In the fast-paced world of decentralized finance (DeFi), where billions of dollars flow through smart contracts and blockchain networks, risks like hacks, exploits, and market failures are ever-present. DeFi insurance has emerged as a critical tool to protect users’ assets, offering coverage against these threats without relying on traditional insurance companies. This article explores the future of DeFi insurance, with a focus on two leading protocols: InsurAce and Nexus Mutual. We’ll break down their current offerings, key achievements, and how broader market trends are shaping the sector. Whether you’re a beginner dipping your toes into crypto or an experienced investor, understanding DeFi insurance can help safeguard your portfolio in this volatile space.

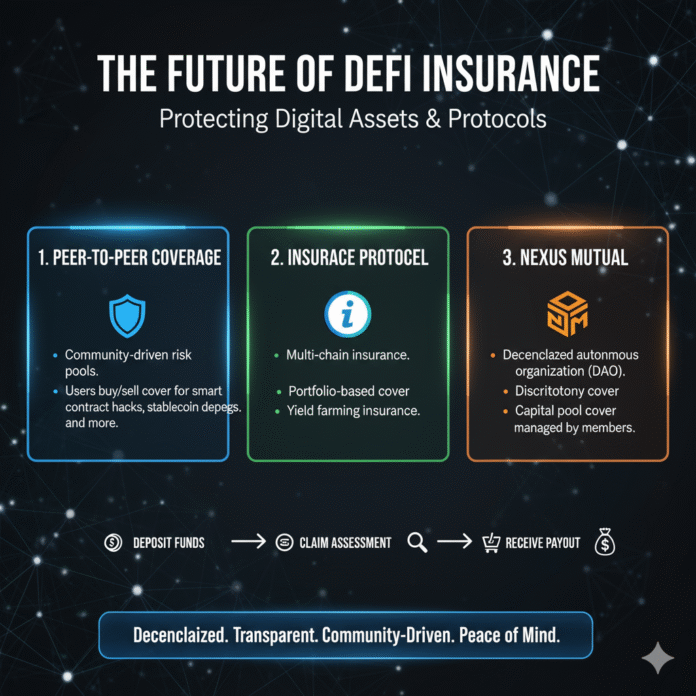

How DeFi Insurance Protects Your Digital Assets

DeFi insurance works by pooling funds from users to create mutual protection funds. Instead of a central authority deciding claims, blockchain technology ensures transparency and automation. As of 2025, DeFi’s total value locked (TVL) hovers around the $150–170 billion range, with platforms like DefiLlama tracking global TVL at approximately $157 billion in October 2025.

Market-sizing reports project strong growth for decentralized insurance: from roughly $3.5 billion in 2025 to approximately $16.94 billion by 2029, representing a compound annual growth rate (CAGR) of about 48.4% according to The Business Research Company. This explosive growth reflects the increasing recognition that DeFi participants need robust protection mechanisms.

On the security front, reputable trackers estimate crypto losses in 2024 at around $2.2 billion, underscoring the critical need for insurance solutions in this space.

Understanding DeFi Insurance Basics

DeFi insurance protocols allow users to buy “covers” – essentially policies – that pay out if specific risks materialize, such as a smart contract hack or a stablecoin losing its peg to the dollar. These covers are funded by premiums paid into shared pools, where liquidity providers earn yields in return for backing the risks. Unlike traditional insurance, everything happens on-chain, meaning transactions are verifiable and claims can be processed quickly without intermediaries.

For beginners, think of it like car insurance: You pay a small fee upfront to protect against big losses. Premium rates vary widely depending on the specific risk profile and provider. Platforms like InsurAce and Nexus Mutual have established track records of paying out claims, building trust in the system.

According to Nexus Mutual’s documentation, the protocol has paid out more than $18 million in claims to date and issued over 10,000 covers, with more than $5.8–6 billion of assets historically protected.

Key Benefits of DeFi Insurance

Transparency: All data, from pool balances to claims history, is public on the blockchain, allowing anyone to verify the protocol’s financial health and claims performance.

Accessibility: Anyone with a crypto wallet can buy coverage, often across multiple chains like Ethereum and BNB Chain, as noted by platforms like Alchemy.

