In the fast-paced world of cryptocurrencies, building a resilient portfolio is key to navigating market volatility. As we enter 2025, with Bitcoin surpassing $100,000 and institutional adoption accelerating, diversification remains a cornerstone strategy for both seasoned investors and newcomers.

This comprehensive guide explores how to diversify your crypto portfolio effectively, using simple language to explain expert concepts. We’ll cover why it matters, practical strategies, top assets to consider, and common pitfalls—all backed by reliable data from industry reports and analyses.

Whether you’re just starting with $100 or managing a larger sum, understanding diversification can help minimize risks while maximizing potential gains. Let’s break it down step by step.

Why Diversify Your Crypto Portfolio in 2025?

Cryptocurrencies are notoriously volatile. Prices can swing 10-20% in a single day, influenced by factors like regulatory news, technological advancements, and global economic shifts. In 2025, this volatility is amplified by emerging trends such as AI integration in blockchain, tokenized real-world assets (RWAs), and clearer U.S. regulations on stablecoins.

According to Bitbo data, U.S. spot Bitcoin ETFs have materially accelerated mainstream access, with combined assets under management (AUM) around $135–140 billion as of November 7, 2025, and BlackRock’s IBIT nearing $100 billion alone. This institutional adoption brings both opportunity and increased market complexity.

Diversification spreads your investments across different assets, reducing the impact of any single coin’s poor performance. Think of it like not putting all your eggs in one basket—if one asset drops, others might rise to balance it out. Understanding risk management in volatile markets is essential for protecting your capital during turbulent periods. Research from CryptoQuant suggests that diversified crypto portfolios often show lower drawdowns than Bitcoin-only holdings, though outcomes depend on methodology and rebalancing rules.

For beginners, this approach is especially valuable. A Fidelity analysis found that adding a small Bitcoin allocation improved portfolio returns in certain historical periods—albeit with higher volatility.

Key Benefits of Diversification

Risk Mitigation: Combining assets with different behaviors (e.g., blue chips vs. stablecoins) can buffer losses during market downturns. Implementing proper risk management strategies helps preserve capital when markets turn bearish.

Opportunity Maximization: Exposure to multiple sectors like DeFi, AI/compute, and RWAs captures diverse growth narratives across the crypto ecosystem. Organizations like DAOs are also pioneering new approaches to treasury management that can inform individual portfolio strategies.

Emotional Stability: According to a Kraken survey, 84% of crypto holders admit to making FOMO-driven decisions, and 63% of U.S. holders say emotions have hurt their returns. Diversification combined with disciplined rules helps counter emotional trading.

Key Strategies for Diversifying Your Crypto Portfolio

Building a diversified crypto portfolio in 2025 involves intentional allocation based on your risk tolerance and investment goals. Start small: review your current holdings, identify gaps, and reallocate gradually.

1. Diversify Across Asset Types and Market Caps

Allocate across large-cap (stable leaders like BTC and ETH), mid-cap (scalable challengers like SOL), and small-cap (higher-risk growth opportunities). A common framework is the “60/40 crypto edition”: 60% in core blue-chips (40% BTC, 20% ETH) for stability, and 40% in diversified altcoins for growth potential.

Large-Caps (Blue-Chips): Bitcoin and Ethereum anchor your portfolio. BTC is increasingly accessed via spot ETFs, providing regulated exposure for institutional and retail investors. When comparing these two giants, our detailed Bitcoin vs Ethereum investment guide can help you understand their distinct value propositions. ETH underpins the DeFi and NFT ecosystems and now also has spot ETH ETFs available in the U.S., though these do not offer staking. For data-driven insights into Ethereum’s performance and network health, check out key Ethereum statistics and charts that every investor should monitor.

Mid-Caps: Solana (SOL) offers speed and scalability advantages. According to CryptoDnes.bg, Solana’s DeFi total value locked (TVL) showed approximately 165% year-over-year growth heading into late 2025, demonstrating strong ecosystem expansion.

Small-Caps and Presales: Keep these allocations to 10–20% maximum to avoid overexposure to high-risk assets.

Example Beginner Portfolio ($1,000)

- $400 BTC (foundation and store of value)

- $200 ETH (smart contract utility)

- $150 SOL (growth and scalability)

- $150 stablecoins like USDC (liquidity and dry powder)

- $100 altcoins (e.g., ARB for Layer-2 exposure)

According to L2BEAT data, Arbitrum One leads by value secured among Ethereum Layer-2 solutions. As of November 7, 2025, Arbitrum’s total value secured (TVS) is approximately $16 billion versus total L2 TVS of roughly $38 billion—representing about 42% market share, with Base close behind.

