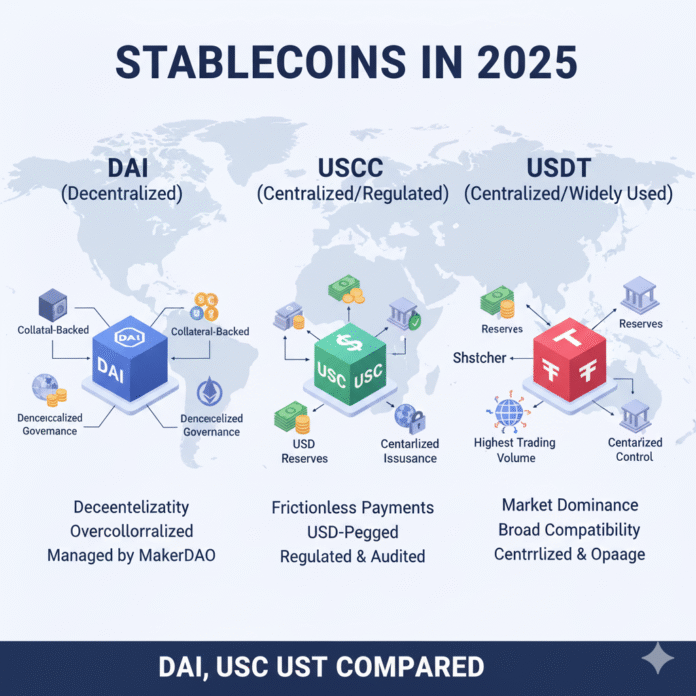

In the fast-evolving world of cryptocurrency, stablecoins have become essential tools for bridging traditional finance and digital assets. As of 2025, the stablecoin market has surged past $300 billion in total market capitalization, reflecting their growing role in payments, trading, and decentralized finance (DeFi). Among the top players, DAI, USDC, and USDT stand out as the most prominent dollar-pegged stablecoins.

This article compares these three leading stablecoins—USDT (Tether), USDC (USD Coin), and DAI—focusing on their features, backing, adoption, and outlook in 2025. Whether you’re a beginner exploring crypto or an experienced trader, understanding these stablecoins can help you navigate the market more effectively.

Stablecoins like DAI, USDC, and USDT offer stability in a volatile crypto landscape, maintaining a value close to $1 USD. They enable seamless transactions without the price swings of assets like Bitcoin or Ethereum. In 2025, with regulatory frameworks solidifying worldwide—including the EU’s MiCA regulation and the U.S. GENIUS Act—these stablecoins are more reliable than ever.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to hold a steady value, typically pegged to a fiat currency like the US dollar. Unlike volatile coins, they minimize risk, making them ideal for everyday use in crypto ecosystems. There are different types of stablecoins:

- Fiat-collateralized: Backed by reserves of real-world assets like cash or bonds. USDT and USDC fall into this category.

- Crypto-collateralized: Backed by other cryptocurrencies, often over-collateralized to handle volatility. DAI is a prime example.

- Algorithmic: Maintained through smart contracts and supply adjustments, though these are less common due to past failures.

In 2025, stablecoins facilitate trillions in annual transaction volume, powering everything from remittances to DeFi lending. Their appeal lies in combining blockchain’s speed and security with the predictability of traditional money.

The Role of Stablecoins in Crypto

Stablecoins act as a “safe haven” during market downturns, allowing users to park funds without exiting crypto entirely. They’re widely used for trading pairs on exchanges, cross-border payments, and earning yields in DeFi protocols. For beginners, think of them as digital dollars that move instantly across borders at low cost. In 2025, with global adoption rising, stablecoins are integral to institutional finance, including payroll and treasury management.

Overview of USDT (Tether)

USDT, issued by Tether, is the oldest and most dominant stablecoin, launched in 2014. It’s pegged 1:1 to the US dollar and backed by a mix of cash, cash equivalents, and other assets, including receivables from loans. Tether emphasizes full reserves, meaning the value of its holdings always meets or exceeds the circulating supply.

History and Backing

Tether started on the Bitcoin blockchain but now operates on multiple networks like Ethereum, Tron, and Solana. Its backing includes traditional currency and short-term investments, ensuring liquidity. Despite past controversies over reserve transparency, Tether now provides daily circulation and reserve metrics, and publishes quarterly attestation reports by BDO Italy.

Market Position in 2025

As of October 2025, USDT’s market cap is approximately $178 billion, capturing roughly 60%+ of the stablecoin market. Reported 24-hour trading volumes frequently exceed $170 billion on busy days. Source: CoinMarketCap

In emerging markets, USDT is particularly popular for remittances due to its widespread availability on exchanges worldwide.

Overview of USDC (USD Coin)

USDC, launched in 2018 by Circle in partnership with Coinbase, is another fiat-backed stablecoin pegged to the USD. It’s fully reserved with cash and cash equivalents, primarily held in U.S. Treasury securities and managed via regulated structures like the Circle Reserve Fund.

