Ever wondered if 2025 could be your year to finally jump into crypto without getting overwhelmed?

If you’re a complete beginner or even an intermediate investor dipping your toes into the world of digital assets, you’re not alone. The crypto market can feel like a wild ride—exciting but a bit intimidating. Prices swing dramatically, new coins pop up daily, and everyone’s talking about the next big thing. But here’s the deal: you don’t need to be a tech whiz or have thousands to start. With the right crypto exchange, you can buy solid cryptocurrencies safely and start building your portfolio.

What You’ll Learn in This Guide

In this article, we’ll break down the best cryptocurrencies to buy in 2025 on a reliable crypto exchange. We’ll focus on beginner-friendly options that have strong fundamentals, real-world use, and growth potential. Specifically, you’ll learn how to pick a trustworthy crypto exchange to avoid common pitfalls, discover our top 10 cryptocurrencies with their pros and cons, get practical tips on buying and storing your assets, and find answers to frequently asked questions from real beginners.

By the end, you’ll feel confident enough to take that first step. Trust me, I remember my first crypto buy back in 2015—it was nerve-wracking, but starting small changed everything.

Quick Comparison: Top 10 Cryptocurrencies for 2025

First off, let’s look at a quick comparison of our top 10 cryptocurrencies. Moreover, this’ll give you a snapshot of why they’re worth considering on a crypto exchange like Coinbase or Binance. These figures represent approximate market levels in November 2025—always check live prices on your exchange before investing.

| Cryptocurrency | Current Price (USD) | Market Cap (Billions USD) | Why for Beginners? | YTD Performance |

|---|---|---|---|---|

| Bitcoin (BTC) | ~96,000 | ~1,920 | Digital gold; stable store of value | +40% |

| Ethereum (ETH) | ~3,500 | ~420 | Smart contracts; DeFi hub | +21% |

| Solana (SOL) | ~200 | ~95 | Fast transactions; low fees | +16% |

| BNB (BNB) | ~930 | ~140 | Exchange perks; ecosystem utility | +40% |

| XRP (XRP) | ~2.50 | ~140 | Cross-border payments | +21% |

| Cardano (ADA) | ~0.55 | ~20 | Research-backed; sustainable | +12% |

| Avalanche (AVAX) | ~60 | ~24 | Scalable; DeFi friendly | +18% |

| Polkadot (DOT) | ~10 | ~15 | Blockchain connector | +15% |

| Chainlink (LINK) | ~25 | ~15 | Data oracles; real-world integration | +20% |

| Tron (TRX) | ~0.20 | ~18 | Content sharing; low-cost transfers | +10% |

This table highlights established coins with solid track records—perfect for avoiding the hype of risky altcoins.

Why Invest in Cryptocurrencies in 2025?

The Market Landscape and Institutional Adoption

2025 is shaping up to be a blockbuster year for crypto. With Bitcoin trading around the $95,000–$100,000 range in mid-November 2025, and the total crypto market cap surpassing $3 trillion, adoption is skyrocketing. Furthermore, think about it: major companies like Tesla and PayPal accept crypto, and governments are even creating strategic reserves. Consequently, for beginners, this means more stability and less “wild west” vibes than a decade ago.

But why now? To begin with, inflation is still a concern in many economies, and crypto acts like a hedge—similar to gold but digital. Moreover, with spot ETFs for Bitcoin and Ethereum approved, institutional money is pouring in. According to data from various sources, U.S. spot Bitcoin ETFs have attracted over $60 billion in cumulative net inflows since their launch in early 2024. As a result, if you’re an intermediate investor, diversifying into crypto could boost your portfolio’s growth potential.

Starting Small: Your Entry Point into Crypto

Here’s the thing: you don’t need much to start. In fact, even $50 on a crypto exchange can buy fractions of coins. I started with just $100 in Bitcoin back when it was $500—wish I’d bought more! However, remember, this isn’t get-rich-quick. Instead, it’s about long-term potential.

Pro Tip: Start with dollar-cost averaging—buy a fixed amount weekly to smooth out volatility. This strategy, recommended by financial experts at Investopedia, helps reduce the impact of market swings.

Regulatory Clarity in 2025

One concern beginners have is regulation. Fortunately, in 2025, clearer rules from bodies like the SEC are making things safer. Nevertheless, always use a reputable crypto exchange to buy—more on that next.

Overall, this sets the stage: crypto isn’t just hype; it’s evolving into a mainstream asset class.

How to Choose the Best Crypto Exchange for Beginners

Essential Security Features

Picking the right crypto exchange is crucial—it’s your gateway to buying those top cryptocurrencies. Similarly, imagine it like choosing a bank: you want security, ease, and low fees. Therefore, for beginners, avoid complicated platforms; go for user-friendly ones. If you’re just starting out, check out our detailed guide on the 5 best crypto exchanges for beginners in 2025 for a comprehensive comparison.

