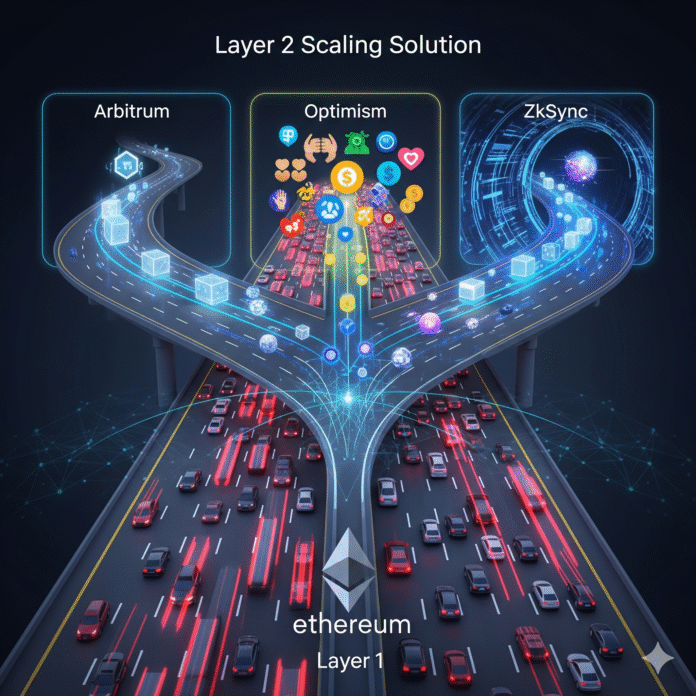

Ethereum is one of the most popular blockchains in the world. It’s like a giant, decentralized computer that runs smart contracts—small programs that automate agreements without needing a middleman. Think of it as the backbone for things like decentralized finance (DeFi), non-fungible tokens (NFTs), and even games. But Ethereum has a big problem: it’s slow and expensive. During busy times, sending a simple transaction can cost you $50 or more, and it might take minutes to confirm. This is where Layer 2 solutions come in. They’re like adding extra lanes to a highway to make traffic flow faster without rebuilding the entire road.

In this article, we’ll break down what Layer 2 (L2) is, how it works, and dive into three popular ones: Arbitrum, Optimism, and zkSync. We’ll keep things simple, so even if you’re new to crypto, you’ll get it. By the end, you’ll understand why these tools are game-changers for Ethereum. Let’s start with the basics.

Why Does Ethereum Need Layer 2?

First, a quick recap on Ethereum. The main Ethereum network is called Layer 1 (L1). Every transaction on L1 has to be verified by thousands of computers (nodes) around the world. This makes it super secure and decentralized, but it’s also why it’s slow. Ethereum can only handle about 15-30 transactions per second (TPS), compared to Visa’s 24,000 TPS. Plus, as more people use it, the fees (called “gas”) skyrocket because everyone competes for space in the next block.

Layer 2 solutions build on top of Ethereum to fix this. They process transactions off the main chain (off-chain) but still rely on Ethereum’s security. It’s like doing most of your work in a side office and only checking in with the headquarters when needed. This way, L2s can handle thousands of TPS at a fraction of the cost, while keeping your funds safe on Ethereum. Learn more about Ethereum’s Layer 2 landscape and how different networks compare in our comprehensive guide.

There are two main types of L2s: rollups and sidechains. Rollups bundle (or “roll up”) many transactions into one and post a summary back to Ethereum. Sidechains are separate blockchains that connect to Ethereum but have their own rules. We’ll focus on rollups because Arbitrum, Optimism, and zkSync are all rollups—the most secure and popular kind right now.

Rollups come in two flavors: Optimistic Rollups and Zero-Knowledge (ZK) Rollups. Optimistic ones assume transactions are valid unless proven otherwise, like trusting someone until they lie. ZK Rollups use math proofs to prove everything is correct upfront, like showing a receipt before anyone asks. Both reduce congestion on Ethereum by doing the heavy lifting elsewhere. If you want to dive deeper into how ZK Rollups work and their unique advantages, we’ve got you covered.

Now, let’s see how these work in practice with our three examples.

Arbitrum: The Speedy Optimistic Rollup

Arbitrum, launched by Offchain Labs in 2021, is one of the biggest L2s. It’s an Optimistic Rollup, which means it optimistically processes transactions and only checks for fraud if challenged.

Here’s how it works step by step:

- Transaction Submission: You send your transaction to Arbitrum’s network instead of directly to Ethereum. Arbitrum has its own validators (called sequencers) that quickly bundle these into batches.

- Off-Chain Processing: Arbitrum runs a virtual machine that’s compatible with Ethereum’s (EVM-compatible). This means developers can copy-paste their Ethereum apps here without changes. Transactions happen fast and cheap because they’re not fighting for space on L1.

- Posting to Ethereum: Once a batch is ready, Arbitrum posts a compressed summary (called a “rollup block”) to Ethereum. This includes a hash—a unique fingerprint—of all the transactions. But it doesn’t post every detail to save space and fees.

- Fraud Proofs: Here’s the optimistic part. For seven days (the challenge window), anyone can dispute the batch if they think it’s fraudulent. If challenged, Arbitrum uses a clever system called “interactive proving” where the disputer and the sequencer narrow down the issue to a single step. Ethereum then verifies that step. If fraud is found, the bad actor loses a stake (like a deposit), and the chain rolls back.

- Finality: After the window, the batch is considered final, and you can withdraw funds back to Ethereum if needed.

Arbitrum shines in speed: it can do over 40,000 TPS in theory, though real-world is around 100-500 TPS depending on usage. Fees are often under $0.10, making it great for everyday stuff like trading on DEXes (decentralized exchanges) or playing blockchain games. Check Arbitrum’s activity dashboard on Dune Analytics for live stats.

A fun fact: Arbitrum has its own token, ARB, used for governance. Users vote on updates, like the recent “Arbitrum Nova” for even cheaper data storage. Popular apps on Arbitrum include GMX (a perpetual trading platform) and Treasure DAO (for NFT gaming). If you’re a beginner, try bridging some ETH to Arbitrum via their official bridge—it’s straightforward and secure.

But it’s not perfect. The seven-day withdrawal delay can be annoying if you need funds back on L1 quickly. Also, if no one challenges a bad batch, fraud could slip through (though economic incentives make this unlikely).

Optimism: The Community-Focused Optimistic Rollup

Optimism, created by the Optimism Foundation, is another Optimistic Rollup. It launched in 2021 and is very similar to Arbitrum, but with a few twists that make it stand out for developers and users. Learn more about Optimism’s unique approach to scaling Ethereum in our detailed breakdown.

Let’s break it down:

- Transaction Flow: Like Arbitrum, you submit to Optimism’s sequencer. It processes in an EVM-compatible environment, so Ethereum dApps work seamlessly.

- Batching and Posting: Transactions are batched and a Merkle root (a tree-like hash structure) is posted to Ethereum. This root proves the state without revealing everything.

- Challenge Mechanism: Optimism uses fraud proofs too. During the seven-day window, challengers can submit proofs. But Optimism’s system is more modular—it uses “cannon,” a tool that simulates the disputed transaction on Ethereum to verify.

- Unique Features: Optimism is all about “retroactive public goods funding.” A portion of fees goes to projects that benefit the ecosystem, like open-source tools. This has funded things like Etherscan for Optimism or educational resources.

- Governance and Token: OP token holders govern the chain. Recently, they introduced “Superchain,” a vision to connect multiple L2s like Base (from Coinbase) under one umbrella for shared security and easy cross-chain movement.

Optimism handles around 100 TPS in practice, with fees often below $0.05. It’s home to apps like Synthetix (for synthetic assets) and Velodrome (a DEX). For newbies, Optimism’s bridge is user-friendly, and tools like Hop Protocol make hopping between L2s easy.

Compared to Arbitrum, Optimism is more idealistic—focusing on community over pure speed. But it shares the same drawbacks: withdrawal delays and reliance on watchdogs for security.

One cool upgrade is “Bedrock” in 2023, which made Optimism cheaper and more compatible with Ethereum’s upcoming changes like Danksharding (a way to store more data cheaply on L1).

zkSync: The Privacy-Preserving ZK Rollup

zkSync, developed by Matter Labs, is a Zero-Knowledge Rollup. Launched in 2020, it’s different from the optimistic ones because it proves validity upfront, not after. For a comprehensive comparison of ZK rollup technologies, check out our zkSync vs StarkNet analysis.

Here’s the simple explanation:

- ZK Proofs Basics: Zero-Knowledge proofs are math magic. They let you prove something is true without showing how. Like proving you know a password without saying it.

- Transaction Processing: You send to zkSync’s network. It uses zkEVM (a ZK version of Ethereum’s VM) to run smart contracts.

- Batching with Proofs: zkSync bundles transactions and generates a ZK proof that everything is correct. This proof is tiny—much smaller than posting all data—and gets verified on Ethereum in seconds.

- Posting to L1: The batch summary and proof go to Ethereum. No challenge window needed because the proof guarantees no fraud. Withdrawals can happen almost instantly (after a short finality period).

- Privacy Bonus: ZK tech adds privacy. For example, zkSync’s “account abstraction” lets you pay fees in any token or use social logins instead of seed phrases.

zkSync can theoretically hit 100,000 TPS, but currently, it’s around 200-500 TPS. Fees are super low, often under $0.01. It has two versions: zkSync Lite (simpler, for payments) and zkSync Era (full smart contracts). To understand the broader implications of this technology, explore our complete guide to ZK Rollups.

Popular on zkSync: SyncSwap (DEX) and Mute.io (privacy-focused trading). The ZK token governs the ecosystem, and recent airdrops rewarded early users.

Pros: Faster finality (no waiting a week), better privacy, and it’s more secure by default since proofs catch errors immediately. Cons: ZK proofs are computationally heavy, so generating them takes more power (though improving). Also, zkEVM is newer, so some Ethereum features might lag.

zkSync is part of a bigger ZK wave, with competitors like Polygon zkEVM and StarkNet.

Comparing Arbitrum, Optimism, and zkSync

All three make Ethereum faster and cheaper, but let’s compare:

- Type: Arbitrum and Optimism are Optimistic; zkSync is ZK.

- Speed and Fees: All are fast (100+ TPS) and cheap (<$0.10), but zkSync edges out with instant finality.

- Security: All inherit Ethereum’s security. Optimistic rely on economic games; ZK on math.

- Developer Ease: All EVM-compatible, but zkSync requires learning ZK tools.

- TVL (Total Value Locked): Arbitrum leads with over $10B, Optimism $5B, zkSync $1B (as of mid-2025 estimates).

- Use Cases: Arbitrum for gaming/DeFi; Optimism for social good; zkSync for privacy.

For beginners: Start with Arbitrum or Optimism if you’re into DeFi. Try zkSync for private transactions.

The Future of Layer 2 and Ethereum

Layer 2 is evolving fast. Ethereum’s Dencun upgrade in 2024 made L2s even cheaper by introducing “blobs” for data storage. Soon, we might see “Layer 3” apps built on L2s for ultra-specific uses.

But challenges remain: Fragmentation (funds split across L2s) and centralization risks (sequencers could be points of failure). Solutions like shared sequencers and cross-chain bridges are coming.

In summary, Arbitrum, Optimism, and zkSync are making Ethereum usable for everyone—not just whales. They solve scalability without sacrificing decentralization. If you’re new, grab a wallet like MetaMask, bridge some ETH, and experiment. The crypto world is more accessible than ever.