In the fast-evolving world of blockchain technology, choosing the right network can make all the difference for developers, investors, and users. Ethereum, Solana, Polygon, and TON (The Open Network) are four prominent blockchains, each with unique strengths in scalability, cost-efficiency, and ecosystem growth. This article compares their key chain metrics—such as Total Value Locked (TVL), Transactions Per Second (TPS), gas fees, active users, and decentralization—to help beginners understand the differences without overwhelming technical jargon.

We’ll use verified data from reliable sources like CoinGecko, DefiLlama, and blockchain analytics platforms to ensure accuracy. Whether you’re new to crypto or exploring options for dApps, NFTs, or DeFi, this comparison will break down the essentials in simple terms. By the end, you’ll have a clear picture of how these chains stack up in 2025.

For a DeFi-focused breakdown of these chains, see our detailed comparison — Ethereum vs Solana vs Polygon: Which Blockchain Wins for DeFi?.

What Are Chain Metrics and Why Do They Matter?

Chain metrics are like vital signs for a blockchain—they show how healthy, efficient, and popular the network is. Here’s a quick beginner-friendly explanation:

Total Value Locked (TVL): This measures the total amount of crypto assets “locked” in the chain’s smart contracts, often for DeFi apps like lending or trading. A higher TVL indicates more trust and activity. Note that TVL methodologies differ across platforms and aren’t perfectly standardized.

Transactions Per Second (TPS): How many transactions the chain can handle in one second. Faster TPS means quicker confirmations, ideal for gaming or payments.

Gas Fees: The cost to perform actions on the chain, like sending tokens. Low fees make the network accessible to everyday users. For more on how sidechains help reduce transaction costs, see Understanding Ethereum Sidechains

Active Users (DAU/MAU): Daily Active Users (DAU) and Monthly Active Users (MAU) count unique addresses interacting with the chain. High numbers signal strong adoption.

Decentralization Metrics: Things like node count and validator numbers. More decentralization means better security and resistance to control by a few entities.

These metrics help compare blockchains objectively. For instance, Ethereum is like a bustling city with high traffic (and sometimes high costs), while Solana is a high-speed highway designed for volume. Now, let’s overview each chain.

Overview of the Blockchains

Ethereum: The Pioneer

Ethereum, launched in 2015, is the original smart-contract platform. It’s home to most DeFi and NFTs, with a market cap around the mid-$400–$500B range in mid-October 2025. Ethereum has used Proof-of-Stake (PoS) since 2022, making it energy-efficient. However, its base layer can get congested, leading to Layer 2 solutions for scaling — see our complete Ethereum Layer-2 guide for 2025. Learn more at ethereum.org.

Solana: The Speed Demon

Solana, started in 2020, focuses on high throughput using Proof-of-History (PoH) combined with PoS. It’s popular for fast, cheap transactions, attracting gaming and meme-coin projects. Solana’s token, SOL, has a market cap of roughly $90–$105B in mid-October 2025. It’s known for handling massive volumes without slowing down. Why their growth still doesn’t dethrone Ethereum — Solana and TON Can’t Kill Ethereum. More details at The Block.

Polygon: The Ethereum Scaler

Polygon (formerly Matic) is a network that scales Ethereum; the widely-used Polygon PoS chain launched in 2019. It uses PoS to offer faster, cheaper alternatives while anchoring to Ethereum. To understand how these sidechains enhance Ethereum scalability, read Understanding Ethereum Sidechains. As of mid-October 2025, POL’s market cap is around $2B. Polygon excels in DeFi and enterprise apps and bridges to Ethereum seamlessly. Visit Artemis Analytics for detailed metrics.

TON: The Telegram-Integrated Network

The Open Network (TON), originally from Telegram and independent since 2020, uses PoS and sharding concepts for scalability. Integrated with Telegram’s massive user base, TON targets mass adoption through mini-apps and payments. As of mid-October 2025, TON’s market cap is in the $5–7B range. Explore more at polygon.technology and TON documentation. For more context on TON’s rise and Ethereum’s resilience, see this analysis.

