In the world of blockchain and cryptocurrencies, especially on networks like Ethereum, there’s a hidden layer of activity that goes beyond simple buying and selling. Terms like “MEV” and “gas fee arbitrage” might sound technical, but they play a huge role in how transactions happen and how some people make extra money. If you’re new to crypto, think of the blockchain as a busy highway where transactions are cars trying to get to their destination. MEV and gas fee arbitrage are like savvy drivers finding shortcuts or paying for VIP lanes to get ahead.

This article breaks it all down in simple terms. We’ll explore what MEV is, how it works, and why it’s important. Then, we’ll dive into gas fee arbitrage, showing how it ties into MEV with real-world examples. By the end, you’ll understand these concepts without feeling overwhelmed. Let’s get started.

What Is MEV? The Basics of Maximal Extractable Value

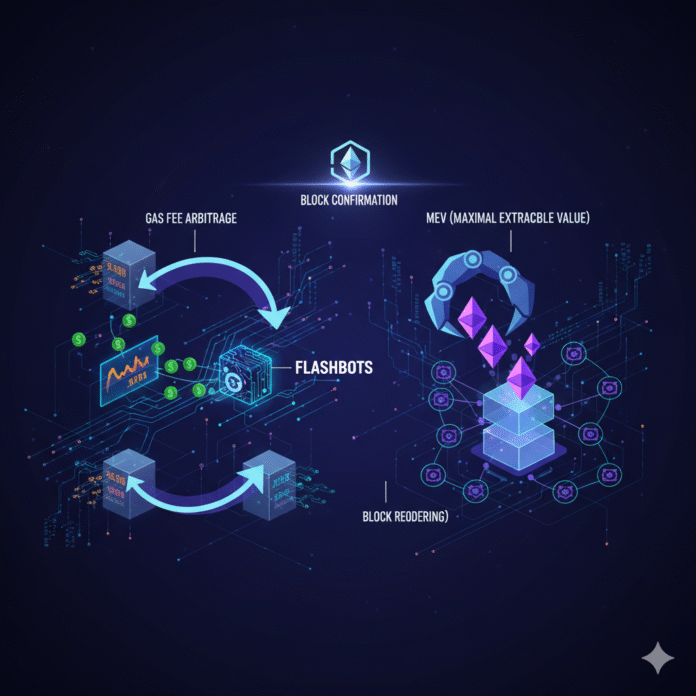

Maximal Extractable Value, or MEV, is essentially the extra profit that blockchain validators (or miners in older systems) can earn by controlling the order of transactions in a block. Originally called “Miner Extractable Value,” it was renamed to reflect that it’s not just miners anymore—especially after Ethereum switched to Proof-of-Stake in 2022, where validators take the lead.

Imagine you’re at a coffee shop, and the barista decides the order in which they make drinks. If someone tips extra, their order might jump ahead. Similarly, on the blockchain, transactions wait in a “mempool” (like a waiting room), and validators choose which ones to include and in what sequence. By rearranging them cleverly, validators—or bots working with them—can extract additional value.

MEV isn’t inherently bad; it’s a natural part of how blockchains work. It comes from users’ competing interests, like traders wanting the best prices or lenders avoiding losses. For beginners, think of it as the “hidden fee” or “extra juice” squeezed from the system. In 2025, with Ethereum’s ongoing business applications and upgrades, MEV remains a hot topic because it affects network fairness and efficiency.

How Does MEV Work on Ethereum?

Ethereum, the second-largest blockchain by market cap, is where MEV is most prominent. Here’s a step-by-step breakdown:

Transactions Enter the Mempool: When you send a transaction (like swapping tokens on Uniswap), it goes into the public mempool. Everyone can see it, including sophisticated bots and AI trading systems that continuously scan for opportunities.

Validators Spot Opportunities: Validators (or searchers using bots) scan for ways to profit. They might reorder transactions to buy low and sell high or front-run a big trade.

Block Building and Inclusion: The validator builds the block, including transactions that maximize their rewards. They get standard fees plus any MEV profits. Today this separation is implemented via MEV-Boost, an out-of-protocol, relay-based version of proposer-builder separation (PBS). Enshrined PBS is still being researched and is not part of the Ethereum protocol yet.

Why does this happen? Blockchains process transactions in batches (blocks), and order matters. A slight change can mean the difference between profit and loss in fast-moving markets. For example, if two people try to buy the same scarce NFT, the one with higher priority (via gas fees) gets it first.

MEV extraction has grown substantially. Estimates from public dashboards and regulators suggest hundreds of millions of dollars in MEV revenues have been captured on Ethereum since The Merge. For instance, EigenPhi estimates roughly $963M in MEV revenues and $417M in profits from December 2022 to January 2025. However, exact totals vary by methodology, so treat any single number with caution.

Common MEV Strategies: From Arbitrage to Attacks

MEV isn’t one thing; it’s a toolbox of strategies. Here are the main ones, explained simply with examples:

DEX Arbitrage: This is the most common. Bots spot price differences between decentralized exchanges (DEXs) like Uniswap and Sushiswap. They buy cheap on one and sell high on another in the same block, pocketing the difference minus fees. Example: If ETH is $2,500 on Uniswap but $2,510 on Curve due to a big trade, a bot arbitrages it instantly. Tools like DEX aggregators help optimize these trades across multiple platforms.

Front-Running: A bot sees your transaction in the mempool and submits its own ahead by paying higher gas fees. If you’re buying a token, the bot buys first, drives up the price, then sells to you at a profit. It’s like cutting in line at the grocery store. This practice is particularly common in volatile memecoin markets where price movements happen rapidly.

Sandwich Attacks: An advanced front-run. The bot places a buy order before yours (front-running) and a sell order after (back-running), squeezing profit from your slippage. Beginners often fall victim when trading volatile tokens, especially when using leverage in their trading strategies.

Liquidation Sniping: In lending protocols like Aave, if collateral drops below a threshold, loans can be liquidated. Bots compete to liquidate first for the bonus fee.

Back-Running: Less harmful, this involves placing a transaction right after a big one to capitalize on its effects, like arbitraging after an oracle update.

These strategies rely on speed and smarts. Bots often use Flashbots Protect and private bundles to bypass the public mempool and reduce the risk of being copied.

What Is Gas Fee Arbitrage? Tying It to MEV

Now, let’s zoom in on gas fee arbitrage, which is closely linked to MEV. Gas fees are the “fuel” you pay for Ethereum transactions—covering computation and storage. They’re calculated, post-EIP-1559, using Gas Used × (Base Fee + Priority Fee). The base fee is burned, while the tip goes to the proposer.

Gas fee arbitrage happens when participants (often MEV bots) exploit gas price dynamics or bid premium priority fees to secure profitable positions. It’s not about arbitraging gas itself but using gas as a tool for bigger gains.

Priority for Profit: In MEV scenarios, bots bid higher priority fees (tips) to get their transactions included first. This “gas war” drives up costs but can still be profitable if the arbitrage spread is wide enough.

Layer 2 Impact: On Ethereum Layer 2s like Arbitrum or Optimism, lower fees make arbitrage more accessible and complex bundles cheaper to execute—especially after EIP-4844 (proto-danksharding) reduced data costs for rollups.

Realistic Cost Context (2025): Typical fees fluctuate widely with demand. After EIP-4844, several analyses reported single-digit USD averages at times on L1 (while swaps can cost more), and much lower on L2s. Importantly, The Merge itself did not reduce fees—it changed consensus, not transaction costs.

Real-World Examples of Gas Fee Arbitrage and MEV

To make this concrete, consider illustrative patterns you can observe on public dashboards:

Flash Arbitrage via Private Bundles: A searcher simulates a Uniswap V3 price discrepancy, then sends a private bundle through Flashbots with a high priority fee to ensure inclusion, capturing the spread after gas. This pattern is consistent with Flashbots’ private transaction tooling.

Curve Pool Rebalance Back-Run: After a large deposit skews pool ratios on Curve, a back-running arbitrage restores prices across DEXs within the same block. This arbitrage and back-run behavior has been measured in academic studies of MEV.

High-Competition Liquidations: During sharp market moves, multiple searchers race—bidding up priority fees—to liquidate under-collateralized loans for a protocol-defined bonus. This is a well-documented category in MEV literature.

These examples show how gas fees are the “entry ticket” to MEV profits. Beginners can experiment on testnets or study public reports without risking real funds.

The Pros, Cons, and Future of MEV and Gas Fee Arbitrage

MEV has benefits: It can improve market efficiency by correcting prices quickly and helps compensate validators, supporting network security. Gas fee competition pushes innovation in routing, simulation, and infrastructure.

But there are downsides:

User Harm: Sandwich attacks cause slippage, costing traders money.

Centralization Risk: Specialized builders, searchers, and relays can concentrate power. PBS research and measurements flag ongoing centralization concerns.

Fee Externalities: Gas wars during hot opportunities can raise costs for everyone using the same blockspace.

Mitigations & What’s Actually Live Today

MEV-Boost (live): Relay-based, out-of-protocol PBS-like market that lets validators pick the most profitable built block. It’s not enshrined in the protocol.

MEV Protection / Private Orderflow (live): CoW Protocol’s batch auctions and MEV Blocker RPC reduce frontrun and sandwich risk and can rebate back-runs. Flashbots Protect supports private transactions.

Proto-Danksharding / EIP-4844 (live since 2024): Lowers L2 data costs, indirectly helping users by making rollups cheaper—though it doesn’t directly “remove MEV.” Full danksharding is a future scaling step focused on data availability.

Enshrined PBS (research/roadmap): Actively studied with the goal of integrating PBS into the protocol to reduce reliance on trusted relays, but it’s not on mainnet yet.

Conclusion: Navigating MEV and Gas Fees as a Beginner

MEV and gas fee arbitrage reveal the sophisticated underbelly of blockchain. While they enable profits and efficiency, they also highlight the need for fairness. As a newbie, start by using wallets or routers with MEV protection, monitor gas trackers, and learn from public dashboards rather than chasing opportunities blind.

Remember: Ethereum’s fee mechanics are EIP-1559-based (base fee plus tip), The Merge changed consensus (not fees), and L2s are where most users now find affordable execution. If you’re building on blockchain, consider how MEV impacts your dApps: protect users from sandwiching, evaluate private orderflow where appropriate, and keep an eye on PBS research and future enshrinement.

Understanding these concepts gives you a deeper appreciation for how blockchain networks operate behind the scenes—and helps you make smarter decisions as you navigate the crypto landscape.Retry