Ethereum (ETH) is one of the most exciting names in the world of cryptocurrency and blockchain technology. More than just the second largest cryptocurrency by market cap, it’s a whole ecosystem of decentralized applications (dApps), smart contracts, and blockchain innovation. If you’re beginning to dive into Ethereum investing, understanding Ethereum’s key metrics and statistics helps you see both the opportunities—and the risks.

What Is Ethereum?

Launched in 2015 by Vitalik Buterin and his team, Ethereum is a decentralized blockchain platform that enables developers to create smart contracts—self-executing agreements coded directly on the blockchain. Its native cryptocurrency, Ether (ETH), is used to pay for computation (gas fees), build decentralized applications (dApps), and deploy tokens on the Ethereum network.

In September 2022, Ethereum completed The Merge, transitioning from energy-intensive Proof-of-Work to efficient Proof-of-Stake consensus. This upgrade reduced Ethereum’s energy consumption by approximately 99.95%. Learn more about The Merge at Investopedia.

In May 2025, Ethereum executed the Pectra upgrade (which included EIP-7702), improving wallet abstractions, staking usability, and user experience, with mainnet activation reported for May 7, 2025. Additional details are available at QuickNode and Kraken.

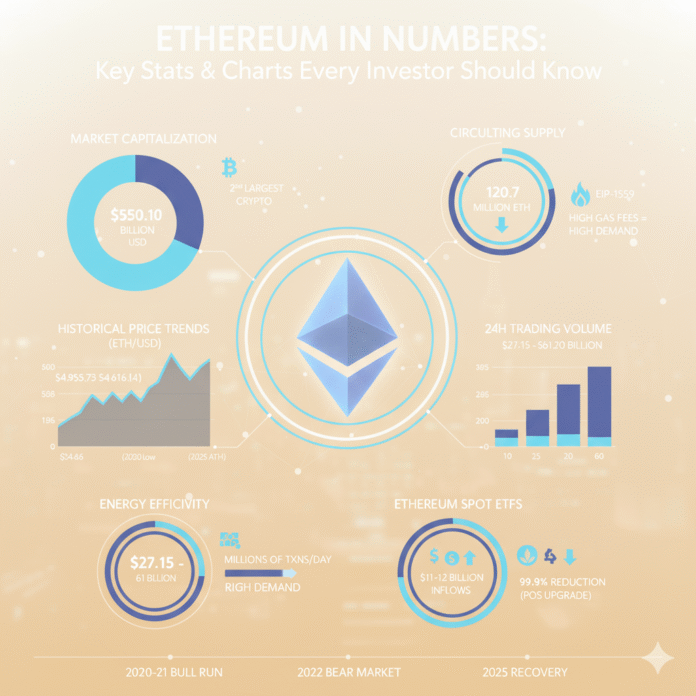

Key Ethereum Statistics (as of September 23, 2025)

Here are the most important Ethereum metrics every investor should track:

| Ethereum Metric | Current Value |

|---|---|

| ETH Price (USD) | ~$4,180 |

| All-Time High (ATH) | ~$4,946 (late August 2025) |

| Circulating Supply | ~120.70 million ETH |

| Market Capitalization | ~$505–515 billion USD |

| 24-Hour Trading Volume | ~$25–34 billion USD |

| Daily Transactions (L1) | ~1.4–1.6 million transactions |

| Transaction Speed (TPS) | ~15–25 transactions per second |

| Average Transaction Fee | Frequently under $1 USD |

| Energy Usage | ~0.0026 TWh/year (≈ 2,600 MWh/yr) |

| Spot ETH ETFs Holdings | ~6.8 million ETH (~5.6% of supply) |

| ETF Total AUM | ~$27.5B across U.S. spot ETH ETFs |

Price, supply, and market cap data align with major cryptocurrency trackers around September 23, 2025, including CoinMarketCap and Etherscan. Daily Layer 1 transactions in the 1.4–1.6 million range are consistent with Etherscan and YCharts time series data. Average transaction fees often under $1 are supported by YCharts recent daily averages. Energy usage at approximately 0.0026 TWh/year comes from CCRI’s post-Merge estimate. The all-time high near $4,950 in late August 2025 is reported by multiple cryptocurrency outlets. Spot ETH ETF holdings are approximately 6.8 million ETH, with assets under management totaling roughly $27.5 billion according to recent ETF dashboards and reports.

Track live data at CoinMarketCap, The Block, and Etherscan.

The SEC approved the rule changes (19b-4) for spot ETH ETFs in May 2024, and the first U.S. spot ETH ETFs began trading on July 23, 2024. Read the full announcement at Reuters.

