Imagine logging into your crypto exchange account one morning only to find your balance wiped clean – poof, gone. It’s a gut-wrenching scenario that’s hit way too many folks, including some I know personally.

In the fast-paced world of cryptocurrency, where fortunes can be made or lost in a blink, security is your best friend. Here’s the deal: according to recent reports, hackers stole a staggering $2.17 billion in crypto in just the first half of 2025. That’s not just numbers on a screen; that’s real people’s hard-earned money vanishing into the digital ether. Whether you’re a complete beginner just buying your first Bitcoin on a crypto exchange, or an intermediate investor juggling ETH and altcoins, you can’t afford to ignore this.

I’ve been writing about crypto for over a decade, and let me tell you, I’ve seen the good, the bad, and the ugly. Back in my early days, I almost fell for a slick phishing scam that looked just like my exchange’s login page. Trust me, it was a wake-up call. This guide is packed with practical advice to help you avoid those pitfalls. We’ll cover everything from picking a secure crypto exchange to advanced tricks that keep pros safe.

What You’ll Learn From This Guide

By the end, you’ll know:

- The major risks lurking on crypto exchanges and how to spot them

- How to choose and set up a crypto exchange with top-notch security

- Essential tools like two-factor authentication and hardware wallets

- Ways to dodge common scams that trap even savvy users

- What to do if the worst happens and how to recover

Plus, we’ll throw in some pro tips, warnings, and real-world examples to make it all stick.

Security Features Comparison Table

To kick things off, let’s look at a quick comparison of security features from popular crypto exchanges. This table will give you a snapshot to help decide where to start.

| Crypto Exchange | 2FA Options | Cold Storage Percentage | Insurance Coverage | Recent Security Audits |

|---|---|---|---|---|

| Coinbase | App, SMS, Hardware Key | 98% | FDIC-insured USD balances up to $250,000 per depositor | SOC reports (including SOC 2) by Deloitte and other auditors |

| Binance | App, SMS, Hardware Key | 95% | SAFU fund (over $1B) | Multiple third-party audits in 2025 |

| Kraken | App, Hardware Key (no SMS) | 95% | No direct broad deposit insurance, but strong reserves | ISO 27001 certified, 2025 review |

| Gemini | App, Hardware Key | 95%+ | FDIC for USD, crypto insurance | SOC 2 Type 2, 2025 |

This comparison shows why not all crypto exchanges are created equal when it comes to security. Now, let’s dive in.

Understanding the Risks on Crypto Exchanges

Let’s start with the basics: why is security such a big deal on a crypto exchange? Think of a crypto exchange like a bustling digital marketplace where you buy, sell, and trade cryptocurrencies. It’s convenient, sure, but it’s also a prime target for bad actors. In 2025 alone, major hacks like the Bybit breach, where hackers made off with $1.5 billion, show just how vulnerable these platforms can be.

The Three Main Categories of Crypto Exchange Risks

Here’s the thing – most risks come from three main areas: exchange vulnerabilities, user errors, and external threats. First, exchanges can get hacked if their systems aren’t ironclad. Remember the FTX collapse in 2022? While not a hack, it highlighted how internal issues can wipe out billions. Fast forward to 2025, and we’re seeing more sophisticated attacks, like the $90 million Nobitex hack linked to state-sponsored cyber ops.

Secondly, user errors are where most people trip up. Weak passwords, reusing them across sites, or clicking shady links – I’ve done it once, and it nearly cost me. Finally, external threats include phishing, malware, and social engineering, where scammers trick you into handing over your info.

Pro Tip: Always assume your crypto exchange could be targeted. Therefore, don’t keep all your eggs in one basket – spread your holdings.

Balancing Convenience and Security on Exchanges

To address common concerns: Is it safe to leave crypto on an exchange? For small amounts you trade often, yes, but for long-term holdings, no way.

