In the ever-evolving world of cryptocurrency, memecoins have emerged as more than just internet jokes turned digital assets. These tokens, often inspired by memes like Dogecoin’s Shiba Inu dog or Pepe the Frog, are playing a surprising role in expanding blockchain technology’s reach.

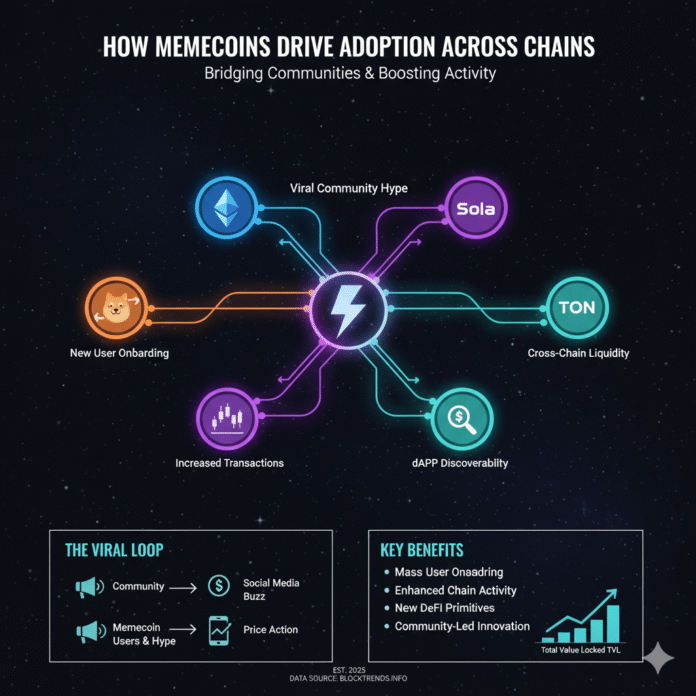

Traditional cryptocurrencies focus on solving real-world problems like payments or decentralized finance (DeFi). In contrast, memecoins thrive on humor, community, and viral trends. This makes them accessible to beginners. As a result, they draw in new users who might otherwise find blockchain intimidating. Consequently, memecoins have evolved from simple jokes to complex ecosystems, driving adoption not just on one chain but across multiple blockchains, boosting activity, liquidity, and innovation in the crypto space.

This article explores how memecoins are fueling this growth, backed by real examples and data from reliable sources. We’ll break it down into simple terms, so even if you’re new to crypto, you can follow along.

The Cultural Power of Memecoins: A Gateway for New Users

Memecoins start with something simple and relatable: a meme. Consider Dogecoin (DOGE), launched in 2013 as a joke based on the “Doge” meme. It gained traction through social media buzz and celebrity endorsements, particularly from Elon Musk. This helped it reach an all-time high market cap of approximately $83–89 billion in May 2021.

This cultural appeal lowers the entry barrier for newcomers. Unlike complex projects requiring technical knowledge, memecoins invite participation through fun and shared experiences. Moreover, they serve as an accessible introduction to blockchain technology before users explore more complex aspects of cryptocurrency.

Why Memecoins Attract New Users

Experts note that memecoins act as a “Trojan horse” for crypto adoption. They wrap speculation in humor, making blockchain less scary. For instance, during market highs, memecoins attract retail investors who generate more activity on networks like Ethereum and Solana.

This influx of users increases transaction volumes. In turn, this validates the blockchain’s utility. On Solana, memecoin seasons have coincided with large spikes in decentralized exchange (DEX) volumes and network fees. Subsequently, these metrics cool off when markets soften.

Furthermore, on Solana, BONK’s holder base has grown into the hundreds of thousands, approaching one million. This makes it one of the most widely held tokens on the chain. When comparing BONK to other leading memecoins like PEPE, DOGE, and WIF, it’s clear that community size and holder distribution play crucial roles in determining long-term success.

For beginners, starting with a small investment in a fun token can lead to exploring deeper crypto features. These include wallets or trading platforms. Therefore, memecoins bridge cultural trends and digital assets, serving as an entry point that encourages long-term engagement.

Expanding Across Chains: From Single-Network to Multi-Chain Marvels

One key way memecoins drive adoption is by going multi-chain. Early memecoins like DOGE were tied to one blockchain. DOGE still runs natively on its own chain. However, wrapped versions (such as wDOGE on Ethereum) let DOGE circulate on other networks. This is how many legacy coins gain multi-chain presence.

Multi-Chain Strategy in Action

Take Floki Inu (FLOKI) and Pepe (PEPE) as examples. These tokens operate on multiple chains, enhancing accessibility and liquidity. By deploying on various blockchains, they tap into diverse user bases. Additionally, they reduce costs through lower-fee networks and boost trading activity.

Cross-chain compatibility is becoming standard. Tools like Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enable secure token and message passing across more than 20 chains. Moreover, the SHIB ecosystem (Shibarium) has integrated CCIP to expand interoperability.

Launchpads like Memetropolis claim to let projects launch across six chains. These include Solana, Ethereum, BNB Chain, Base, Avalanche, and Arbitrum. They use LayerZero-based interoperability. This omnichain approach pools liquidity and reduces friction for users moving between networks.

Emerging Blockchain Ecosystems

For chains like Base (operated by Coinbase) or TON (linked to Telegram’s ecosystem), top memecoins often act as leveraged bets on chain growth. Coinbase counts approximately 100–120 million verified users historically. Meanwhile, Telegram surpassed 1 billion monthly active users by 2025. These represent huge funnels for on-chain applications and tokens.

The new generation of memecoins emerging on TON and Base blockchains demonstrates how these platforms leverage their massive user bases to drive adoption. This multi-chain strategy not only drives adoption by making memecoins more available. It also encourages users to explore different blockchains, spreading awareness and usage.

Boosting Liquidity and Network Activity

Memecoins aren’t just fun; they create real economic activity. By attracting speculators and communities, they increase transaction volumes. This benefits the underlying blockchains. On Solana, memecoin waves have coincided with surges in DEX volumes and chain fees. Correspondingly, these metrics dip during risk-off periods.

The Liquidity Advantage

Liquidity is a big winner here. Multi-chain deployments mean more trading pairs and deeper pools. This reduces slippage and makes trades efficient. Platforms like Pump.fun on Solana have generated roughly $800 million or more in cumulative protocol fees to date. Projections suggest it could cross $1 billion in 2025. This shows the sheer scale of memecoin-driven activity.

For beginners, memecoins can introduce concepts like liquidity pools or decentralized exchanges in a low-stakes way. As users trade, they learn about blockchain mechanics. Thus, this fosters broader adoption. If you’re new to crypto and want to safely manage your memecoin investments, exploring the best crypto wallets for Ethereum, Bitcoin, and multi-chain support is an essential first step.

Integration with DeFi and Real Utility

While memecoins started as pure speculation, many are evolving. They’re integrating with DeFi, turning from jokes into functional assets. For example, BONK on Solana participates in DeFi integrations. Meanwhile, dogwifhat (WIF) serves as a community mascot that helped catalyze Solana activity during peaks.

WIF’s all-time high price was approximately $4.83. This implies a peak market cap of roughly $4.8–5 billion given its circulating supply.

Building Sustainable Models

Projects like Memeland onboard users in Asia via Web2 audiences. Others build revenue-sharing or buyback mechanics to create sticky utility. On Base, tokens like TOSHI, DEGEN, and BRETT have fostered social and creator-led use cases. This turns the chain into a hub for real usage.

Cross-chain tools like Chainlink CCIP make this safer and more seamless. Furthermore, omnichain launchpads reward creators for deploying where their communities already live. As the industry matures, there’s a growing shift toward sustainable tokenomics models that prioritize real yield over Ponzi-like structures. This evolution is crucial for memecoins seeking long-term viability beyond initial hype cycles.

Real-World Examples of Memecoin-Driven Adoption

Let’s examine specific examples that demonstrate how memecoins drive blockchain adoption:

Dogecoin (DOGE): Started and still runs on its own chain. Wrapped DOGE exists on EVM networks for cross-chain use. At its 2021 peak, DOGE exceeded an $80 billion market cap.

Shiba Inu (SHIB): Ethereum-native with its own Layer 2 solution called Shibarium. Shibarium integrated Chainlink CCIP, aligning with CCIP’s 20+ chain reach for interoperability. Currently, SHIB’s market cap in October 2025 fluctuates around $6–7 billion.

Pepe (PEPE): Ethereum-based memecoin with an all-time high price on December 9, 2024. It reached approximately $0.000028, implying a peak market cap of roughly $11–12 billion.

dogwifhat (WIF): Solana’s flagship meme with an all-time high of approximately $4.83. This implies a peak market cap of $4.8–5 billion.

Brett (BRETT) on Base: Leading Base memecoin that has traded in the hundreds of millions to billions market-cap range. Its all-time high price reached around $0.234 in 2024.

Avalanche (AVAX): COQ Inu (COQ) and Landwolf (WOLF) are active Avalanche memecoins. They illustrate how competing memes on a single Layer 1 blockchain vie for attention and liquidity.

TON: REDO (Resistance Dog) is a prominent TON memecoin. It’s tied culturally to Telegram and TON. Its on-chain activity and listings are tracked across TON DEXs and aggregators.

These examples show memecoins can represent a material share of a chain’s market cap during peaks. However, the ratio varies widely by chain and market cycle.

The Future: Memecoins as a Pillar of Blockchain Growth

Looking ahead, memecoins will likely integrate more with DeFi, NFTs, and artificial intelligence. They’re becoming increasingly interoperable across chains. Trends like multi-chain launches will enhance accessibility. Meanwhile, proof-of-stake chains such as Solana and Avalanche continue courting these communities with low fees and high throughput.

Challenges and Opportunities

However, challenges like hype cycles and rug pulls persist. Therefore, chains must balance fun with real utility. Regulatory scrutiny is also increasing. Consequently, projects need to focus on building sustainable value beyond speculation.

Despite these challenges, the memecoin sector demonstrates resilience. The total memecoin sector hovers around $60–65 billion today. This underscores that they’re no longer a fringe phenomenon.

Conclusion: Your Gateway to Blockchain

In summary, memecoins drive blockchain adoption by making cryptocurrency fun and approachable. They expand across chains and boost network activity. For beginners, starting with a memecoin could be your first step into a vast, interconnected crypto world.

As these tokens continue to evolve, they’re proving that humor and community can coexist with technological innovation. Whether you’re a seasoned trader or a curious newcomer, memecoins offer an accessible entry point to explore blockchain technology.

Key Resources:

- CoinMarketCap – Cryptocurrency market data and rankings

- CoinGecko – Cryptocurrency prices and market intelligence

- Chainlink Cross-Chain Interoperability Protocol – Cross-chain infrastructure

- Solana Official Website – Solana blockchain platform

- Base Official Website – Coinbase’s Layer 2 network

- TON Official Website – The Open Network blockchain

- Backlinko Telegram Statistics – Telegram user data and trends