History and Backing

USDC was created to offer a transparent alternative in the stablecoin space. Circle provides monthly third-party attestations by Deloitte & Touche LLP and frequent reserve disclosures, helping to ensure 1:1 backing. USDC is natively supported on 28 blockchains including Ethereum, Solana, Base, and Stellar, reflecting its emphasis on compliant, multi-chain reach.

Market Position in 2025

With a market cap of approximately $75 billion in October 2025, USDC ranks second among stablecoins and has grown roughly 90% year-over-year, driven by institutional demand. Source: CoinMarketCap

USDC is favored for regulatory alignment, including integrations and settlement pilots with Visa and Mastercard networks.

Overview of DAI

DAI, created by MakerDAO in 2017, is a decentralized stablecoin backed by crypto collateral rather than fiat. Users generate DAI by locking assets like ETH in smart contracts, with over-collateralization—typically 150% or more—to maintain stability.

History and Backing

Governed by a DAO (Decentralized Autonomous Organization), DAI relies on community votes for decisions. Its collateral set includes cryptocurrencies and significant real-world asset (RWA) exposure, such as short-dated U.S. Treasuries via RWA structures. This setup avoids central control, appealing to DeFi enthusiasts who value decentralization.

Market Position in 2025

DAI’s market cap is approximately $5.3 billion in 2025, placing it among the largest decentralized stablecoins and making it integral to DeFi usage on platforms like Aave. Source: CoinMarketCap

Key Comparisons: DAI vs. USDC vs. USDT

When comparing DAI, USDC, and USDT in 2025, several factors highlight their differences. Here’s a comprehensive breakdown:

Backing and Stability

- USDT: Fiat-backed with a diverse reserve portfolio featuring large U.S. Treasury exposure and quarterly attestations. Maintains a peg near $1 with only brief deviations.

- USDC: Cash and cash-equivalents held primarily in Treasuries via the Circle Reserve Fund with monthly attestations; generally trades very close to $1.

- DAI: Crypto and RWA-backed with over-collateralization; typically holds close to $1, with on-chain mechanisms absorbing shocks.

Key Insight: All three have proven resilient, but DAI’s decentralized design can face added stress in extreme crypto downturns due to its reliance on cryptocurrency collateral.

Transparency and Regulation

Regulatory clarity improved significantly in 2025. In the United States, the GENIUS Act establishes a federal framework for payment stablecoins, including reserve and disclosure requirements. In the European Union, MiCA licensing favors compliant issuers, with Circle becoming the first to comply in July 2024.

- USDC leads on formal disclosures and assurance with monthly attestations

- USDT provides daily circulation data and quarterly attestations

- DAI’s transparency is on-chain, though outside traditional issuer regulation

Adoption and Use Cases

- USDT: Dominates trading and remittances, with unmatched exchange liquidity across global markets

- USDC: Preferred for institutional and enterprise use including treasury management and payments, with integrations and pilots with Visa and Mastercard

- DAI: Excels in DeFi applications for lending, borrowing, and yield farming

In 2025, USDT and USDC handle most global transaction volume, while DAI thrives in decentralized applications and protocols.

Risks

No stablecoin is risk-free. USDT and USDC face issuer, counterparty, and regulatory risks, though these are mitigated by disclosures and oversight. DAI can face liquidation cascades if collateral values drop sharply during market crashes. Beginners should diversify their stablecoin holdings and monitor reserve reporting regularly.

Future Outlook for Stablecoins in 2025 and Beyond

The stablecoin market is projected to grow further in 2025, driven by institutional adoption and regulatory clarity. USDT will likely maintain dominance in liquidity and trading volume, USDC in compliance-focused sectors and enterprise adoption, and DAI in DeFi innovations and decentralized applications.

Emerging trends include expanded multi-chain support and increased real-world asset (RWA) integration, expanding use cases like tokenized payments and institutional treasury management. With the total market cap now around $300 billion, stablecoins are set to keep reshaping global finance.

Conclusion

In 2025, DAI, USDC, and USDT each offer unique strengths:

- USDT for broad accessibility and trading liquidity

- USDC for regulatory trust and institutional compliance

- DAI for decentralization and DeFi integration

For beginners, start with small holdings and research based on your needs—whether for trading, saving, or participating in DeFi. As the crypto space matures, these stablecoins will continue to play a pivotal role in the digital economy.

Important: Always verify the latest data from reliable sources like CoinMarketCap, CoinGecko, and official issuer websites to make informed decisions. Market caps and trading volumes change rapidly in the cryptocurrency market.

Additional Resources:

- CoinDesk – Cryptocurrency news and analysis

- Reuters Technology – Financial technology coverage

- Forbes Digital Assets – Crypto market insights

Read also: Stablecoins on Ethereum.