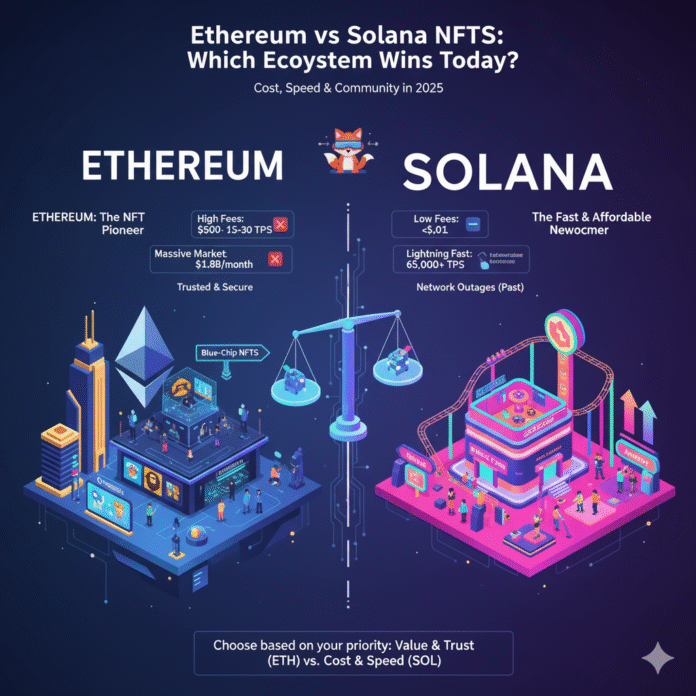

Non-fungible tokens, or NFTs, have revolutionized digital ownership. They’re unique digital assets—like digital art, collectibles, or virtual real estate—stored on a blockchain, which acts as a secure, immutable ledger. If you’re new to NFTs, you might be wondering where to start. Two of the biggest platforms for NFTs are Ethereum and Solana, and each has its own strengths and weaknesses. In this comprehensive guide, we’ll break down the differences between Ethereum NFTs and Solana NFTs so you can decide which ecosystem is better for you in 2025.

What Are NFTs and Why Do They Matter?

Imagine owning a one-of-a-kind trading card, like a rare Pokémon card—but it’s digital. Non-fungible tokens (NFTs) are exactly that: unique digital assets where the blockchain proves your ownership. You can buy, sell, or trade NFTs on specialized marketplaces, and they’re used for digital art, music, in-game items, virtual land in metaverses, and more.

Both Ethereum and Solana are two of the most important blockchains for NFT trading and creation, offering different experiences for creators, collectors, and investors.

Ethereum: The NFT Pioneer and Market Leader

Ethereum is the undisputed pioneer of the NFT space. Since its launch in 2015, it has become the foundation of the NFT world. Most of the famous NFT collections—like CryptoPunks and Bored Ape Yacht Club—originated on this blockchain. Its reputation, massive community, and robust security make it the go-to platform for high-value NFT projects.

Why People Choose Ethereum for NFTs

- Largest NFT Marketplace: Ethereum boasts the largest NFT ecosystem globally. Major marketplaces like OpenSea, Blur, and Rarible host millions of NFTs and attract the widest pool of buyers and sellers worldwide. For a detailed comparison of these platforms, check out our NFT marketplaces guide.

- Trusted and Secure Blockchain: With almost a decade of operational history, Ethereum is considered one of the most reliable and secure blockchains. Moreover, it successfully transitioned from Proof of Work to Proof of Stake in September 2022 (The Merge), cutting energy consumption by over 99.95% while maintaining industry-leading security.

- Blue-Chip NFT Projects: Premium collections like Bored Ape Yacht Club, CryptoPunks, and Azuki have sold individual NFTs for millions of dollars. As a result, Ethereum NFTs are often considered “blue-chip” assets—valuable, culturally significant, and more likely to retain long-term value.

- Strong Developer Ecosystem: Furthermore, Ethereum’s mature development tools, extensive documentation, and ERC-721 and ERC-1155 NFT standards make it the preferred choice for serious NFT projects.

The Downsides of Ethereum NFTs

- Higher Transaction Costs on Layer 1: While significantly lower than during the 2021 bull run, Ethereum’s base layer (L1) transaction fees typically range from $0.40–$2, with occasional spikes during network congestion. Check current Ethereum gas prices.

- Slower Transaction Speed: In comparison, Ethereum processes approximately 15–30 transactions per second (TPS) on its main chain, which is modest compared to newer blockchains like Solana. For a deeper dive into these performance differences, see our chain metrics comparison.

- Learning Curve for Beginners: To minimize costs, much NFT activity has shifted to Layer-2 solutions like Optimism, Arbitrum, and Base. However, this adds complexity for newcomers navigating the ecosystem.

Solana: The Fast and Affordable Alternative

Solana, launched in 2020, was designed from the ground up for high speed and ultra-low costs. Consequently, it has rapidly become a compelling alternative for NFTs, particularly among beginners, gamers, and traders seeking affordability. Understanding why Solana is rising helps explain its growing appeal in the NFT space.

Why People Choose Solana for NFTs

- Ultra-Low Transaction Fees: Solana transactions typically cost less than $0.0025 (a fraction of a cent). Therefore, minting, buying, or trading NFTs is incredibly affordable, making Solana exceptionally beginner-friendly and ideal for frequent traders.