Efficiency: Smart contracts and standardized processes can accelerate payouts compared to traditional insurers, eliminating weeks or months of paperwork and bureaucracy.

However, challenges remain, such as relatively low adoption rates compared to the broader DeFi ecosystem and the need for better user interfaces that make these products more intuitive for newcomers. Despite these hurdles, trends like real-world asset (RWA) tokenization and institutional involvement point to a brighter future for the sector.

Nexus Mutual: Pioneering Mutual Protection in DeFi

Nexus Mutual stands out as one of the earliest and most trusted DeFi insurance providers, launched in 2019. It operates as a decentralized mutual fund where members pool capital to cover risks, governed by holders of its NXM token. The protocol focuses on protecting against smart contract failures, exchange and custody events, governance attacks, and more.

By 2025, Nexus Mutual reports more than 10,000 covers issued and over $5.8 billion in assets protected, according to research published in ScienceDirect.

Current Products and Coverage Options

Nexus Mutual offers several product lines designed to meet diverse risk protection needs:

Fund Portfolio Cover and institutional or bespoke solutions for complex operations, catering to larger players in the DeFi space.

Custody, Exchange, and Halted-Withdrawal Coverage, which proved particularly valuable during incidents like the FTX collapse, where users who had purchased coverage were able to file claims.

Payment Methods and Process

Users can purchase covers using ETH or supported ERC-20 tokens such as USDC. Covers become active after payment and policy issuance, as detailed in Nexus Mutual’s documentation. It’s worth noting that Bitcoin (BTC) is not currently supported as a payment asset.

Proven Claims Track Record

Nexus Mutual has established credibility through its consistent claims payouts. The platform highlights more than $18 million paid across major incidents, including:

- Rari Capital exploit: Approximately $5 million in payouts

- FTX halted withdrawals: Around $4.9 million distributed to affected users

- Euler hack: Roughly $2.4 million in claims honored

In July 2025, the DAO also approved a payout of approximately $250,000 for victims of the Arcadia Finance incident, demonstrating ongoing commitment to protecting users.

Future Direction and RWA Integration

A recent governance proposal, NMPIP-262, explores connecting Nexus’s capital pool—estimated to be in excess of $100 million according to CoinGecko—to off-chain insurance opportunities via partners like Edge Capital and Fasanara. This initiative aims to grow capacity and bridge DeFi with traditional markets.

As RWA tokenization has accelerated—with DeFiLlama tracking the category crossing approximately $10 billion in March 2025 and reaching around $16–17 billion by October 2025—Nexus-style on-chain underwriting could extend to insuring tokenized treasuries, real estate, or bonds. This represents a significant expansion opportunity as reported by CoinDesk.

InsurAce: Multi-Chain Coverage for Broader Accessibility

InsurAce, launched in 2021, differentiates itself with comprehensive multi-chain support, making it easier for users on networks beyond Ethereum to obtain insurance coverage. The protocol offers protection against smart contract vulnerabilities, centralized exchange risks, IDO failures, stablecoin de-pegs, and more.

InsurAce describes itself as a decentralized multi-chain insurance protocol with portfolio-based products. According to its official documentation, the platform emphasizes multi-chain coverage and cost optimization as core differentiators.

Key Features and Product Offerings

Full-Spectrum Coverage: InsurAce offers bundled coverage across multiple risks, a feature also referenced by aggregators like Bright Union. This allows users to protect multiple positions with a single policy rather than purchasing separate covers for each risk.

Stablecoin De-Peg Protection: InsurAce was among the early movers in offering stablecoin de-peg cover, a product category that became standard across the ecosystem starting in 2021–2022. This protection proved prescient given subsequent stablecoin volatility events. Details can be found on InsurAce’s website.

Multi-Chain Compatibility: The protocol supports major blockchain networks including Ethereum, BNB Chain, and Polygon, as documented by Alchemy, enabling users to protect assets wherever they choose to deploy capital.

Ecosystem and Partnerships

InsurAce has built an extensive ecosystem of integrations and partnerships across various protocols and blockchain networks. The platform announced numerous collaborations throughout 2021–2022, establishing itself as a key infrastructure provider across the DeFi landscape, as documented in various Medium announcements.

