What is Aave Protocol? Understanding DeFi Lending

Aave is a decentralized, non-custodial liquidity protocol built on Ethereum and multiple Layer 2 networks. Unlike traditional banks, liquidity providers deposit crypto assets and earn interest while borrowers take over-collateralized loans directly from smart contracts.

Think of it as liquidity pools, not one-to-one lending. The protocol operates across multiple blockchain networks including:

- Ethereum Mainnet – The original and most liquid market

- Polygon – Low-cost alternative with MATIC gas fees

- Arbitrum – Ethereum Layer 2 with reduced transaction costs

- Optimism – Another popular L2 scaling solution

- Avalanche – Fast, low-fee blockchain network

- Base – Coinbase’s Layer 2 network

Timeline snapshot: Launched as ETHLend in 2017 by Stani Kulechov, rebranded to Aave in 2018, and deployed Aave V3 on Ethereum Mainnet in 2023 after successful testing on other networks.

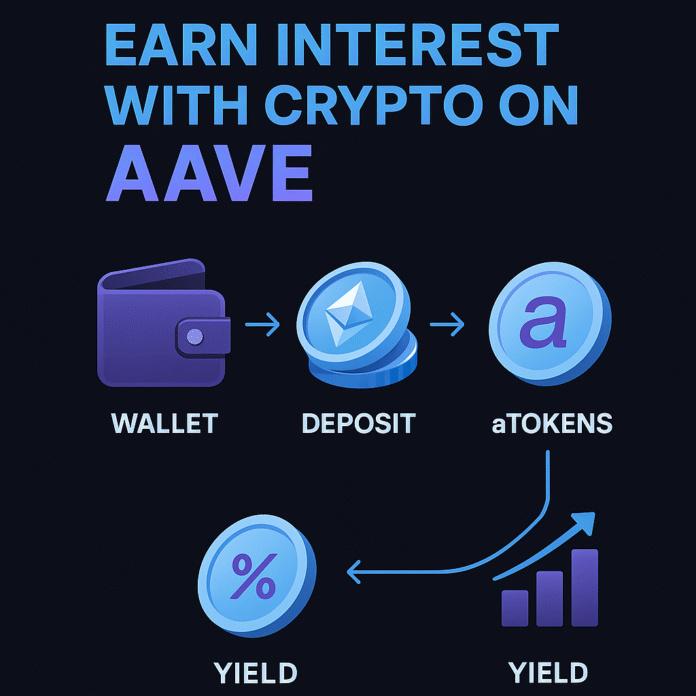

How Aave Yield Works: The aToken Mechanism

When you supply an asset like USDC to Aave, the protocol mints aTokens (such as aUSDC). These aTokens represent your share of the lending pool and automatically compound interest in real-time.

The balance of aTokens grows continuously—that’s your yield accumulating 24/7. When you decide to withdraw, the aTokens are burned and you receive the underlying asset plus all accumulated interest.

Key advantage: Withdrawals are possible anytime, provided the pool maintains sufficient liquidity (typically 80%+ availability).

Interest rates follow an algorithmic utilization model: higher pool usage drives up borrowing rates, which directly increases supplier yields. This creates a natural balance between supply and demand.

Why Choose Aave for Crypto Lending?

Benefits of Aave Protocol

- Passive income generation: Variable APY that adjusts to market demand

- Non-custodial security: You maintain control of your private keys

- Multi-asset support: Lend DAI, USDT, ETH, and 20+ other tokens

- Cross-chain flexibility: Deploy capital on the most cost-effective network

- Complete transparency: All transactions visible on blockchain explorers like Etherscan

- No lock-up periods: Withdraw funds whenever pools have liquidity

Supported Assets (2025)

Popular lending assets include:

- Stablecoins: USDC, USDT, DAI, FRAX, LUSD

- Major cryptocurrencies: ETH, WBTC, LINK, AAVE

- Network-specific tokens: MATIC (Polygon), AVAX (Avalanche)

Note: Asset availability varies by network and is determined by Aave Governance.

Step-by-Step Guide: Start Lending on Aave

1. Set Up Your Crypto Wallet

Recommended wallets:

- MetaMask – Most popular browser extension

- WalletConnect – Connect mobile wallets

- Coinbase Wallet – User-friendly option

When creating a wallet, you’ll receive a Secret Recovery Phrase (12-24 words). Store this securely offline—it’s your only way to recover funds if you lose device access.

2. Purchase Crypto and Prepare for Gas Fees

Where to buy crypto:

- Coinbase – Beginner-friendly US exchange

- Binance – Global exchange with low fees

- Kraken – Security-focused platform

Gas fee requirements:

- Ethereum: Need ETH for transaction fees ($5-50+ depending on network congestion)

- Polygon: Need MATIC (usually under $0.01 per transaction)

- Arbitrum/Optimism: Need ETH (typically $1-5 per transaction)

- Avalanche: Need AVAX (usually under $1 per transaction)

3. Connect to Aave Protocol

- Visit app.aave.com (bookmark this official URL)

- Click “Connect Wallet” and select your wallet provider

- Choose your preferred network (start with Polygon for lowest fees)

- Review available markets and current APY rates

4. Supply Assets and Start Earning

- Select the asset with your desired Supply APY

- Click “Supply” and enter the amount

- Approve the token spending (first-time users need this step)

- Confirm the supply transaction

- Receive aTokens that immediately start earning yield

5. Monitor and Manage Your Position

Use the Aave dashboard to:

- Track real-time earnings and APY changes

- Monitor pool utilization rates

- Withdraw funds (subject to liquidity availability)

- Compound earnings by supplying additional assets

Aave Lending Risks: What You Need to Know

Smart Contract Risk

Despite multiple security audits, smart contract vulnerabilities remain possible. The Aave Bug Bounty Program offers up to $250,000 for critical discoveries.

Risk mitigation: Never invest more than you can afford to lose completely.

Liquidity Risk

If a lending pool reaches near-100% utilization, withdrawals may be temporarily paused until borrowers repay loans or new liquidity enters the pool.

Historical context: This occurred during the March 2020 market crash and various DeFi summer events.

Oracle and Price Risk

Aave relies on Chainlink Price Feeds for asset valuations. Oracle failures or extreme price movements can trigger mass liquidations, affecting pool dynamics.

Stablecoin Depeg Risk

Even established stablecoins like USDC or DAI can temporarily lose their dollar peg during market stress. The May 2022 UST collapse demonstrated this risk clearly.

Protocol Backstop Limitations

Aave’s Safety Module (upgraded to “Umbrella” in 2025) provides some deficit coverage through AAVE token staking, but this doesn’t guarantee full protection for all suppliers.

Understanding Aave APY Calculations

Aave uses a dual-slope interest rate model:

Formula: Supply APY = (Borrow Interest × Utilization Rate) – Reserve Factor

Key factors affecting your yield:

- Utilization rate: Higher borrowing demand = higher yields

- Reserve factor: Protocol fee (typically 10-25% of interest)

- Market conditions: DeFi yield farming trends and overall market sentiment

Real-time rates are available on DeFi Pulse and DeFiRate.

Advanced Strategies for Experienced Users

Multi-Chain Yield Optimization

Deploy assets across different networks to maximize returns:

- Ethereum: Highest liquidity but expensive gas

- Polygon: Best for frequent transactions and small amounts

- Arbitrum: Good balance of security and cost efficiency

- Avalanche: Fast transactions with competitive yields

Recursive Lending (Advanced)

Experienced users can:

- Supply ETH as collateral

- Borrow USDC against ETH

- Supply borrowed USDC to earn additional yield

- Repeat the process (carefully managing liquidation risk)

Warning: This amplifies both profits and losses. Only attempt with thorough understanding of liquidation mechanics.

Aave vs Competitors: Why Aave Leads DeFi Lending

| Feature | Aave | Compound | MakerDAO |

| Multi-chain | ✅ 8+ networks | ✅ Limited | ❌ Ethereum only |

| Flash loans | ✅ Industry leader | ❌ Not available | ❌ Not available |

| Asset variety | ✅ 25+ assets | ✅ 15+ assets | ❌ ETH collateral focus |

| Governance token | ✅ AAVE | ✅ COMP | ✅ MKR |

| Protocol maturity | ✅ 6+ years | ✅ 5+ years | ✅ 8+ years |

Frequently Asked Questions

Q: Is Aave safe for beginners? A: Aave has the longest track record in DeFi lending with extensive security measures, but all DeFi protocols carry inherent smart contract risk.

Q: What’s the minimum deposit amount? A: No minimum, but consider gas fees. On Ethereum, deposits under $1,000 may not be cost-effective.

Q: Can I lose money lending on Aave? A: Yes, through smart contract exploits, stablecoin depegs, or temporary liquidity crunches preventing withdrawals.

Q: How do taxes work for Aave lending? A: Consult a tax professional. Generally, earned interest is taxable income. Use tools like CoinTracker or TokenTax for tracking.

Getting Started: Beginner Checklist

✅ Set up MetaMask wallet and secure recovery phrase

✅ Purchase stablecoins (USDC recommended for beginners)

✅ Start with Layer 2 networks (Polygon) to minimize gas fees

✅ Begin with small amounts ($100-500) to learn the interface

✅ Bookmark app.aave.com and never share private keys

✅ Join Aave Discord for community support

The Future of Aave: 2025 Roadmap

Aave continues evolving with:

- GHO Stablecoin: Aave’s native algorithmic stablecoin

- Aave V4: Enhanced capital efficiency and new features

- Institutional Products: Permissioned pools for traditional finance

- Additional Layer 2 deployments: Following user demand and governance decisions

Conclusion: Is Aave Right for Your Crypto Portfolio?

Aave represents the most mature and battle-tested DeFi lending protocol, offering genuine utility for earning yield on crypto assets. With over $10 billion in total value locked and support across 8+ blockchain networks, it provides the infrastructure for decentralized finance to compete with traditional banking.

Bottom line: If you want to earn passive income on crypto holdings without giving up custody, Aave delivers. Just remember the golden rules of DeFi: understand the risks, start small, and never invest more than you can afford to lose.

Ready to start? Visit app.aave.com and begin with a small stablecoin deposit on Polygon to experience the protocol firsthand.

Disclaimer: This article is for educational purposes only and not financial advice. DeFi protocols involve significant risk including total loss of funds. Always do your own research and consider consulting a financial advisor.

Sources: