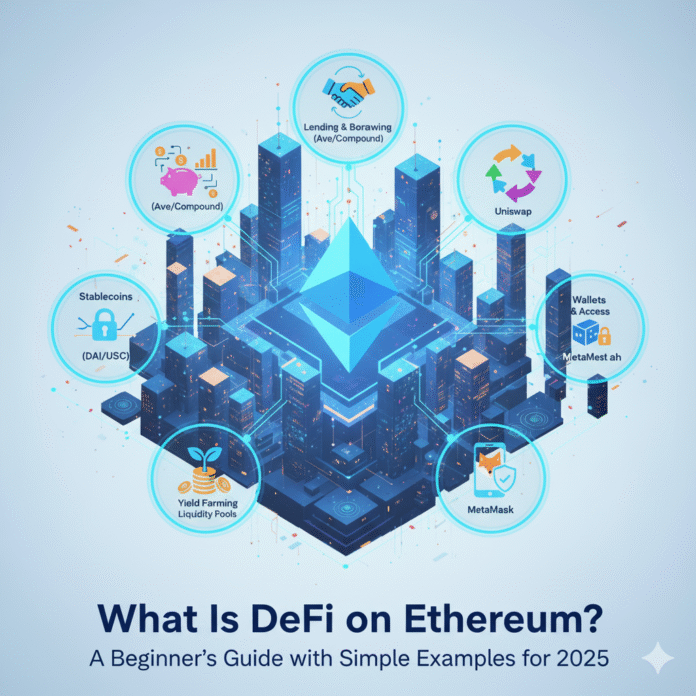

Decentralized Finance (DeFi) represents one of the most revolutionary developments in blockchain technology. This comprehensive guide explains DeFi on Ethereum, smart contracts, and how to get started with crypto wallets and DeFi applications.

What Is DeFi? Understanding Decentralized Finance

DeFi (Decentralized Finance) eliminates traditional financial intermediaries like banks by using blockchain technology. Instead of relying on centralized institutions, DeFi enables peer-to-peer financial transactions through smart contracts.

Traditional banking requires credit checks, paperwork, and approval processes. DeFi applications allow instant borrowing, lending, and trading without middlemen, offering greater accessibility and often higher returns for certain financial activities.

Why Ethereum Powers Most DeFi Applications

Ethereum dominates the DeFi ecosystem because it pioneered smart contracts—self-executing programs that automatically enforce agreements. While other blockchains like Binance Smart Chain and Polygon support DeFi, Ethereum remains the largest DeFi platform with roughly $93 billion in total value locked (TVL) as of October 2025, though this figure changes daily based on market conditions.

Smart contracts work like digital vending machines: insert the correct input, and the contract automatically executes the programmed outcome without human intervention. This automation removes the need for banks, lawyers, or other intermediaries to validate transactions.

For current TVL data, visit DeFiLlama, which provides real-time analytics across DeFi protocols.

Essential DeFi Components

To participate in DeFi, you need three fundamental elements:

Crypto Wallet: MetaMask, Trust Wallet, or Coinbase Wallet serve as your gateway to DeFi protocols. These non-custodial wallets give you full control over your private keys and assets.

Cryptocurrency: ETH or ERC-20 tokens are required to interact with Ethereum-based DeFi protocols. ETH specifically is needed to pay transaction fees (gas fees) on the network.

Internet Connection: Access DeFi protocols through web browsers by connecting your wallet to decentralized applications (dApps).

Top DeFi Use Cases and Platforms

1. Lending and Borrowing Protocols

Popular platforms like Aave and Compound have transformed how cryptocurrency holders access capital. These protocols allow users to deposit cryptocurrency to earn interest or borrow against collateral without credit checks or lengthy approval processes.

Interest rates are variable and algorithmic, adjusting based on the utilization of each lending pool. For major assets on large markets, supply APY often ranges from sub-1% to low-single-digits, while smaller or more volatile assets can offer higher rates. Always check live market rates before depositing funds.

Real-world example: When you deposit 1 ETH into Aave’s lending pool, you earn a variable supply rate determined by borrower demand. Borrowers accessing that liquidity pay a higher variable rate based on pool utilization.

The decentralized nature means rates respond to real-time market dynamics rather than centralized bank decisions. However, borrowers must maintain sufficient collateralization ratios to avoid liquidations if their collateral value drops.

2. Decentralized Exchanges (DEXs)

Leading DEXs like Uniswap and SushiSwap enable cryptocurrency trading directly from your wallet without account registration or identity verification.

