Executive Summary: The Current DeFi Leadership Battle

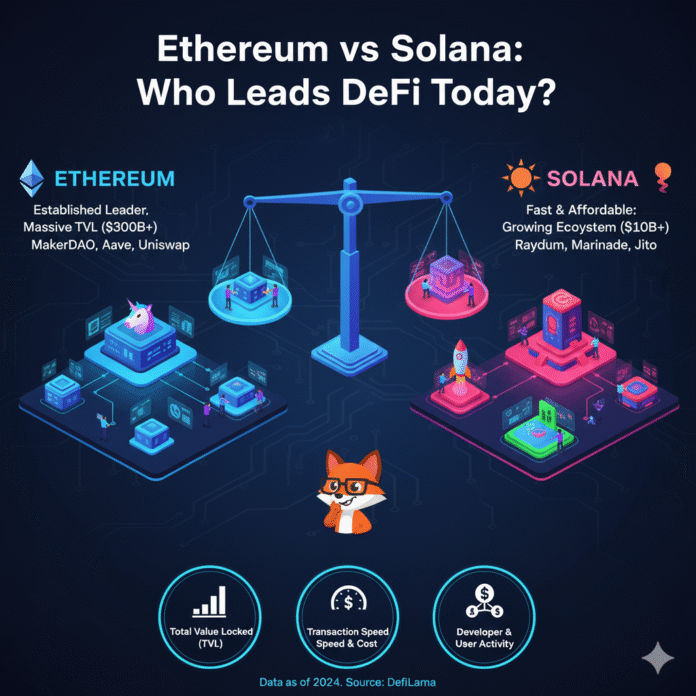

Short answer: As of now, Ethereum continues to dominate DeFi through total value locked (TVL) and institutional trust in October 2025. Meanwhile, Solana shines as the retail-focused chain—delivering faster transactions and lower costs, frequently topping daily DEX volumes despite having shallower liquidity pools.

Key Takeaways for Busy Readers

First and foremost, Ethereum commands about $94 billion in TVL compared to Solana’s $12.6 billion. In other words, this represents roughly 7-8× more capital locked in DeFi protocols. However, Solana has repeatedly exceeded Ethereum in daily and monthly DEX volumes during 2024-2025 memecoin surges through platforms like Raydium and Jupiter.

Additionally, transaction fees differ dramatically between the two chains. For instance, Solana maintains sub-cent costs while Ethereum mainnet can spike. Nevertheless, Layer 2 solutions like Arbitrum, Base, and Optimism now offer penny-level fees after the Dencun upgrade.

Furthermore, Ethereum operates with over 1 million validators without multi-hour outages. In contrast, Solana experienced a 5-hour chain halt on February 6, 2024, and continues to strengthen infrastructure with the upcoming Firedancer client.

Understanding What DeFi Leadership Really Means in 2025

The Multiple Dimensions of Blockchain Success

To clarify, DeFi leadership analysis requires looking at several key factors rather than just one metric. If you’re interested in how these chains compare across broader metrics, check out our detailed Ethereum vs Solana vs Polygon vs TON chain metrics comparison. Specifically, critical performance indicators include:

Critical Performance Indicators:

- Liquidity depth (TVL): Notably, this impacts slippage, credit availability, and derivatives markets

- Throughput & transaction costs: Similarly, this affects user experience for swaps, perpetuals, and market making

- Reliability & decentralization: Moreover, this covers network uptime and resistance to capture

- Ecosystem momentum: Finally, this includes developer activity, protocol launches, and real-world asset (RWA) integrations

As a result, on composite scoring, Ethereum leads in overall DeFi infrastructure. On the other hand, Solana dominates retail user experience and volume spikes.

Ethereum: The Institutional DeFi Standard

Why Liquidity Depth Matters Most

To begin with, Ethereum DeFi protocols hold about $94 billion in TVL across Layer 1 and related applications according to DefiLlama. Consequently, this liquidity advantage translates to reduced slippage on large transactions. Furthermore, it creates deeper money markets for lending protocols like Aave and Compound.

For a deeper dive into Ethereum’s fundamental metrics and performance data, see our comprehensive guide on Ethereum in numbers: key stats and charts every investor should know.

How the Dencun Upgrade Changed Everything

The Technical Breakthrough

In March 2024, the Dencun upgrade (EIP-4844) introduced blob data structures for rollups. As a result, this collapsed Layer 2 transaction fees to cent-level pricing while keeping mainnet security intact. Subsequently, users can now access:

- Arbitrum: An optimistic rollup with an extensive DeFi ecosystem

- Base: A Coinbase-backed Layer 2 with consumer focus

- Optimism: A governance-focused scaling solution

- ZK-rollups: Including zkSync, Polygon zkEVM, and Starknet

The Impact on Users

Because of these changes, most Ethereum DeFi users now pay only a few cents per transaction. Therefore, this makes Ethereum competitive with Solana on cost while maintaining superior security.

Security That Institutions Trust

Network Resilience

Above all, Ethereum maintains operational continuity without multi-hour chain halts. In fact, it’s supported by about 1.0-1.1 million validators ensuring decentralization according to Beaconcha.in. Moreover, this resilience has been proven across multiple market cycles and network stress tests.

Real-World Institutional Adoption

Major tokenization projects like BlackRock’s BUIDL fund operate on Ethereum. Additionally, many real-world asset funds and pilots launch on the network first. For example, traditional finance integration includes:

- Tokenized treasuries: Franklin Templeton, WisdomTree

- Securities settlement: DTCC pilot programs

- Corporate blockchain: JPMorgan’s Onyx, Visa’s stablecoin initiatives

The Trade-off: Despite these advantages, Ethereum mainnet fees remain volatile during congestion. Also, Layer 2 fragmentation splits liquidity across multiple rollups, which can complicate the user experience.

Solana: The High-Speed Retail DeFi Champion

What Makes Solana Different

Lightning-Fast Performance

First of all, Solana delivers sub-second transaction finality with fees under $0.01. In particular, this is perfect for frequent swaps, memecoin trading, and high-speed strategies. Unlike Ethereum’s modular approach, the monolithic architecture processes everything on a single layer. To understand why Solana continues rising despite Ethereum’s dominance, read our analysis on Solana and TON: why these chains are rising but still can’t kill Ethereum.

When Solana Beats Ethereum in Volume

The DEX Revolution

During late 2024 and 2025, Solana DEXs periodically beat Uniswap in monthly volume and weekly fees. Specifically, this happened during memecoin explosions on platforms like:

- Jupiter: The leading DEX aggregator

- Raydium: A popular automated market maker (AMM)

- Marinade Finance: The top liquid staking platform

- Drift Protocol: For perpetuals trading

As a matter of fact, this demonstrates Solana’s capacity to dominate transaction flow despite lower TVL according to Messari data.

How Solana Is Getting More Reliable

Learning from Downtime

After the February 6, 2024 outage, Solana’s ecosystem focused intensely on reliability efforts. Most importantly, Jump Crypto’s Firedancer client targets massive throughput improvements. In testing, it has shown about 1 million TPS capacity, which would significantly enhance network stability.

The Current State of Development

Nevertheless, these improvements are still in progress. Meanwhile, the network continues operating with over 1000 validators as tracked by Solana Compass.

Understanding Solana’s Liquidity Gap

The Numbers Don’t Lie

Despite impressive transaction volumes, Solana’s TVL stands at about $12.6 billion according to DefiLlama. In comparison, this is much smaller than Ethereum’s liquidity pools. Therefore, collateral depth still trails by substantial margins.

The Bottom Line: Lightning-fast user experience doesn’t equal deep composable credit or derivatives infrastructure. In other words, institutional-scale DeFi operations still require Ethereum’s deeper liquidity.

Side-by-Side: Ethereum vs Solana Comparison (October 2025)

Complete Feature Breakdown

| Metric | Ethereum | Solana |

|---|---|---|

| DeFi TVL | ~$94B | ~$12.6B |

| Transaction Fees | Mainnet variable; L2s cent-level after Dencun | Near-zero (fractions of cent) |

| Architecture | Modular: L1 security, L2 scalability | Monolithic high-throughput |

| Finality | 12-15 minutes (L1), seconds (L2) | Sub-second |

| Recent Reliability | No multi-hour outages | 5-hour halt Feb 6, 2024 |

| Validators | ~1M+ validators | 1000+ validators |

| Institutional Focus | BlackRock BUIDL, RWA pilot preference | R3 partnership, Taurus integration |

| DEX Volume Pattern | Strong on blue-chips, second during meme cycles | Often tops during memecoin surges |

Clearing Up Common Myths About DeFi

Myth #1: Solana Has $30B in TVL

The Reality: Mainstream metrics from DefiLlama show Solana TVL at about $12-13 billion. However, some communities circulate inflated claims of $30 billion. In fact, different tracking methods (including staked assets, bridged tokens) create these discrepancies.

Myth #2: Arbitrum TVL Is Wrong

What’s Really Happening: DefiLlama lists Arbitrum at roughly $3.7 billion native TVL. However, it shows about $11.4 billion in bridged TVL. As a result, various dashboards report different figures based on their counting methods.

Myth #3: Ethereum Does 100k+ TPS Now

The Truth: While post-Dencun upgrades greatly increased throughput and reduced costs, actual transactions-per-second vary by rollup and workload. Therefore, six-figure TPS claims represent theoretical capacity rather than daily averages.

The Final Verdict: Who Actually Leads DeFi Right Now?

Ethereum’s Continued Dominance

In summary, Ethereum keeps DeFi leadership through superior TVL, proven security, protocol variety, and institutional adoption. You can verify current TVL data at DefiLlama and validator counts at Beaconcha.in.

For a comprehensive overview of the top DeFi protocols across both chains and others, explore our guide to DeFi 2025: top 10 protocols across all chains.

Solana’s Growing Influence

On the other hand, Solana leads in retail user experience and burst transaction volumes. Moreover, it drives innovation through competitive pressure, which benefits the entire DeFi ecosystem.

Simple Analogy: If DeFi were athletics, Ethereum runs the marathon (steady, deep, reliable). Meanwhile, Solana sprints (explosive, smooth, engaging). Therefore, choose based on your specific use case, not tribal loyalty.

Your Practical Guide: Which Chain Should You Use?

When Ethereum Makes More Sense

Best Use Cases

Choose Ethereum for:

- Large-value transactions that need deep liquidity

- Complex DeFi strategies (options, perpetuals, structured products)

- Real-world asset exposure (tokenized treasuries, securities)

- Multi-protocol interactions (flash loans, collateral chains)

Recommended platforms: Start with Arbitrum, Base, or Optimism for low-cost access. Alternatively, try zkSync for zero-knowledge proof benefits.

When Solana Is Your Better Option

Perfect Scenarios

Choose Solana for:

- High-speed trading strategies

- Memecoin discovery and speculation

- Small transaction sizes where every cent matters

- NFT trading and gaming applications

If you’re curious about how NFT ecosystems compare between these chains, check out our detailed comparison: Ethereum vs Solana NFTs: which ecosystem wins in 2025.

Performance tools: Check live fees at Solana Beach. Additionally, monitor network health at Solana Status.

Why You Need Both Chains

The Multi-Chain Strategy

Modern DeFi success requires tools that work across chains. For this reason, consider:

- Cross-chain bridges: LayerZero, Wormhole, Axelar

- Swap aggregators: 1inch, LI.FI

- Portfolio trackers: Zapper, DeBank, Zerion

Essential Resources for DeFi Traders

Data & Analytics Platforms

Track Total Value Locked

- DefiLlama: Complete DeFi TVL tracking across all chains

- Messari: Deep protocol analytics and research reports

- Dune Analytics: Custom on-chain data views

Monitor Network Performance

- L2Fees.info: Real-time Layer 2 cost comparison tool

- Beaconcha.in: Ethereum validator metrics and network health

- Solana Compass: Solana network performance tracking

News & Research Sources

- CoinDesk: Daily crypto news and market analysis

- The Block: In-depth research and data

- Blockworks: Professional trader insights

Common Questions About Ethereum vs Solana

Which blockchain is better for DeFi beginners?

Answer: Ethereum Layer 2s offer better educational resources and safer on-ramps through established protocols like Uniswap and Aave. However, Solana suits users comfortable with higher-speed trading. To start safely, try Phantom Wallet for Solana or MetaMask for Ethereum.

Can I use both chains at the same time?

Answer: Absolutely! In fact, most DeFi traders maintain multi-chain portfolios. Furthermore, they use cross-chain bridges like Wormhole and aggregators to access opportunities across both ecosystems.

What’s the future outlook for these chains?

Answer: Both chains continue improving rapidly. Specifically, Ethereum’s roadmap focuses on increased rollup efficiency through EIP-4844 improvements. Meanwhile, Solana targets client variety and throughput gains through Firedancer.

How do I track my positions across both chains?

Answer: Use portfolio tools like Zapper, DeBank, or Zerion that support both Ethereum and Solana. As a result, you’ll see all your holdings in one place.

Which chain has lower fees right now?

Answer: Currently, Solana maintains the lowest fees at fractions of a cent. Nevertheless, Ethereum Layer 2s now offer competitive pricing at just a few cents per transaction. Check current rates at L2Fees.info and Solana Beach.

Stay Updated on DeFi Trends

Follow official channels: Track @ethereum and @solana for official updates. Additionally, monitor DefiLlama for real-time TVL changes across both ecosystems.

Join the community: Participate in Ethereum Research Forum and Solana Forums to stay ahead of development updates.

Last updated: October 4, 2025

Disclaimer: This article provides information for educational purposes only. Always do your own research before making investment decisions. Crypto markets are volatile and carry significant risk.