The cryptocurrency market continues to evolve rapidly in 2025. Bitcoin (BTC) and Ethereum (ETH) remain the dominant forces in digital finance. As of October 9, 2025, the crypto market stands at approximately $4.1 trillion. Investors now face a crucial decision: which digital asset offers better investment potential?

Understanding Bitcoin and Ethereum

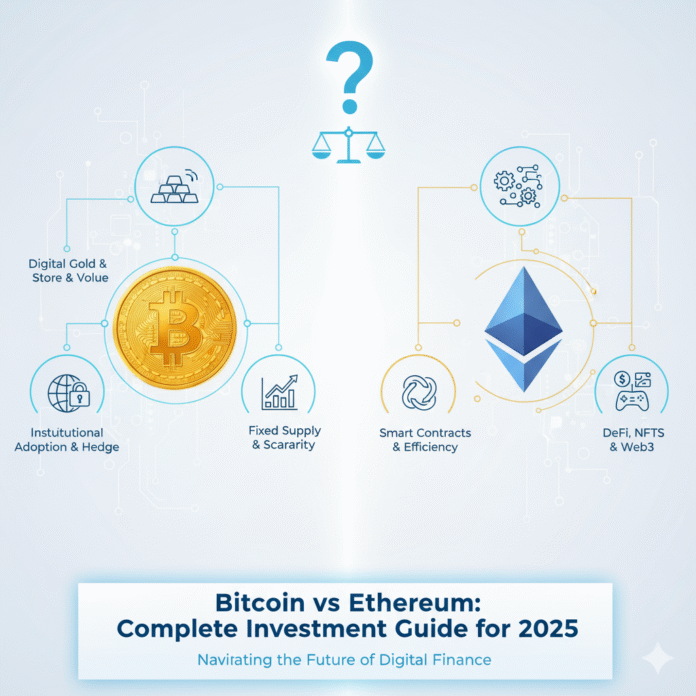

Bitcoin: Digital Gold Standard

Bitcoin launched in 2009 by the mysterious Satoshi Nakamoto. It revolutionized digital finance as the world’s first cryptocurrency. Operating on a decentralized blockchain network, it functions as “digital gold.” This creates a store of value independent of traditional banks.

Key Bitcoin Features:

The coin has a fixed supply capped at 21 million. It uses a Proof of Work system that is energy-intensive but highly secure. Market dominance remains strong with over $2.3–$2.5 trillion in market cap at recent October 2025 prices. The primary use centers on value storage and peer-to-peer transactions.

Ethereum: The World Computer

Vitalik Buterin created Ethereum in 2015. This platform extends beyond simple cryptocurrency transactions. The blockchain enables smart contracts and decentralized applications (dApps). It powers the DeFi ecosystem and NFT markets.

Key Ethereum Features:

Smart contracts execute agreements automatically through code. The network operates on an energy-efficient Proof of Stake system since 2022. This shift reduced energy use by roughly 99.95%. Unlike Bitcoin, there’s no fixed supply cap. Base fees are burned, making net supply mildly inflationary or deflationary based on activity. The platform serves dApps, DeFi, and Web3 applications.

Why Invest in Cryptocurrency in 2025?

Institutional adoption has accelerated significantly:

U.S. spot Bitcoin ETFs received approval on January 10, 2024. Spot Ether ETFs began trading on July 23, 2024. These mark major regulatory milestones. Companies like Strategy (formerly MicroStrategy) hold massive BTC treasuries. Reports show approximately 640,000 BTC as of October 2025.

El Salvador adopted Bitcoin as legal tender in 2021. This demonstrated government-level recognition. Many investors view scarce digital assets as a hedge against currency loss. Recent safe-haven flows support this narrative. Understanding how Bitcoin and Ethereum are regulated worldwide is crucial for informed investment decisions.

Bitcoin Investment Analysis 2025

Bitcoin Strengths

The coin maintains market leadership as the largest cryptocurrency by value. Strong brand recognition and institutional trust remain key advantages. Approximately 19.8 million of the 21 million total coins are already in circulation as of Q2 2025.

Institutional infrastructure has strengthened dramatically. Spot BTC ETFs saw very large inflows and assets under management in 2024–2025. BlackRock’s IBIT is nearing $100 billion in AUM. The network has operated for over 15 years without a protocol-level security breach.

Bitcoin Limitations

Scalability remains a challenge. On-chain throughput generally limits to 3–7 transactions per second. Energy consumption stays significant. Recent estimates place annual usage around 138 TWh according to 2025 Cambridge analysis.