Comparing Total Value Locked (TVL)

TVL is a top indicator of a chain’s economic activity. As of October 2025, Ethereum dominates with a TVL of approximately $81–83B, capturing the largest market share across all blockchains. This reflects its mature ecosystem, with billions in DeFi protocols like Aave and Uniswap. For a direct head-to-head look at DeFi dominance, read Ethereum vs Solana — Who Leads DeFi Today?

Solana follows with a strong TVL of around $12B, ranking among the top chains, driven by DEXs and high-volume apps.

Polygon, as an Ethereum scaler, has a TVL around $1.2–1.5B.

TON’s TVL shows a smaller, still-growing DeFi footprint in the low-hundreds of millions. TON experienced a spike above $600M in June 2024, but it has since retraced. Check current data at DefiLlama.

For beginners: Imagine TVL as money in a bank’s vault—the more there, the more services the bank (chain) can offer reliably.

Snapshot (approx., Oct 2025)

- Ethereum: ~$81–83B — DeFi, NFTs, institutional use

- Solana: ~$12B — DEXs, gaming, high-volume apps

- Polygon: ~$1.2–1.5B — L2-style scaling for Ethereum

- TON: Low-hundreds of millions — Telegram integration, mini-apps (peaked >$600M in 2024)

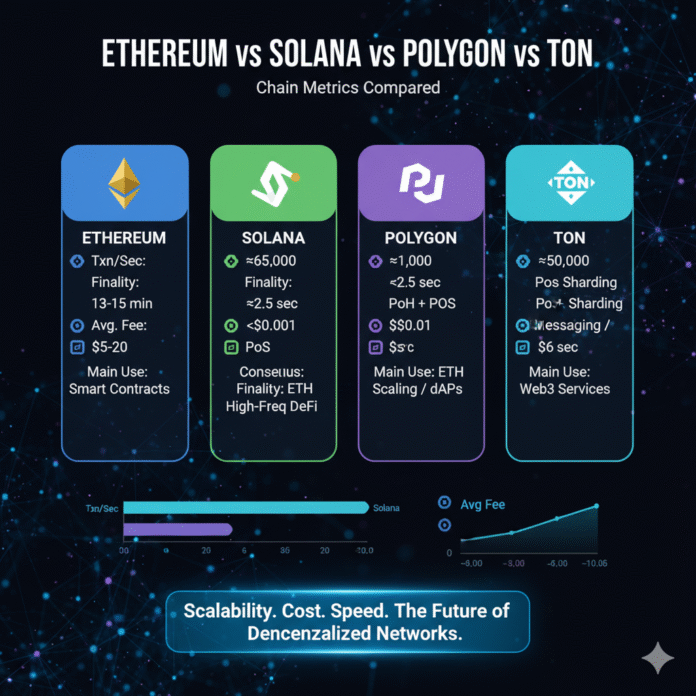

Transactions Per Second (TPS): Speed Showdown

Speed is crucial for real-world use. Ethereum’s base layer handles approximately 15 TPS, with dozens possible through optimizations; practical throughput scales via Layer 2 solutions. Learn how L2 solutions boost throughput and cut costs in Ethereum Layer-2 Solutions 2025.

Solana shines here with real-time throughput often hovering around 1,000 TPS. On September 5, 2025, it processed approximately 91M transactions in a day, averaging around 1,050 TPS for that day. Peaks above 4,700 TPS have been observed.

Polygon (PoS) sustains approximately 50–60 TPS today, with recent data showing around 4.7–4.9M transactions per day. While claims for higher “theoretical” TPS exist, observed peaks are much lower. View current stats at Polygon Blockchain Explorer.

TON is optimized for social-app bursts. Public, consistent “real TPS” figures vary by source. Marketing materials sometimes cite very high theoretical ceilings via sharding, but these are design-targets rather than steady real-world throughput. More information at TON docs.

