralized DeFi where no identifiable issuer or provider exists. Currently, national and EU authorities are studying DeFi for potential future rules. Learn more at European Banking Authority.

EU Data Act Implications

In parallel, the EU Data Act (2023) imposes certain safeguards for smart contracts used in data-sharing, though this is not a general MiCA audit mandate for all Ethereum contracts.

Exchange Adjustments

As a result of these regulations, some EU exchanges adjusted listings for USDT to align with MiCA and e-money token (EMT) supervision. For instance, OKX delisted USDT in the European Economic Area, and Kraken reviewed its EU stablecoin offering in 2024-2025. Follow updates at SEC.gov.

MiCA Review and Evolution

Looking ahead, the European Securities and Markets Authority (ESMA) and European Banking Authority (EBA) have ongoing Level-2 and Level-3 work, with a MiCA effectiveness review planned by December 2025. Visit ESMA for updates.

Asia-Pacific Crypto Laws

Asia represents the world’s largest crypto trading volume, with diverse regulatory approaches across the region. Importantly, each jurisdiction has developed unique frameworks reflecting local priorities.

Singapore: Innovation-Friendly Framework

Notably, the Monetary Authority of Singapore (MAS) treats BTC and ETH as Digital Payment Tokens (DPTs) under the Payment Services Act. Moreover, recent 2024-2025 measures include:

- Enhanced custody and segregation rules for service providers

- Phased consumer-protection guidelines (bans on retail incentives, leverage and credit card restrictions)

- Risk awareness tests for retail investors

Consequently, Singapore has positioned itself as a leading crypto hub while maintaining strong consumer protections. Comprehensive guidance available at MAS.gov.sg, Morgan Lewis, and Bovill Newgate.

Hong Kong: Global Crypto Hub Ambitions

Similarly ambitious, Hong Kong launched Asia’s first spot Bitcoin and Ether ETFs on April 30, 2024 via ChinaAMC, Harvest, and Bosera/HashKey. Subsequently, approvals and listings expanded through 2024-2025, solidifying Hong Kong’s position as a regional leader. Read coverage at Reuters and ChinaAMC.

Japan: Mature Regulatory Environment

In contrast, Japan’s Financial Services Agency (FSA) maintains a public register of licensed crypto-asset exchange service providers under the Payment Services Act, updated periodically. Additionally, policymakers in 2025 floated proposals to grant crypto assets financial-product status under the Financial Instruments and Exchange Act (FIEA) by 2026. Check the official registry at FSA.go.jp.

India: Heavy Taxation Approach

Taking a different approach, India applies a 30% flat tax on crypto gains and a 1% Tax Deducted at Source (TDS) on certain transfers. Meanwhile, the Reserve Bank of India and government advisories remain cautious regarding cryptocurrency adoption.

China: Continued Prohibition

Conversely, China continues its comprehensive ban on domestic crypto trading, mining, and initial coin offering (ICO) fundraising through 2025, maintaining one of the world’s strictest stances.

Other Notable Jurisdictions

El Salvador: Bitcoin Legal-Tender Pioneer

Remarkably, Bitcoin remains legal tender in El Salvador, but merchant acceptance was made voluntary after a January 29, 2025 legislative amendment aligned with International Monetary Fund (IMF) program conditions. Nevertheless, the state continues Bitcoin reserve activity; for example, 21 BTC were added on September 8, 2025. Coverage at Reuters and Yahoo Finance.

Brazil: Emerging Crypto Power

Similarly progressive, Law 14.478/2022 recognizes crypto as a means of payment and establishes a Virtual Asset Service Provider (VASP) regime under Central Bank of Brazil oversight. Currently, full implementation phases continue into late-2025. Details at SEC.gov.

Belarus: Crypto-Friendly Jurisdiction

In Eastern Europe, Belarus maintains crypto tax exemptions through 2025 via the High-Tech Park regime, fostering blockchain innovation. More at Blockchain.com.

Kazakhstan: Blockchain & Mining Hub

Meanwhile in Central Asia, Kazakhstan operates licensed mining and regulated digital-asset pilots through the Astana International Financial Centre (AIFC) with sandbox initiatives and defined permits. Updates at X (formerly Twitter).

Global Stablecoin and DeFi Regulations

Stablecoin Frameworks Worldwide

United States

As mentioned earlier, the GENIUS Act requires 1:1 reserve backing, independent audits, consumer protections, and provides a pathway to deposit-insurance eligibility for qualifying issuers. Full details at Congress.gov.

European Union

In comparison, MiCA distinguishes between e-money tokens (EMTs) and asset-referenced tokens (ARTs) with strict licensing and reserve/issuance controls. Official documentation at Wikipedia – MiCA.

Decentralized Finance (DeFi) Oversight

Importantly, DeFi—largely built on Ethereum—faces growing supervisory attention, often via sandboxes and pilots rather than blanket rules:

United Kingdom

For example, the Digital Securities Sandbox (DSS) remains open through 2028 for distributed ledger technology (DLT) market-infrastructure pilots. Learn more at Bank of England.

Singapore and Japan

Likewise, innovation frameworks and sandboxes continue under MAS and FSA programs, though comprehensive DeFi rules remain evolving. Visit MAS.gov.sg for Singapore updates.

Investment Strategies and Compliance

Tax Considerations by Jurisdiction

United States

Generally speaking, capital gains tax applies to cryptocurrency transactions. Specifically, Form 8949 reporting and accounting methods such as First-In-First-Out (FIFO) or Last-In-First-Out (LIFO) are commonly used. Nevertheless, consult a qualified tax professional for personalized guidance.

European Union

In contrast, tax treatment varies by Member State. Typically capital gains tax applies, while professional trading may incur income tax. Additionally, Common Reporting Standard (CRS) reporting can apply to international holdings.

Asia-Pacific

Regional tax approaches vary significantly:

- Singapore: Generally no capital gains tax for individuals

- Japan: Progressive tax brackets can reach high rates for crypto income

- India: 30% flat tax plus 1% TDS on transactions

- Hong Kong: No capital gains tax (assessed case-by-case for business income)

Best Practices for Compliance

Choose Licensed Platforms

Above all, always use regulated exchanges and custodians in your jurisdiction:

- US: SEC-registered or state-licensed entities

- EU: MiCA-authorized CASPs

- Singapore: MAS-licensed DPT providers

- Japan: FSA-registered exchanges

Maintain Detailed Records

Furthermore, keep comprehensive transaction records including timestamps, prices, fees, wallet addresses. Additionally, integrate specialized crypto tax software for accurate reporting.

Stay Informed on Regulatory Changes

Finally, subscribe to regulator updates, follow policy trackers like CoinDesk, and consult qualified legal counsel regularly.

Regulatory Challenges and Risks

Compliance Cost Burden

Undoubtedly, MiCA and US regulatory obligations can strain smaller firms with limited resources. Read analysis at Wikipedia – MiCA.

Jurisdictional Inconsistencies

Moreover, cross-border complexity persists as different nations adopt varying approaches to digital asset regulation.

Market Concentration Risks

Additionally, rapid growth of large US spot BTC ETFs magnifies concentration considerations for market stability. Analysis available at Financial Times.

2025 Crypto Regulation Outlook

United States: Innovation-Friendly Trajectory

Looking forward, GENIUS Act implementation is underway, with ongoing SEC-CFTC coordination and clearer DeFi guidance expected. Furthermore, the Strategic Bitcoin Reserve framework exists via Executive Order, with codification bills under congressional debate. Track at Congress.gov.

European Union: Framework Refinement

Similarly, MiCA effectiveness review scheduled for December 2025, plus Level-2 and Level-3 technical standards and coordination across Member States. Updates at ESMA.

Asia-Pacific: Continued Divergence

Meanwhile, Singapore and Hong Kong deepen innovation initiatives. Simultaneously, Japan advances financial-product treatment proposals. In contrast, India maintains heavy taxation approach, while China’s prohibition remains unchanged. Coverage at Reuters and SEC.gov.

Global Trends

Ultimately, expect more international coordination, standardized compliance baselines, stronger consumer protections, and accelerating institutional adoption across jurisdictions.

Key Takeaways for 2025

For Investors

- First, research local regulations before trading any cryptocurrency

- Then, use only licensed platforms and custodians in your jurisdiction

- Additionally, maintain thorough tax records for all transactions

- Moreover, diversify across compliant assets and jurisdictions

- Finally, monitor legal changes through official sources

For Businesses

- Initially, secure all required licenses before launching services

- Subsequently, implement robust AML/KYC programs that exceed minimum standards

- Furthermore, engage experienced legal counsel early in planning

- Additionally, track compliance costs and budget accordingly

- Finally, plan strategically for regulatory evolution

For Developers

- First, understand securities-law implications for token launches

- Next, design compliance-friendly smart contracts with audit trails

- Additionally, engage regulatory sandboxes where available

- Furthermore, consider jurisdiction-specific deployments

- Lastly, track DeFi policy developments closely

Final Thoughts: A Maturing Digital Asset Ecosystem

The cryptocurrency regulatory landscape in 2025 represents a dramatic maturation from the “Wild West” era of the 2010s. Indeed, with clear frameworks in major jurisdictions, Bitcoin and Ethereum now operate within increasingly defined legal parameters that support both innovation and consumer protection.

Success in this environment requires staying informed, choosing regulated service providers, and maintaining rigorous compliance practices. Whether you’re an investor, business operator, or developer, understanding the regulatory landscape is no longer optional—it’s essential for long-term success.

Pro Tip: Bookmark this guide and check back regularly—crypto regulations evolve rapidly as regulators respond to market developments and technological innovations.

Read also: Bitcoin vs Ethereum.

Disclaimer: This guide is for informational purposes only and does not constitute legal or financial advice. Cryptocurrency regulations vary by jurisdiction and change frequently. Always consult qualified legal and financial professionals for jurisdiction-specific guidance before making investment decisions or launching crypto-related businesses.