Strategic Positioning for Future Growth

Looking ahead, InsurAce’s multi-chain strengths align well with cross-chain interoperability, identified as a top 2025 DeFi theme. The protocol is also positioned to benefit from industry-wide advances in risk-pricing automation, which could bring more consistent and accurate underwriting over time.

Emerging Trends Shaping DeFi Insurance’s Future

Real-World Asset (RWA) Tokenization

On-chain RWAs have scaled rapidly—from approximately $10 billion TVL in March 2025 to around $16–17 billion by October 2025, driven by tokenized treasuries from major players like BlackRock’s BUIDL fund, Ethena’s USDtb, and Ondo Finance. This growth trajectory is tracked by CoinDesk and represents a natural expansion opportunity for DeFi insurance protocols.

Insurance for RWAs is a logical next step, as institutional players bringing traditional assets on-chain will demand robust protection mechanisms that match or exceed traditional insurance standards.

Cross-Chain Interoperability

Broader coverage across Layer-1 and Layer-2 blockchains enables protocols to underwrite risks wherever users actually deploy their capital. This is particularly advantageous for platforms like InsurAce that have built multi-chain capabilities from the ground up, as noted by Alchemy.

AI and Smart Contract Innovation

The industry is moving toward more parametric products that enable automatic payouts triggered by oracle data, eliminating the need for manual claims assessment in certain scenarios. AI-assisted risk pricing represents another frontier, with potential to dramatically improve underwriting accuracy and efficiency, as discussed in analyses by 1inch.

Institutional Adoption and Reinsurance Bridges

Nexus Mutual’s NMPIP-262 proposal represents one pathway for institutional integration. Reinsurance bridges from platforms like Re Protocol and OnRe promise access to real-world, uncorrelated yield opportunities. Public sources cite potential returns ranging from low-double-digit to approximately 25% APY in certain structures, though these are naturally risk-dependent, as documented by CoinGecko.

Market Trajectory and Long-Term Projections

Beyond the 2029 projections of approximately $16.94 billion, some market research firms model the DeFi insurance market reaching around $17.76 billion by 2033, representing a CAGR of roughly 39.7% according to DataIntelo. While long-dated forecasts should be treated with appropriate caution, the directional trend toward substantial growth appears well-established.

Challenges and Opportunities Ahead

Despite significant progress, the DeFi insurance sector faces several hurdles:

Regulatory Uncertainties: The regulatory landscape for DeFi insurance remains unclear in many jurisdictions, with prediction markets and insurance hybrids potentially raising legal questions.

Scalability Limits: Capital pools remain relatively small compared to the total value at risk in DeFi, limiting the size of positions that can be fully insured.

User Demand: Adoption rates remain below what the sector’s fundamentals might suggest, partly due to complexity and partly due to cost considerations.

However, significant opportunities exist:

Parametric Insurance: Oracle-triggered automatic payouts can dramatically reduce claims processing time and costs while improving user experience.

Aggregation Layers: Platforms that simplify shopping for coverage across multiple providers can drive adoption by reducing complexity, as noted by OpenCover.

Institutional Bridges: Connections to traditional reinsurance markets can bring substantial new capital while maintaining on-chain transparency and efficiency.

Building a Safer DeFi Ecosystem

The future of DeFi insurance looks promising, with InsurAce and Nexus Mutual leading the charge in different but complementary ways. Nexus Mutual excels in providing deep, institutional-grade protection with a strong claims history and proven track record. InsurAce prioritizes accessibility across multiple blockchain networks, making protection more readily available to users wherever they operate.

As the market scales—helped by RWA integration, better risk models, and bridges to traditional reinsurance—these protocols will play pivotal roles in building trust and stability in the DeFi ecosystem. For beginners, starting with a simple, well-scoped cover on your DeFi positions can prevent catastrophic losses that might otherwise end your crypto journey.

The key takeaway: as DeFi matures and institutional capital flows in, insurance will transition from optional to essential infrastructure. The protocols building this infrastructure today—particularly those with proven claims records and innovative approaches to multi-chain coverage—are positioning themselves as foundational layers for the next generation of decentralized finance.

Always conduct your own research and use verified platforms. The blockchain’s inherent transparency is your best ally in this evolving space, allowing you to verify claims histories, pool capitalizations, and protocol performance before committing your premium payments.

Related Resources: