Introduction to DEXes and Trading Volumes

Decentralized exchanges, or DEXes, are platforms where users can trade cryptocurrencies directly with each other. Notably, they don’t need a central authority like a bank or company. Unlike traditional centralized exchanges (CEXes) such as Binance or Coinbase, DEXes run on blockchain technology. As a result, this gives users full control over their funds.

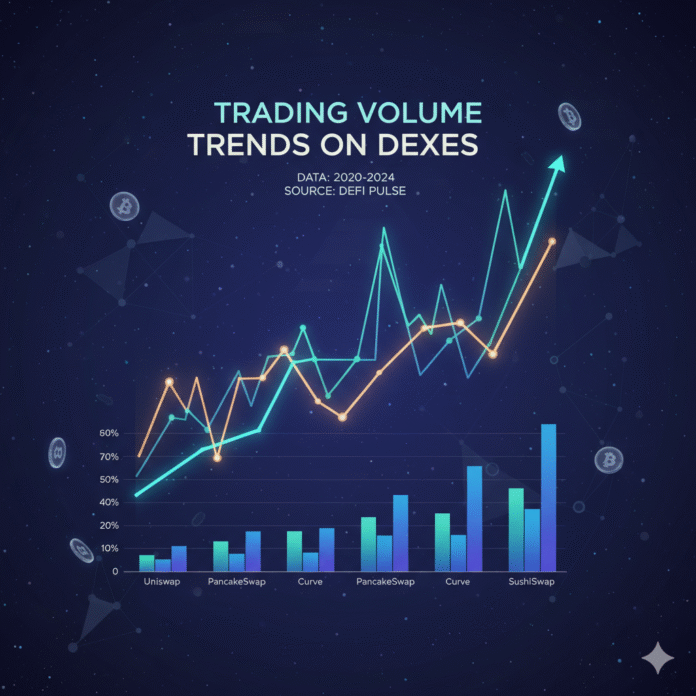

Furthermore, no middleman holds your assets. Consequently, this reduces risks like hacks or shutdowns.

Trading volume refers to the total value of cryptocurrencies traded on these platforms. Specifically, it covers specific periods like a day, month, or year. Moreover, it’s a key indicator of market activity and liquidity. Typically, high volumes often signal growing adoption. On the other hand, low volumes might indicate market slowdowns.

In recent years, DEX trading volumes have surged. Indeed, this reflects the maturation of decentralized finance (DeFi). For beginners, understanding these trends can help you spot opportunities in crypto trading. Therefore, this article explores the latest trends in DEX trading volumes. Importantly, it’s backed by reliable data from 2024 and 2025.

What Drives Trading Volume on DEXes?

Blockchain Networks and Their Impact

Several factors influence trading volumes on DEXes. First and foremost, blockchain networks play a big role. Ethereum has long dominated due to its robust smart contracts. However, faster and cheaper alternatives like Solana and Base have gained traction.

In particular, Solana’s high-speed transactions have made it a favorite for retail traders. Generally, Solana’s share of total DEX volume stays in the 25–30% range. This was especially true during late-2024 and early-2025. Moreover, specific months even saw Solana surpassing Ethereum in monthly DEX volume. For instance, figures reached around $110–130 billion in November and December 2024. This data comes from Messari and The Block.

Market Events and Memecoin Influence

In addition, market events like bull runs or new token launches boost activity significantly. Notably, memecoins—fun, speculative tokens—have driven massive volumes. They’re especially popular on Solana-based DEXes, such as Raydium.

Specifically, Raydium reached roughly 27% of all DEX volume in January 2025. Furthermore, this was a sharp jump from December 2024, as reported by KuCoin Research. Clearly, these community-driven tokens have become a significant catalyst. Additionally, the new generation of memecoins on TON and Base blockchains has particularly contributed to the surge. As a result, trading volumes on these emerging networks exploded in 2025.

Regulatory Changes

Similarly, regulatory changes also matter significantly. In fact, clearer rules in places like the U.S. have encouraged more users to shift to DEXes. Consequently, they offer privacy and self-custody features.

Notably, the U.S. enacted the GENIUS Act on July 18, 2025. Essentially, it established a federal framework for payment stablecoins. Therefore, market observers link this to growing on-chain activity according to The White House.

Innovation in DEX Types

Meanwhile, innovations in DEX types affect volumes substantially. For example, Automated Market Makers (AMMs) like Uniswap use liquidity pools for trades. In contrast, perpetual DEXes (Perp DEXes) allow leveraged trading. Importantly, these platforms have no expiration dates.

Remarkably, Perp DEXes saw their first ever $1 trillion+ month in September 2025. Specifically, the volume reached around $1.05 trillion. Subsequently, this continued into October. Overall, platforms like Hyperliquid, Lighter and Aster have led recent surges. Indeed, The Block documented this growth.

Understanding the difference between spot trading and futures trading becomes crucial when navigating these different DEX types. Essentially, each offers unique advantages depending on your trading strategy.

Historical Trends: From 2024 to Mid-2025

2024: A Turning Point

Looking back, 2024 marked a turning point for DEXes. Notably, monthly spot DEX volume set records. For instance, March 2024 reached approximately $268 billion. Subsequently, late-2024 monthly volumes accelerated further as the market recovered.

Several factors fueled this growth. First, the Bitcoin halving happened in April 2024. Additionally, spot Bitcoin ETFs launched in January 2024. Later, Ether ETFs followed in July 2024. Consequently, these brought institutional attention and liquidity to crypto, according to Axios.

Perpetual DEX Growth

Similarly, perpetual DEX volumes expanded sharply across 2024. In fact, industry trackers showed steady growth into year-end. Moreover, a significant step-change occurred in 2025, as reported by ChainCatcher.

Furthermore, the most authoritative 2025 study from CoinGecko provides context. Specifically, perp DEX volume ratios versus CEX remained in the low single digits in 2023–2024. In particular, the ratio was approximately 2–3%. However, it’s rising into 2025 but has room for continued growth.

Q4 2024 Performance

Meanwhile, in Q4 2024, spot activity continued to strengthen. This happened across both DEX and CEX platforms. As a result, the ongoing liquidity war between these two types of exchanges intensified. Consequently, decentralized platforms captured more market share.

Current Trends in 2025: Explosive Growth and Market Share Gains

Record-Breaking Volumes

Significantly, 2025 has seen DEX trading volumes reach unprecedented levels. In fact, spot DEX volume hit an all-time high of approximately $613.3 billion in October 2025. This data comes from DefiLlama and The Block.

Moreover, in the same period, perp DEX monthly volume crossed the $1 trillion mark for the first time. Specifically, September saw roughly $1.05 trillion. Subsequently, October reached around $1.2 trillion per The Block and other trackers. Additionally, some outlets cite approximately $1.36 trillion. However, estimates vary by inclusion criteria, as noted by TradingView and ForkLog.

Market Share Expansion

Furthermore, DEXes’ spot share approached approximately 20% in October 2025. Notably, this is up from low-teens averages in 2024. Therefore, it underscores structural on-chain migration according to Coinglass. Indeed, this represents a significant shift in how traders interact with crypto markets.

Chain-Specific Performance

Meanwhile, chain-specific trends show diversity. In several 2025 snapshots, Ethereum often led with roughly 30% of DEX volume. Additionally, Solana captured 25–30%. Similarly, Base held the low-teens. Likewise, Arbitrum maintained around 10–12%, based on analysis from Messari.

Notably, the growth of Base’s memecoin ecosystem has been particularly noteworthy. As a result, it contributed to its rising share of overall DEX activity.

Top DEXes Leading the Volume Surge

Leading Spot DEXes

Clearly, several DEXes have dominated 2025’s trends. For instance, Uniswap processed about $171 billion in October 2025. Importantly, this was up sharply month-over-month. Similarly, PancakeSwap did about $102 billion in the same month. Together, they captured a substantial share of spot DEX volume. Indeed, Binance Research reported these figures.

DEX Aggregators Rising

Furthermore, for traders looking to optimize their trading experience, DEX aggregators have become increasingly popular. Specifically, platforms like 1inch, Matcha, and CoWSwap lead this space. Essentially, these platforms scan multiple DEXes to find the best prices and lowest fees. Therefore, they’re valuable tools for both beginners and experienced traders.

Perpetual DEX Leaders

Meanwhile, in perp DEXes, recent data show market share rotating rapidly among leaders. Notably, Hyperliquid’s share fell from approximately 33–45% in prior months to around 10% in October. In contrast, Lighter captured roughly 27%. Similarly, Aster also ranked near the top. However, absolute volumes and shares vary by source and cut-off date. Indeed, TradingView and ForkLog track these changes.

Getting Started with DEXes

For beginners, starting with user-friendly DEXes like Uniswap is ideal. First, to swap ETH for USDC, connect your wallet (such as MetaMask). Then, select tokens and confirm. However, note that Uniswap’s fees vary by pool tier. For example, examples include 0.05%, 0.30%, and 1.00%. Therefore, it’s not a flat 0.3% in all cases, as detailed on DefiLlama.

Factors Influencing Future Trends

Regulatory Developments

Looking ahead, several elements could shape DEX volumes. First and foremost, regulatory clarity matters significantly. For instance, in the U.S., the GENIUS Act was signed July 18, 2025. Essentially, it established a federal framework for payment stablecoins.

Consequently, many industry analyses expect this to support greater on-chain settlement and liquidity. Indeed, The White House and legal analysis from Latham & Watkins documented this development.

On-Chain Activity Growth

Additionally, October 2025 also saw record stablecoin transfer activity on Ethereum alone. Specifically, the month reached approximately $2.82 trillion. Therefore, this is another indicator of increasing on-chain money velocity. As a result, it can feed DEX volumes significantly.

Furthermore, these record-breaking Ethereum metrics demonstrate the network’s continued dominance. Clearly, DeFi activity remains strong on Ethereum.