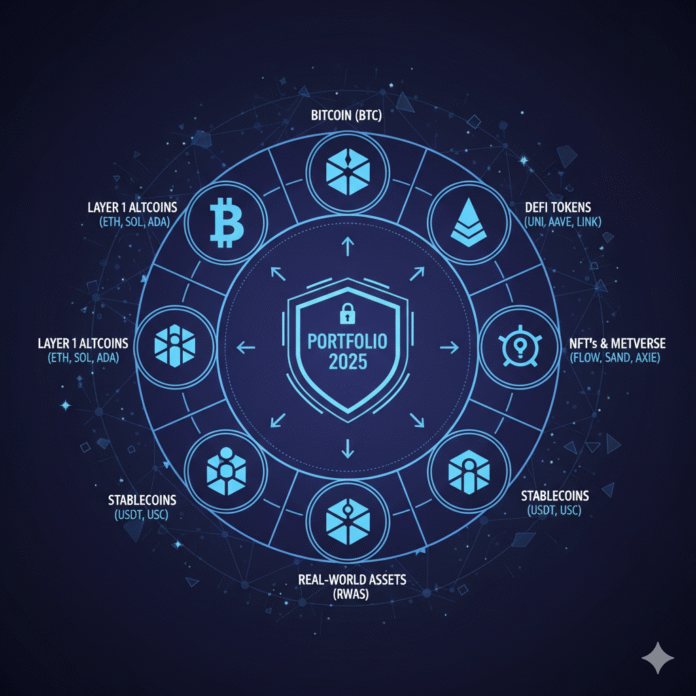

2. Spread Across Sectors and Narratives

Crypto isn’t monolithic—diversify by use cases to capture 2025’s hottest trends and technological innovations.

DeFi and Yield: Tokens like Uniswap (UNI) or Pendle (PENDLE) provide exposure to decentralized exchange liquidity and yield-rate markets. Check DefiLlama for current TVL metrics across DeFi protocols.

AI and Compute: Bittensor (TAO) remains a pure-play AI token. Fetch.ai has rebranded under the Artificial Superintelligence (ASI) Alliance—use ASI/FET rather than the legacy “FET/Fetch.ai” label when referencing this project. Note that the alliance has experienced some turbulence in 2025.

Real-World Assets (RWAs): Infrastructure tokens like Chainlink (LINK) and Ondo (ONDO) underpin tokenized assets and on-chain Treasury products. Forecasts for tokenized assets by 2030 range widely from approximately $2 trillion (McKinsey) to $16 trillion (BCG), reflecting different methodologies and assumptions.

Memecoins: PEPE or DOGE can capture viral upside and community-driven momentum—but cap this bucket at 5–10% of your portfolio due to extreme volatility. Interestingly, memecoins are driving adoption across multiple blockchain chains, creating network effects that extend beyond speculation.

Gaming and Social: Sui has experienced substantial TVL growth since early 2024, expanding from under $500 million to over $2 billion by January 2025 according to Bingx Exchange data, supporting gaming and social applications.

3. Include Stablecoins and Passive Income Strategies

Stablecoins like USDT and USDC provide a “safe haven” for preserving capital and maintaining dry powder for opportunities. Annual stablecoin transaction volume exceeded $27 trillion in 2025, up sharply from prior years according to McKinsey research.

Traditional remittances still cost an average of 4.6–6.5% according to World Bank data, while many on-chain transfers can be significantly cheaper, though fees vary by network and venue.

Add passive income opportunities through staking (e.g., ETH on supported platforms) or low-touch automation like dollar-cost averaging (DCA) or grid trading bots on reputable exchanges to smooth returns over time. Remember that U.S. spot ETH ETFs themselves do not stake underlying assets.

4. Use Tools and Automation

Portfolio tracking tools like CoinMarketCap help monitor performance across exchanges. Rebalancing and DCA features on platforms like Bybit help enforce discipline and remove emotion from investment decisions.

Top Cryptocurrencies for Diversification in 2025

Based on expert analyses and market data, here’s a curated list for a balanced 2025 portfolio. Focus on high-quality assets with lower correlation to maximize diversification benefits.

Bitcoin (BTC): The benchmark cryptocurrency, with spot ETFs turbocharging institutional access. Public pension funds including Wisconsin and Michigan have disclosed spot BTC ETF holdings according to Reuters reporting, though positions can change over time. To understand the fundamental differences between the two largest cryptocurrencies, read our comprehensive Bitcoin vs Ethereum comparison.

Ethereum (ETH): Dominates the smart contract ecosystem. Spot ETH ETFs arrived in 2025 and have experienced both inflow and outflow cycles according to Farside data. Learn more about how institutions are entering ETH in 2025 through these regulated products. Investors should also review Ethereum’s key statistics and metrics to make informed allocation decisions.

Solana (SOL): High-throughput blockchain for DeFi and NFTs. Check DefiLlama for current TVL statistics showing ecosystem growth.

XRP (Ripple ecosystem): Primarily focused on cross-border payments and financial institution partnerships, providing exposure to the payments sector rather than RWA specifically.

Chainlink (LINK): Oracle network and RWA infrastructure provider operating across multiple blockchains, essential for connecting smart contracts to real-world data. Visit the Chainlink website for technical documentation.

Arbitrum (ARB): Leading Ethereum Layer-2 solution by value secured (approximately $16 billion representing roughly 42% share) according to L2BEAT, with Base as a close competitor.

Memecoins (DOGE/PEPE): Speculative assets that can provide upside during bull markets—cap allocation at 5–10% maximum. Despite their speculative nature, understanding how memecoins drive blockchain adoption reveals their unexpected role in onboarding new users.

Sample Balanced Portfolio Allocation

- 35% BTC (foundation)

- 25% ETH (smart contracts)

- 15% SOL (high-performance alternative)

- 10% stablecoins (liquidity)

- 10% RWAs (e.g., ONDO, LINK)

- 5% AI/compute (e.g., TAO or ASI)

This allocation provides exposure to established assets while capturing emerging narratives in tokenization and artificial intelligence. When allocating to Ethereum, consider analyzing on-chain data and network metrics to time your entries more effectively.

Common Mistakes to Avoid in Crypto Diversification

Over-Diversification: Spreading investments across 30 tiny positions dilutes potential gains and makes portfolio management difficult. Five to ten quality picks is typically sufficient for effective diversification.

Ignoring Correlations: If all your assets move in lockstep with Bitcoin, you haven’t achieved true diversification. Look for assets with lower correlation coefficients to BTC price movements.

Emotional Trading: The Kraken survey found that 63% of U.S. crypto holders regret FOMO and FUD-driven moves. Establish rules-based investing strategies to counter emotional impulses. Developing robust risk management techniques is crucial for long-term success.

Neglecting Rebalancing: Market dynamics shift constantly. Review your portfolio quarterly at minimum to maintain target allocations. Organizations managing collective capital can learn from modern DAO treasury management approaches.

High-Risk Overexposure: Memecoins and small-cap tokens can be exciting but volatile. Maintain strict position limits to protect capital.

How to Rebalance and Maintain Your Portfolio

Rebalancing keeps your allocations aligned with investment goals as market conditions change.

Set Clear Thresholds: For example, if Bitcoin exceeds 50% of portfolio value, trim the position back to target allocation.

Review Regularly: Conduct monthly reviews or trigger rebalancing after significant market movements (20%+ swings).

Automate Where Possible: Use exchange features or portfolio management tools to reduce manual intervention. Platforms like Coinbase and Binance offer automated rebalancing features.

Rotate Profits: Move gains from outperforming assets into stablecoins during market peaks to lock in profits and maintain dry powder.

Monitor Market Indicators: While rules of thumb like “BTC dominance dropping 20% signals altseason” exist, dominance cycles ebb and flow unpredictably. Avoid relying on hard thresholds according to Fidelity research. Instead, use multiple indicators and fundamental analysis.

Conclusion: Building Wealth Through Smart Diversification

Crypto portfolio diversification in 2025 is about achieving balance, not engaging in blind speculation. By spreading investments across asset types, sectors, and narratives, beginners can weather volatility while capturing growth opportunities across the expanding crypto ecosystem.

Start with core holdings like Bitcoin and Ethereum to establish a foundation—understanding the key differences between these two assets helps inform allocation decisions. Add exposure to emerging trends like real-world assets, AI/compute tokens, and scalable Layer-2 solutions. Always prioritize risk management through position sizing and rebalancing discipline.

As institutions increasingly adopt crypto through Ethereum ETFs and Bitcoin ETFs, and regulations continue evolving, a diversified approach positions investors for long-term success. Remember the golden rules: invest only what you can afford to lose, conduct thorough research using reliable sources like CoinDesk, Cointelegraph, and The Block, and maintain disciplined investing strategies.

With these evidence-based strategies and a commitment to ongoing education, your 2025 crypto journey can be both financially rewarding and intellectually enriching. The key is starting with solid fundamentals, implementing proper risk management protocols, and building gradually as you gain experience in this dynamic asset class.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with qualified financial advisors before making investment decisions.