Are NFT Royalties Still Profitable for Artists in 2025?

The NFT marketplace has evolved dramatically since its 2021 peak. While digital artists initially celebrated recurring revenue through NFT royalties, the landscape has shifted. This comprehensive guide explores whether NFT royalties remain viable in 2025 and how creators can maximize their earnings.

What Are NFT Royalties? Understanding the Basics

NFT (Non-Fungible Token) represents a unique digital asset verified on blockchain technology, primarily Ethereum. In essence, creator royalties allow artists to earn a percentage (typically 2.5%–10%) from secondary sales of their work.

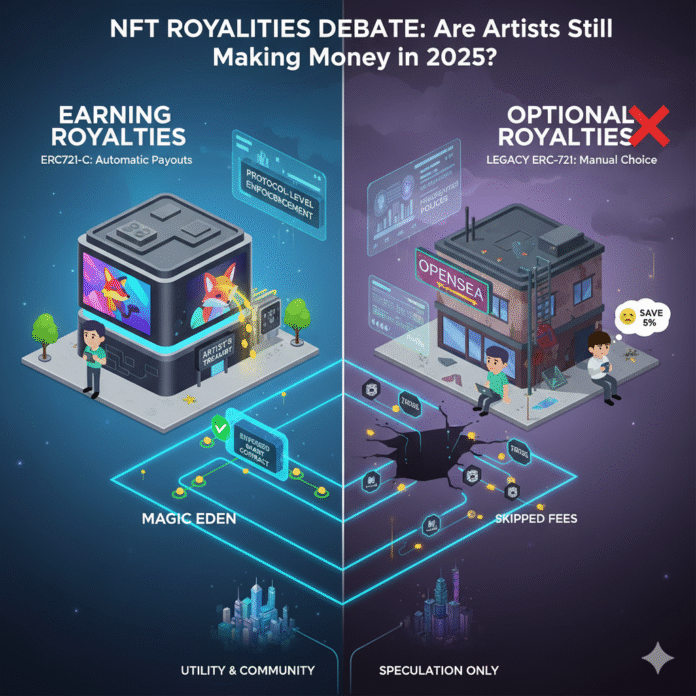

Technical Foundation: On the technical side, royalties operate through the EIP-2981 standard on Ethereum, which signals royalty information to marketplaces. Nevertheless, enforcement depends on marketplace policies and smart contract design—it’s not automatically guaranteed by default ERC-721 or ERC-1155 standards.

The Evolution of NFT Royalties: 2021–2025 Timeline

The Golden Era (2021–2022)

During the NFT boom, creator royalties on Ethereum surpassed $1.8 billion in cumulative payments, according to Galaxy Digital research. Consequently, artists enjoyed substantial passive income from secondary market trades.

The Turning Point (2023)

In August 2023, OpenSea—the largest NFT marketplace—announced optional creator fees, effectively ending mandatory royalty enforcement by early 2024. As a result, this policy shift catalyzed industry-wide changes, making royalty payments voluntary on most major platforms.

Current State: NFT Royalties in 2025

Royalties aren’t dead—they’ve transformed. Furthermore, success now requires strategic technical implementation and marketplace selection. For a broader perspective on whether NFTs on Ethereum are still relevant in 2025, market dynamics have fundamentally changed.

Enforcement Mechanisms That Work

1. Contract-Level Enforcement (EVM Chains)

Modern standards like ERC721-C and ERC1155-C enable smart contract-based royalty enforcement through:

- First and foremost, allow/deny lists for marketplace addresses

- Additionally, transfer validators that verify royalty compliance

- Moreover, on-chain enforcement logic

Notably, platforms like Magic Eden explicitly enforce royalties for ERC721-C collections while making them optional for legacy contracts.

2. Protocol-Level Enforcement (Alternative Chains)

Sui blockchain implements Transfer Policy and Kiosk systems that enforce royalties at the protocol layer—payments cannot be bypassed by switching marketplaces. In fact, this represents the future of guaranteed creator compensation. When comparing Ethereum vs Solana NFTs, protocol-level enforcement capabilities vary significantly across ecosystems.

3. Market Performance Data

July 2025 recorded approximately $574 million in NFT sales across all blockchains, according to Cointelegraph. Although volumes fluctuate, successful projects combine royalties with:

- Initially, utility-driven value propositions

- Subsequently, exclusive access and experiences

- In addition, physical merchandise

- Furthermore, intellectual property licensing

- Finally, brand partnerships

How to Actually Earn NFT Royalties in 2025

Artists making money from royalties share these characteristics:

✓ Use enforcement-capable smart contract standards (ERC721-C/1155-C or protocol-native tools)

✓ Subsequently, list on marketplaces respecting enforcement mechanisms

✓ Additionally, build genuine utility and engaged communities

✓ Most importantly, maintain consistent secondary market demand

In contrast, projects using legacy ERC-721/1155 contracts without enforcement mechanisms see royalties approaching zero on optional-fee marketplaces.