- Lightning-Fast Speed: Solana can theoretically process up to 50,000 transactions per second, compared to Ethereum’s ~30 TPS. In practice, transactions feel nearly instantaneous, providing an excellent user experience.

- Rapidly Growing NFT Market: Collections like Degenerate Ape Academy and Solana Monkey Business have achieved significant success, with individual NFTs selling for over $1–2 million. Notably, in December 2023, Solana surpassed Ethereum in monthly NFT trading volume ($366.5M vs $353.2M).

- Gaming and Web3 Integration: Popular blockchain games like Star Atlas and Aurory leverage Solana’s speed and low costs for seamless in-game item trading. Additionally, Solana excels in profile-picture (PFP) projects, gaming NFTs, and experimental collections.

- User-Friendly Wallets: Meanwhile, wallets like Phantom offer intuitive interfaces that simplify NFT collecting for newcomers.

The Downsides of Solana NFTs

- Network Reliability Concerns: Unfortunately, Solana has experienced several major outages, including a 17-hour downtime in September 2021 and a five-hour outage in February 2024. Although the network is improving with upgrades like Frankendancer and the upcoming Firedancer client, reliability remains a consideration.

- Less Decentralized Network: As of 2025, Solana operates with approximately 1,300 consensus nodes, compared to Ethereum’s over 1 million validators. This makes Ethereum significantly more decentralized and censorship-resistant.

- Smaller Prestige Market: While growing rapidly, Solana’s NFT ecosystem still lacks the cultural prestige and established “blue-chip” collections that define Ethereum. For high-value art and collectibles, Ethereum remains the dominant choice.

Ethereum vs Solana NFTs: Head-to-Head Comparison

Cost – Winner: Solana

Solana’s near-zero transaction fees (under $0.0025) make it unbeatable for newcomers, frequent traders, and those minting multiple NFTs. Although Ethereum’s Layer-2 solutions have dramatically reduced costs, Solana still wins on raw affordability.

Speed – Winner: Solana

For raw throughput and instant transaction confirmation, Solana’s 50,000+ TPS capability far exceeds Ethereum’s 15-30 TPS on the main chain.

Market Size & Popularity – Winner: Ethereum

Ethereum hosts the largest NFT community, the most valuable collections, and the highest total trading volume. Furthermore, it remains the gold standard for prestigious NFT projects and attracts institutional collectors.

Security & Reliability – Winner: Ethereum

Ethereum has maintained continuous operation since 2015 without a complete network shutdown. Its massive validator network provides unparalleled security and decentralization. In contrast, Solana is improving but has experienced multiple outages.

NFT Categories – Different Strengths

- Ethereum: High-value digital art, prestigious collectibles, established brands, virtual real estate

- Solana: Gaming NFTs, affordable PFP projects, experimental collections, utility-focused NFTs

Beginner-Friendliness – Winner: Solana

Overall, Solana’s simplicity, minimal costs, instant transactions, and user-friendly wallets like Phantom make it more accessible for first-time NFT collectors.

What’s New in 2025? Latest Developments

Ethereum Updates

- Dencun Upgrade (March 2024): Introduced proto-danksharding (EIP-4844), slashing Layer-2 transaction costs by up to 90%.

- Pectra Upgrade (May 2025): Brought wallet improvements (EIP-7702), flexible staking (EIP-7251), and further scaling enhancements.

- Layer-2 Dominance: Subsequently, most Ethereum NFT activity has migrated to L2s like Base, Arbitrum, and Optimism, where fees are just a few cents.

Solana Updates

- Seeker Smartphone Launch: In 2025, Solana released the Seeker mobile device (formerly Saga Chapter 2), deeply integrating Solana blockchain features into mobile hardware.

- State Compression Technology: Additionally, advances in compressed NFTs enable ultra-cheap minting for mass-market games and applications.

- Firedancer Development: Meanwhile, continued progress on the high-performance Firedancer validator client, designed to dramatically increase network throughput and reliability.

Which NFT Ecosystem Should You Choose in 2025?

The answer depends on your specific goals and priorities:

Choose Ethereum NFTs if:

- You’re seeking prestige, cultural significance, and long-term investment value

- You want access to the largest, most established NFT marketplace

- You’re interested in blue-chip collections and high-value digital art

- Security and decentralization are top priorities

- You’re willing to use Layer-2 solutions to minimize costs

Ethereum is the “premier art gallery” of NFTs—home to the most famous collections, strongest network effects, and highest liquidity for valuable assets.

Choose Solana NFTs if:

- You’re a beginner looking for an affordable entry point

- Transaction speed and minimal costs are crucial

- You’re interested in gaming NFTs, experimental projects, or frequent trading

- You want a simpler, more streamlined user experience

- You’re exploring emerging collections and communities

Solana is the “dynamic, accessible gallery”—offering fast-growing projects, gaming integration, and ultra-low barriers to entry.

The Bottom Line: Both Ecosystems Have Value

In 2025, both Ethereum and Solana occupy important niches in the NFT ecosystem. Indeed, many sophisticated collectors use Ethereum for high-value investments and established collections while leveraging Solana for gaming, experimentation, and affordable trading.

Ultimately, the NFT market is diverse enough to support multiple blockchains, each serving different needs. Your choice ultimately depends on whether you prioritize prestige and security (Ethereum) or speed and affordability (Solana)—or ideally, you can explore both ecosystems to maximize your opportunities. For broader context on how these platforms compare across different use cases, including DeFi, read our comprehensive blockchain comparison.