Imagine a world where big banks, hedge funds, and corporations are diving into cryptocurrencies, not just as a side experiment, but as a core part of their investment strategy. That’s exactly what’s happening with Ethereum (ETH) in 2025, thanks to the rise of Ethereum Exchange-Traded Funds (ETFs).

If you’re new to crypto or investing, don’t worry—this article breaks it down in simple terms. We’ll explore what Ethereum ETFs are, why they’re attracting massive institutional interest, and what this means for the future of Ethereum and cryptocurrency investing.

What Are Ethereum ETFs?

An ETF, or Exchange-Traded Fund, is like a basket of investments you can buy and sell on a stock exchange. Instead of owning a single stock, an ETF can hold a mix of assets—stocks, bonds, or, in this case, Ethereum cryptocurrency.

An Ethereum ETF tracks the price of ETH. Instead of buying ETH directly on a crypto exchange like Coinbase or Binance and dealing with digital wallets or private keys, investors can simply buy ETF shares through their traditional brokerage account. These shares represent a slice of ETH held by the fund, making it easier for individuals and institutions to gain exposure to crypto in a safe and familiar way.

Launched in the U.S. in July 2024 following SEC approval, Ethereum ETFs quickly became a game-changer by opening the door for pension funds, banks, and asset managers to participate in Ethereum markets without the technical complexity of cryptocurrency custody.

Why Are Institutions Interested in Ethereum?

1. Ethereum’s Superpowers: Utility and Programmability

Unlike Bitcoin, often viewed as “digital gold,” Ethereum is a programmable blockchain platform—a foundation for decentralized applications (dApps). It powers DeFi (decentralized finance), real-world asset tokenization, and NFTs (non-fungible tokens).

In 2025, institutional adoption accelerated:

- BlackRock’s BUIDL fund and Sony’s Ethereum-based Layer-2 project Soneium highlight how institutions are using Ethereum for tokenized assets

- Over $45 billion is locked in DeFi protocols on Ethereum, according to DeFi Llama, demonstrating its role as critical financial infrastructure

- Major enterprises are building on Ethereum for supply chain management, digital identity, and asset tokenization

2. Staking Rewards – But Not in ETFs

Ethereum’s proof-of-stake consensus mechanism lets participants earn rewards (approximately 3–5% APR) by locking ETH to secure the network. For institutional investors seeking yield, this is attractive. Learn more about the top staking platforms and their APY rates.

⚠️ However, U.S. ETFs cannot stake ETH currently. The SEC prohibits funds from earning staking rewards due to regulatory concerns, so ETF investors get price exposure only—not the staking yield. Still, Ethereum staking strengthens the long-term investment case, even if ETFs don’t directly participate yet.

3. Regulatory Clarity in the United States

For years, regulatory uncertainty kept institutions away from crypto markets. But in 2024–25, clarity dramatically improved:

- The SEC approved spot Ethereum ETFs in July 2024, a watershed moment

- In July 2025, the SEC allowed in-kind creations and redemptions, making ETFs more capital-efficient and liquid

- The CFTC classifies ETH as a commodity, providing additional regulatory clarity

- While Congress hasn’t passed comprehensive crypto legislation, regulatory frameworks are stabilizing

This regulatory progress gave institutional investors the green light to scale their Ethereum exposure significantly.

4. Technology Upgrades and Network Development

Ethereum isn’t standing still—continuous technological improvements make it more scalable and efficient:

- Dencun Upgrade (March 2024): Introduced proto-danksharding (EIP-4844), cutting Layer-2 transaction fees by up to 90%

- Pectra Upgrade (May 2025): Brought wallet improvements (EIP-7702), validator flexibility, and enhanced security features

- Fusaka Upgrade (planned Q4 2025): Expected to implement PeerDAS and deliver further scalability improvements

These upgrades demonstrate that Ethereum is future-proofing itself for mass institutional adoption and mainstream use cases.

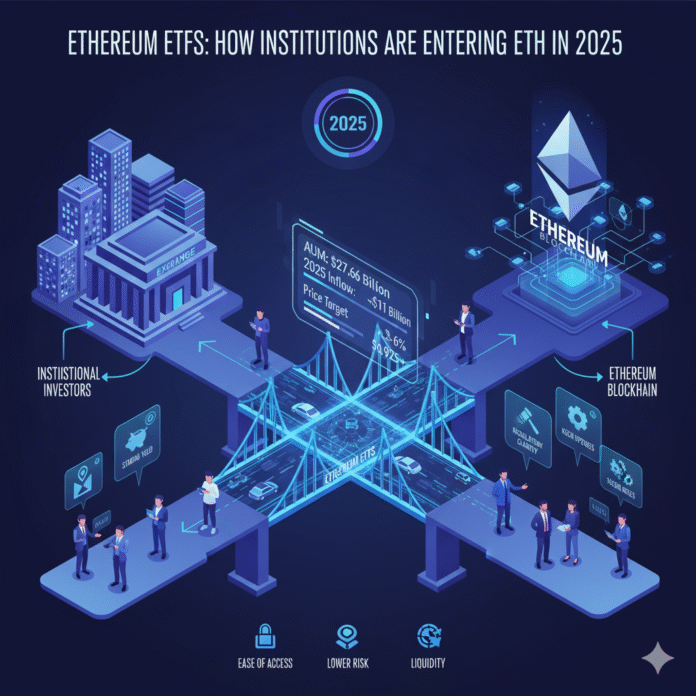

The Numbers Tell the Institutional Adoption Story

The data reveals unprecedented institutional interest in Ethereum ETFs. For a deeper dive into Ethereum’s key statistics and metrics:

