In the ever-evolving world of blockchain technology, Ethereum has long been a cornerstone for decentralized applications and finance. But what if the assets you stake to secure the network could do more? Enter restaking—an innovative concept that’s transforming how users earn rewards and how networks build security. At the forefront of this shift is EigenLayer, a protocol that’s not just enhancing Ethereum’s ecosystem but redefining staking efficiency.

Whether you’re a beginner or a seasoned crypto investor, think of staking as parking your car in a garage to earn a fee, and restaking as using that same parked car to deliver packages for extra cash—without moving it. This comprehensive guide explores EigenLayer’s mechanics, benefits, risks, and why restaking is gaining massive traction in 2025.

What Is Staking and Why Does It Matter?

In proof-of-stake (PoS) blockchains like Ethereum, staking means locking up cryptocurrency (like ETH) to help validate transactions and secure the network. In return, stakers earn rewards—similar to interest on a savings account—but instead of a bank, the network relies on your stake to keep participants honest.

After Ethereum’s monumental shift to PoS in September 2022, known as “The Merge”, staking became central to the network’s security model. Validators who stake at least 32 ETH run nodes and process transactions. If they act maliciously, part of their stake can be slashed—a penalty mechanism that reinforces honest behavior and network integrity.

Traditional staking, however, has inherent limitations: your ETH is locked and only earns Ethereum’s base rewards, typically ranging from 3-5% APR depending on network conditions. Meanwhile, new blockchain networks often must bootstrap their own validator sets from scratch, requiring significant time and capital to establish robust security.

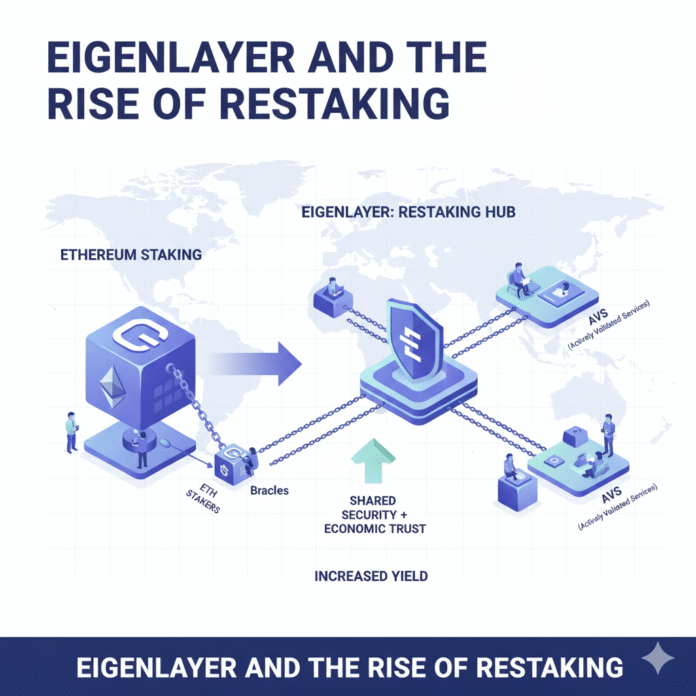

Restaking fundamentally changes this dynamic by allowing staked ETH to be reused to secure additional protocols simultaneously. Your stake can help protect sidechains, oracles, bridges, data-availability layers, and layer-2 networks—all while continuing to secure the Ethereum mainnet. This dramatically improves capital efficiency because the same stake performs multiple functions.

Introducing EigenLayer: The Pioneer of Restaking

EigenLayer is a groundbreaking middleware protocol built on Ethereum that transformed restaking from concept to reality. The protocol launched its restaking contracts on mainnet in 2023, followed by a comprehensive operator and AVS (Actively Validated Services) rollout throughout 2024.

EigenLayer functions as a decentralized marketplace connecting two key parties:

- Stakers (security providers) who supply cryptoeconomic security through their restaked assets

- AVSs (Actively Validated Services)—protocols requiring protection, including data availability layers, oracles, bridges, and specialized services

As of October 2025, EigenLayer has achieved remarkable growth metrics:

- Total Value Locked (TVL): Approximately $16.8 billion (source)

- Cumulative incentives distributed: Over $130 million

- Active AVSs: Around 40 live services

- AVSs in development: Approximately 190 protocols building on the platform

The protocol supports a diverse range of Ethereum derivatives through LSTs (Liquid Staking Tokens) like Lido’s stETH and Rocket Pool’s rETH, as well as LRTs (Liquid Restaking Tokens). Additionally, EigenLayer introduced EIGEN, its native token designed to handle intersubjective faults—disputes that cannot be easily proven through on-chain data alone.

For those new to the space, imagine EigenLayer as a shared security hub: instead of every application building its own fortress from the ground up, they can leverage Ethereum’s established security infrastructure, creating a more interconnected and resilient ecosystem.

How EigenLayer Works: A Technical Deep Dive

Step 1: Deposit and Restake

Users begin by depositing native-staked ETH or LSTs (such as stETH from Lido or rETH from Rocket Pool) into EigenLayer’s smart contracts. Alternatively, users can deposit LRTs like eETH from ether.fi.

For native Ethereum validators, EigenLayer employs a withdrawal credential delegation mechanism. For LST and LRT holders, the process involves directly depositing tokens into the protocol’s smart contracts, which then manage the restaking process.

Step 2: Opt-In to AVSs

Restakers maintain control by choosing which AVSs to support. Operators—specialized node runners—provide validation services using the restaked collateral as security. This creates a pooled security model where multiple stakers combine their economic weight to secure services more efficiently than they could individually.

Step 3: Earn Stacked Rewards

The reward structure in EigenLayer is additive: participants earn Ethereum’s base staking yield (typically 3-5% APR) plus AVS-specific fees and incentives. These additional rewards vary by service but can significantly boost overall returns.

For example, EigenDA—EigenLayer’s flagship data-availability AVS—now targets throughput of approximately 100 MB/s on mainnet, helping layer-2 networks scale more cost-effectively while providing additional yield to restakers.

Step 4: Slashing and Security Mechanisms

EigenLayer implements a sophisticated dual-slashing system:

Objective Faults: Violations that can be cryptographically proven (like double-signing) trigger automatic ETH slashing through Ethereum’s consensus layer, following the same mechanisms used by standard validators.

Intersubjective Faults: Disputes that are difficult to prove purely on-chain (such as data withholding) are handled through EIGEN’s innovative token-forking mechanism, where the community can fork the token to resolve disputes while maintaining security.

Practical Example

Consider this scenario: You stake 32 ETH on Ethereum, then restake it via EigenLayer to secure a bridge protocol while holding an LRT like eETH to maintain liquidity. You now earn base Ethereum staking rewards (approximately 4% APR) plus bridge protocol incentives (potentially 2-6% additional APR), while your eETH position remains usable across DeFi protocols for lending, liquidity provision, or other yield strategies.

The Compelling Benefits of Restaking with EigenLayer

Enhanced Capital Efficiency

The primary advantage of restaking is maximized capital utilization. A single stake can simultaneously secure multiple networks, potentially generating stacked yields from Ethereum’s base layer plus multiple AVS incentives. This efficiency is unprecedented in crypto staking models.

Dramatically Lower Barriers for New Protocols

Emerging blockchain projects face a significant challenge: bootstrapping validator sets requires substantial capital and time. EigenLayer enables teams to effectively “rent” Ethereum-grade security rather than building from scratch, accelerating product launches across DeFi, gaming, AI infrastructure, and beyond.

This shared security model can reduce launch timelines from months to weeks while providing institutional-grade security from day one.

Strengthened Network Security Through Pooling

Pooled security raises the economic cost of attacking AVSs by leveraging Ethereum’s massive collateral base. Rather than targeting smaller, isolated networks, attackers would need to overcome the combined economic weight of restaked Ethereum—a vastly more expensive proposition.

Flexible Liquidity Options

LRTs such as ether.fi’s eETH allow users to maintain liquidity on their restaked positions. These tokens can be deployed across DeFi protocols for additional yield strategies, used as collateral for loans, or traded on decentralized exchanges—providing flexibility that traditional staking cannot match.

Critical Risks and Considerations in Restaking

Amplified Slashing Risk

Supporting multiple AVSs means exposure to multiple sets of slashing conditions beyond Ethereum’s base protocol. In worst-case scenarios involving simultaneous failures across multiple services, a substantial portion of your stake could be at risk. This represents the trade-off for earning additional yields.

Potential Centralization Pressures

The operational complexity of running nodes for multiple AVSs can favor large, sophisticated operators with extensive infrastructure. While public estimates suggest approximately 12-16% of all staked ETH has been restaked through EigenLayer—material but not dominant—ongoing monitoring of operator concentration is essential for long-term decentralization.

EigenLayer has implemented safeguards including 33% caps (per-token and per-entity limits) to mitigate excessive centralization risks.

Extended Unbonding and Exit Delays

Withdrawing from EigenLayer involves multiple waiting periods:

- Escrow/cooldown period: Currently around 7 days, moving toward approximately 14 days with upcoming slashing mechanism upgrades

- Standard Beacon Chain validator exit time: The normal Ethereum validator exit queue

These delays can create challenges during market volatility when rapid position adjustments might be desired. Users should factor these timelines into their risk management strategies.

AVS Incentive Variability

Rewards from individual AVSs fluctuate based on network demand, token prices, and protocol-specific economics. Best practices include:

- Starting with modest position sizes

- Diversifying across multiple AVSs

- Selecting operators with strong track records and transparent operations

- Continuously monitoring performance metrics

The Explosive Rise of Restaking in 2025

Restaking’s adoption trajectory has been nothing short of remarkable. EigenLayer’s TVL experienced explosive growth:

- December 2023: Approximately $250-350 million

- March 2024: Surpassed $10 billion as deposit caps were lifted and institutional integrations multiplied

LRT platforms like ether.fi posted outsized growth during this period, capturing significant market share within the liquid restaking segment. On the AVS side, infrastructure builders such as Brevis are launching production services leveraging EigenLayer’s security layer, while numerous other protocols actively advertise EigenLayer integrations as a key differentiator.

The ecosystem now features native support for major LSTs including those from Lido Finance and Rocket Pool. Major cryptocurrency exchanges and wallets, including OKX and institutional partners, have rolled out educational resources and native integrations for EigenLayer and LRT products.

This growth occurs against the backdrop of DeFi’s broader recovery, with total value locked across the ecosystem exceeding $100 billion in 2025, providing a strong tailwind for restaking adoption.

Future Outlook: The Emerging Restaking Economy

Restaking is evolving into what industry observers call a “restaking economy”—a fundamental infrastructure layer fueling modular blockchain architectures, specialized data layers, and verifiable compute for AI agents and other advanced applications.

Expansion into Verifiable Computing

EigenLayer’s vision extends beyond securing blockchain protocols. The platform is actively developing infrastructure for what it calls the “verifiable cloud”—using cryptoeconomic security to validate off-chain computation and AI model execution with on-chain assurances. This could extend Ethereum-grade trust to traditionally centralized computing tasks.

Key Growth Areas

- Modular blockchain infrastructure: Security for specialized execution layers, data availability networks, and settlement layers

- Oracle networks: Decentralized data feeds backed by restaked collateral

- Bridge protocols: Cross-chain communication secured by shared economic security

- AI and machine learning: Verifiable inference and model execution

Remaining Challenges

Despite strong momentum, several challenges require ongoing attention:

- Regulatory clarity: Evolving frameworks around staking derivatives and yield-bearing tokens

- Slashing mechanism design: Balancing security guarantees with operator risk tolerance

- Operator decentralization: Maintaining distributed validation as operational complexity increases

- Smart contract risk: Continuous security audits and formal verification efforts

Conclusion: Embrace the Restaking Revolution Responsibly

EigenLayer and the restaking paradigm represent a fundamental evolution in how blockchain networks achieve security and how crypto holders generate yield. By enabling the reuse of Ethereum’s battle-tested security infrastructure, these innovations empower both users seeking enhanced returns and builders launching new protocols—all while striving to preserve the decentralization principles core to blockchain technology.

With TVL maintaining strong levels and the AVS ecosystem rapidly expanding, 2025 is shaping up to be restaking’s breakthrough year in mainstream crypto adoption.

Getting Started: Best Practices

For those ready to explore restaking:

- Start small: Begin with a modest allocation to understand mechanics and risks

- Use established platforms: Consider well-known LSTs and LRTs like Lido’s stETH or ether.fi’s eETH

- Understand exit timelines: Factor in 7-14 day cooldowns plus Ethereum validator exit queues

- Diversify AVS exposure: Don’t concentrate all restaked assets in a single service

- Research operators thoroughly: Select node runners with transparent performance records

- Stay informed: Follow EigenLayer’s official documentation and community channels

- Read also: Ethereum in Business.

Additional Resources

- EigenLayer Official Documentation

- Ethereum Staking Guide

- DeFi Llama – EigenLayer Analytics

- Lido Finance

- Rocket Pool

- ether.fi

As EigenLayer continues evolving and the restaking economy matures, this infrastructure could become the backbone of a more verifiable, efficient, and interconnected Web3 ecosystem. The revolution is underway—participate thoughtfully and stay educated.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry substantial risk including potential loss of principal. Always conduct your own research and consult with qualified financial advisors before making investment decisions.