Short answer: NFTs on Ethereum aren’t dead — they’ve matured. Speculation has cooled, but real use cases are emerging, and Ethereum still handles a substantial slice of the market.

What Is an NFT (and Why Ethereum)?

A Non-Fungible Token (NFT) is a unique digital certificate stored on blockchain, proving provable ownership or provenance of a digital or physical asset. Ethereum pioneered this model via ERC-721 and ERC-1155 standards, enabling trustless secondary marketplaces and composability across decentralized applications.

The Ethereum blockchain became the natural home for NFTs because its smart contract functionality allowed developers to create programmable, interoperable tokens. Unlike fungible tokens where each unit is identical, NFTs represent distinct items — whether digital art, virtual real estate, or membership credentials.

From Boom to Correction: The NFT Market Evolution

The 2021 Peak

The NFT market surged to approximately $25.1 billion in sales during 2021, with Beeple’s $69 million Christie’s auction becoming an iconic cultural moment. Major brands, gaming companies, and celebrities rushed into the space, treating NFTs as the next frontier of digital ownership.

The 2022-23 Downturn

Trading volumes fell sharply as speculative interest waned. While some sources claimed 95% of NFT collections became inactive or “worthless,” that statistic stems from narrow studies examining specific collection samples and should be qualified. What actually occurred was market consolidation — weak projects disappeared while serious builders remained.

The NFT Landscape in 2025

Current Market Metrics

Based on current market data from sources like CoinLedger and DappRadar, the NFT landscape in 2025 shows these key metrics:

- The global NFT market is estimated at approximately $49 billion in 2025

- NFT sales in the first half of 2025 totaled $2.82 billion, representing only a 4.6% decline from late 2024, while the number of sales climbed nearly 80%

- Ethereum continues to dominate, powering nearly 62% of all NFT transactions in 2025

- OpenSea remains the top marketplace with over 2.4 million monthly active users in Q2 2025

- Gaming NFTs have surged, accounting for 38% of total transaction volume this year

- The average sale price for NFTs has stabilized at around $940, indicating maturing buyer behavior

Chain Distribution in 2025

Solana powers around 18% of NFT traffic in 2025, known for its fast and low-cost transactions, while BNB Chain supports a variety of DeFi-NFT hybrids with around 6% market share. Ethereum Layer-2 solutions Arbitrum and Optimism together account for nearly 9% of transaction volume due to scaling benefits. For a detailed comparison of how Ethereum and Solana NFT ecosystems stack up, check out our guide on Ethereum vs Solana NFTs.

Marketplace Dynamics

While OpenSea maintains strong brand recognition and user base, the marketplace landscape has become more competitive. Blur, Magic Eden, and Rarible now serve different niches, from gaming-focused marketplaces to luxury brand NFT drops. To understand which platform best fits your needs, read our comprehensive NFT marketplaces comparison guide.

Why Some Say “NFTs Are Dead” — But Not Quite

Several factors contribute to the “NFTs are dead” narrative:

Low liquidity in many collections. A majority of collections display minimal trade activity — typical behavior in a matured market where consolidation occurs naturally.

Scams, hacks, and wallet exploits dent trust. Security hygiene remains critical, with phishing attacks and contract vulnerabilities continuing to pose risks to collectors.

Environmental criticisms are outdated for Ethereum. After The Merge, the average NFT mint on Ethereum now consumes 99.95% less energy than pre-2022, making NFTs more eco-friendly. The NFT sector has reduced its estimated carbon footprint by over 75% between 2021 and 2025.

Overhype versus tech failure. The correction weeded out weak projects while Ethereum’s infrastructure continues evolving. The shift suggests fewer speculative bubbles and more consistent adoption, with long-term holders dominating activity.