- Total ETH held by ETFs: Approximately 6.3–6.8 million ETH (~5–5.6% of circulating supply)

- Assets under management (AUM): BlackRock’s iShares Ethereum Trust (ETHA) alone had $15.7 billion as of September 30, 2025

- Record flows: August 2025 saw record inflows of $1 billion in a single day across ETH ETFs. On August 26, ETHA alone pulled in $323 million

- YTD Performance: Around $11 billion net inflows into ETH ETFs in 2025, while some Bitcoin ETFs experienced stagnation or outflows

- Corporate Treasury Adoption: Companies like Bitmine Immersion Technologies (163,000+ ETH) and SharpLink Gaming (hundreds of thousands ETH) are holding Ethereum directly

Together, this represents a massive institutional vote of confidence in ETH’s future as a core financial asset.

Why Ethereum ETFs Appeal to Institutional Investors

Ease of Access and Integration:

- ETFs trade on traditional stock exchanges like NYSE and Nasdaq

- Can fit seamlessly into 401(k) retirement plans, IRAs, and pension fund portfolios

- No need to manage crypto wallets, private keys, or exchange accounts

Trusted Institutional Custody:

- Managed by established firms like BlackRock, Fidelity, VanEck, and Franklin Templeton

- Institutional-grade security and compliance infrastructure

- Regulated by the SEC with strict reporting requirements

Transparency and Liquidity:

- Daily pricing, NAV reporting, and transparent holdings

- In-kind redemption mechanisms improve capital efficiency

- High trading volumes ensure easy entry and exit

Competitive Fee Structures:

- ETF expense ratios range from 0.19% to 0.25% annually

- Comparable to traditional index funds and much lower than actively managed funds

- No custody fees, withdrawal fees, or blockchain gas fees for investors

Important Risks to Consider

Market Volatility: ETH can experience 10–20% price swings in a single week. To understand historical patterns, review 10 years of Ethereum price data. While institutions typically have longer time horizons, individual investors should be prepared for significant short-term fluctuations.

Regulatory Evolution: U.S. regulatory clarity has improved significantly, but global regulations continue to evolve. Europe’s MiCA framework and Asian regulations may differ, potentially impacting international markets.

Layer-2 Network Dependence: Ethereum’s scalability strategy relies heavily on Layer-2 networks like Arbitrum, Optimism, and Polygon. Security failures in major L2 networks could impact the broader ecosystem.

No Staking Rewards: Unlike direct ETH ownership, U.S. ETF investors cannot earn staking yields, potentially underperforming versus direct staking by 3–5% annually.

What Ethereum ETFs Mean for the Future

Supply Pressure and Scarcity: ETFs combined with corporate treasuries are removing millions of ETH from circulation, pushing exchange balances to a 9-year low (~15–16M ETH). This supply crunch could support higher prices long-term.

Market Maturity and Stability: Institutional investors bring longer time horizons and less emotional trading, potentially reducing volatility compared to retail-driven market cycles of previous years.

Mainstream Financial Integration: The entry of BlackRock, Fidelity, VanEck, and major corporate treasuries makes Ethereum a core financial asset class, not just a speculative investment or technological experiment. To explore whether Ethereum will maintain its dominance through 2030, consider the long-term trajectory.

Price Predictions and Market Outlook: While inherently speculative, some analysts forecast ETH could reach $6,900–$13,000 by year-end 2025, depending on broader market conditions, regulatory developments, and continued institutional adoption. The institutional momentum is undeniable.

How New Investors Can Get Involved in Ethereum ETFs

Research Available ETFs: Compare leading options including:

- BlackRock’s iShares Ethereum Trust (ETHA)

- Fidelity Ethereum Fund (FETH)

- VanEck Ethereum ETF (ETHV)

- Franklin Ethereum ETF (EZET)

Start Small with Dollar-Cost Averaging: ETFs allow fractional share purchases—you can invest as little as $100 and build your position gradually over time to reduce timing risk.

Understand the Risk Profile: Cryptocurrency remains highly volatile. Treat Ethereum ETFs as a high-growth but high-risk allocation within a diversified portfolio (typically 5–10% maximum for most investors).

Stay Informed on Developments:

- Follow Ethereum’s technology upgrades like the upcoming Fusaka hard fork

- Monitor ETF flow data on platforms like Bloomberg or CoinDesk

- Track regulatory developments from the SEC and CFTC

Additional Resources for Learning More

- Official Ethereum Documentation: ethereum.org

- Ethereum Foundation: ethereum.foundation

- DeFi Analytics: DeFi Llama

- Crypto Market Data: CoinMarketCap, CoinGecko

- Regulatory Updates: SEC.gov, CFTC.gov

- Investment Education: Investopedia Crypto Guide

Conclusion: The Institutional Ethereum Era Has Arrived

In 2025, Ethereum ETFs are the bridge between Wall Street and Web3. With regulatory approval, massive institutional inflows totaling billions, and Ethereum’s unique utility powering DeFi, tokenization, and programmable finance, ETH has evolved beyond a speculative asset—it’s becoming critical financial infrastructure.

For institutional investors, Ethereum ETFs provide a regulated, simple, and liquid entry point to gain cryptocurrency exposure. For individual retail investors, they offer an accessible way to participate in Ethereum’s growth story without the technical complexity of handling wallets, private keys, or cryptocurrency exchanges.

If 2021 was the year of retail NFT mania and speculative excess, 2025 is shaping up as the year of institutional Ethereum adoption—and Exchange-Traded Funds are leading the charge.