Why These Numbers Matter for Ethereum Investors

Price and Market Cap Analysis

Ethereum’s market capitalization and price movements show the network’s scale and how the cryptocurrency market values it. With ETH approaching its all-time high, this suggests strong institutional and retail demand—but also increases the risk of potential price corrections. Follow market analysis at Axios.

Supply Dynamics and EIP-1559 Impact

Unlike Bitcoin’s fixed 21 million coin supply, Ethereum has no hard cap. However, the EIP-1559 fee burn mechanism means that during periods of high network usage, ETH supply can actually decrease, creating deflationary pressure. Learn more at Consensys.

Liquidity and Trading Volume

High daily trading volume indicates strong market liquidity, allowing large investors to enter and exit positions without excessively moving the market price, with ranges corroborated by major market trackers. Check current volume at CoinMarketCap.

Network Performance Metrics

While Ethereum’s base layer (Layer 1) processes approximately 15–25 TPS, it remains reliable and heavily utilized. Layer 2 scaling solutions offload significant activity from L1, which is visible in falling fees and sustained transaction counts post-upgrades. Monitor network performance at The Block.

Transaction Costs

Lower gas fees (often under $1) improve user experience and encourage more network activity. Recent daily averages confirm sub-$1 levels on many days. Track gas prices at YCharts.

Institutional Adoption via ETFs

Spot Ethereum ETFs, approved by the SEC in 2024 and launched in July 2024, bring traditional finance visibility, easier investment access, and help reduce regulatory friction around cryptocurrency investing. Recent weeks have shown ongoing net inflows and rising AUM. Follow ETF flows at Reuters.

Environmental Impact

For ESG-focused investors, Ethereum’s approximately 99.95% energy reduction post-Merge makes it significantly more energy-efficient than proof-of-work blockchains. Post-Merge electricity consumption is estimated near 2,600 MWh/year (approximately 0.0026 TWh). Read more at Consensys.

Key Ethereum Charts to Watch

ETH/USD Price Chart — Track support/resistance levels, volatility patterns, and bull vs bear market phases on TradingView. Recent ATH set in late August 2025 at approximately $4,950. Check out Axios coverage.

Market Cap and Supply Chart — Monitor valuation versus circulating supply changes due to staking rewards and fee burns on CoinMetrics. EIP-1559 burn contributes to supply pressure. Explore data at Consensys.

Trading Volume Analysis — Volume spikes often coincide with network upgrades or regulatory news, tracked on CoinGecko and major cryptocurrency trackers. Visit CoinMarketCap.

Network Activity Metrics — Track daily L1 transactions and watch L2 rollup dashboards on L2BEAT and The Block. Analyze the data at The Block.

Gas Fee Trends — Check Etherscan Gas Tracker for median fees and gas price patterns. Monitor fees at Etherscan.

ETF Flow and AUM Charts — Analyze money flows and AUM for spot ETH ETFs using CoinShares weekly reports and Reuters roundups. Read updates at Reuters.

Risks to Be Aware Of

Cryptocurrency Volatility — ETH can swing 20–50% over short periods; risk management is essential.

Blockchain Competition — Solana, Cardano and Layer 2 solutions improve fast; relative performance can shift.

Regulatory Uncertainty — Policy shifts on staking, taxation or ETF rules can move markets.

Technical and Smart Contract Risks — Bugs or upgrade issues can damage confidence and cause losses.

How to Start Investing in Ethereum

Choose a Reliable Platform

Centralized Exchanges: Coinbase, Binance, Kraken

Ethereum ETFs: Traditional brokerage accounts for simpler regulatory exposure

Decentralized Exchanges: Uniswap for direct blockchain interaction

Secure Storage Solutions

Hardware Wallets: Ledger, Trezor

Software Wallets: MetaMask, Trust Wallet

Track Essential Data Sources

Price and Market Data: CoinMarketCap, CoinGecko

Network Analytics: Etherscan

ETF Tracking: CoinShares and Reuters coverage of weekly flows

Risk Management Strategy

Start with smaller position sizes and scale in over time as you become comfortable with cryptocurrency market risks and Ethereum’s price volatility.

Bottom Line

Ethereum demonstrates strong fundamentals with a market capitalization exceeding $500 billion, substantial daily trading volumes, improving network efficiency, and growing institutional adoption through spot ETFs. The network’s future success depends on continued adoption, maintaining reasonable transaction fees, and avoiding major regulatory or technical setbacks.

Investment Disclaimer: This article is for informational and educational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks. Always conduct your own research and consider your risk tolerance before investing in Ethereum or any cryptocurrency.

About Ethereum Resources

Official Ethereum Website: ethereum.org

Ethereum Foundation: ethereum.foundation

Developer Documentation: docs.ethereum.org