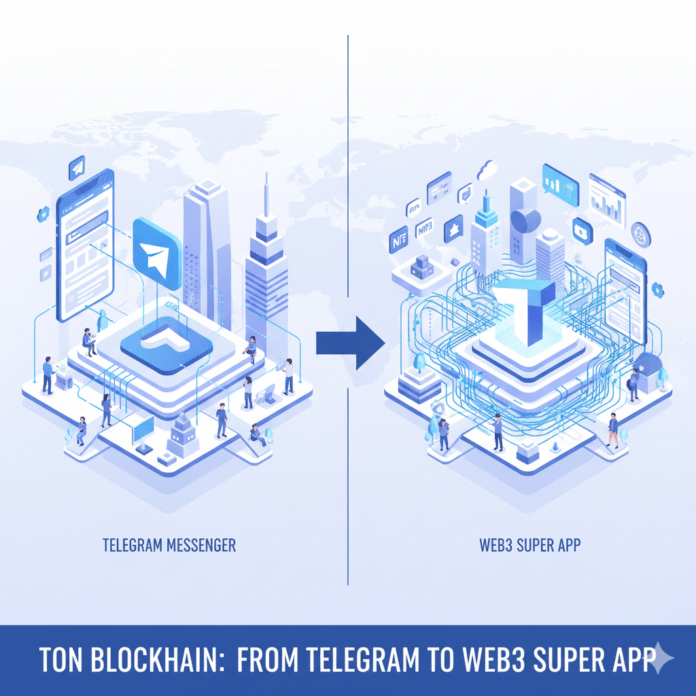

Telegram’s blockchain experiment has evolved dramatically. Today, it’s The Open Network (TON). This independent Layer-1 system integrates deeply with Telegram’s ecosystem. Moreover, it includes built-in wallets and crypto-based ad payments. Additionally, it features mini-apps, gaming platforms, and cross-chain bridges. Consequently, TON stands as one of the most ambitious mainstream Web3 projects.

The SEC Confrontation and Telegram’s Exit

Initially, TON began as the Telegram Open Network. The goal was clear: embed payments and DeFi directly into Telegram. In 2018, Telegram raised $1.7 billion through private Gram token sales. This marked one of blockchain’s largest fundraising efforts.

However, trouble emerged in October 2019. The U.S. Securities and Exchange Commission filed suit. They alleged unregistered securities offerings. Eventually, settlement came in June 2020. Telegram returned $1.224 billion to investors. Additionally, they paid an $18.5 million penalty. As a result, Telegram officially ended its involvement.

Nevertheless, community developers revived the project. They renamed it The Open Network (TON). Furthermore, they established the non-profit TON Foundation in Switzerland. The Gram token became Toncoin. Meanwhile, the original technical design remained mostly intact.

Technical Architecture and Performance Capabilities

TON operates as a native Layer-1 blockchain. It uses Proof of Stake consensus. Moreover, it employs dynamic sharding architecture. This includes a masterchain that coordinates multiple workchains and shardchains. Therefore, the network achieves better scalability.

In 2024, a controlled stress test showed impressive results. Specifically, the network processed 104,715 transactions per second. However, this represented ideal conditions. It wasn’t sustained mainnet performance. Nevertheless, this benchmark shows the network’s theoretical capacity. For context on how TON compares to other high-performance chains, see our analysis of Solana and TON: why these chains are rising but still can’t kill Ethereum.

Smart contracts run within the TON Virtual Machine (TVM). Developers use specialized languages like FunC and TACT. Additionally, the Jetton standard makes creating fungible tokens easier.

Technical documentation:

Telegram Integration: The Return to Native Territory

The Telegram-TON relationship evolved through key milestones. Here’s how it unfolded:

@wallet Bot (2022): First, this introduced peer-to-peer Toncoin transfers. Users could send crypto directly within Telegram chats. This marked the initial step toward in-app cryptocurrency features.

TON Space (September 2023): Next, Telegram launched a self-custodial wallet. It embedded directly in the application. Consequently, users no longer needed external wallet apps. For those evaluating wallet options across different blockchains, our guide to the top 10 crypto wallets in 2025 provides comprehensive comparisons.

Cryptocurrency Ad Revenue (2024): Then, Telegram started paying channel owners in Toncoin. This created a direct economic loop. Content creators earned cryptocurrency automatically.

U.S. Market Expansion (July 2025): Subsequently, Telegram launched the TON Wallet mini-app. It reached 87 million U.S. users. The app enabled full crypto functionality. As a result, Toncoin prices rose approximately 3%.

Exclusive Blockchain Partnership (2025): Most significantly, Telegram and TON Foundation expanded their partnership. TON became the exclusive infrastructure for Telegram’s mini apps. Furthermore, all wallet interactions must use TON Connect. This effectively made TON the sole blockchain for Telegram’s in-app economy.

Importantly, this exclusivity requirement had major consequences. Third-party mini apps on other blockchains faced a choice. They could migrate to TON or lose platform support.

Explore TON’s Telegram integration:

Ecosystem Development: DeFi, Gaming, and Applications

Mini Applications: Telegram mini apps support multiple payment methods. These include both cryptocurrency and fiat options. Specifically, users can pay with Google Pay or Apple Pay. Additionally, apps feature push notifications and authorization workflows.

Gaming and User Onboarding: Meanwhile, projects like Notcoin and Hamster Kombat serve key roles. They help onboard non-crypto users into TON. Notably, Hamster Kombat expanded further in 2025. They deployed a Layer-2 solution on TON. Understanding how blockchain games actually work provides valuable context for evaluating these gaming initiatives.

Decentralized Finance: Furthermore, protocols like STON.fi and DeDust operate as primary exchanges. They offer liquidity pooling services. Additionally, users can stake tokens and trade freely.

Cross-Chain Infrastructure: The original TON bridges have been retired. These connected to Ethereum and BNB Chain. Instead, the network now uses LayerZero and Stargate-style solutions. This represents a strategic shift. However, it also introduces bridge security risks.

Ecosystem resources:

Adoption Metrics and Market Position

Telegram’s user base is massive. According to TON Foundation announcements, it reaches 950 million monthly active users. This provides huge potential for blockchain adoption.

Currently, Toncoin’s market cap stands at approximately $7.7 billion. This calculation uses circulating supply and current pricing from CoinGecko. The token trades between $2.70 and $3.50 across exchanges. These figures reflect late 2025 data. For newcomers looking to purchase Toncoin, our guide to the top 10 crypto exchanges for beginners in 2025 covers the best platforms supporting TON trading.

These numbers show meaningful traction. However, market conditions remain dynamic. User adoption patterns continue to evolve. For a detailed comparison with another major Asian blockchain project, read our analysis of TON vs TRON.

Market data sources:

Current Capabilities for Users

The TON ecosystem enables several practical uses:

First, users can hold and transact Toncoin within Telegram. They can also use USDT. This works through TON Space or mini app interfaces. Second, users can stake assets. This generates yield through DeFi protocols. Third, mini apps enable various activities. These include payments, gaming, and buying digital goods. Finally, users can interact with cross-chain assets. Approved solutions like LayerZero make this possible.

However, availability varies by region. Additionally, different clients offer different features. Regulatory limits may restrict full access in some areas.

Risk Factors and Critical Considerations

Regulatory Uncertainty: Telegram’s previous SEC confrontation serves as a warning. Blockchain integrations in mass-market apps face ongoing legal review. Therefore, regulatory risk remains significant.

Bridge Security Vulnerabilities: Cross-chain bridges face frequent attacks historically. They represent major targets in DeFi. Consequently, this creates potential security exposure for users.

Data Transparency: Many published numbers lack independent verification. Wallet user counts and engagement metrics often come from marketing materials. They rarely undergo independent audits. Therefore, treat these figures cautiously.

Centralization Concerns: The mandatory TON Connect requirement raises questions. TON’s exclusive status creates debate. Specifically, does Telegram exercise too much control? Can other blockchains operate fairly within the ecosystem? These remain open questions.

Performance Under Real Conditions: Public tests show high transaction speeds. However, sustained real-world performance differs significantly. Continuous usage under stress presents distinct challenges.

Security resources:

The Path Forward for TON

TON has transformed completely. It evolved from a discontinued Telegram project. Now it’s an independent Layer-1 blockchain. Moreover, it features unique integration within Telegram’s platform. The ecosystem includes embedded wallets and crypto-based ad revenue. Additionally, it offers mini apps, DeFi protocols, and gaming. Consequently, it’s approaching true Web3 super app status.

Success depends on several key factors. First, regulatory clarity must improve. Second, bridge security needs continuous maintenance. Third, user adoption must remain strong. All these factors continue evolving.

Nevertheless, TON represents a practical approach among blockchain projects. It pursues mainstream adoption effectively. The strategy leverages Telegram’s massive user base. Meanwhile, it maintains technical independence. This creates a distinct value proposition.

The infrastructure already exists. The user base is in place. However, one question remains unanswered. Will this integration model successfully bring cryptocurrency to mainstream audiences? Time will tell.

Stay updated: