In the world of cryptocurrency and blockchain, Decentralized Finance (DeFi) has emerged as a revolutionary way to handle money without traditional banks or intermediaries. DeFi protocols are essentially software programs built on blockchains like Ethereum that offer services such as lending, borrowing, trading, and earning interest on digital assets. But how do these protocols stay operational and grow? The answer lies in their ability to generate real revenue—actual income from user activities, not just speculative token values.

This comprehensive guide explores how DeFi protocols earn real revenue in simple terms, using verified facts from reliable sources. We’ll break it down step by step, with examples to make it easy for beginners to understand. Whether you’re new to crypto or curious about blockchain economics, you’ll learn the key mechanisms behind DeFi’s financial sustainability. You’ll discover why revenue matters for these protocols to thrive in a competitive market.

What is DeFi and Why Does Revenue Matter?

Understanding Decentralized Finance

DeFi stands for Decentralized Finance. It’s a system that uses smart contracts—self-executing code on the blockchain—to provide financial services openly and transparently. Unlike traditional finance, where banks profit from fees and interest, DeFi protocols are often community-governed. They aim to distribute value back to users.

However, to survive and innovate, they need revenue. This covers operational costs like development, security audits, and network fees.

Why Revenue is Critical for Protocol Success

Revenue in DeFi ensures long-term viability and sustainability. Without consistent income streams, protocols can’t fund improvements. They can’t incentivize participants or maintain competitive advantages. This leads to stagnation or failure.

Sustainable income allows protocols to attract more users. They can offer better yields or features. This creates a positive cycle of growth and adoption.

Tracking DeFi Revenue Performance

For tracking and analyzing protocol performance, specialized platforms provide invaluable data. DeFiLlama and Token Terminal offer real-time metrics on fees and revenue.

As a concrete example, MakerDAO’s annualized revenue reached approximately $165.4 million in August 2023. This occurred during a favorable rate-hike environment. However, this represents a point-in-time, annualized run-rate rather than a guaranteed full-year total.

The DeFi Revenue Philosophy

Think of DeFi protocols as online marketplaces. Users pay small fees for convenience. Those fees fund platform operations and development.

This model makes DeFi inclusive. Anyone with an internet connection can participate. Revenue isn’t just about profits. It’s about building trust, ensuring security, and maintaining efficiency in a decentralized ecosystem.

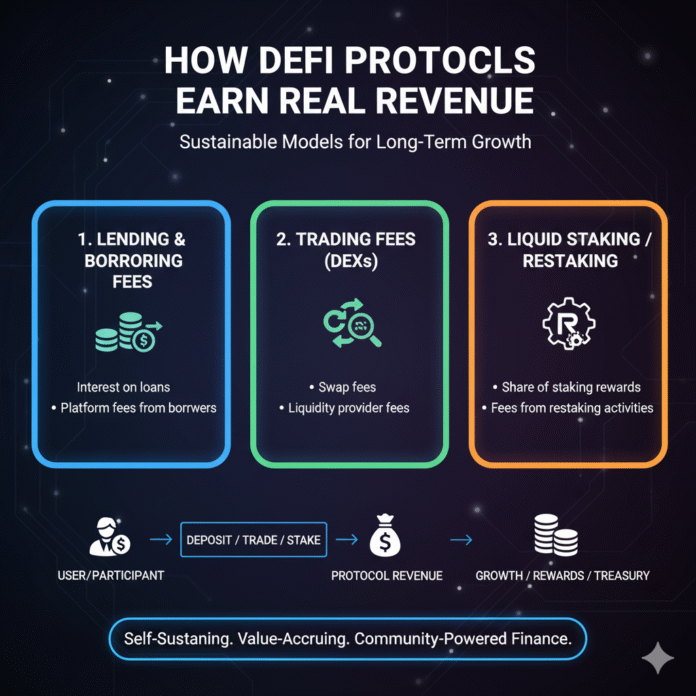

Common Revenue Models in DeFi

DeFi protocols earn revenue through various user-paid fees and strategic mechanisms. These are considered “real” revenue because they’re based on actual usage and economic activity. They don’t rely on token inflation or speculative hype. Let’s explore the main revenue models with straightforward examples for beginners.

Transaction and Trading Fees

How DEX Trading Fees Work

One of the most straightforward ways DeFi protocols generate revenue is by charging fees on trades or token swaps. Decentralized Exchanges (DEXs) like Uniswap allow users to swap one cryptocurrency for another. No central authority or intermediary is required.

Every time a user executes a trade, a small percentage fee is deducted from the transaction.