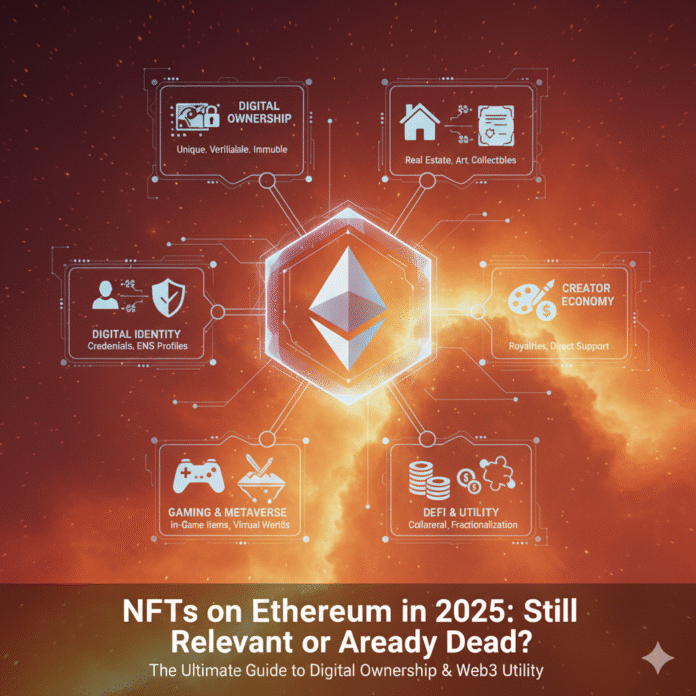

Where Real Utility Is Emerging

Gaming and Metaverse Assets

Gaming NFTs account for 38% of total NFT transaction volume in 2025, though actual developer adoption remains limited. Only 7% of game developers are very interested in incorporating NFTs into their work, with a dominant 70% not interested. Play-to-earn models continue evolving, with platforms like Axie Infinity and The Sandbox leading in-game NFT integration, though scaling remains a challenge. To understand how blockchain gaming actually works and why NFTs play a crucial role, read our in-depth guide on Ethereum gaming and blockchain games.

NFTs in Decentralized Finance

Projects like BendDAO, JPEG’d, and others enable using NFTs as collateral or accessing credit/liquidity. These protocols allow NFT holders to access DeFi services without selling their assets.

Fractional Ownership

Fractional ownership protocols enable multiple investors to own shares of high-value NFTs, improving accessibility to blue-chip collections that would otherwise be out of reach for individual collectors.

Digital Identity and Credentials

ENS (Ethereum Name Service) serves as a unified web3 identifier. Protocols like Sign-In with Ethereum (SIWE) and Ethereum Attestation Service tie identity, authentication, and attestation to NFT-like records, creating portable digital identity systems across platforms.

Tokenized Real-World Assets (RWAs)

According to RWA.xyz, the real-world asset tokenization market reached $24 billion in size in mid-2025, having grown 380% in three years. With an on-chain value reaching $30 billion in 2025, representing a massive 400% growth over three years, RWA tokenization has transitioned to scaled institutional adoption. The market encompasses tokenization of real estate, bonds, stocks, commodities, and other physical or financial assets onto blockchain platforms.

Private credit has become a dominant segment, commanding 58% of the RWA market with approximately $14 billion in tokenized value, while US Treasuries represent the second-largest category at 34% market share. Major institutions like BlackRock and Franklin Templeton have launched tokenized fund products. Learn more about how enterprises are leveraging Ethereum in our article on Ethereum for business use cases in 2025.

Technological Drivers and Infrastructure

Dencun Upgrade and EIP-4844

EIP-4844, also known as “Proto-Danksharding,” was introduced in the Dencun upgrade on March 13, 2024, enabling Layer 2 rollups to use blob transactions that store data temporarily in the beacon node. According to analysis from Blocknative, the Dencun update had an immediate impact on Layer 2 fees, which were reduced by a factor of 100 to 200, with fees dropping from an average of around $1 to less than $0.01 on some second-layer networks.

This infrastructure upgrade drastically reduced transaction costs for NFT interactions on Layer-2 solutions like Base, making NFT minting, trading, and transferring more affordable for users.

