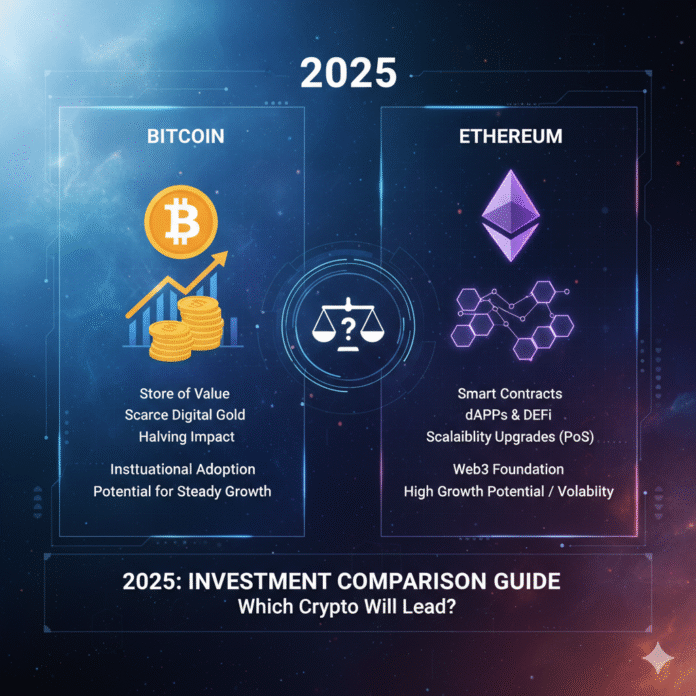

Are you trying to decide between Bitcoin and Ethereum for your investment portfolio in 2025? You’re not alone. As the crypto market evolves, these two giants continue to dominate discussions among beginners and seasoned investors alike. Bitcoin, often called “digital gold,” and Ethereum, the powerhouse behind smart contracts and decentralized apps, offer unique opportunities. But which one might be the better pick for 2025?

In this guide, we’ll break down the key differences, historical performance, current trends, price predictions, risks, and more. We’ll use simple language to make it easy for newcomers to grasp, while drawing on reliable data from trusted sources. By the end, you’ll have a clearer picture to help inform your decisions. Remember, this isn’t financial advice—always do your own research and consider your risk tolerance.

Understanding Bitcoin: The Original Cryptocurrency

Bitcoin (BTC) was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It’s designed as a peer-to-peer electronic cash system, but over time, it’s become more like a store of value—similar to gold. Bitcoin operates on a blockchain, a secure ledger that records all transactions without needing banks or governments.

Key features of Bitcoin include:

Proof-of-Work Consensus: Miners use powerful computers to solve puzzles and validate transactions, which makes the network secure but energy-intensive. Bitcoin targets a roughly 10-minute block interval, maintained by difficulty adjustments, as explained in Investopedia’s guide to Bitcoin mining.

Fixed Supply: There’s a hard cap of 21 million coins, creating scarcity. As of November 2025, approximately 19.95 million BTC are in circulation, according to YCharts data. The last coins are expected to be mined around 2140.

Use Cases: Primarily for holding as an asset, transferring value across borders, or as a hedge against inflation. It’s not built for complex applications like games or finance apps.

Bitcoin’s simplicity and security have attracted institutional investors. Spot Bitcoin ETFs launched in January 2024 and, by mid-2025 to early November 2025, have accumulated roughly $50–62 billion in cumulative net inflows across issuers, as reported by The Block and ForkLog. Bitcoin’s market cap in early November 2025 is around $2.0–2.1 trillion, per CoinMarketCap.

Think of Bitcoin like a reliable savings account in the digital world. If you’re new to crypto, starting with Bitcoin is often recommended because it’s less volatile than many alternatives and has a proven track record. For those ready to begin trading, check out our guide to the top 10 crypto exchanges for beginners in 2025.

Understanding Ethereum: The Programmable Blockchain

Ethereum (ETH), launched in 2015 by Vitalik Buterin and a team of developers, takes blockchain a step further. While Bitcoin focuses on basic transactions, Ethereum allows for “smart contracts“—self-executing code that runs automatically when conditions are met. This opens the door to decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

Key features of Ethereum include:

Proof-of-Stake Consensus: Since the 2022 “Merge” upgrade, Ethereum uses this energy-efficient method where validators stake ETH to secure the network, reducing energy use by roughly 99.95% versus the old system, according to the EU Blockchain Observatory and Forum.

No Hard Supply Cap: Ethereum doesn’t have a fixed limit like Bitcoin, but its issuance is controlled. The circulating supply is approximately 120.7 million ETH as of November 2025, per YCharts. Recent upgrades like Dencun (March 2024) significantly reduced Layer 2 data costs and helped slash user-level transaction costs, especially on rollups, as The Cryptonomist reports. For a deeper dive into Ethereum’s metrics, see our article on Ethereum in numbers: key stats and charts every investor should know.

Use Cases: Beyond payments, Ethereum powers DeFi, NFTs, decentralized apps (dApps), and tokenization of real-world assets. DeFi total value locked (TVL) across chains is approximately $136 billion as of now, according to DefiLlama.

Ethereum’s market cap in early November 2025 ranges roughly $410–$480 billion, depending on the day and data provider, making it about 2–3 times the next-largest altcoin, as tracked by YCharts.

For beginners, Ethereum might seem more complex, but it’s exciting if you’re interested in how blockchain can change finance or gaming. Imagine building a loan app that runs without a bank—that’s Ethereum in action. To understand how institutions are getting exposure to Ethereum, read our guide on Ethereum ETFs: how institutions are entering ETH in 2025.

Key Differences Between Bitcoin and Ethereum

To compare Bitcoin vs. Ethereum for investment in 2025, let’s look at the core distinctions. For a more comprehensive breakdown, check out our dedicated article on Bitcoin vs Ethereum: what’s the real difference in 2025.

Technology and Speed: Bitcoin’s average block interval is roughly 10 minutes, as documented on Bitcoin.org. Ethereum’s time is organized in 12-second “slots,” with effective block times around 12 seconds when slots are filled—so ETH settles much faster for simple transfers. Bitcoin lacks native smart contracts, while Ethereum supports Turing-complete smart contracts.

Supply and Economics: Bitcoin’s 21 million cap makes it structurally scarce. Ethereum’s supply is approximately 120.7 million and can be modestly inflationary or deflationary depending on burn and issuance dynamics. Staking yields vary but are commonly in the low single digits, per YCharts data.

Energy and Environment: Bitcoin’s Proof-of-Work is energy-intensive, consuming substantial electricity as detailed by the Cambridge Bitcoin Electricity Consumption Index. Ethereum’s Proof-of-Stake cut energy use by roughly 99.95%, according to the EU Blockchain Observatory.

Adoption and Ecosystem: Bitcoin leads in spot ETF adoption and cumulative flows, with approximately $60 billion by late October and early November 2025, as reported by The Block and ForkLog. Ether spot ETFs launched later (July 2024) and by mid-October 2025 had roughly $14.5 billion cumulative inflows, growing but still smaller than BTC’s.

In simple terms: Bitcoin is for storing value safely, like gold bars. Ethereum is for building and using digital tools, like a Swiss Army knife.

Historical Performance: Lessons from the Past

Looking back helps predict the future. Exact multi-year compound annual growth rate figures vary by the start and end dates you pick and aren’t consistent across sources, but the pattern is clear: over longer windows since 2017, BTC has generally outperformed on a compounded basis, while ETH tends to outperform during innovation-driven bull phases, such as DeFi and NFT cycles. Rather than hard CAGRs, focus on cycle behavior and relative strength into and after halving years and major ETH upgrades.

Both assets have experienced significant volatility throughout their history, with bull and bear market cycles that have tested investor patience. Bitcoin’s 2017 peak near $20,000 was followed by an 80%+ decline, while its 2021 all-time high above $60,000 demonstrated renewed institutional interest.

2025 Performance So Far: Who’s Leading?

Point-in-time year-to-date percentages depend on the exact start date and provider and were inconsistent across sources. What we can verify:

Early November 2025 snapshots show BTC around $102,000–$109,000 with a market cap of approximately $2.0–2.1 trillion, and ETH around $3,400–$3,900 with a market cap of approximately $410–480 billion, according to CoinMarketCap and YCharts. On-chain activity on Ethereum has picked up alongside lower post-Dencun costs, particularly on Layer 2 solutions.

Cumulative ETF flows: Bitcoin spot ETFs have accumulated approximately $60 billion since launch. Ether ETFs have reached roughly $14.5 billion as of mid-October 2025, with flows that can swing week-to-week, per ForkLog. The growing institutional adoption through ETFs signals increasing mainstream acceptance of both cryptocurrencies.

Price Predictions for the End of 2025

Price forecasts vary, but here are sourced guideposts—remember, these are speculative:

Bitcoin: Several sell-side and research shops have cited $150,000 as a plausible 2025 print. Standard Chartered has mentioned $150,000–$200,000 scenarios, and mainstream analyses from outlets like Yahoo Finance discuss ranges from low six figures to more aggressive targets. Keep in mind that ultra-bullish projections from firms like ARK Invest are typically for 2030, not 2025, as reported by The Block.

Analysts at JPMorgan and Goldman Sachs have also weighed in on Bitcoin’s potential trajectory, considering factors like ETF adoption, halving cycles, and macroeconomic conditions.

Ethereum: Banks and analysts have $4,300–$7,500 year-end targets depending on adoption and macroeconomic conditions, according to Reuters. Retail-facing outlets sometimes cite $5,000–$10,000 scenarios in strong risk-on conditions. Ethereum’s price potential is closely tied to DeFi growth, Layer 2 adoption, and continued network upgrades.

Investment Risks to Consider

No investment is risk-free, especially in crypto:

Volatility: Both can swing wildly. Bitcoin has high volatility, with minimal consumer protections. Ethereum faces gas spikes under heavy demand, though post-Dencun costs on Layer 2s dropped dramatically, as The Cryptonomist notes. Understanding cryptocurrency volatility is crucial before investing.

Regulatory Scrutiny: Governments could impose rules affecting prices and ETF flows. Flows have swung between big inflows and outflows even in late 2025, as FinanceFeeds reports. The SEC’s approach to crypto regulation continues to evolve and impact market sentiment.

Competition and Tech Risks: Bitcoin has scalability constraints. Ethereum competes with faster Layer 1 blockchains like Solana and Avalanche, and is still evolving throughput via rollups and potential future slot-time changes, according to Unchained.

Security Concerns: While both networks are highly secure, investors face risks from exchange hacks, wallet vulnerabilities, and phishing attacks. Using hardware wallets and following crypto security best practices is essential.

Inflation-Hedge Claims: Neither has a century-long history. Narratives can shift with macroeconomic conditions.

For beginners, start small and use secure wallets. Diversify if possible—many hold both. When you’re ready to purchase, our guide to the top crypto exchanges for beginners can help you choose the right platform.

Which One Should You Choose in 2025?

It depends on your goals:

If you want stability and value preservation: Go with Bitcoin. It’s lower-risk in crypto terms and acts as a reserve asset, with deep ETF demand and a fixed supply, as The Block’s data shows. Bitcoin’s stock-to-flow model suggests continued scarcity-driven appreciation.

If you seek growth through innovation: Ethereum offers more upside via DeFi, Layer 2s, and staking—with materially lower post-Dencun costs, according to The Cryptonomist. Ethereum’s versatility makes it attractive for those interested in Web3 development and decentralized applications.

Many experts recommend a mix: 60–70% Bitcoin for safety, 30–40% Ethereum for potential gains. If you’re a hodler, BTC makes sense. If you’re into building or DeFi, ETH is your play. For a complete comparison to help with your decision, read our Bitcoin vs Ethereum: complete investment guide for 2025.

Dollar-Cost Averaging (DCA): Regardless of which you choose, consider a DCA strategy to reduce the impact of volatility. This involves investing fixed amounts at regular intervals rather than trying to time the market.

A Balanced Approach to Crypto Investing in 2025

Bitcoin and Ethereum are both powerhouse investments, each with strengths that could shine in 2025. Bitcoin’s scarcity and institutional backing make it a solid choice for long-term holding, while Ethereum’s versatility in DeFi and upgrades position it for growth. As of early November 2025, their combined market caps are already approximately $2.4–2.6 trillion, per CoinMarketCap, underscoring how much the space has matured.

For beginners, educate yourself, start slow, and monitor trends like ETF flows and network upgrades. Resources like CoinGecko, Messari, and Glassnode provide valuable on-chain analytics to inform your decisions.

Whether you pick Bitcoin, Ethereum, or both, the key is patience—crypto rewards those who understand the tech and manage risks. Always remember to conduct your own research and never invest more than you can afford to lose. Consider consulting with a financial advisor who understands cryptocurrency before making significant investment decisions.

The crypto market continues to evolve rapidly, with new developments in regulation, technology, and adoption shaping the landscape daily. Staying informed through reputable sources and maintaining a long-term perspective will serve you well in navigating this exciting but volatile asset class.