Ethereum continues to power the world’s largest ecosystem of decentralized applications, from DeFi protocols to NFT marketplaces and Web3 gaming platforms. However, the network’s fundamental scalability constraints remain a critical challenge—processing only 15–30 transactions per second on average, with gas fees occasionally exceeding $50 during periods of high network congestion.

By October 2025, Layer 2 scaling solutions have matured significantly, with rollups securing approximately $48.6 billion in total value. This comprehensive guide examines how these technologies work, recent developments, and practical considerations for choosing between them.

⚠️ Important Disclaimer: This content is strictly educational. Cryptocurrency investments involve substantial risk. Always conduct thorough research and seek professional financial advice before making investment decisions.

The Current State of Ethereum Scaling (October 2025)

Rollup Ecosystem Growth

The rollup ecosystem has experienced remarkable growth, with major platforms including Arbitrum One holding approximately $21 billion in total value secured, Base with around $16 billion, and platforms like OP Mainnet, Linea, and zkSync Era also managing billions in assets.

Transaction Activity Surge

Rollup networks now process hundreds of millions of transactions monthly, with daily usage measured in unique operations (UOPS) averaging around 242—representing more than a twelvefold increase since 2024. Base currently leads in daily transaction volume, followed by Arbitrum and OP Mainnet.

For real-time tracking of Layer 2 metrics, visit L2BEAT and Ethereum.org Layer 2 resources.

Fusaka Upgrade: The Next Evolution

What’s Coming in December 2025

The Fusaka upgrade, scheduled for deployment on December 3, 2025, represents the most significant Ethereum enhancement since Proto-Danksharding was introduced.

Core Technical Improvements

Peer Data Availability Sampling (PeerDAS) allows validators to sample data blobs rather than downloading them entirely, substantially reducing operational costs and expanding rollup data capacity. Additional enhancements include increased blob capacity per block, gas limit expansion, and Verkle Trees implementation for more efficient storage and bandwidth utilization.

Testing Progress

The Holesky testnet successfully completed testing in October 2025, with ongoing evaluations continuing on Sepolia and Hoodi testnets before the mainnet deployment.

Expected Impact

Following the Fusaka upgrade, rollup transaction fees are projected to decrease to fractions of a cent, substantially narrowing the cost differential that has historically favored sidechains.

Learn more about Ethereum’s roadmap at IndexBox and CoinDesk.

Understanding Rollups: Technical Deep Dive

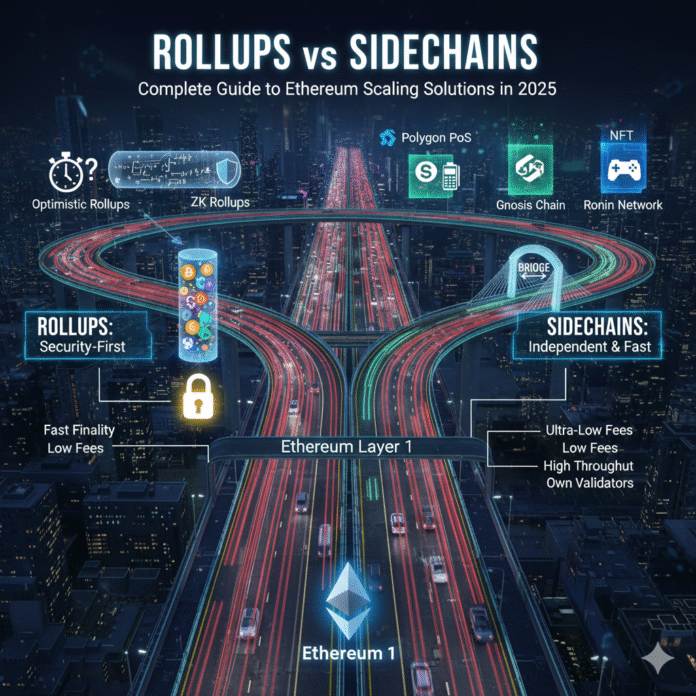

Rollups execute transactions off the main Ethereum chain and submit compressed data or cryptographic proofs back to the mainnet, thereby inheriting significant portions of Ethereum’s security guarantees. To explore how Ethereum Layer 2 works in detail, including the specific mechanisms behind Arbitrum, Optimism, and zkSync, check out our comprehensive technical breakdown.

Optimistic Rollup Architecture

Optimistic rollups, exemplified by platforms like Arbitrum, Optimism, and Base, operate under an assumption-of-validity model where transactions are considered legitimate unless challenged during a dispute window lasting approximately seven days. Security is maintained through fraud proof mechanisms and economic incentive structures, though withdrawals require up to seven days to complete.

Zero-Knowledge Rollup Technology

ZK-rollups, including zkSync Era, Polygon zkEVM, and StarkNet, utilize cryptographic proofs such as zk-SNARKs or zk-STARKs to mathematically guarantee transaction correctness. This approach provides mathematically assured security and enables withdrawals in minutes to hours rather than days. For those new to this technology, our beginner’s guide to understanding zk-rollups breaks down these complex cryptographic concepts into digestible explanations, while our complete guide to zk-rollups in 2025 covers the latest developments and implementations.

Data Availability Mechanism

Both rollup types maintain independent state trees and periodically submit state roots to Ethereum’s mainnet, with data availability guaranteed by posting transaction data directly to Layer 1.

Sidechain Architecture Explained

Fundamental Design

Sidechains function as independent blockchains operating parallel to Ethereum, connected through bridge protocols that lock assets on Ethereum and mint equivalent representations on the sidechain. To dive deeper into understanding Ethereum sidechains, how they work, and why they matter, explore our dedicated guide that covers their architecture, use cases, and trade-offs in detail.