Major NFT Marketplace Royalty Policies (2025)

For a detailed comparison of platform features and fee structures, see our comprehensive guide on NFT marketplaces: OpenSea vs Blur vs Magic Eden.

OpenSea (Ethereum)

- Standard ERC-721/1155: Optional creator fees

- ERC721-C/1155-C with enforcement: Mandatory royalties

- Policy implemented August 2023

Magic Eden

- Ethereum: Enforced for ERC721-C; optional for standard contracts

- Solana: Supports Open Creator Protocol (OCP) and collection-specific mechanisms

- Enforcement depends on launch configuration

Blur, LooksRare, X2Y2

- Primarily zero-royalty or optional-fee models

- Competitive on trading fees to attract volume

- Limited creator royalty support

Case Study: Successful Royalty Implementation in 2025

Collections like Good Vibes Club on Ethereum demonstrate the viable path forward:

- Supply: ~6,969 NFTs

- Active secondary trading volume

- Healthy floor price maintenance

- Technical: Proper enforcement standards + compatible marketplace alignment

- Revenue: Meaningful royalties from resales

Key takeaway: In essence, demand combined with technical enforcement generates sustainable creator revenue.

Pros and Cons of NFT Royalties (2025 Reality Check)

Advantages

✓ Ongoing passive income for successful creators

✓ Aligns long-term incentives beyond initial mint

✓ Integrates with broader monetization strategies

✓ Rewards community building and sustained value creation

Disadvantages

✗ Optional enforcement trends toward zero on many platforms

✗ High royalty percentages can suppress trading volume

✗ Fragmented policies across chains and marketplaces

✗ Technical complexity for non-technical creators

Actionable Strategy: 7 Steps to Maximize NFT Royalties

1. Choose Enforcement-Ready Technology

To begin with, deploy ERC721-C/1155-C contracts on EVM chains or use protocol-enforced chains like Sui. Importantly, avoid legacy standards if royalties matter to your business model.

2. Strategic Marketplace Selection

Next, list where your contract’s enforcement is respected. Therefore, research platform policies before launch—don’t assume universal support.

3. Build Real Utility

Furthermore, provide tangible value: exclusive access, events, physical products, intellectual property rights, or community experiences. Indeed, speculation alone won’t sustain demand. Similar to how DeFi protocols generate real revenue, NFT projects need sustainable value propositions.

4. Diversify Revenue Streams

Additionally, treat royalties as supplementary income. In particular, primary revenue sources should include:

- First, initial NFT sales

- Second, merchandise and physical products

- Third, licensing deals

- Fourth, community memberships

- Finally, brand collaborations

5. Transparent Communication

Moreover, publish clear royalty policies explaining your percentage and the value it funds. Notably, communities support creators who communicate openly.

6. Community Engagement

Similarly, active Discord, Twitter/X, and holder engagement sustains secondary market interest—which drives royalty opportunities.

7. Monitor and Adapt

Lastly, track marketplace policies, technical standards, and community feedback. Consequently, the NFT space evolves rapidly; flexibility matters.

The Future of NFT Creator Compensation

The 2025 reality demands intentionality. Artists still earn meaningful money from NFT royalties—but only through:

- Technical preparation: First, enforceable smart contracts

- Strategic platform choices: Then, compatible marketplaces

- Value creation: Additionally, utility beyond speculation

- Diversified business models: Finally, multiple revenue streams

In conclusion, the era of automatic, universal royalties has ended. Ultimately, the winners engineer their royalty infrastructure, then earn payments through genuine community value.

Related Resources

- Ethereum.org: Understanding NFTs

- EIP-2981 Technical Documentation

- OpenSea Creator Resources

- Magic Eden Help Center

- Sui Documentation: Transfer Policy

Frequently Asked Questions

Q: Can I add royalties to existing NFT collections?

A: Unfortunately, it’s difficult with legacy contracts. Therefore, new deployments with ERC721-C or migration strategies may be necessary.

Q: What’s the optimal royalty percentage in 2025?

A: Generally speaking, 2.5%–5% balances creator compensation with trading volume. However, higher percentages require exceptional utility justification.

Q: Which blockchain offers best royalty enforcement?

A: Currently, Sui provides protocol-level enforcement. Meanwhile, Ethereum with ERC721-C offers strong contract-level options.

Q: Do all marketplaces honor royalties?

A: No. Consequently, research each platform’s policy and ensure technical compatibility before listing.