Functionality is limited compared to programmable platforms. The focus stays on payments and value storage rather than broader applications.

Bitcoin Price Outlook

The coin reached new all-time highs above $125,000 in October 2025. ETF inflows and post-halving dynamics drove this growth. Forward price targets vary across analysts. Treat forecasts cautiously.

Ethereum Investment Analysis 2025

Ethereum Strengths

The platform demonstrates clear ecosystem dominance. It hosts thousands of dApps across DeFi, NFTs, and stablecoins. Energy efficiency improved dramatically after the 2022 Merge to Proof of Stake. Usage dropped approximately 99.95%.

Layer-2 scaling solutions now handle a large share of network activity. Arbitrum, Base, and Optimism enable very high throughput with low fees. Staking offers typical yields of 3%–5% APY depending on setup and MEV opportunities.

Developer engagement remains high. Millions of smart contracts have been deployed on the network.

Ethereum Challenges

Competition comes from alternatives like Solana that offer high throughput and low fees. Complexity creates challenges. Smart-contract risks can introduce attack vectors.

Fee volatility persists. Mainnet gas prices can still spike during congestion periods. Layer-2 solutions mitigate most of this impact.

Ethereum Price Outlook

ETH traded in the $4,100–$4,500 range in late September and early October 2025. Banks’ year-end targets vary. Citi’s baseline projection sits at $4,300. Some institutions forecast higher levels.

Investment Strategy Comparison

Choose Bitcoin If:

You are a risk-averse investor seeking digital asset exposure. An inflation hedge against fiat currency loss appeals to you. Long-term wealth preservation is your focus. You prefer a simple investment without technological complexity.

Choose Ethereum If:

You believe in Web3 and DeFi platform growth potential. Higher risk tolerance for potentially greater returns suits your profile. Earning staking income interests you. Exposure to innovation across dApps, NFTs, and Layer-2 systems appeals to your strategy.

Portfolio Diversification Strategy

Many experts prefer a balanced approach with various allocation models:

- 60% BTC / 40% ETH for stability-focused investors

- 40% BTC / 60% ETH for growth-oriented portfolios

- 50/50 for balanced exposure

These allocation examples are illustrative rather than specific advice.

Key Investment Risks

Market volatility presents significant challenges. Double-digit percentage swings are possible within weeks. Both BTC and ETH experienced this in September–October 2025.

Regulatory uncertainty creates ongoing concerns. Policy shifts can materially affect pricing and access. Technology risks include smart-contract bugs and network upgrade challenges.

Ongoing competition exists as new blockchain platforms challenge established leaders. Scaling models continue to evolve.

How to Invest Safely

Choose reputable exchanges like Coinbase, Kraken, or Binance. For those just starting out, explore the top crypto exchanges for beginners to find the platform that best suits your needs.

Secure long-term holdings in hardware wallets such as Ledger or Trezor. Learn more about the best crypto wallets for beginners to protect your investments. Start with small amounts you can afford to lose completely.

Stay informed through reputable sources like CoinDesk and Reuters. Employ dollar-cost averaging with fixed-amount purchases. This reduces timing risk.

2025 Market Outlook

The cryptocurrency market is maturing with record institutional participation. Spot ETFs for both BTC and ETH show rising assets under management. Layer-2 ecosystems continue improving cost efficiency and throughput. Stablecoin adoption supports increasing on-chain activity.

Key Trends:

Growing institutional access through regulated ETFs for both coins. Rising stablecoin usage across the technology stack. Layer-2 scaling solutions offload a significant share of transactions from the main network.

Final Investment Considerations

Neither coin represents a guaranteed investment opportunity. Success depends on market conditions, technological developments, and regulatory environments beyond investor control.

Before investing, conduct thorough research using multiple sources. Understand your risk tolerance and investment timeline. Consider consulting qualified financial advisors. Only invest funds you can afford to lose completely.

Both coins continue shaping the future of digital finance in 2025. One offers stability and broad institutional acceptance. The other provides innovation exposure and ecosystem growth potential. The optimal choice depends on your investment objectives, risk tolerance, and conviction in long-term crypto adoption.

Success in the volatile cryptocurrency market requires patience, research, and disciplined risk management.

External Resources

Regulatory & Market Data:

Research & Analysis:

- Investopedia Cryptocurrency Guide

- Reuters Markets Coverage

- Financial Times Digital Assets

- Barron’s Crypto Coverage

Technical Resources:

Trading & Storage:

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks, including total loss of capital. Always conduct your own research and consult with qualified financial professionals before making investment decisions.