Key factors to consider:

Security: First and foremost, look for two-factor authentication, cold storage, and clear information on how your assets are protected. On Coinbase, for example, U.S. dollar cash balances held at partner banks may be eligible for FDIC pass-through insurance up to $250,000 per depositor, but your crypto itself is not FDIC-insured.

Fees, Usability, and Compliance

Fees: Trading fees can eat into profits. Specifically, Binance offers low 0.1% fees, great for frequent trades. Additionally, if you’re interested in more advanced trading strategies, you might want to learn about spot trading vs futures trading to understand which approach suits your goals.

Ease of Use: Apps like Coinbase have simple interfaces—buy Bitcoin in minutes.

Supported Coins: Ensure it has our top 10, like Ethereum and Solana.

Regulation: US-based? Coinbase is compliant; international? Binance is massive but check local laws.

Top Exchange Recommendations

I recommend starting with Coinbase if you’re new—it’s trustworthy and has educational resources. Once comfortable, try Binance for more options. Here’s a quick comparison:

- Coinbase: Beginner-friendly, higher fees (1–2%)

- Binance: Lower fees, more advanced tools

- Kraken: Good security, supports staking

According to CoinDesk, these exchanges rank among the most reliable platforms for cryptocurrency trading in 2025.

Warning: Never leave large amounts on exchanges; transfer to a wallet for safety. For secure storage options, explore our guide on the top 10 crypto wallets for beginners in 2025.

A common objection: “What if the exchange gets hacked?” Valid point—use ones with proven track records. In 2025, exchanges like these have robust defenses and insurance policies in place.

Ready to dive in? Get started on Coinbase and grab their welcome bonus.

Ultimately, this choice can make or break your experience, so take your time.

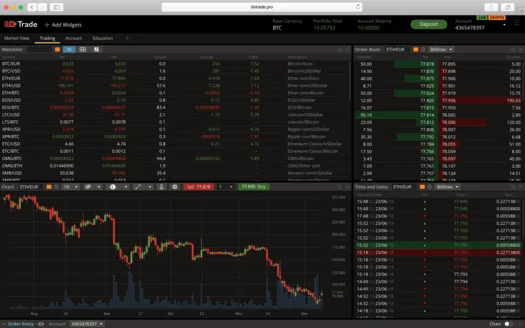

Crypto Exchange Platform – Trading Engine – White Label Ready

Top Cryptocurrencies 1-3: The Blue-Chip Essentials

Bitcoin: The Digital Gold Standard

Let’s kick off with the heavy hitters—Bitcoin, Ethereum, and Solana. In particular, these are like the Apple, Google, and Amazon of crypto: established, reliable, and beginner-proof.

Bitcoin (BTC): The original crypto, often called digital gold. As of November 2025, it’s trading around $102,000. Why buy? It’s scarce (only 21 million ever), and with ETFs, it’s easier than ever. Pros: Store of value, widespread acceptance. Cons: Volatile, high energy use.

Case study: In past cycles, Bitcoin has historically rallied strongly after halvings—but future performance is never guaranteed. Bloomberg and other financial news outlets continue tracking Bitcoin’s institutional adoption. Meanwhile, if you’re ready to take the plunge, our complete step-by-step guide on how to buy Bitcoin in 2025 walks you through the entire process.

Ethereum: The Smart Contract Powerhouse

Ethereum (ETH): Powers smart contracts and DeFi. At approximately $3,500, it’s up 21% YTD. Analogy: If Bitcoin is gold, Ethereum is oil—fuels the ecosystem. Pros: Staking rewards (4–6%), NFTs. Cons: Gas fees can be high.

Real example: DApps like Uniswap run on it, generating billions in volume according to data from DeFi Pulse. For those interested in adding Ethereum to their portfolio, we’ve created a comprehensive resource on how to buy Ethereum safely in 2025.

Solana: Speed Meets Efficiency

Solana (SOL): Known for speed—can theoretically process up to 65,000 transactions per second (TPS) versus Ethereum’s roughly 15–30 TPS. Priced at around $200, it’s great for low-cost trades. Pros: Cheap fees, growing DeFi. Cons: Past outages.

Furthermore, for intermediates, stake for approximately 7% APY. The Solana Foundation continues improving network stability.

Pro Tip: Buy these on a crypto exchange like Binance for the best rates.

Overall, these three form a solid foundation—diversify here first.

Top Cryptocurrencies 4-6: Utility and Growth Plays

BNB: The Exchange Token Advantage

Moving to mid-tier gems: BNB, XRP, and Cardano. Notably, these offer utility beyond just holding.

BNB (BNB): Binance’s token, trading around $700-930. Use it for fee discounts on the exchange. Pros: Burns tokens quarterly, increasing value. Cons: Tied to Binance’s fate. Example: Pay gas on Binance Smart Chain—cheap alternative to Ethereum.

In addition, if you want to dive deeper into BNB’s ecosystem, check out our ultimate guide to Binance Coin for beginners and experts. Moreover, for those comparing platforms, our analysis on Ethereum vs BNB Chain explores which DeFi ecosystem is stronger.

XRP: Cross-Border Payment Solution

XRP (XRP): Ripple’s coin for fast payments, approximately $2.50. Pros: Settles in seconds, low fees. Cons: Past SEC lawsuit over XRP sales—major issues were largely resolved by court rulings and settlements by 2025, but it’s still a regulatory story worth monitoring.

Case study: Banks like Santander use it for cross-border transfers according to Ripple’s partnerships page.

Cardano: Research-Driven Sustainability

Cardano (ADA): Focuses on sustainability, currently trading around the $0.50–0.60 range in November 2025. Pros: Peer-reviewed tech, Africa projects. Cons: Slower development.

Similarly, great for staking—earn approximately 5% passively. Learn more at Cardano.org.

Important: Always research on a crypto exchange’s app for real-time prices.

In summary, these add practical use to your portfolio. Question: Which fits your style—trading or holding?

Top Cryptocurrencies 7-10: Emerging Stars for Diversification

Avalanche and Polkadot: Infrastructure Innovators

Round out with Avalanche, Polkadot, Chainlink, and Tron—higher risk, higher reward.

Avalanche (AVAX): Scalable blockchain, around $60. Pros: Sub-second finality, eco-friendly. Cons: Competition from Solana. Nevertheless, check Avalanche.com for ecosystem updates.

Polkadot (DOT): Connects blockchains, approximately $10. Pros: Parachains for customization. Cons: Complex for newbies. Consequently, learn more at Polkadot Network.

Chainlink and Tron: Specialized Use Cases

Chainlink (LINK): Provides real data to smart contracts, around $25. Pros: Essential for DeFi. Cons: Oracle risks. Example: Integrates with weather APIs for insurance. In addition, more details at Chainlink Labs.

Tron (TRX): For content, approximately $0.20. Pros: High throughput, cheap. Cons: Centralized concerns. Meanwhile, visit Tron.network for more information.

Pro Tip: Limit these to 20% of your portfolio.

Thus, diversifying here can boost returns in 2025’s bull market.

Common Risks and How to Manage Them

Understanding Market Volatility

Crypto isn’t risk-free. Volatility? Prices can drop 20% overnight. Scams? Plenty out there. Regulation? Could change.

Address objections: “It’s too risky!” Yes, but so is not investing. Therefore, manage with:

- Only invest what you can lose

- Use stop-loss on exchanges

- Diversify across 5–10 coins

Warning: Avoid pump-and-dump schemes—stick to established coins. In particular, resources like CoinMarketCap and CoinGecko can help you research properly.

Learning from Experience

Personal story: I lost 30% in 2018 crash but held—recovered tenfold. Ultimately, patience pays.

In conclusion, knowledge is your best defense.

Getting Started: Buying and Storing Your Crypto

The Purchase Process

Ready? First, sign up on a crypto exchange like Coinbase. Next, verify ID, deposit fiat, buy BTC.

Secure Storage Solutions

Then, store in a wallet—hardware like Ledger for safety. Proper storage is essential for protecting your investment, so make sure to review different wallet options in our crypto wallets guide.

Pro Tip: Enable 2FA everywhere for maximum security, as recommended by cybersecurity experts at Kaspersky.

Furthermore, learn more on Binance for advanced features.

Overall, this step-by-step gets you investing safely.

FAQ

What is the best cryptocurrency to invest in 2025? Bitcoin remains a top choice for its stability and growth potential.

Which crypto will boom in 2025? Experts point to Solana and Ethereum due to tech upgrades.

Is it good to invest in crypto in 2025? Yes, with adoption rising, but do your research using resources like Coinbase Learn.

What crypto will explode in 2025? Look at Avalanche for its scalability.

Which coin will pump in 2025? Chainlink could surge with DeFi growth.

What is the best cheap crypto to buy in 2025? Cardano at under $1 offers value.

Which crypto has 1000x potential? High-risk ones like new altcoins, but stick to established for beginners.

How much will 1 Bitcoin be worth in 2025? Projections vary widely, with some analysts suggesting up to $150,000.

Is crypto a good investment for beginners? Absolutely, start small on a crypto exchange.

What are the top 10 cryptos for 2025? As listed: BTC, ETH, SOL, BNB, XRP, ADA, AVAX, DOT, LINK, TRX.

Conclusion

We’ve covered the best cryptocurrencies to buy in 2025 on a crypto exchange—from Bitcoin’s reliability to Chainlink’s utility. For beginners and intermediates, focus on diversification, use trusted exchanges, and invest wisely.

Next steps:

- Choose a crypto exchange like Coinbase

- Buy your first coin—start with $50 in BTC

- Learn more and track your portfolio using tools like CoinGecko

Try Binance for low fees and variety.

Remember, this isn’t investment advice—consult a professional financial advisor. Resources like the Financial Industry Regulatory Authority (FINRA) can help you find qualified professionals. Crypto can be rewarding, but patience is key.

Read also: Top 10 Crypto Exchanges For Beginners in 2025

Last Updated: November 15, 2025