Ever felt overwhelmed by the crypto hype, wondering if you could actually make money trading digital coins without losing everything? Indeed, crypto trading can seem like a wild ride – exciting, but scary for newcomers. Most likely, you’ve heard stories of people turning small investments into fortunes overnight, or worse, losing it all in a market crash.

Fortunately, you don’t need to be a Wall Street wizard to get started. In fact, with the right knowledge, anyone can learn how to trade crypto for beginners and build a solid foundation. Additionally, this guide is your roadmap, packed with practical advice based on my 10+ years in the trenches. I’ll share what works, what doesn’t, and how to avoid the pitfalls I fell into early on.

Here’s a quick preview of what you’ll learn:

- The fundamentals of crypto trading and why 2025 is a great time to start

- How to choose and set up on top exchanges like Binance or Coinbase

- Essential strategies, from buying low to managing risks

- Real-world examples, pro tips, and warnings to keep you safe

- Answers to common questions and next steps to take action

Quick Comparison: Top Crypto Exchanges for Beginners

Let’s kick things off with a quick comparison to help you visualize the top exchanges for beginners. I’ve put together this table based on my experience and recent data from 2025 – think low fees, user-friendly interfaces, and solid security.

| Exchange | Fees (Maker/Taker) | Beginner-Friendly Features | Supported Cryptos | Pros | Cons |

|---|---|---|---|---|---|

| Binance | 0.1%/0.1% | Tutorials, demo accounts | 500+ | Low fees, high liquidity | Complex for absolute newbies |

| Coinbase | 0.6%/1.2% | Easy app, educational resources | 200+ | Simple interface, insured USD cash balances | Higher fees |

| Kraken | 0.25%/0.40% | Margin trading basics, staking | 100+ | Strong security, fiat support | Slower customer service |

| Gemini | 0.20%/0.40% | ActiveTrader platform, earn interest | 70+ | Regulated in US, secure | Limited altcoins |

This table should give you a head start on where to park your money. Now, let’s dive deeper into each aspect.

Understanding the Basics of Crypto Trading

So, what exactly is crypto trading? Essentially, at its core, it’s buying and selling digital currencies like Bitcoin or Ethereum on exchanges, hoping to profit from price changes. Unlike stocks, crypto markets run 24/7, which means opportunities (and risks) never sleep.

The 2025 Crypto Market Explosion

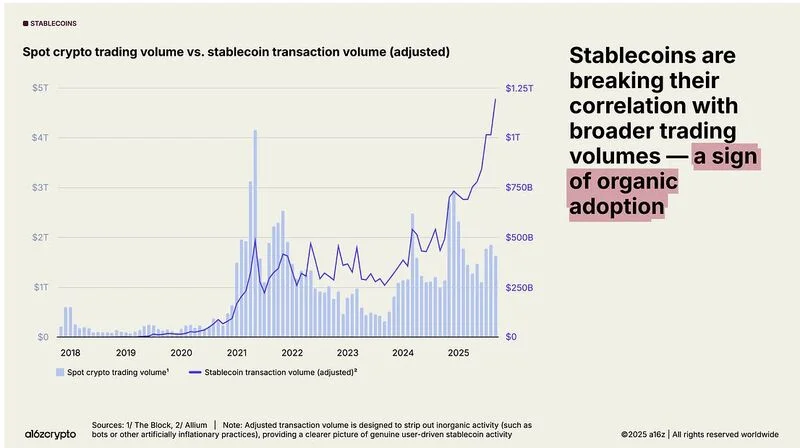

Here’s the interesting part: In 2025, the crypto market has exploded, with stablecoin transaction volumes hitting around $1.25 trillion in September alone, according to a16z’s State of Crypto report. Clearly, that’s massive growth from just a few years ago.

Monthly stablecoin transaction volume now at $1.25 trillion / linkedin.com

Think of it like trading baseball cards as a kid – you buy low, sell high, but with real money on the line. For beginners, I recommend starting small. Specifically, you don’t need thousands; even $50 can get you going. My first trade back in 2015 was buying Ethereum at $7 and selling at $20. Felt like a genius, but trust me, I’ve had losses too.

Why Trade Crypto in 2025?

Adoption is skyrocketing. According to Chainalysis, India and the US lead global crypto adoption. Moreover, separate research from analytics firms like TRM Labs shows U.S. crypto transaction volumes growing by roughly 50% between January and July 2025. As a result, governments are regulating it better, making it safer. However, remember that it’s volatile – prices can swing 10% in a day.

Pro Tip: Before jumping in, ask yourself: Am I in for quick flips or long-term holds? Generally, most beginners do better with the latter.

In short, crypto trading basics boil down to understanding supply, demand, and market sentiment. Master this, and undoubtedly, you’re off to a strong start.

Choosing the Right Crypto Exchange

Picking an exchange is like choosing a bank – you want one that’s secure, easy, and won’t rip you off with fees. For how to trade crypto for beginners, I always recommend starting with user-friendly platforms. Learn more about top crypto exchanges for beginners in 2025.

Top Exchange Options Compared

Binance is my go-to for variety; it’s got over 500 coins and super low fees at 0.1%. On the other hand, if you’re in the US, Coinbase might be better – it’s regulated, and U.S. dollar cash balances are held at FDIC-insured banks with pass-through coverage typically up to $250,000 per depositor (that protection applies to fiat cash, not your crypto itself). Meanwhile, Kraken offers great security, while Gemini is perfect for those wanting a clean, no-frills experience. Check out our detailed guide on best crypto exchange picks for buying top cryptocurrencies.

Here’s a real example: A friend of mine started on Coinbase in 2024 with $100 in Bitcoin. Subsequently, by mid-2025, amid the bull run, it grew 30%. He loved the app’s simplicity.

Pros and Cons of Popular Exchanges

Pros of top exchanges:

- High liquidity for fast trades

- Mobile apps for on-the-go monitoring

- Built-in wallets

Cons:

- Some have KYC requirements (know your customer)

- Hacking risks – always enable 2FA

Security Considerations

Warning: Never leave large amounts on exchanges; use hardware wallets for storage. For comprehensive guidance, check out our detailed article on best crypto wallets for beginners and why they’re essential. Additionally, learn how to keep your crypto safe with our ultimate security guide.

Objection: “What if I’m scared of hacks?” Fair point. In that case, stick to reputable ones with insurance on fiat balances and strong security practices. Furthermore, the SEC provides guidance on regulated exchanges if you want extra peace of mind.

Ready to choose? Head to Binance and Get Started – it’s free to sign up.

Setting Up Your Trading Account

Alright, you’ve picked an exchange – now what? Setting up is straightforward, but let’s break it down step by step so you don’t miss anything.

Step 1: Registration and Verification

First of all, sign up with your email and create a strong password. Most platforms require ID verification for compliance – upload your driver’s license or passport. Typically, this takes 5-10 minutes.

Step 2: Funding Your Account

Next, fund your account. You can link a bank or use a credit card. I suggest starting with $100 to test the waters. Notably, in 2025, many exchanges support instant deposits or purchases via Apple Pay.

Step 3: Making Your First Purchase

Once funded, buy your first crypto. Simply search for Bitcoin (BTC), enter the amount, and hit buy. Boom – you’re trading!

Practice Before You Play

My Binance experience years ago gave me that initial rush. However, here’s the thing: Practice with demo or paper-trading accounts first – many platforms and third-party tools let you trade with fake money before risking real funds.

Important: Disclaimer – crypto trading involves risk; only invest what you can afford to lose. Not financial advice.

By the end of this section, you’ll be set up and ready. Consequently, questions? What coin are you eyeing first?

Learning Key Crypto Trading Terms

Crypto lingo can feel like a foreign language, right? Don’t worry; I’ll explain the essentials simply, with examples.

HODL: Holding on for dear life – buying and not selling despite dips. For instance, that Bitcoin you buy at $60,000 and hold through a crash.

FOMO: Fear of missing out – jumping in because everyone’s talking about it. Unfortunately, bad idea; I lost $500 on a meme coin once due to FOMO.

Bull/Bear Market: Bull means prices rising (optimism), while bear means falling (pessimism). In fact, 2025 has started bull-ish but it’s also had some nasty dips along the way.

Other terms: Wallet (digital storage), Blockchain (the tech behind it), Altcoin (non-Bitcoin cryptos). Moreover, if you’re curious about specific tokens, explore our guide on game tokens economy including SAND, MANA, GALA, and IMX.

Use these in context: “I’m bullish on Ethereum because of its upgrades.”

Pro Tip: Bookmark Investopedia’s cryptocurrency terms for quick lookups. Honestly, it saved me countless times.

Ultimately, mastering terms makes trading less intimidating. You’re building confidence here.

Developing a Trading Strategy

No strategy? You’re gambling. For how to trade crypto for beginners, I recommend starting with basics like buy-and-hold or day trading.

Popular Trading Strategies

Buy-and-hold: Purchase solid coins like BTC or ETH and wait. Case study: If you bought $1,000 of ETH during one of the 2025 dips around $2,000, it might be worth significantly more now amid adoption growth. Learn more about how to buy Ethereum safely in 2025.

Day trading: Buy/sell same day for quick profits. However, it’s risky – needs charts and indicators like RSI (Relative Strength Index). Fortunately, TradingView’s educational resources can help you understand technical indicators.

Personally, my opinion: Beginners, stick to long-term. For example, I made 200% on Solana holding through 2024-2025.

Building Your Personal Strategy

Steps to build one:

- First, set goals (e.g., 20% annual return)

- Then, research coins via CoinMarketCap

- Finally, use technical analysis – candlestick charts show price action

Warning: Avoid leverage trading early; it amplifies losses. Similarly, the CFTC warns about the risks of leveraged crypto trading.

Before diving in, test your strategy on paper first. What’s yours shaping up to be?

Risk Management: Protecting Your Investments

Here’s where most beginners fail – ignoring risks. Undoubtedly, crypto’s volatile; Bitcoin wiped out early 2025 gains in a dip, but eventually rebounded.

Essential Risk Management Rules

The most important rule? Never invest more than 5% of your portfolio in one trade. Instead, diversify across 5–10 coins.

Use stop-loss orders: Sell automatically if price drops 10%. Notably, this strategy saved me during the 2022 crash.

Emotional control: Don’t chase losses. Unfortunately, I once did and regretted it.

Benefits and Trade-offs

Pros of good risk management:

- Preserves capital

- Reduces stress

Cons: Might miss some gains.

Tracking and Planning

Pro Tip: Track trades in a journal. Review weekly. Furthermore, financial experts at NerdWallet recommend tracking every trade for tax purposes too.

Address concern: “What if the market crashes?” Have an exit plan.

Overall, stay safe, and you’ll last longer in this game.

Tools and Resources for Beginners

You need tools to succeed. Luckily, free ones exist: TradingView for charts – customizable and beginner-friendly.

For mobile trading, both Binance and Coinbase offer excellent apps for trades anywhere.

Books: Cryptoassets by Chris Burniske – timeless advice.

When it comes to communities, Reddit’s r/cryptocurrency provides valuable tips, but beware hype.

Furthermore, in 2025, AI tools like chatbots help analyze trends. Additionally, CoinGecko offers comprehensive market data and portfolio tracking.

Important: Use VPNs for privacy on public Wi-Fi.

Ultimately, these resources will accelerate your learning.

Common Mistakes and How to Avoid Them

Most beginners chase hype coins – I did with Dogecoin in 2021, lost big. Learn more about memecoins and their evolution from jokes to ecosystems.

The first common error is lack of research. Solution: Read whitepapers on projects’ official sites.

Mistake 2: Ignoring fees – They add up; choose low-fee exchanges.

Another critical error? Emotional trading. Solution: Use data, not gut.

Case: A newbie lost 50% panic-selling in a 2025 dip; holders recovered.

Pro Tip: Set rules and stick to them. In addition, Forbes Advisor suggests writing down your investment thesis before buying.

Ultimately, avoid these, and you’ll be ahead of 90% of traders.

Last Updated: November 18, 2025

FAQ

How do beginners trade crypto?

Start by choosing an exchange like Coinbase, fund your account, and buy simple coins like Bitcoin. Then, practice with small amounts.

Can I start trading crypto with $100?

Absolutely! Many exchanges allow small deposits. In fact, focus on low-fee trades to maximize your start.

Is crypto trading good for beginners?

Yes, if you educate yourself. Indeed, it’s accessible but risky – start slow and learn strategies.

How much money do you need to start trading crypto?

As little as $10–50 on some platforms. Importantly, the key is consistency, not amount.

What is the best crypto to trade for beginners?

Bitcoin or Ethereum – they’re established with less volatility than many altcoins.

How do I start crypto trading with no experience?

Use demo or paper-trading tools, or read guides like this one. Alternatively, take free courses on Coursera or YouTube.

Is crypto trading profitable?

It can be, but not guaranteed. Indeed, in 2025, many saw gains from adoption, but losses happen too.

How to trade crypto daily?

Use day trading strategies with charts. Monitor news, set limits, but it’s high-risk for beginners.

What are the risks of crypto trading?

Volatility, hacks, scams. Always use secure exchanges and never invest more than you can lose. Additionally, the Federal Trade Commission tracks crypto scams.

How long does it take to learn crypto trading?

A few weeks for basics, months for proficiency. Most importantly, practice consistently.

Conclusion

Whew, we’ve covered a lot – from crypto trading basics to strategies and pitfalls. Remember, how to trade crypto for beginners starts with education, patience, and smart risks. In 2025, with adoption booming, it’s an exciting time to dive in. Nevertheless, always prioritize safety over quick wins.

Your next steps:

- First, sign up on Coinbase or Binance today

- Next, start with $50–100 and buy Bitcoin

- Finally, track your progress and learn from trades

Ready to begin? Get Started on Binance or Try Coinbase Now. Ultimately, you’ve got this – trust the process.