Royalties and EIP-2981

The ERC-2981 standard defines metadata for royalty information, establishing a standardized way for NFT contracts to communicate royalty payment data to marketplaces. However, enforcement depends on marketplace support. Many platforms now allow creators to set royalty percentages when minting, but marketplaces ultimately control whether these royalties are honored, as some platforms allow optional bypass of creator royalties to remain competitive. For a deep dive into how NFT royalties work in 2025, read our complete guide for digital artists and creators.

Future Upgrades: Pectra

Future Ethereum upgrades like Pectra (Prague-Electra) have design goals that include UX improvements, validator enhancements, and further efficiency gains, though specific timelines remain subject to change as development progresses. Stay updated on the Ethereum roadmap.

Market Outlook and Forecasts

Market forecasts vary significantly depending on the source and methodology. According to various market research firms, the NFT market size is projected to grow from $43.08 billion in 2024 to $61.01 billion in 2025, with projections reaching $247.41 billion by 2029. Grand View Research anticipates the global non-fungible token market size to reach $211.7 billion by 2030, registering a CAGR of 34.5% from 2024 to 2030.

Statista offers more conservative projections, while McKinsey and BCG provide varying forecasts for tokenization markets broadly.

Given the wide variance in projections—ranging from conservative estimates in the tens of billions to aggressive forecasts exceeding $200 billion by 2030—it’s safer to conclude that NFT markets in the next five years may span tens to low hundreds of billions, depending heavily on adoption rates, regulatory clarity, and utility-driven traction rather than speculative trading.

Smart Approaches for Investors in 2025

Start small, investigate thoroughly. Focus on projects demonstrating real utility, credible teams, transparent tokenomics, and sustainable business models—not just hype or celebrity endorsements. Use resources like CryptoSlam for NFT market analytics.

Use trusted security tools. Hardware wallets like Ledger and Trezor protect private keys from online threats. Contract audits from reputable firms like OpenZeppelin and CertiK provide assurance about smart contract security. Positive community signals and transparent developer communication indicate healthier projects.

Evaluate liquidity carefully. Always consider exit strategies. Blue-chip collections typically offer better liquidity than newly launched projects. Use tools like NFT Price Floor and Nansen to track market trends. Understand that many NFTs may be difficult to resell quickly.

Understand protocol risks. DeFi-NFT hybrid protocols carry additional risks including smart contract vulnerabilities, liquidation scenarios, and platform-specific risks. Never invest more than you can afford to lose. Read Ethereum’s security best practices.

Get started safely with Ethereum. If you’re new to the Ethereum ecosystem and want to participate in NFT markets, it’s essential to understand how to acquire ETH securely. Check out our beginner’s guide on how to buy Ethereum safely in 2025 to get started on the right foot.

Final Take

Ethereum-based NFTs in 2025 have transcended the boom-bust hype cycles of previous years. While speculative trading has diminished, a leaner and more robust market persists—anchored by genuine utility, blockchain composability, and continuously evolving infrastructure. Ethereum maintains its position commanding a significant share of NFT trading volume, supported by technological upgrades like EIP-4844 that dramatically reduced transaction costs on Layer-2 solutions.

The future favors projects combining real-world utility with disciplined execution and sound risk management. Gaming integrations, tokenized real-world assets, digital identity systems, and DeFi applications represent areas where NFTs demonstrate practical value beyond collectibles. Hype alone won’t sustain projects—utility, proper execution, and robust risk controls will determine long-term success.

For participants in the 2025 NFT ecosystem, success requires moving beyond speculation toward understanding fundamentals, evaluating genuine use cases, and making informed decisions based on project quality rather than market sentiment alone.

Related Resources

- Ethereum Foundation

- EIP-4844 Documentation

- ERC-721 Standard

- ERC-1155 Standard

- ERC-2981 Royalty Standard

- OpenSea Marketplace

- Blur Marketplace

- Magic Eden

- DappRadar NFT Analytics

- CryptoSlam NFT Data

- RWA Tokenization Data

- Nansen Analytics

- CoinLedger NFT Research

- Grand View Research NFT Report

- Statista NFT Market Forecast

- ENS Domains

- Ethereum Security Best Practices