If TPS is like cars on a road, Solana is a multi-lane freeway; Ethereum is a busy city street that uses side roads (L2s) to avoid jams.

Gas Fees: Cost Efficiency Breakdown

High fees can deter users, especially in developing regions.

Ethereum: Average L1 fees in 2025 are well below $1 much of the time, with recent averages often around $0.4–$0.9. The Dencun upgrade primarily slashed L2 costs by over 90%, while L1 fees are now frequently sub-$1. See detailed comparisons in Ethereum Layer-2 Solutions 2025: Complete Guide to Fees and Speed. Data available at YCharts and BitInfoCharts.

Solana: Fees are fractions of a cent. The base fee is 0.000005 SOL per signature, with small priority fees during congestion. Real-world estimates typically fall between approximately $0.0001 and a few tenths of a cent. Learn more at Solana.com and Helius.

Polygon (PoS): Typical fees are in the $0.0005–$0.01 range, with recent analytics placing the average around $0.002–$0.01 depending on demand. Check Token Terminal for updated data.

TON: Fees are low (small TON-denominated amounts). Reliable USD-denominated averages vary by payload and are not consistently published. More details at TON docs.

Beginner tip: Low fees mean you can experiment without losing much—like buying coffee versus a fancy dinner.

Active Users: Adoption and Engagement

User metrics show real-world traction. Daily active addresses (DAU) are more consistently tracked than MAU across chains:

- Solana: Approximately 2.6M active addresses (24h) recently

- Ethereum: Approximately 0.5M active addresses (24h) recently

- Polygon (PoS): Approximately 0.6–0.7M active addresses (24h)

- TON: Daily actives are commonly reported in the low-hundreds-of-thousands. One synthesis places DAU around 155k with approximately 1.7–1.8M MAU, though methodologies differ

Source: CoinLaw

For novices: High user counts mean a lively community, like a popular social app versus a quiet forum.

Decentralization: Security and Distribution

Decentralization prevents single-point failures.

Ethereum: Over 1M active validators (crossed this milestone in 2024 and still rising in 2025), plus thousands of nodes. Decentralization is reflected in validator count and client diversity.

Solana: Approximately 6,000+ nodes and 1,400 validators across approximately 49 countries, with a Nakamoto coefficient around 20 according to the Solana Foundation (2025).

Polygon (PoS): Approximately 100 validators for the PoS chain’s validator set size. Data available at YCharts.

TON: Public sources put active validators in the 300–350 range. Exact counts vary by cycle. Check CoinGecko for current data.

Simple analogy: More validators are like more guards at a vault—harder to breach.

Other Metrics: Fees, Revenue, and Ecosystem

Daily fees and revenue highlight profitability. Ethereum still generates the most fee revenue among these chains, though averages have fallen versus peak years. Recent sources place a typical 2025 average transaction fee around $0.4–$0.9, with variability by day. L2 fees fell much more post-Dencun. Data at YCharts.

Stablecoins: Ethereum holds the largest stablecoin float. Solana and Polygon have grown their shares, while TON’s stablecoin footprint is developing (for example, USDT expansion). Composition changes frequently, so check dashboards for current splits.

Market-Cap-to-TVL: With ETH’s market cap in the $450–550B area and TVL around $81–83B, the ratio is closer to approximately 6:1. Source: CoinLaw.

Conclusion: Which Chain Wins?

No single winner exists. Ethereum excels in TVL and security, Solana in speed and current DAU, Polygon in cost-effective Ethereum-aligned scaling, and TON in Telegram-native distribution and mobile UX.

For beginners, start where your use case lives: Polygon or Solana for low-cost experimentation; Ethereum when you need the deepest liquidity and composability; TON if your product distribution is Telegram-first. Why SOL and TON can’t replace Ethereum — read the full breakdown. As blockchain evolves in 2025, monitor these metrics via DefiLlama and CoinGecko—numbers move.

Key Resources: