Ever dreamed of making money while you sleep? That’s the magic of staking Ethereum – a way to put your ETH to work and earn rewards without lifting a finger.

If you’re new to crypto or just dipping your toes into Ethereum, you might be wondering how to stake Ethereum without getting overwhelmed. Staking lets you lock up your ETH to help secure the network, and in return, you get passive income through rewards. It’s like earning interest on a savings account, but with blockchain twists. In this complete guide, we’ll break down everything from the basics to advanced tips. Whether you’re a complete beginner or an intermediate investor looking to optimize, you’ll walk away knowing exactly how to get started.

Here’s a quick preview of what you’ll learn:

- The fundamentals of Ethereum staking and why it’s worth your time

- Step-by-step instructions for different staking methods

- Pros, cons, and real-world examples to help you decide

- Common pitfalls to avoid and pro tips for maximizing rewards

- How to handle taxes and stay safe in 2025’s crypto world

What Is Ethereum Staking?

Let’s start simple. Ethereum staking is basically lending your ETH to the network to help it run smoothly. Back in the day, Ethereum used proof-of-work, like Bitcoin, where miners solved puzzles to validate transactions. But since the Merge in 2022, it’s switched to proof-of-stake. Now, instead of energy-hungry mining, validators stake their ETH as collateral to propose and verify blocks.

Here’s the deal: When you stake, you’re committing your ETH to act as a “vote” for the network’s integrity. If everything goes well, you earn rewards – think of it as interest. But if you act maliciously, you could lose some ETH through “slashing.” It’s like being a bank teller: Do your job right, get paid; mess up, get fined.

In 2025, with over 1 million validators and more than 35 million ETH staked, the network is stronger than ever. Rewards hover around 3–4% APY on average as of late 2025, but can vary based on network activity. For beginners, this means passive income without trading volatility. I remember when I first staked a small amount – it felt empowering, like owning a piece of the internet’s future.

But is it for everyone? Not quite. If you have less than 32 ETH, solo staking isn’t an option, but don’t worry – there are workarounds we’ll cover. Staking Ethereum isn’t just about money; it’s supporting decentralization. Trust me, once you see those rewards trickle in, you’ll be hooked.

Key Takeaway: Ethereum staking turns your idle ETH into a productive asset, earning you rewards while securing the blockchain.

How it Works: Ethereum Staking | Hex Trust / hextrust.com

Why Should You Stake Ethereum?

Okay, so why bother learning how to stake Ethereum? For starters, it’s one of the easiest ways to earn passive income in crypto. Imagine your ETH sitting in a wallet doing nothing – staking changes that. You could earn 2–6% APY, depending on the method and market conditions, which lines up with typical ranges across exchanges and liquid staking providers in 2025. In 2025, with Ethereum’s price stabilizing post-upgrades, that’s real money. For example, stake 10 ETH at 3.5% APY, and you’re looking at about 0.35 ETH yearly – not bad for doing zilch.

Compared to holding or trading, staking offers stability. Trading? It’s stressful, with wild swings. Holding? Fine, but why not earn extra? Staking beats traditional savings accounts, where rates are under 1% in many places. Plus, it helps the environment – proof-of-stake uses over 99% less energy than proof-of-work after the Merge.

From my experience, intermediate investors love staking for compounding. Reinvest rewards, and your stack grows exponentially. A case study: A friend staked 32 ETH in 2023; by 2025, with rewards and price appreciation, it’s worth way more. But here’s a rhetorical question: Are you okay with some lock-up periods? If yes, staking’s a no-brainer.

Pros:

- Passive income without active management

- Supports Ethereum’s growth

- Potential for liquid staking (use ETH while staked)

Cons:

- Rewards aren’t guaranteed (network-dependent)

- Some methods have fees

- Price volatility still affects your principal

In fact, with Ethereum’s upgrades like Dencun in 2024, which focused on making data availability cheaper and scaling layer-2s, the overall ecosystem (including staking-based DeFi protocols) has become more efficient. If you’re in it for the long haul, this is your ticket to steady gains.

Pro Tip: Start small if you’re a beginner – test with 1 ETH on a pool to build confidence.

Ethereum Staking Requirements: What You Need to Get Started

Before diving into how to stake Ethereum, let’s talk requirements. You don’t need a supercomputer or tech degree, but there are basics.

First, ETH amount: For solo staking, it’s 32 ETH minimum – just under $100,000 at current prices, with ETH trading around $3,000 in November 2025. Too much? No sweat; pools let you stake as little as 0.01 ETH. If you’re just getting started and need to buy Ethereum safely, there are plenty of beginner-friendly options available.

Hardware-wise: Solo stakers need a reliable computer (laptop or mini-PC) with stable internet. Think 8GB RAM, SSD storage, and uptime – downtime means penalties over time. Software includes clients like Prysm or Lighthouse.

Wallets: A non-custodial one like MetaMask or Ledger for security. For pools, exchanges handle this.

Knowledge: Beginners can use user-friendly platforms, but intermediates might enjoy setting up nodes. Costs? Electricity and internet – around $10–20/month for home setup.

In 2025, post-Merge and post-withdrawals (enabled in 2023), staking’s accessible. But remember, ETH is locked until you exit, though liquid staking tokens (like stETH) let you trade.

Addressing concerns: “What if I can’t afford 32 ETH?” Join a pool! “Is it safe?” Yes, if you follow best practices.

Warning: Never stake more than you can afford to lose – crypto’s volatile.

Solo Staking: earn crypto rewards from your home – Dappnode / dappnode.com

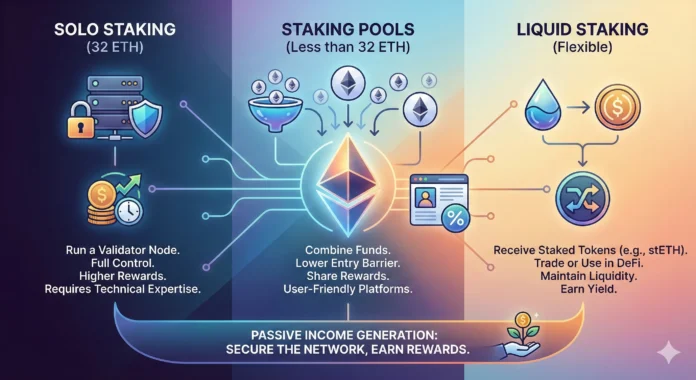

Different Ways to Stake Ethereum (With Comparison)

Now, the fun part: how to stake Ethereum in different ways. There’s no one-size-fits-all; it depends on your ETH amount and risk tolerance. If you want a detailed comparison of the best options, check out our guide to the top 5 staking platforms for ETH.

Here’s a comparison table to kick things off:

| Method | Minimum ETH | APY (Approx. 2025) | Ease of Use | Risks | Best For |

|---|---|---|---|---|---|

| Solo Staking | 32 ETH | 3–5% | Advanced | Slashing, Downtime | Tech-savvy intermediates |

| Staking as a Service | 32 ETH | 2–4% (after fees) | Medium | Provider trust | Hands-off big holders |

| Pooled/Liquid Staking (e.g., Lido, Rocket Pool) | 0.01 ETH+ | 3–4% | Easy | Smart contract bugs | Beginners |

| Centralized Exchanges (e.g., Coinbase, Binance) | Varies (low) | ~1.5–6% | Very Easy | Custodial risks | Newbies wanting simplicity |

Solo: Run your own node – full control, max rewards.

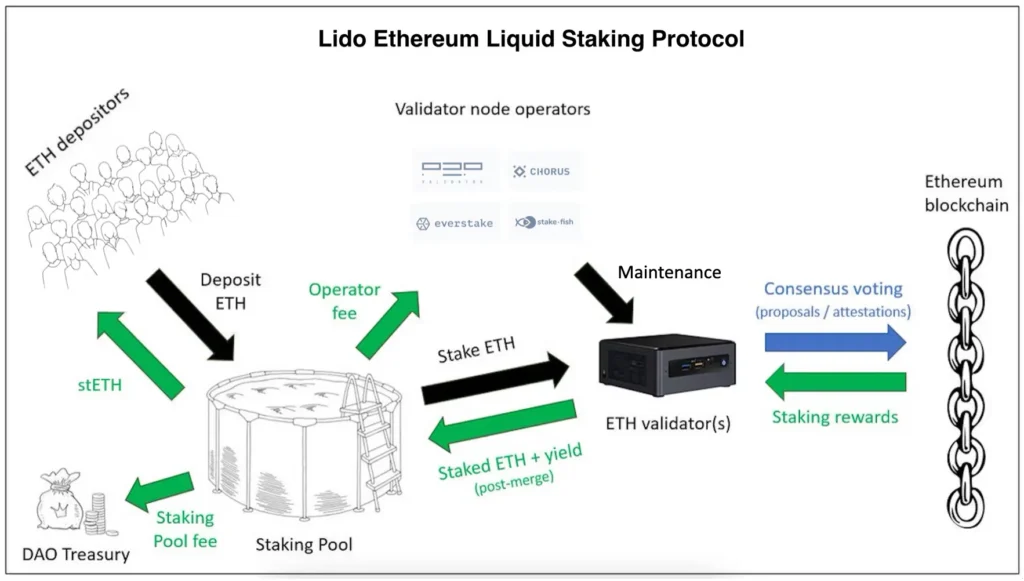

Pooled: Join others via protocols like Lido; get stETH to use in DeFi. Liquid staking tokens now represent a large chunk of all staked ETH. If you’re trying to decide between the two biggest players, our Lido vs Rocket Pool comparison breaks down which platform might be best for you.

Exchanges: Easiest, but you’re trusting the platform.

I tried pooled staking first – convenient, and I earned 3.2% last year without hassle. For intermediates, mixing methods diversifies.

Meanwhile, liquid staking’s booming in 2025, with over 10 million ETH parked in these protocols and growing.

Liquid Staking with Lido | Messari / messari.io

Step-by-Step Guide: How to Stake Ethereum Solo

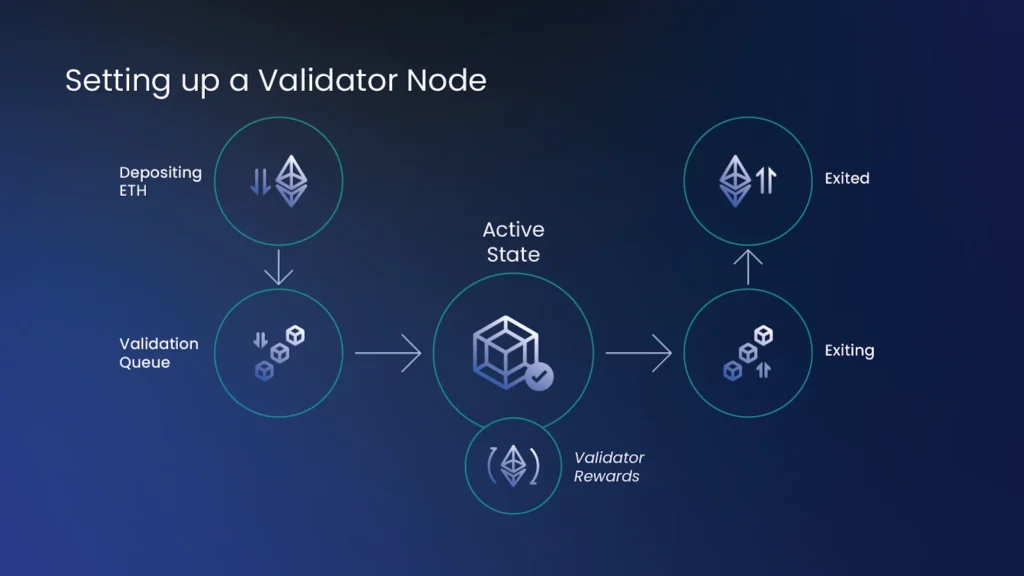

Ready to learn how to stake Ethereum solo? It’s rewarding but requires setup. Here’s the breakdown.

Step 1: Gather 32 ETH in a wallet like MetaMask or a hardware wallet.

Step 2: Set up hardware: A small, always-on machine (like a dedicated mini-PC with SSD and 8GB+ RAM) works well.

Step 3: Install Ethereum clients: Download an execution client (e.g., Geth) and a consensus client (e.g., Prysm, Lighthouse).

Step 4: Generate keys: Use the official deposit CLI tool from ethereum.org to create your validator keys securely.

Step 5: Deposit ETH: Send 32 ETH per validator to the official deposit contract via the Ethereum staking launchpad.

Step 6: Run the node: Sync the chain (this can take a while), keep your node online, and start validating.

Expect roughly 3–4% APY before costs, depending on performance and MEV (maximal extractable value). My first time? Nerve-wracking, but tutorials helped. Pro: No third-party fee skim. Con: 24/7 uptime and ops responsibility.

If it sounds daunting, skip to pools.

Pro Tip: Use monitoring tools like beaconcha.in or similar dashboards to track your validator.

How to Stake Ethereum on Exchanges and Pools

For most, this is how to stake Ethereum easily.

On Coinbase: Sign up, buy ETH, go to the staking tab, confirm. The current estimated ETH staking reward rate on Coinbase is around 1.9% APY.

On Binance: Similar flow, sometimes with higher rates (e.g., around 2–3% in many 2025 listings, with some products advertising up to ~4% depending on terms and promotions). Check Binance’s staking page for current offers.

Pools like Lido: Connect your wallet, stake ETH, get stETH. You earn 3–4% APY, plus you can potentially earn extra yield using stETH in DeFi through yield farming strategies, though that adds risk.

Example: Stake 5 ETH on Rocket Pool – decentralized, earns rETH, which tracks staked ETH plus rewards.

It’s beginner-friendly. Get started on Coinbase for quick setup or explore Binance or other exchanges if you’re comfortable with centralized platforms.

However, fees apply (usually a protocol or provider commission in the single-digit percentage of rewards).

Important: Research platform security – hacks and smart contract vulnerabilities have affected staking and DeFi protocols before. Make sure to review security audits before committing large amounts.

How to stake Ether | Coinbase / coinbase.com

Risks Involved in Staking Ethereum

No sugarcoating: Staking has risks.

Slashing: You can lose a portion of your staked ETH for bad behavior (like double-signing or running misconfigured validators). In practice, typical slashing penalties are around 1 ETH for a 32-ETH validator, with additional smaller penalties over the exit period, but in extreme, highly correlated events the penalty can grow much larger and, in theory, wipe out most or all of a validator’s stake.

Offline penalties: If your validator goes offline while the chain is finalizing, you mostly just miss rewards and incur small penalties, but extended downtime still costs you.

Volatility: ETH’s price can drop, reducing the fiat value of your staked stack.

Smart contract risk: In pools and liquid staking, bugs in contracts can lead to loss of funds. Always check for third-party security audits before using a protocol.

Custodial risk: On exchanges, you’re trusting a centralized party with your coins.

In 2025, with mature tech, risks are lower than in early days, but always DYOR (do your own research).

Case study: In 2023, infrastructure and signer configuration issues at a Lido node operator (Launchnodes) led to multiple validators being slashed – a reminder that even reputable pools can have operational risks.

Address objections: “Too risky?” Start small on a reputable platform and avoid overexposure.

Warning: Staking isn’t FDIC-insured or government-backed – it’s crypto.

Staking risks: what should you be aware of? | Bitpanda Academy / bitpanda.com

Best Practices and Pro Tips for Successful Staking

To get the most out of staking:

Diversify methods: Split between a pool, an exchange, and (if you’re advanced) a solo validator to spread risk.

Use hardware wallets: Especially when interacting with staking protocols from DeFi wallets. Hardware security is crucial for protecting your assets.

Reinvest rewards: Compounding boosts long-term returns.

Monitor APY and fees: Use dashboards like StakingRewards or provider pages to track net yields.

Stay updated: Follow Ethereum upgrade news on the official Ethereum blog – changes to issuance or penalties can affect yields and risk.

Pro Tip: In liquid staking, don’t chase every extra yield strategy. Layering DeFi leverage on top of staked ETH can boost returns but also amplifies smart contract and liquidation risk.

Mini-conclusion: Follow these, and staking becomes second nature instead of a constant anxiety source.

Tax Considerations for Ethereum Staking Rewards

Rewards are taxable as income in most places – for example, the US IRS treats staking rewards as ordinary income when you receive them, according to 2023 guidance.

Track with tools like Koinly or CoinTracking.

Example: Earn 1 ETH reward at $3,000? You may owe income tax on $3,000 at your marginal rate (exact treatment depends on your jurisdiction). When you later sell that 1 ETH, capital gains tax may apply on any gain above that $3,000 basis.

Consult pros. Disclaimer: Not financial or tax advice. For more guidance, check the IRS cryptocurrency tax guidelines.

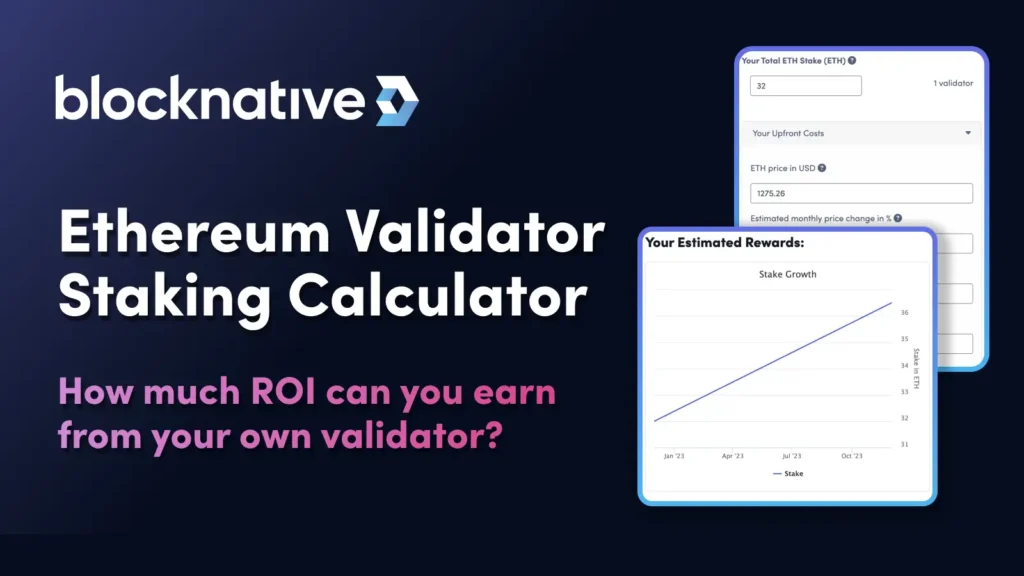

Ethereum Staking Rewards ROI Calculator – Node APY Rates / blocknative.com

FAQ

Is staking Ethereum worth it in 2025?

Yes, with around 3–4% APY on many setups and about 29–30% of all ETH already staked, it’s a strong option for long-term holders seeking passive income.

How much ETH do I need to stake?

32 ETH for solo staking, but as little as 0.01 ETH via pools.

What is the current Ethereum staking APY?

Around 3% at the network level, with exchanges and liquid staking platforms typically offering in the ~2–4% range depending on fees and MEV sharing.

Can I unstake Ethereum anytime?

Yes, but there can be exit queues and protocol-level delays (from hours to days or, in heavy exit periods, even weeks).

Is Ethereum staking safe?

Generally yes, but slashing, smart contract bugs, custodial failures, and price volatility are real risks.

What’s the difference between staking and mining?

Staking uses ETH as collateral in proof-of-stake; mining uses hardware and electricity in proof-of-work. Learn more about Ethereum’s transition from mining to staking.

How do I stake Ethereum on Coinbase?

Sign up, deposit or buy ETH, go to the ETH staking page, and toggle staking on – Coinbase shows the current reward rate (around 1.9% APY recently).

What are liquid staking derivatives?

Tokens like stETH or rETH representing claims on staked ETH plus rewards, usable in DeFi as collateral or for trading.

Does staking Ethereum lock my funds?

Native staking does lock your validator balance until you exit, but liquid staking options give you a tradable token so you can keep some flexibility.

How to calculate Ethereum staking rewards?

Use calculators on ethereum.org or major staking dashboards – input your ETH amount, APY, and time horizon for estimates.

Conclusion

Wrapping up, learning how to stake Ethereum opens doors to passive income and network participation. We’ve covered the basics, methods, risks, and tips – now it’s your turn. Start small, choose a method that fits, and watch your ETH grow over time.

Next steps: Pick a platform, stake your first ETH, and monitor rewards. Try an exchange like Coinbase or Binance for easy entry, or dig into Lido, Rocket Pool, or similar protocols if you want liquid staking.

Remember, crypto evolves – stay informed, manage risk, and treat staking as a long-term strategy rather than a get-rich-quick scheme. Get started today and join the staking revolution.

Read also: Real Yield vs Ponzinomics