A Simple Example for Beginners

Imagine swapping $100 worth of ETH for USDC on a DEX. If the trading fee is 0.3%, you pay $0.30 for that transaction. Part of this typically goes to liquidity providers. These are people who deposit funds into pools to enable trades. Portions may flow to the protocol’s treasury for development and operations.

Uniswap’s Fee Structure

Uniswap v3 supports multiple fee tiers. Common options include 0.05%, 0.30%, and 1%. This allows liquidity providers to choose appropriate fee structures. The choice depends on expected volatility and trading volume.

However, by default, the protocol fee switch that would divert a portion to the DAO treasury is generally not active. Fees typically go entirely to liquidity providers. Governance has debated activating a “fee switch” for protocol-level revenue. But it isn’t broadly enabled at the time of writing.

Comparing Different DEX Fee Models

Other popular DEXs have different fee structures. PancakeSwap typically charges around 0.25% per swap on its v3 implementation. It offers dynamic tiers ranging from approximately 0.17% to 0.25%. These are split between liquidity providers and the platform according to each pool’s configuration.

Trader Joe, another prominent DEX, retained approximately 15% of trading fees in 2023. Roughly 85% went to liquidity providers. This demonstrates how protocols can capture a slice as “protocol-side” revenue. This funds operations and development.

Lending and Borrowing Fees

How Lending Protocols Generate Revenue

Lending protocols represent another major revenue stream in DeFi. They allow users to deposit cryptocurrency assets to earn interest. Meanwhile, others borrow those same assets. Revenue is generated through the interest rate spread and designated protocol fees.

The Simple Mechanics of Lending Revenue

Here’s how it works simply. Lenders deposit assets like DAI or USDC into lending pools. They earn interest paid by borrowers. Most lending protocols route a configurable share of borrower interest to the protocol treasury.

This happens via a “reserve factor”—a percentage set per asset that captures value for the protocol. On platforms like Aave, reserve factors often range from 10% to 25%. This depends on the specific asset and market conditions. These parameters are adjusted by governance.

Compound’s Dynamic Approach

Compound, another leading lending platform, similarly uses per-market reserve factors. There’s no flat percentage across all markets. Borrowers pay interest rates based on real-time supply and demand dynamics. This ensures market-driven pricing that adjusts to utilization levels.

MakerDAO’s Unique Revenue Model

MakerDAO operates with a slightly different model. It earns revenue through “stability fees” charged on DAI debt positions. Its annualized protocol revenue peaked near $165.4 million in August 2023.

Additionally, Maker’s real-world asset (RWA) strategy involves investing in U.S. Treasury bills. This has typically yielded approximately 4-5% returns. The protocol also briefly set its DAI Savings Rate (DSR) to 8% in 2023 as a promotional rate. This was separate from Treasury yields.

Flash Loan Fees

Understanding Flash Loans

Flash loans represent a unique and innovative DeFi feature. Users can borrow substantial amounts without providing collateral. However, they must repay the entire loan plus fees within the same blockchain transaction. Protocols charge fees for providing this instant liquidity access.

How Flash Loans Work in Practice

In simple terms, a sophisticated trader might borrow $1 million worth of ETH. They use it for a quick arbitrage opportunity across different exchanges. Then they repay the loan immediately—all within seconds. They pay a small fee for the privilege.

On Aave v3, the flash loan premium is initialized at 0.05%. It can be adjusted by governance. Earlier configurations on some markets referenced 0.09% fees. If the borrower cannot repay within the same transaction, the entire transaction reverts. This protects the protocol from default risk.

This mechanism generates revenue from sophisticated market participants and arbitrageurs. It maintains zero default risk—a truly innovative financial primitive unique to blockchain technology.

Liquidation and Penalty Fees

How Liquidation Fees Work

When borrowers fail to maintain required collateral levels, their positions are liquidated. For example, if the price of ETH drops significantly, collateral is sold off to repay the outstanding loan. Protocols charge penalty fees on these liquidation events. This creates another revenue stream.

A Beginner’s Guide to Liquidations

If you borrow assets against collateral and its value falls below a safety threshold, the protocol acts automatically. It auctions off your collateral to repay lenders. The protocol takes a fee called a “liquidation incentive” in the process.

In Compound v2 and v3, liquidation incentives typically range from approximately 5% to 8%. This depends on the specific asset and market configuration. A portion of these fees may flow to protocol reserves or the treasury. This depends on the mechanism design.

These liquidation processes protect lenders while generating protocol revenue. They also incentivize third-party liquidators to maintain system solvency.

Performance and Management Fees in Yield Aggregators

How Yield Aggregators Earn

Yield aggregators optimize returns by automatically moving user assets across different DeFi protocols. They capture the best available yields. These platforms charge fees on the profits they generate for users.

Understanding Vault Fees

Simply put, you deposit funds into an automated “vault.” The protocol implements sophisticated strategies—such as lending across multiple platforms or yield farming—to maximize returns. The protocol takes a percentage cut of profits generated.

Yearn Finance’s classic fee structure includes approximately 20% performance fees taken from profits. It also charges 2% annual management fees. However, these rates can vary by specific vault and governance decisions over time.

This model aligns incentives. The protocol only earns substantial fees when it successfully generates profits for depositors. This encourages continuous optimization of strategies.

Staking and Liquidity Provider Fees

Liquid Staking Revenue Models

Liquid staking protocols like Lido allow users to stake ETH for network validation. At the same time, they maintain liquidity through tokenized representations like stETH (staked ETH). Revenue comes from taking a percentage cut of the staking rewards earned by validators.

Lido’s Fee Structure

Lido retains a 10% fee on ETH staking rewards. This is split between node operators who run the validators and the Lido DAO treasury. Lido’s market share of total staked ETH has fluctuated significantly. It reached over 30% at points during 2023-2024. But it sat closer to approximately 24% in September 2025.

Market share and total value locked figures are time-sensitive. They fluctuate with ETH price movements and overall staking adoption.

This model has proven highly successful. It generates substantial protocol revenue while providing users with liquid, composable staking tokens. These can be used throughout DeFi.

Other Models: Insurance, Partnerships, and Ecosystem Incentives

Diversifying Revenue Streams

Beyond the core revenue models, some protocols explore additional income streams. Insurance protocols like Nexus Mutual charge premiums to users seeking protection. This covers smart contract hacks or protocol failures, similar to traditional insurance models.

Strategic Partnerships and Grants

Strategic partnerships and ecosystem grants can also boost protocol activity. They indirectly increase fee generation. For instance, GMX received substantial ARB incentive grants from the Arbitrum DAO. This included 12 million ARB in the 2023 STIP program, with additional tranches in 2024.

While such grants represent ecosystem incentives rather than operating revenue, they can significantly boost trading activity. This increases the resulting fee generation.

These diverse revenue models demonstrate the creativity and innovation occurring in DeFi. Protocols experiment with sustainable business models.

Real-World Examples of DeFi Protocols Earning Revenue

Let’s examine specific leading protocols to see these revenue models in action. We’ll understand their real-world implementation.

Uniswap: The Leading DEX Model

Uniswap primarily earns fees paid by traders executing swaps. These currently accrue almost entirely to liquidity providers. Protocol-level fee sharing to the DAO or UNI token holders is under active governance discussion. However, it’s generally not enabled system-wide.

Consequently, there is no standing protocol-funded UNI buyback program at present. Uniswap operates across numerous blockchain networks. V4 deployments span approximately a dozen networks. Its total value locked has hovered in the multi-billion dollar range throughout 2025.

The UNI-denominated treasury, tracked by platforms like DeepDAO, typically shows holdings in the low single-digit billions. These are mostly in UNI tokens. They fluctuate with token price movements.

Aave: Multi-Stream Lending Revenue

Aave combines multiple revenue streams. These include interest rate spreads captured through reserve factors, flash loan fees, and liquidation-related flows. The exact reserve factor varies significantly by asset and market. It’s governed through on-chain governance proposals.

These reserve factors represent material revenue, often double-digit percentages. They’re adjusted by governance based on market conditions and protocol needs.

Lido: Liquid Staking Dominance

Lido captures 10% of all staking rewards. This is split between node operators who maintain validators and the Lido DAO treasury. Its market share of total staked ETH recently stood at approximately 24%. This is down from peaks exceeding 30% in earlier periods.

Revenue scales directly with the total amount of ETH staked through Lido. It also depends on the underlying network staking reward rates.

GMX: Real Yield Pioneer

GMX operates a “real yield” model. It distributes approximately 30% of trading fees to GMX token stakers. Roughly 70% goes to liquidity providers (GLP holders) in its v1 implementation. Exact fee splits and v2 mechanics can differ over time based on governance decisions.

The protocol is widely cited as demonstrating genuine “real yield.” Distributions come directly from actual trading fees collected, not from token inflation or emissions.

MakerDAO: Stability Fee Innovation

MakerDAO generates revenue through multiple channels. These include stability fees charged on DAI debt positions, liquidation penalties, and income from real-world assets. The protocol particularly invests in U.S. Treasury bills.

Annualized revenue reached approximately $165.4 million in August 2023. This occurred during favorable interest rate conditions. The protocol’s Treasury bill investment strategy has typically targeted yields around 4-5%. This is separate from the temporary 8% DAI Savings Rate promotional period in 2023.

Tracking Protocol Performance

These real-world examples demonstrate how diverse revenue models adapt to different service offerings. Protocols calculate earnings as gross revenue minus user incentives and operational costs.

For current data on protocol revenues and fees, refer to Token Terminal and DeFiLlama. They provide comprehensive, regularly updated metrics.

Challenges in Generating Real Revenue

Competitive Pressure on Fees

Despite notable successes, DeFi protocols face significant hurdles in generating and maintaining sustainable revenue streams. Intense competition among protocols often compresses fee margins. Users naturally gravitate toward platforms offering the lowest costs.

This creates a challenging environment. Protocols must balance competitive pricing with revenue needs.

Regulatory Uncertainties

Regulatory uncertainties present another substantial challenge. As governments worldwide develop frameworks for digital assets, protocols must adapt to evolving compliance requirements. They must maintain their decentralized nature.

This tension can impact operational costs and business models.

Security Risks and Trust

Security vulnerabilities and hacks can severely erode user trust and protocol value. Even with extensive audits, smart contract risks remain. Major exploits can devastate both user confidence and treasury reserves built from fee revenue.

Balancing Incentives and Sustainability

Protocols must also carefully balance user rewards with treasury needs. Over-incentivizing users with token emissions can dilute token value. It creates unsustainable “mercenary capital” that leaves when rewards decrease.

Finding the right equilibrium between growth incentives and protocol profitability remains an ongoing challenge.

Evolving Valuation Models

Valuation models for DeFi protocols also remain actively debated within the industry. While traditional finance focuses on revenue and earnings multiples, DeFi has historically emphasized metrics like Total Value Locked (TVL).

The shift toward revenue-based valuation represents a maturation of the space. However, it creates uncertainty during the transition period.

The Future of DeFi Revenue Models

Real-World Asset Tokenization

Looking ahead to 2025 and beyond, several innovations show promise for enhancing DeFi revenue streams. The tokenization of real-world assets could substantially boost protocol revenue. This includes U.S. Treasury bills, private credit, real estate, and other traditional financial instruments.

It attracts institutional capital and traditional finance participants seeking blockchain-based exposure.

Next-Generation Yield Engines

Emerging protocols like Ethena and Pendle are pioneering new yield generation mechanisms. These are designed to provide stable, attractive returns through innovative financial engineering. These “yield engines” represent the next evolution in DeFi revenue models.

They potentially create more sustainable and predictable income streams.

Traditional Finance Integration

Integration between DeFi and traditional finance continues accelerating. Major financial institutions are exploring blockchain-based settlement, tokenized securities, and DeFi infrastructure. This convergence could dramatically expand the addressable market.

It creates new revenue opportunities for leading protocols.

Data-Driven Protocol Analysis

Rather than relying on aggregate market-size projections, the industry increasingly tracks protocol-level fees and revenue. These projections often vary inconsistently across sources and lack reliable methodology.

Token Terminal and DeFiLlama provide the most comprehensive, standardized metrics. They enable accurate comparison of protocol economics and revenue generation.

Conclusion: Understanding DeFi Revenue for Smarter Participation

Key Takeaways

DeFi protocols earn real revenue through user fees collected on trades, loans, staking services, and numerous other financial activities. This revenue ensures protocols can continuously innovate, enhance security, and reward their communities for participation.

From Uniswap’s trading fees to Lido’s staking fee splits, these diverse business models make blockchain-based finance increasingly accessible. They’re potentially profitable for participants worldwide.

Getting Started Safely

For beginners exploring DeFi, start by investigating low-fee, battle-tested protocols. Look for proven track records and extensive security audits. Always verify current parameters—including fee structures, reserve factors, yields, and governance decisions.

These change regularly through community governance processes.

Essential Resources for Research

Dashboards like DeFiLlama and Token Terminal help you compare protocols accurately. Make informed decisions based on real data rather than marketing claims.

As the DeFi ecosystem matures, revenue-generating protocols with sustainable business models will likely emerge as long-term leaders. They’ll drive the decentralized finance revolution.

Key Resources for Further Research

- DeFiLlama – Comprehensive DeFi analytics and TVL tracking

- Token Terminal – Protocol revenue and financial metrics

- Uniswap Documentation – DEX mechanics and fee structures

- Aave Documentation – Lending protocol parameters

- Compound Finance Docs – Lending markets and reserve factors

- Lido Documentation – Liquid staking mechanisms

By understanding how DeFi protocols generate revenue, you can better evaluate projects. You can assess sustainability and make more informed decisions. This helps you allocate your capital wisely in the decentralized finance ecosystem.