These platforms use automated market makers (AMMs) instead of traditional order books. AMMs rely on liquidity pools funded by users, enabling instant token swaps at algorithmically determined prices. This innovation solved the liquidity problem that plagued early decentralized exchanges.

Benefits of DEXs include permissionless access, resistance to censorship, and elimination of custodial risk since your assets never leave your wallet until the trade executes.

3. Stablecoins for Price Stability

Major stablecoins like USDC and DAI provide the utility of cryptocurrency without price volatility, targeting a stable $1.00 value.

DAI is overcollateralized and governed by MakerDAO, a decentralized autonomous organization. Users generate DAI by locking up cryptocurrency collateral in smart contracts, maintaining stability through algorithmic mechanisms.

USDC is issued by Circle and backed by cash reserves and short-term U.S. Treasury bonds, offering a more centralized but highly liquid stablecoin option.

Stablecoins serve as the backbone of DeFi, enabling users to lock in profits, avoid volatility, and move value between protocols without converting back to traditional fiat currency.

4. Yield Farming and Liquidity Mining

Yield farming involves providing liquidity to trading pairs on decentralized exchanges to earn trading fees and sometimes additional token rewards. Returns vary widely and are not guaranteed—they depend on trading volume, fee structure, and protocol incentives.

A common strategy involves providing liquidity to ETH/USDC pools on platforms documented in Uniswap’s guides. Liquidity providers earn a percentage of trading fees generated by the pool.

Critical Risk Consideration: Impermanent loss occurs when token prices diverge significantly from when you deposited them. If ETH doubles in price relative to USDC, you would have been better off simply holding ETH rather than providing liquidity. Use reputable impermanent loss calculators and thoroughly research pool behavior before committing capital.

5. DeFi Insurance

Platforms like Nexus Mutual and InsurAce provide protection against smart contract failures and other specified risks in the DeFi ecosystem.

These protocols operate differently from traditional insurance—Nexus Mutual functions as a discretionary mutual where members assess claims, while InsurAce offers parametric coverage options.

Coverage can protect against smart contract exploits, oracle failures, and severe depeg events. Always read policy terms carefully and review claim histories before purchasing coverage, as the DeFi insurance sector is still maturing.

DeFi Benefits vs Traditional Finance

| Feature | DeFi | Traditional Finance |

|---|---|---|

| Access | Global, 24/7 availability | Limited by location and banking hours |

| Approval | Permissionless participation | Credit checks and approval required |

| Interest Rates | Market-driven; can be competitive | Typically lower for deposit accounts |

| Control | Full self-custody possible | Bank custody and control |

| Transparency | Public blockchain verification | Private ledgers |

DeFi’s composability allows protocols to integrate seamlessly—you can borrow from Aave, swap on Uniswap, and provide liquidity to Curve, all in minutes. This “money lego” functionality creates unprecedented financial flexibility.

Critical DeFi Risks to Understand

Smart Contract Vulnerabilities

Code bugs can cause permanent fund loss, as blockchain transactions are irreversible. Even audited protocols have suffered exploits resulting in millions of dollars in losses.

Review security audits from multiple firms (not just one), check for active bug bounty programs, and prioritize protocols with proven track records. Platforms like Aave publish their audit reports and maintain substantial bug bounties to incentivize security research.

Impermanent Loss

Liquidity providers face impermanent loss when token prices change relative to each other. This “loss” is impermanent because it only becomes permanent when you withdraw liquidity.

The more volatile the price movement, the greater the potential impermanent loss. Use calculators to model different scenarios before providing liquidity, especially for volatile trading pairs.

Regulatory Uncertainty

Government policies regarding DeFi continue evolving, with potential impacts on protocol access and compliance requirements. Different jurisdictions are taking varied approaches to DeFi regulation.

Follow reputable sources like DeFiLlama for data and analytics, and publications like The Defiant and Bankless for industry news and regulatory developments.

Gas Fees on Ethereum

After Ethereum’s 2024 Dencun upgrade implementing EIP-4844, average Layer 1 fees have often fallen under $1 during normal network conditions, though they spike during periods of high demand.

Layer 2 scaling solutions like Arbitrum and Optimism offer significantly lower transaction costs while maintaining Ethereum’s security guarantees. Check current gas prices on Etherscan or YCharts before executing transactions.

For frequently interacting with DeFi protocols, consider using Layer 2 networks where transaction costs are often measured in cents rather than dollars.

