In the fast-paced world of cryptocurrency investing, emotions often run high. One of the most common psychological hurdles faced by traders is FOMO, or the Fear of Missing Out. This phenomenon drives investors to make impulsive decisions, chasing hype and potentially leading to significant financial losses. But what exactly is the psychology behind crypto FOMO, and how can beginners navigate it? In this article, we’ll explore the roots of FOMO in cryptocurrency trading, its impacts, historical examples, and practical strategies to overcome it. Whether you’re new to crypto or looking to refine your approach, understanding FOMO can help you become a more disciplined investor.

What is FOMO in the Context of Cryptocurrency?

FOMO, short for Fear of Missing Out, is a psychological state where individuals feel anxious about missing potentially rewarding experiences that others are enjoying. In cryptocurrency, this translates to the dread of missing out on massive gains from surging coins or tokens. Imagine scrolling through social media and seeing posts about friends or influencers boasting huge profits from a new altcoin—suddenly, you’re tempted to buy in without research.

This isn’t just a casual worry; it’s a powerful emotional trigger amplified by the volatile nature of crypto markets. Unlike traditional stocks, cryptocurrencies can skyrocket or plummet overnight, fueled by news, celebrity endorsements, or viral trends. For instance, when Bitcoin rallied dramatically in 2017, many investors jumped in late, driven by FOMO, only to face corrections later. According to surveys reported by Axios, 84% of U.S. crypto holders have made investment decisions due to FOMO at some point, highlighting its widespread grip on the community.

At its core, FOMO in crypto stems from human nature’s aversion to regret. Investors fear not just missing profits but also the social sting of watching others succeed while they sit on the sidelines. This is particularly potent in decentralized markets where information spreads rapidly via platforms like Twitter (now X) or Reddit, creating echo chambers of excitement that fuel impulsive decision-making. This phenomenon is especially prevalent in viral trends like memecoins, which drive adoption across blockchain chains through social hype and community enthusiasm.

The Psychological Principles Driving Crypto FOMO

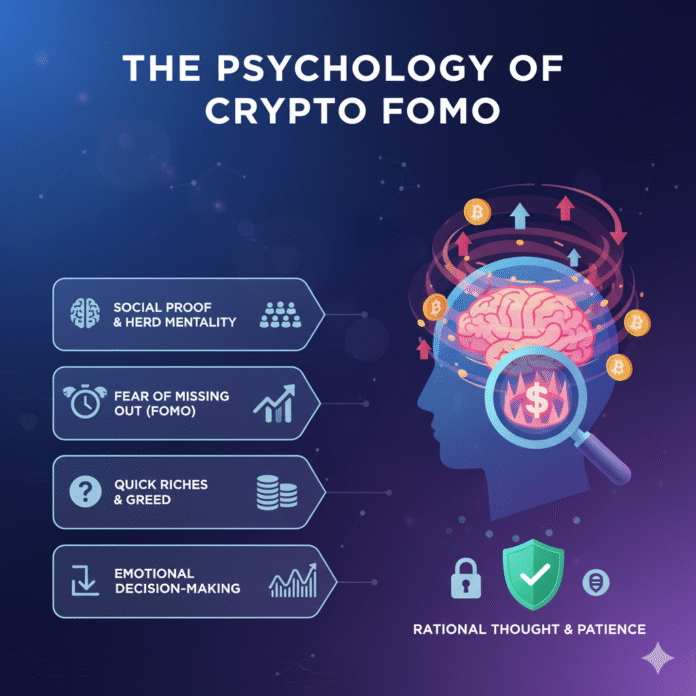

To grasp why FOMO is so prevalent in crypto trading, we need to delve into key psychological principles. Behavioral finance experts point to several cognitive biases that fuel this emotion.

Loss aversion stands as one of the primary drivers. This concept, developed by psychologists Daniel Kahneman and Amos Tversky as part of prospect theory, suggests that people feel the pain of losses twice as intensely as the pleasure of equivalent gains. In crypto, this manifests as investors rushing to buy during rallies, fearing they’ll “lose” by not participating, even if the asset is overvalued.

Another critical principle is social proof, popularized by psychologist Robert Cialdini. When we see crowds flocking to a coin—through rising prices, media hype, or social media buzz—we assume it must be a good investment. This herd mentality is exacerbated in crypto, where pump-and-dump schemes can create artificial hype, drawing in FOMO-driven buyers. Research documented on ScienceDirect shows significant herding behavior and time-varying herding patterns in crypto markets.

Overconfidence bias also plays a substantial role. Traders often overestimate their ability to predict market moves, especially after seeing quick wins shared online. Combined with fear, uncertainty, and doubt (FUD)—the flip side of FOMO—this creates a cycle of emotional trading. Peer-effect evidence extends to both miners and investors, and market studies published on SSRN reveal asymmetric volatility in crypto, where positive shocks can amplify volatility more than negative shocks—an asymmetry consistent with FOMO-driven chasing behavior.

Additionally, recent research on SpringerLink indicates that regret and FOMO are associated with speculative trading, while cryptocurrency and financial literacy can mitigate FOMO-biased decisions. Understanding these psychological principles is the first step toward making more rational investment choices.

The Effects of FOMO on Crypto Investors

FOMO isn’t harmless—it has tangible, often detrimental effects on investors’ portfolios and mental health. A 2024 Kraken survey of 1,248 U.S. crypto holders found that 63% believe emotional decisions (including FOMO/FUD) negatively affected their portfolios, 84% had made decisions due to FOMO, and 81% due to FUD.

One major effect is impulsive buying at inflated prices. Investors driven by FOMO often enter trades late in a rally, buying high and selling low when the inevitable correction hits. This results in overtrading, where emotional decisions override strategy, increasing transaction fees and tax implications. This is particularly common when investors rush into trending assets on platforms like Base by Coinbase, America’s leading Ethereum Layer 2 solution, without understanding the underlying technology or risks.

Psychologically, FOMO heightens stress and anxiety. Constant market monitoring can lead to burnout, with traders obsessing over missed opportunities. For those who rely on social media as a primary information source, secondary reports from Nasdaq on the same Kraken survey note that approximately 85% said emotional decisions hurt their portfolios—underscoring how external influences amplify FOMO’s negative effects.

On a broader scale, FOMO influences market dynamics. Research shows it drives herding behavior, where uninformed investors pile in during high valuations, exacerbating volatility. For beginners, this means higher risk of financial loss, especially without proper education. Studies consistently show that regret and FOMO increase speculative trading, while financial literacy dampens it.

Historical Examples of FOMO in Crypto Markets

History is rife with examples where FOMO propelled crypto markets to dizzying heights—and subsequent crashes. These cases illustrate the psychology in action and offer valuable lessons for today’s investors.

The 2017 Bitcoin Bull Run

The 2017 Bitcoin bull run stands as a classic example. According to Axios, Bitcoin surged toward $20,000 in December 2017, attracting massive retail interest. Many investors jumped in late, driven by fear of missing the rally, only to face sharp pullbacks in early 2018 when prices corrected dramatically. Understanding the fundamental differences between major cryptocurrencies, as outlined in this Bitcoin vs Ethereum investment guide for 2025, could have helped investors make more informed decisions during this volatile period.

The 2021 Crypto Boom

Similarly, the 2021 crypto boom saw Ethereum and altcoins like Dogecoin explode in value. Celebrity influence—especially Elon Musk’s tweets—regularly moved prices dramatically. Reuters reported that Dogecoin jumped over 60% after one such tweet in February 2021. Multiple academic studies on ScienceDirect document this “Musk effect” and its role in amplifying FOMO-driven trading behavior.

The 2024–2025 Cycle

More recently, the 2024–2025 cycle saw renewed retail interest amid ETF-driven rallies and fresh highs, again raising FOMO risk for newcomers. This cycle has also witnessed a new generation of memecoins on TON and Base blockchains, creating fresh opportunities for FOMO-driven speculation. Mainstream outlets like Investopedia documented the influx and advised keeping crypto allocations small—often under 10%, sometimes under 3%—as a risk guardrail against emotional decision-making.

These examples demonstrate that FOMO isn’t new—it’s a recurring psychological force in speculative markets that investors must learn to recognize and control.

Strategies to Overcome FOMO in Cryptocurrency Investing

The good news? You can combat FOMO with deliberate strategies. Experts recommend building emotional resilience through education and discipline.

Develop a Trading Plan

Start with clear goals, risk tolerance, and entry/exit rules. Stick to it religiously to avoid impulse trades. For beginners, many advisors suggest keeping crypto to a small slice of your portfolio—typically under 10% of total investments. Investopedia recommends this approach to limit exposure while you learn the market dynamics. Before investing, it’s crucial to choose the right platform—consider exploring the top 10 crypto exchanges for beginners in 2025 to find a secure and user-friendly option.

Educate Yourself

Boost your financial literacy to reduce FOMO’s sway. Evidence from SpringerLink shows that cryptocurrency and financial literacy significantly mitigate FOMO-driven speculation. Take time to understand blockchain technology, market fundamentals, and technical analysis before making investment decisions. Consider learning about different organizational structures in crypto, such as DAOs (Decentralized Autonomous Organizations) that run companies on Ethereum, to better understand the ecosystem. For those choosing between major cryptocurrencies, reading a comprehensive comparison of Bitcoin vs Ethereum can help you make more informed, less emotion-driven investment decisions.

Avoid Social Media Triggers

Limit exposure to hype-filled platforms. Notably, in the Kraken survey’s secondary reporting by Nasdaq, approximately 85% of those relying on social media said emotional decisions harmed their investment results. Implement a cooling-off period before acting on information from social platforms—wait at least 24 hours before making any trade based on social media buzz.

Diversify and Focus on Long-Term Goals

Don’t chase every trend. Diversify across different assets and adopt a buy-and-hold strategy to weather volatility. Focus on projects with solid fundamentals rather than short-term price movements driven by hype.

Practice Mindfulness and Reflection

Journal your past trades to learn from FOMO mistakes. Document why you made each decision and review these entries regularly. Techniques like meditation and mindfulness can help curb anxiety and promote more rational decision-making.

Seek Community Support

Join balanced forums or consult financial advisors, but avoid echo chambers that amplify FOMO. Look for communities that emphasize education and risk management over hype and quick profits.

By implementing these strategies, investors can shift from emotion-driven to logic-based decisions, potentially improving long-term outcomes and reducing the psychological toll of crypto investing.

Conclusion: Mastering Your Mind in Crypto Trading

The psychology of crypto FOMO reveals how deeply emotions intertwine with investing. Rooted in cognitive biases like loss aversion, social proof, and overconfidence, it drives impulsive actions that can lead to significant losses, as evidenced by historical bubbles and recent surveys. However, by understanding these psychological principles and adopting strategies like solid planning, continuous education, and disciplined risk management, even beginners can overcome FOMO.

Remember, successful crypto investing is about patience and thorough research, not chasing every price spike. Stay informed, stay disciplined, and let logic guide your decisions. In a market as unpredictable as cryptocurrency, mastering your psychology might be your greatest asset for long-term success.

External Sources:

- Axios – Crypto FOMO Statistics

- ScienceDirect – Herding Behavior in Cryptocurrency Markets

- ScienceDirect – Celebrity Influence on Cryptocurrency Prices

- SSRN – Asymmetric Volatility in Crypto Markets

- SpringerLink – Financial Literacy and FOMO in Crypto Trading

- Kraken Blog – Survey on Emotional Trading in Crypto (2024)

- Nasdaq – Impact of Social Media on Crypto Investment Decisions

- Reuters – Elon Musk and Dogecoin

- Investopedia – Crypto Investment Guidelines