Technical Challenges and Solutions

Nevertheless, challenges include scalability issues. In particular, high gas fees on Ethereum can deter users. Additionally, security risks like smart contract exploits also pose concerns.

However, upgrades like Ethereum’s scaling roadmap have helped. Moreover, Layer-2 solutions like Optimism and Arbitrum have reduced fees. Consequently, they’ve improved throughput over time. As a result, Base and Arbitrum activity has been rising steadily.

Indeed, spot DEX monthly volume reaching approximately $613 billion in October 2025 is impressive. Similarly, perp DEXs topping $1 trillion underline how competitive on-chain venues have become. Overall, The Block continues tracking this growth.

Comparison of DEX vs. CEX Volumes

To illustrate trends, here’s a table comparing key metrics:

| Metric | DEX (2024) | DEX (2025 YTD) | CEX (2024) |

|---|---|---|---|

| Total Spot Volume | Top 10 spot DEXs did ~$1.76T across 2024 | Record monthly in Oct-2025: ~$613.3B spot; perps ~>$1T | Top 10 CEX spot ~$6.45T in Q4-2024 alone |

| Market Share (Spot) | Low-teens (e.g., ~13–14% mid-2024) | ~20% in Oct-2025 | — |

| Notable Highs | Mar-2024: ~$268B monthly spot | Sep/Oct-2025: ~$1.05–1.2T monthly perps | — |

Sources: CoinDesk citing CoinGecko for $1.76T (Top-10 DEXs, 2024); The Block/DefiLlama for Oct-2025 spot ~$613.3B; The Block/CryptoSlate for perp ~$1.05T–$1.2T; CoinGecko (CEX) for $6.45T in Q4-2024; Coinglass for DEX/CEX spot share nearing ~20% (Oct-2025).

Therefore, understanding the key differences between DEX and CEX helps traders choose the right platform. Essentially, you can prioritize self-custody and privacy. Alternatively, you might prefer speed and fiat on-ramps.

Risks and Tips for Beginners

Understanding Volatility

While exciting, high volumes come with volatility. For example, in Q2 2025, volumes dipped amid uncertainty. However, they rebounded into Q3–Q4 alongside ETF-related flows and broader risk-on sentiment. Indeed, multiple market trackers support this direction. Nevertheless, exact percentages vary by dataset.

Essential Safety Practices

Therefore, beginners should follow these guidelines:

- First, use reputable wallets like MetaMask, Trust Wallet, or Ledger

- Additionally, enable two-factor authentication on all platforms

- Moreover, start small—trade familiar pairs like ETH/USDC or ETH/DAI on established platforms

- Furthermore, monitor fees and slippage carefully, especially during high-volatility periods

- Similarly, diversify across chains like Ethereum and Solana to reduce network-specific risks

- Finally, consider using DEX aggregators to automatically find the best prices

Conclusion: The Future of DEX Trading

The Shift Toward Decentralization

Clearly, DEX trading volume trends in 2025 highlight a shift toward decentralized, user-controlled finance. Indeed, from late-2024 records to 2025’s all-time highs, growth is undeniable. Specifically, October saw approximately $613 billion in spot volume. Meanwhile, perps exceeded $1 trillion. Therefore, for beginners, this means more opportunities but also the need for education.

Evolving Technology and Regulation

Furthermore, as DEXes evolve with better tech and clearer rules, they could continue to redefine crypto trading. For instance, the U.S. GENIUS Act is one example of helpful regulation. Additionally, the combination of improved Layer-2 scaling solutions is promising. Similarly, regulatory frameworks supporting stablecoins help too. Moreover, increasing institutional adoption through ETFs matters.

Consequently, all this suggests that decentralized exchanges will play an increasingly important role. Indeed, the broader crypto ecosystem continues expanding.

Diverse Trading Opportunities

Additionally, the rise of perpetual trading platforms demonstrates ecosystem diversity. Similarly, the continued impact of memecoin-driven adoption shows market creativity. As a result, the ecosystem now caters to traders with different risk appetites and strategies.

Moreover, the emergence of new memecoin communities on TON and Base further illustrates the expanding landscape. Clearly, decentralized trading opportunities keep growing.

Whether you’re exploring spot trading or futures trading, understanding these volume trends helps you navigate the DEX landscape more effectively.

Stay Informed and Trade Responsibly

Therefore, stay informed, trade responsibly, and watch how these trends unfold. Perhaps you might be interested in spot trading on platforms like Uniswap and PancakeSwap. Alternatively, perhaps you prefer exploring perpetual contracts on venues like Hyperliquid. Otherwise, maybe you want to use aggregators like 1inch to optimize your trades.

Ultimately, understanding volume trends will help you make more informed decisions. Indeed, this space evolves rapidly.

Finally, for more insights on cryptocurrency trading and DeFi developments, visit key resources. Specifically, The Block, CoinGecko, DefiLlama, and Messari provide the latest market data and trends. Furthermore, to dive deeper into the ongoing competition between DEXes and CEXes, explore how liquidity dynamics are reshaping the entire crypto trading landscape.