Step-by-Step Guide: Getting Started with DeFi

Step 1: Set Up Your Crypto Wallet

Download the MetaMask browser extension from the official website. MetaMask serves as your gateway to Ethereum DeFi applications.

Create a new wallet and securely store your 12-word seed phrase—this is your master key to recovering your wallet. Write it down on paper and store it in a secure location. Never share your private keys or seed phrase with anyone, as this gives complete control over your funds.

Step 2: Buy ETH

Purchase ETH on centralized exchanges like Coinbase, Binance, or Kraken. These platforms accept traditional payment methods including bank transfers and credit cards.

After purchasing, transfer ETH to your MetaMask wallet address. You’ll need ETH both as an asset and to pay gas fees for transactions on Ethereum.

Step 3: Choose Reputable DeFi Protocols

Start with established platforms that have proven track records:

- Trading: Uniswap for decentralized token swaps

- Lending: Aave for earning interest on deposits

- Stablecoins: Convert ETH to USDC on Uniswap for price stability

For a comprehensive overview of the best protocols across different blockchains, check out our guide on top DeFi protocols in 2025.

Prioritize protocols with significant total value locked, multiple security audits, and active development communities.

Step 4: Start Small and Learn

Begin with small amounts ($50-200) to understand how protocols work without risking substantial capital. Each transaction will teach you about wallet connections, transaction confirmation, gas fee estimation, and protocol interfaces.

Follow educational resources like Bankless and The Defiant for ongoing DeFi education, protocol reviews, and industry analysis.

Advanced DeFi Strategies

Yield Optimization

Platforms like Yearn Finance offer automated vault strategies that shift capital among various yield opportunities to optimize returns.

These vaults employ sophisticated strategies including lending, liquidity provision, and yield farming across multiple protocols. Understanding the difference between real yield and unsustainable tokenomics is crucial before depositing. Understand the specific strategy risks, performance fees, and withdrawal terms before committing capital.

Cross-Chain DeFi

Explore opportunities beyond Ethereum on networks like Polygon, Avalanche, and Solana for lower transaction fees and different yield profiles.

Each blockchain offers unique advantages—Polygon provides Ethereum compatibility with lower costs, Avalanche emphasizes transaction speed, and Solana offers high throughput for specific applications. Research bridge security and protocol reputation before moving assets cross-chain.

DeFi Analytics and Research Tools

Track your portfolio and discover new opportunities using specialized tools:

Portfolio Tracking: Zapper and DeBank provide comprehensive dashboards showing your positions across multiple protocols and chains.

Protocol Analytics: DeFiLlama offers broad, current TVL data and protocol comparisons across the entire DeFi ecosystem.

Yield Comparisons: DeFi Rate provides curated lists of yield opportunities and educational content for evaluating strategies.

These tools aggregate data from hundreds of protocols, saving hours of manual research and helping you identify emerging opportunities.

The Future of DeFi on Ethereum

DeFi continues evolving with Ethereum’s post-Merge roadmap. EIP-4844 (proto-danksharding) launched in 2024 and reduced data costs for Layer 2 solutions, with full danksharding on the roadmap to further scale throughput.

Major companies are integrating blockchain rails into traditional finance. Visa has piloted USDC settlement programs, while PayPal launched PYUSD, its own stablecoin. Traditional financial institutions are experimenting with tokenization and on-chain finance infrastructure.

Since The Merge in September 2022, Ethereum has operated on proof-of-stake, cutting energy consumption by approximately 99.95%. Future scaling focuses on danksharding and Layer 2 rollups rather than increasing Layer 1 capacity.

The “Ethereum 2.0” terminology is outdated—Ethereum now runs as a unified proof-of-stake network with ongoing upgrades focused on scalability, security, and sustainability.

Getting Started Today

DeFi represents the future of finance—open, transparent, and globally accessible. While risks exist, starting with small amounts on established platforms like Uniswap and Aave provides valuable hands-on experience with this transformative technology.

Remember these key principles:

- Never invest more than you can afford to lose completely. DeFi remains an emerging sector with technical and market risks.

- Always research protocols thoroughly by reviewing audits, checking TVL on DeFiLlama, and reading community feedback.

- Keep learning through reputable educational resources, staying current with protocol updates and security best practices.

The decentralized finance revolution is just beginning. By understanding these fundamentals and starting cautiously, you can participate in reshaping how the world handles money, loans, and financial markets—without relying on traditional intermediaries.