Consensus and Security Model

Most sidechains employ Proof of Stake or Proof of Authority consensus mechanisms, with security depending on validator integrity and bridge contract code rather than inheriting Ethereum’s security properties. Notable examples include Polygon PoS, Gnosis Chain, and Ronin Network.

Value Proposition

Sidechains continue to offer extremely low transaction fees and straightforward deployment processes, though they require accepting higher trust assumptions compared to rollups.

Comprehensive Comparison: Rollups vs Sidechains

Performance Metrics

Rollups deliver hundreds to thousands of transactions per second, with capacity continuing to increase following the Fusaka upgrade. Sidechains can achieve high throughput levels depending on validator configuration.

Transaction Economics

Rollup transaction costs are declining toward low-cent or sub-cent levels post-Fusaka implementation, while sidechain fees typically remain below one cent.

Security Characteristics

Rollups inherit Ethereum’s security properties, with ZK-rollups offering the strongest guarantees, though risks include sequencer centralization and emerging economic attack vectors. Sidechains rely on independent security models vulnerable to bridge exploits and validator collusion.

Settlement Speed

ZK-rollups enable withdrawals in minutes to hours, while optimistic rollups require multiple days for finalization. Sidechain withdrawal times range from minutes to hours depending on bridge implementation.

Development Environment

Rollups benefit from mature development toolchains with improving ZK stack capabilities, whereas sidechains typically offer complete EVM compatibility and straightforward deployment processes.

Liquidity Considerations

Rollups face liquidity fragmentation across multiple networks, with emerging standards like UAT20 attempting to address interoperability. Sidechains utilize bridges to unify liquidity but introduce additional trust requirements.

Critical Security Considerations for 2025

Economic Attack Vectors

Recent research demonstrates that attackers can execute pricing or fee saturation attacks by flooding rollup networks with low-fee, high-data transactions designed to delay proof generation. For technical details, see arXiv research papers.

Builder Advantage Concerns

The free option problem associated with enshrined proposer-builder separation (ePBS) may grant block builders unfair strategic advantages as Ethereum upgrades this mechanism.

Bridge Vulnerability

The $600 million Ronin Network hack serves as a stark reminder of bridge exploit risks inherent to sidechain architectures.

Centralization Risks

Many rollup platforms currently operate with single centralized sequencers, though decentralization efforts are progressing but not yet complete.

Strategic Decision Framework

When Rollups Are Optimal

Choose rollup solutions when managing high-value DeFi applications or treasury assets, requiring Ethereum-level censorship resistance, or seeking to leverage post-Fusaka cost reductions.

When Sidechains Make Sense

Sidechains remain appropriate for gaming applications, micropayment systems, social platforms, or scenarios prioritizing ultra-low fees and transaction speed over maximum security, as well as projects requiring rapid deployment with acceptable validator and bridge trust assumptions.

Hybrid Architecture Approach

Consider hybrid strategies utilizing sidechains for high-volume operations and rollups for final settlement, connected through interoperability protocols including LayerZero, Hop Protocol, or Polygon’s AggLayer.

Practical Implementation Guide

Deploying on Arbitrum Rollup

To get started with Arbitrum: add the Arbitrum network through Chainlist, bridge ETH using bridge.arbitrum.io, and explore decentralized applications such as Uniswap, GMX, and Radiant.

Deploying on Polygon Sidechain

For Polygon PoS deployment: add Polygon network to MetaMask, bridge assets through wallet.polygon.technology, and utilize applications like QuickSwap or Aave. For a comprehensive comparison of how Polygon stacks up against other major platforms, see our analysis of Ethereum vs Solana vs Polygon for DeFi applications.

Risk Management Recommendation

Begin testing with $10–50 allocations before committing larger capital to any new platform or protocol.

Future Developments to Monitor (Late 2025-2026)

Key upcoming developments include the Fusaka mainnet launch on December 3, 2025, rollout of decentralized sequencers and data availability committees across major rollup platforms, emergence of cross-rollup composability and liquidity standards such as CRATE and UAT20, potential sidechain consolidation as rollup cost advantages diminish, and new economic and MEV-based attack methodologies targeting both rollups and sidechains.

Final Analysis

By October 2025, rollups have transitioned from experimental technology to the primary scaling infrastructure for Ethereum, with the Fusaka upgrade and PeerDAS implementation promising enhanced affordability and scalability despite ongoing challenges including economic attack vectors and sequencer centralization.

Sidechains retain value for ultra-low-cost, high-speed applications but are experiencing erosion of their historical cost advantage as rollup technology matures.

Strategic Recommendations

For security-critical and high-value DeFi applications, rollups provide superior guarantees; for microtransactions and gaming use cases, sidechains continue to excel; developers should carefully evaluate security requirements against cost and user experience factors while monitoring emerging interoperability standards.

This ecosystem evolves rapidly—always verify current data, follow L2BEAT analytics, reference Ethereum.org Layer 2 documentation, and regularly update your technical assumptions.

Essential Resources

For the latest metrics and analysis, visit:

- L2BEAT – Real-time Layer 2 analytics

- Ethereum.org Layer 2 – Official resources

- CoinDesk – Industry news

- arXiv – Academic research

Remember: Cryptocurrency markets and technologies change rapidly. This guide reflects October 2025 conditions. Always conduct independent research before making technical or investment decisions.

Read also: Ethereum vs Solana vs Polygon vs TON.