Pros of keeping some funds on an exchange:

- Easy access for trading

- Built-in tools like charts and orders

- Some offer insurance

Cons:

- Risk of platform hacks

- You don’t control the private keys

- Potential for account freezes

In fact, Chainalysis reports show that illicit crypto activity still makes up well under 1% of total transaction volume, even though individual hacks in 2025 are hitting record levels. So, what can you do? Start by picking a reputable crypto exchange, which we’ll cover next. Bottom line: Knowledge is power. Understand these risks, and you’re already ahead of the game.

Choosing the Right Crypto Exchange for Security

Picking a crypto exchange isn’t just about low fees or fancy apps – security should be your top priority. I’ve tested dozens over the years, and let me explain why some stand out. For a comprehensive comparison, check out our guide on the 5 best crypto exchanges for beginners in 2025.

What Makes a Crypto Exchange Truly Secure

First, look for exchanges with a proven track record. Coinbase, for example, has been around since 2012 and provides FDIC-insured coverage on U.S. dollar balances up to $250,000 per depositor, while also carrying commercial crime insurance for certain digital asset losses. Similarly, Binance, the giant, has its SAFU fund worth over $1 billion to cover losses. Meanwhile, Kraken emphasizes security with no SMS 2FA to avoid SIM swaps.

What makes a crypto exchange secure? Cold storage is key – that’s where they keep most funds offline, away from hackers. Specifically, aim for 95% or higher. Additionally, regular audits by firms like Deloitte or Chainalysis are a must. Also, check for compliance like SOC 2 or ISO 27001.

Recommended Exchanges for Different User Levels

For beginners, Coinbase is my go-to recommendation because it’s user-friendly and has strong protections. If you’re ready to get started, sign up here: Get Started with Coinbase.

On the other hand, intermediate users might prefer Binance for its advanced features, but remember the 2025 CoinDCX incident, where about $44 million was drained from an internal operational wallet and investigators probed possible insider involvement? Consequently, always verify the exchange’s response to past incidents.

Warning: Avoid unregulated exchanges promising sky-high returns – they’re often scams.

Comparing Top Exchange Pros and Cons

Pros and cons of top exchanges:

- Coinbase: Pros – Easy interface, strong security, fiat insurance; Cons – Higher fees

- Binance: Pros – Low fees, vast selection; Cons – Past regulatory issues

- Kraken: Pros – Strong security focus; Cons – Steeper learning curve

Rhetorical question: Why risk your crypto on a shady platform when secure options exist? For more on selecting exchanges, check our related article on choosing cryptocurrency wallets.

In short, do your homework. A secure crypto exchange is your first line of defense.

Cryptocurrency Wallets Explained: How They Work and Stay Secure | 01

Source: https://vocal.media/01/cryptocurrency-wallets-explained-how-they-work-and-stay-secure

Setting Up Your Account Securely

Okay, you’ve chosen your crypto exchange – now what? Setting up your account right from the start can make all the difference. Let me walk you through it step by step, like I wish someone had for me when I started.

Creating Strong Passwords and Email Security

First, use a strong, unique password. None of that “password123” nonsense. Instead, aim for 16+ characters with mixes of letters, numbers, and symbols. I use a password manager like LastPass – it’s a game-changer.

Next, enable two-factor authentication immediately. We’ll dive deeper later, but for now, know it’s like a second lock on your door.

Furthermore, verify your identity properly. Most reputable crypto exchanges require KYC (Know Your Customer) – it’s a pain, but it adds security layers.

Pro Tip: Create a dedicated email for your crypto activities. Don’t use your everyday Gmail; instead, something like ProtonMail for extra privacy.

Initial Funding and Testing Your Setup

Common objection: “This takes too long!” Sure, but think about the time you’d lose recovering from a hack. Real example: The 2025 Bybit hack showed that even large, well-resourced exchanges can still be breached, which is exactly why your personal setup matters.

Once set up, fund your account wisely. Start small, say $50, to test the waters. And remember, this isn’t investment advice – always do your own research. If you’re specifically interested in Ethereum, check out our guide on how to buy Ethereum safely in 2025. Additionally, if you’re curious about newer blockchain ecosystems, read about exploring the new generation of memecoins on TON and Base blockchains in 2025.

Mini-conclusion: A solid setup is your foundation. Get this right, and you’re off to a great start.

Implementing Two-Factor Authentication and Password Best Practices

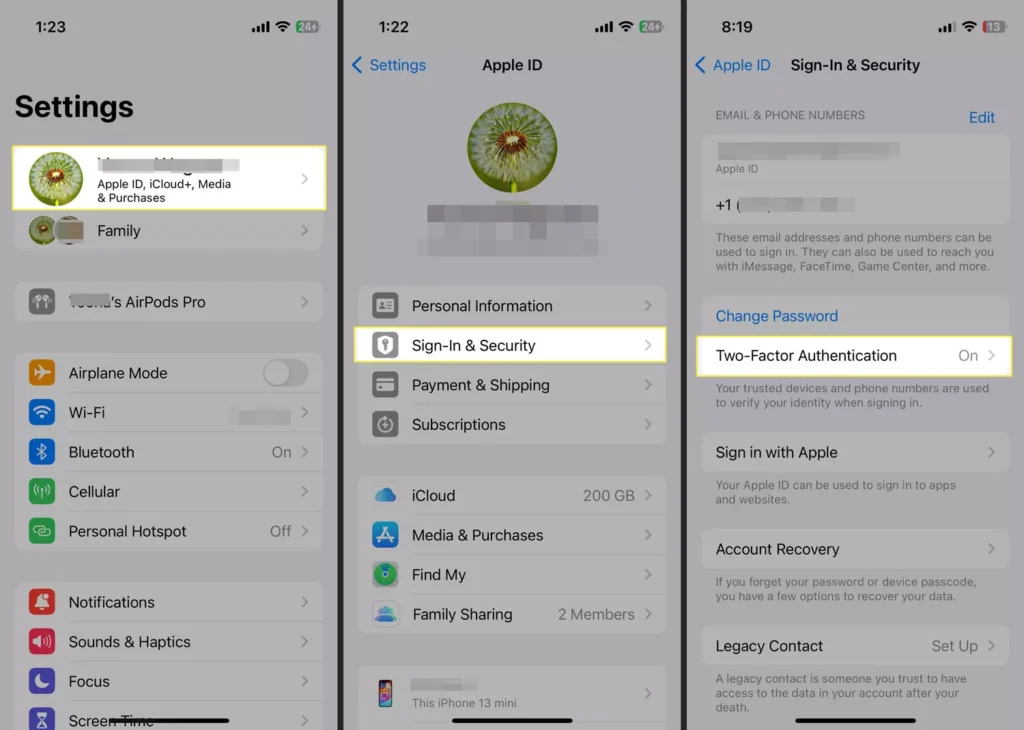

Here’s where things get practical. Two-factor authentication (2FA) is non-negotiable on any crypto exchange. It’s that extra step where you confirm login with a code from your phone or device.

Understanding Different 2FA Methods

Why bother? Because even if someone steals your password, they can’t get in without that second factor. Specifically, Coinbase and others recommend app-based 2FA like Google Authenticator over SMS, which can be hijacked via SIM swaps.

Let me break it down: Download an authenticator app, scan the QR code during setup, and boom – you’re protected. However, I prefer hardware keys like YubiKey for ultimate security.

Password Management Best Practices

For passwords, vary them and change regularly. Analogy: Treat your crypto exchange password like your house key – you wouldn’t leave copies everywhere.

Warning: Never reuse passwords across sites. A breach on one could compromise your crypto.

Pros of strong 2FA:

- Blocks 99% of account takeovers

- Easy to set up

- Free on most exchanges

Cons: If you lose your phone, recovery can be tricky – always back up codes.

Question: Have you enabled 2FA yet? If not, pause and do it now.

In my experience, this one step has saved countless users. Pair it with good habits, and your crypto exchange account is fortified. For detailed setup instructions, check out this guide on setting up two-factor authentication.

Source: https://www.lifewire.com/set-up-two-factor-authentication-on-iphone-4799065

Using Hardware Wallets for Extra Protection

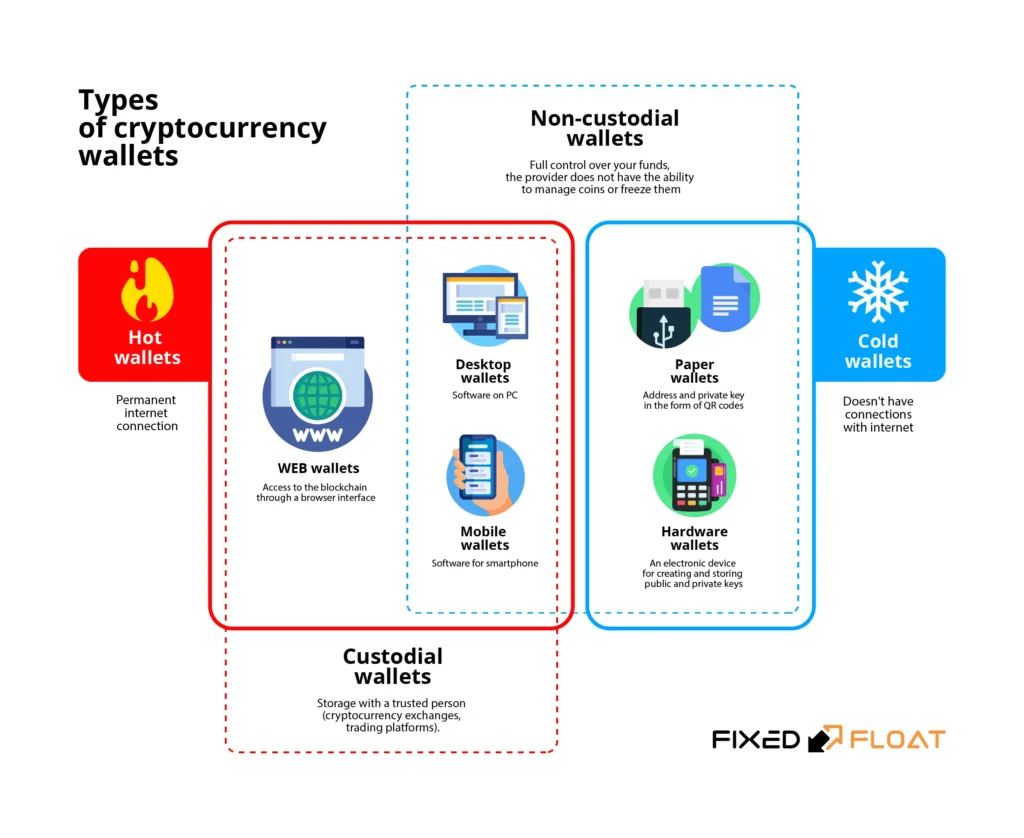

Don’t keep all your crypto on the exchange – that’s like leaving cash in a public locker. Enter hardware wallets: small devices that store your private keys offline. To understand why this matters, read our comprehensive guide on best crypto wallets for beginners.

How Hardware Wallets Work

Brands like Ledger or Trezor are popular. They look like USB drives but pack serious security. Moreover, your keys never touch the internet, so hackers can’t reach them.

I use a Ledger Nano S Plus, and it’s been rock-solid. For long-term holdings, transfer from your crypto exchange to the wallet. It’s simple: Generate an address, send, done. For a detailed comparison of wallet options, explore our article on the top 10 crypto wallets in 2025.

Case study: During the 2024 DMM Bitcoin hack, long-term holders who kept their funds in personal hardware wallets, off the exchange, were unaffected by that specific breach – their coins simply weren’t sitting in the compromised exchange wallets.

Weighing the Pros and Cons of Hardware Wallets

Pros:

- Offline storage (cold wallet)

- Supports multiple coins

- Physical confirmation for transactions

Cons:

- Cost ($50-150)

- Less convenient for frequent trading

Pro Tip: Back up your seed phrase on metal plates for fireproofing – I did, and it gives peace of mind.

Additional Resources for Wallet Security

If you’re holding more than a few hundred bucks, get one. For more on wallets, see our article on understanding different types of crypto wallets. Additionally, you can also learn about hardware wallet secure elements for deeper technical understanding.

Bottom line: Hardware wallets elevate your security game.

Hardware Wallet Secure Element: The Complete Guide – CoolWallet

Source: https://www.coolwallet.io/blogs/blog/hardware-wallet-secure-element-the-complete-guide

Avoiding Phishing and Common Crypto Scams

Scams are the silent killers in crypto. Phishing is the big one: Fake emails or sites mimicking your crypto exchange to steal login info.

Recognizing Phishing Attempts

I’ve gotten those “urgent” emails claiming my account is suspended – always check the URL. Real exchanges use .com, not weird variations. Furthermore, legitimate exchanges will never ask for your password via email.

Other scams: Pump-and-dump schemes, fake giveaways (Elon Musk didn’t promise you free BTC), and rug pulls in DeFi. Notably, in 2025, AI-powered deepfakes impersonated exchange CEOs and other public figures, tricking users out of millions.

Practical Steps to Protect Yourself

How to avoid? Never click unsolicited links. Use bookmarks for your crypto exchange. Additionally, don’t brag about holdings online. These principles apply across all crypto assets, including NFTs – check out our guide on NFT security best practices to learn how to protect your digital collectibles.

Warning: No legit exchange will ask for your seed phrase or remote access.

Pros of vigilance:

- Keeps your funds safe

- Builds smart habits

Question: Ever gotten a suspicious crypto message? Report it immediately.

Real-World Examples of Security Breaches

Real example: The 2025 Nobitex hack started with sophisticated targeting and exploited weaknesses in infrastructure and security practices – a reminder that attackers will probe both platforms and people.

For a comprehensive overview of scam types, read this guide on the most common crypto scams and how to avoid them. Moreover, the FBI’s Internet Crime Complaint Center also provides valuable resources on reporting and preventing crypto fraud.

The Most Common Crypto Scams and How to Avoid Them | P100 Blog

Source: https://www.p100.io/blog/the-most-common-crypto-scams-and-how-to-avoid-them

Best Practices for Transactions and Monitoring

Making transactions? Double-check addresses – one wrong character, and your crypto’s gone forever.

Setting Up Transaction Security Features

Use allowlisting on your crypto exchange: Only approved addresses can withdraw. This simple feature has saved countless users from sending funds to the wrong wallet or falling victim to clipboard malware that swaps addresses. Therefore, take the time to set this up properly.

Monitor regularly with apps like Blockfolio or CoinStats. Set alerts for unusual activity. I check mine every morning with coffee – it’s become a ritual. If you’re actively trading, check out our guide on what is crypto trading to understand the fundamentals.

Additional Safety Measures for Transactions

For intermediate folks, use VPNs on public Wi-Fi. Public networks are hunting grounds for packet sniffers and man-in-the-middle attacks.

Pro Tip: Test small transfers first. Send $5 worth before moving $5,000. Yeah, you’ll pay an extra transaction fee, but it’s insurance against costly mistakes.

Pros of consistent monitoring:

- Catches issues early

- Identifies unauthorized access quickly

- Helps track portfolio performance

Cons:

- Can be time-consuming

- May cause unnecessary anxiety if you check too often

Related Resources for Enhanced Security

For more strategies, check out this article on cryptocurrency security and protecting your investment. Additionally, if you’re dealing with stablecoins, read our comparison of stablecoins in 2025: DAI, USDC, and USDT.

In summary, consistent monitoring keeps you safe. Set up email or push notifications for withdrawals, logins from new devices, and changes to security settings.

Crypto currency Security, Digital Way to Protect Crypto Investment

Source: https://carajput.com/learn/cryptocurrency-security-a-digital-way-to-protect-investment.html

What to Do If Your Crypto Gets Compromised

It happens – even to careful people. However, how you respond makes all the difference. Here’s your action plan.

Immediate Response Steps

Immediate steps:

- Change passwords on your crypto exchange and email immediately

- Enable 2FA if not already active (better late than never)

- Contact the crypto exchange support team right away

- Check your email for unauthorized login notifications

Reporting and Recovery Process

If you’ve been hacked:

- Report to authorities like the FBI’s IC3 and local law enforcement

- Document everything: screenshots, transaction IDs, timestamps

- Use recovery tools if available through your exchange

- Check if your exchange has insurance coverage that applies

Example: Coinbase has a recovery process for compromised accounts that includes investigating suspicious activity and potentially reversing transactions in certain circumstances.

Long-Term Protection Strategies

Don’t panic; many users recover partial funds, especially if they act quickly. Furthermore, exchanges with insurance funds or coverage may compensate for certain types of breaches.

Pro Tip: Keep records of all your crypto transactions in a separate, secure location. If something goes wrong, this documentation becomes invaluable.

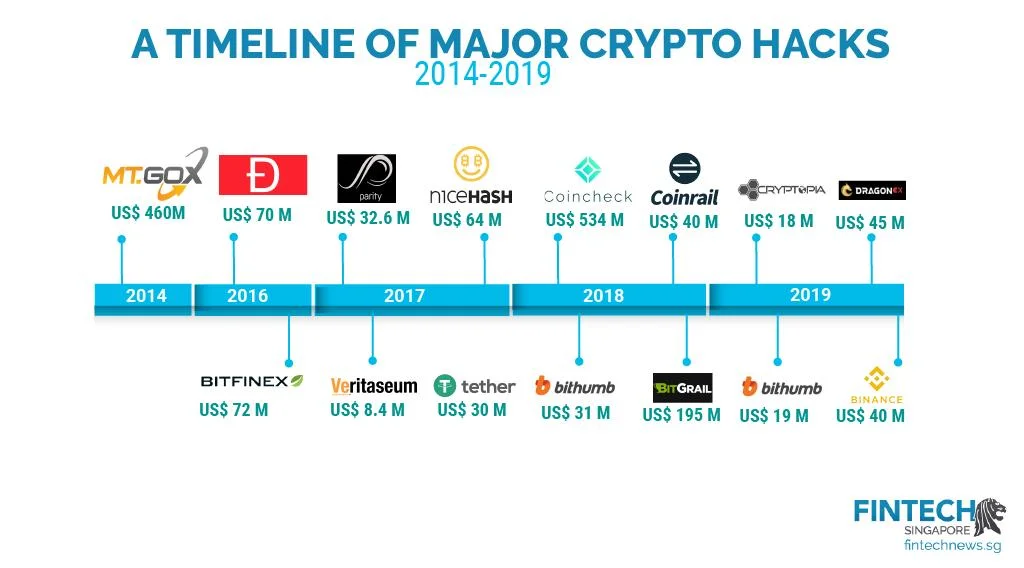

Mini-conclusion: Preparation minimizes damage. Having an incident response plan before you need one is smart risk management. For historical context on major breaches, this timeline of major crypto hacks offers perspective on the evolving threat landscape.

Fintech Singapore on X: “A timeline of major #crypto hacks https …

Source: https://twitter.com/fintechsin/status/1130037883598004229

Advanced Security Tips for Intermediate Users

Ready to level up? These advanced techniques aren’t necessary for everyone, but if you’re managing significant holdings or want maximum protection, they’re worth implementing.

Implementing Multisignature Security

Multisig wallets require multiple approvals for transactions. Think of it as requiring three signatures instead of one to withdraw funds. I’ve set up multisig for my long-term holdings, and while it adds friction, it’s worth the effort. Specifically, Gnosis Safe is a popular option.

Privacy considerations: Use privacy coins like Monero or coin mixing services ethically and legally. However, be aware that regulations around these tools vary by jurisdiction.

Advanced Protection Techniques

Air-gapped computers for signing transactions take security to another level. These are computers that have never connected to the internet, making them virtually unhackable.

Additional strategies:

- Use separate devices for crypto activities (dedicated phone or laptop)

- Implement IP allowlisting on your exchange account

- Set up email filters to catch phishing attempts

- Use Tails OS for ultra-private transactions

- Consider cold storage solutions like Glacier Protocol

Annual Security Audits

Pro Tip: Audit your setup yearly. Security isn’t a one-and-done deal – threats evolve, and so should your defenses.

For intermediate users managing larger portfolios, these measures aren’t paranoia; they’re prudent risk management. Moreover, the time invested in learning and implementing these tools pays dividends in peace of mind.

This levels up your protection significantly. The CryptoCurrency Security Standard (CCSS) provides a comprehensive framework if you want to dive deeper.

Understanding Different Types of Crypto Wallets – RedBelly Blockchain

Source: https://www.redbellyblockchain.io/researchpapers/understanding-different-types-of-crypto-wallets/

Last Updated: November 14, 2025

Frequently Asked Questions

Storage and Wallet Security

What is the safest way to store crypto?

The safest method is using a hardware wallet for long-term storage rather than leaving it on a crypto exchange. Hardware wallets keep your private keys offline and away from potential hackers.

How do I secure my crypto wallet?

Use strong, unique passwords, enable two-factor authentication, never share your seed phrase, and back up your recovery information in multiple secure locations.

Should I use a hardware wallet?

Yes, especially if you’re holding more than $500 worth of cryptocurrency. Hardware wallets provide offline storage and significantly reduce the risk of theft.

How do I backup my crypto seed phrase?

Write it down on paper or engrave it on metal plates, store copies in multiple secure locations (like a safe or safety deposit box), and never store it digitally or online.

Exchange Safety and Authentication

Is it safe to keep crypto on an exchange?

For active trading of small amounts, yes. However, move large holdings to personal wallets since exchanges remain prime targets for hackers and you don’t control the private keys.

What is two-factor authentication in crypto?

Two-factor authentication (2FA) is an extra verification step requiring a code from an app or device in addition to your password, blocking unauthorized access even if passwords are stolen.

How often should I check my crypto exchange account?

Daily for active traders to monitor positions and catch suspicious activity. Weekly for casual holders to verify balances and review account security settings.

What if my crypto exchange gets hacked?

If funds are insured by the exchange, you might recover losses. Otherwise, recovery is unlikely – which is exactly why you shouldn’t keep all your crypto on exchanges.

Scam Prevention

How can I avoid crypto phishing scams?

Verify URLs carefully, don’t click unknown links, use official apps, bookmark your exchange login pages, and never share your seed phrase or private keys with anyone.

What are common crypto scams?

Common scams include phishing emails, fake giveaways, pump-and-dump schemes, rug pulls in DeFi projects, impersonation scams, and fake investment opportunities promising guaranteed returns.

Conclusion

Wrapping up, keeping your crypto safe on a crypto exchange boils down to smart choices, strong setups, and constant vigilance. We’ve covered risks, setups, tools, and recovery – now it’s your turn to act.

Next steps: Choose a secure exchange like Coinbase or Binance, set up 2FA immediately, get a hardware wallet for long-term holdings, and monitor your accounts regularly. If you’re new, start small and learn as you go. Remember, this isn’t financial advice – consult professionals for personalized guidance.

Ready to secure your crypto? Try Coinbase to get started with a beginner-friendly platform. Or explore Binance for more advanced trading features.

The crypto space offers incredible opportunities, but only if you protect what’s yours. Therefore, your future self will thank you for taking security seriously today. Stay safe out there, and remember: in crypto, you’re your own bank – which means you’re also your own security guard.

Don’t wait for a wake-up call. Implement these strategies now, stay informed about emerging threats, and keep your digital assets locked down tight. Ultimately, the best time to strengthen your security was yesterday. The second best time is right now.