What Are Smart Contracts? Understanding Blockchain Automation

Smart contracts are self-executing digital agreements that automatically run on blockchain networks like Ethereum when predetermined conditions are met. As the backbone of Decentralized Finance (DeFi), smart contracts eliminate intermediaries and enable trustless financial interactions. This comprehensive guide explains everything you need to know about smart contracts in 2025.

Smart Contract Definition: Digital Agreements That Execute Themselves

A smart contract is a computer program stored on a blockchain that automatically executes actions when specific conditions are fulfilled. Think of it as a digital vending machine: you insert money, select an item, and the machine automatically dispenses your purchase without human intervention.

Simple Smart Contract Analogy

Vending Machine = Smart Contract

- Input: Physical money → Cryptocurrency

- Condition: Item selection → Code execution

- Output: Product delivery → Automatic transaction

This automation makes smart contracts revolutionary for creating decentralized applications (dApps) and DeFi protocols.

Related resources:

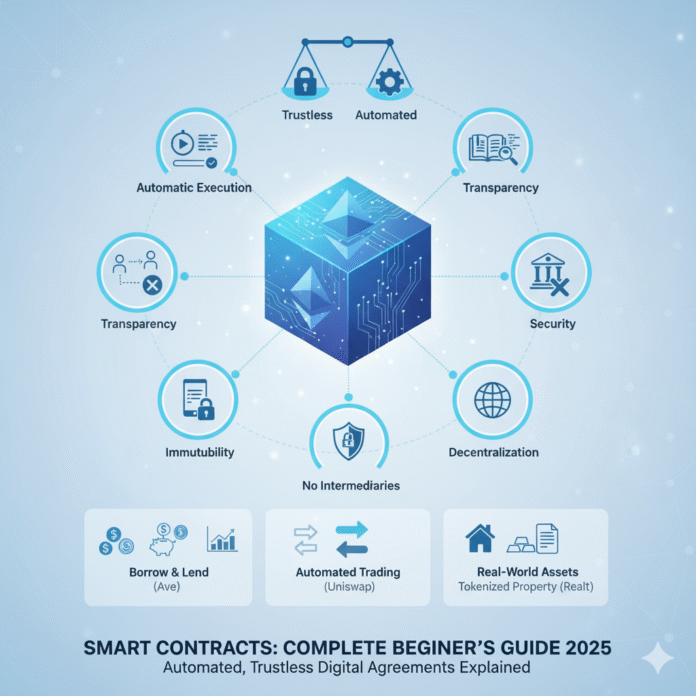

5 Key Features of Smart Contracts

1. Automatic Execution: Runs without human intervention once conditions are met

2. Transparency: Code is deployed as bytecode on-chain; human-readable source is visible when developers verify the contract on explorers like Etherscan.

3. Trustless Operation: No need for intermediaries or third parties

4. Immutability: Cannot be changed after deployment (note: many production protocols use upgradeable proxy patterns controlled by governance)

5. Decentralization: Operates on distributed blockchain networks

Learn more:

How Do Smart Contracts Work on Ethereum? Step-by-Step Process

Smart Contract Development and Execution Workflow

Smart contracts follow a precise technical process from creation to execution:

- Programming Phase: Written in Solidity programming language

- Ethereum Deployment: Uploaded to blockchain with unique contract address

- User Interaction: Transactions sent via crypto wallets (MetaMask)

- Condition Verification: Blockchain validates if requirements are met

- Automatic Execution: Contract performs programmed actions

- Transaction Recording: Results permanently stored on blockchain

Technical resources:

Understanding Gas Fees in Smart Contracts

Every smart contract operation requires gas fees – small payments in ETH that cover computational costs. Gas prices fluctuate based on network congestion, ranging from $1 to $100+ per transaction during peak periods.

Gas Fee Components:

- Gas Limit: Maximum computational units allowed

- Gas Price: Cost per unit in Gwei (1 ETH = 1 billion Gwei)

- Total Fee: Gas Limit × Gas Price

Track gas prices:

Real-World Smart Contract Example: Automated Betting

Scenario: Two friends bet $10 on weather conditions

Traditional Method: Requires trust or escrow service

Smart Contract Solution:

- Both parties deposit $10 in ETH to the contract

- Contract is programmed to obtain the weather result via a decentralized oracle (e.g., Chainlink) rather than calling an external API directly

- If raining → Money goes to Friend A

- If sunny → Money goes to Friend B

Result: Automatic, trustless payout

Why oracle? Smart contracts can’t fetch web APIs by themselves; they need oracles to bring off-chain data on-chain.

Learn about oracles:

Smart Contracts in DeFi: Revolutionary Financial Applications

1. Decentralized Lending Protocols (Aave, Compound)

How It Works: Smart contracts manage liquidity pools for borrowing and lending

Process Flow:

- Users deposit crypto assets to earn interest

- Borrowers provide collateral (typically over-collateralized; exact minimums vary by asset/vault)

- Smart contract automatically calculates interest rates

- Liquidation triggered if collateral value drops below threshold

Real Example: Deposit 1 ETH in Aave, earn 4-8% APY while others borrow your ETH at 6-12% APR

Benefits: Higher yields than traditional banks, no credit checks required

Explore lending protocols:

2. Decentralized Exchanges (Uniswap, SushiSwap, PancakeSwap)

Technology: Automated Market Maker (AMM) model

Trading Mechanism:

- Smart contracts hold token pairs in liquidity pools

- Users trade directly against the pool

- Prices determined by mathematical formulas (x*y=k)

- Liquidity providers earn fees according to the pool’s fee tier (Uniswap v3 tiers include 0.01%, 0.05%, 0.3%, 1%)

Example Transaction: Swap 1 ETH for 2,500 USDC through Uniswap’s ETH/USDC pool

Advantages: 24/7 trading, no KYC requirements, global accessibility

Trade on DEXs:

3. Stablecoins: Price-Stable Cryptocurrencies (DAI, USDC)

Concept: Cryptocurrencies pegged to stable assets like USD

DAI Creation Process:

- Lock ETH collateral worth $150 (e.g., 0.05 ETH at $3,000)

- Generate 100 DAI stablecoins ($1 each)

- Use DAI for payments or DeFi activities

- Repay 100 DAI + stability fee to unlock ETH collateral

Clarification: Maker vaults have asset-specific liquidation ratios (commonly in the ~150–170%+ range, subject to governance).

Use Cases: Stable store of value, DeFi without volatility exposure

Stablecoin resources:

4. Yield Farming: Earning Passive Income

Definition: Providing liquidity to DeFi protocols in exchange for rewards

Yield Farming Strategies:

- Liquidity Mining: Add tokens to DEX pools, earn trading fees + governance tokens

- Lending/Borrowing: Supply assets to protocols like Compound for interest

- Staking: Lock tokens in proof-of-stake networks for rewards

Potential Returns: 5-100%+ APY (high risk, high reward)

Example: Add $1,000 ETH/USDC to SushiSwap pool, earn $4-8/month in fees + SUSHI tokens

Yield farming platforms:

Benefits of Smart Contracts for Users

Financial Advantages

- Higher Yields: DeFi protocols offer 3-20%+ returns vs 0.1% traditional savings

- Lower Fees: Eliminate bank markups and intermediary costs

- 24/7 Availability: Access financial services anytime, anywhere

- Global Access: No geographic restrictions or minimum balances

Technological Benefits

- Programmable Money: Create custom financial logic

- Instant Settlements: Transactions settle in minutes, not days

- Composability: Combine multiple protocols (DeFi legos)

- Transparency: All transactions publicly verifiable

User Empowerment

- Self-Custody: Full control over your assets

- Permissionless: No approval needed to use protocols

- Censorship Resistance: Cannot be shut down by authorities

Smart Contract Risks and Security Considerations

Technical Risks

Smart Contract Bugs and Vulnerabilities

Major Incident: Yam Finance (2020) — community-documented bug in rebase/governance logic; losses around $750,000 were reported and governance was impaired.

Risk Factors:

- Complex code increases bug probability

- Immutable contracts cannot be fixed

- Interdependencies create cascade failures

Protection: Use audited protocols with bug bounty programs

Security audit resources:

Hacking and Exploits

Famous Case: The DAO hack (2016) — ≈$50 million stolen via a reentrancy-style vulnerability; led to the Ethereum/Ethereum Classic split.

Common Attack Vectors:

- Reentrancy: Multiple function calls before state updates

- Flash Loan Attacks: Manipulate prices with borrowed funds

- Oracle Manipulation: Feed false price data to contracts

Prevention: Choose protocols with multiple security audits

Read about DeFi security:

Smart Contract Immutability Issues

Problem: Cannot fix bugs after deployment

Mitigation Strategies:

- Proxy Patterns: Upgradeable contract architecture

- Timelocks: Delayed implementation of changes

- Multi-signature: Require multiple approvals for updates

Economic and Market Risks

High Gas Fees During Network Congestion

Solutions:

- Layer 2 Networks: Arbitrum, Optimism, Polygon zkEVM (significantly cheaper; many L2 swaps cost cents vs dollars on L1)

- Alternative Blockchains: BNB Chain, Avalanche

- Gas Price Optimization: Time transactions during low activity

Compare L2 costs:

Impermanent Loss in Liquidity Pools

Explanation: Temporary loss when token prices diverge in LP pairs

Example: Provide ETH/USDC liquidity, ETH price doubles, you have less ETH than holding

Mitigation:

- Use correlated asset pairs (ETH/wETH)

- Monitor pool performance regularly

- Calculate opportunity cost vs holding

Understand impermanent loss:

Smart Contract and Protocol Risks

- Governance Risks: Protocol changes can affect user positions

- Regulatory Risks: Government actions may impact DeFi protocols

- Liquidity Risks: Difficulty exiting positions during market stress

How to Start Using Smart Contracts: Complete Tutorial

Step 1: Set Up Your Crypto Wallet

- Download MetaMask from official website

- Create New Wallet and securely store seed phrase

- Add Ethereum Network (usually default)

- Fund Wallet with ETH for gas fees

Get started:

Step 2: Buy Cryptocurrency

Centralized Exchanges: Coinbase, Binance, Kraken

Decentralized Options: Use fiat on-ramps like Ramp, MoonPay

Exchange platforms:

Step 3: First Smart Contract Interaction

- Visit Uniswap (app.uniswap.org)

- Connect MetaMask wallet

- Select Trading Pair (e.g., ETH → USDC)

- Set Slippage Tolerance (0.5-1% for stablecoins)

- Review Transaction and confirm gas fee

- Execute Swap and receive tokens

Step 4: Explore Advanced DeFi

- Lending: Try Aave or Compound for earning interest

- Yield Farming: Provide liquidity to earn rewards

- Derivatives: Explore Synthetix or dYdX for advanced trading

DeFi platforms:

Step 5: Security Best Practices

- Start Small: Test with $10-50 initially

- Verify Addresses: Always double-check contract addresses

- Use Hardware Wallets: Ledger or Trezor for large amounts

- Stay Informed: Follow protocol announcements and security updates

Hardware wallet options:

Future of Smart Contracts: 2025 Trends and Innovations

Technological Developments

Layer 2 Scaling Solutions

Impact: 10–100x reduction in transaction costs vs L1 under typical conditions; many L2 actions now cost cents.

Leading Solutions:

- Optimistic Rollups: Arbitrum, Optimism

- ZK-Rollups: Polygon zkEVM, Starknet

- Sidechains: Polygon PoS, BNB Chain

Explore Layer 2:

Cross-Chain Interoperability

Trend: Multi-chain DeFi ecosystem

Technologies: Bridges, wrapped tokens, cross-chain protocols

Examples: Thorchain, Cosmos IBC, Polkadot parachains

Cross-chain projects:

AI-Enhanced Smart Contracts

Innovation: Machine learning integration

Applications: Dynamic pricing, risk assessment, automated strategies

Projects: Numerai, Ocean Protocol, Fetch.ai

AI blockchain platforms:

Emerging Use Cases

Real Estate Tokenization

Concept: Fractional ownership via smart contracts

Benefits: Global liquidity, 24/7 trading, lower minimums

Platforms: RealT, Centrifuge, Roofstock onChain

Tokenized real estate:

Decentralized Insurance

Model: Parametric insurance via smart contracts

Coverage: DeFi protocols, crop insurance, flight delays

Projects: Nexus Mutual, InsurAce (note: Cover Protocol shut down in 2021)

DeFi insurance:

Supply Chain Management

Application: Track products from manufacture to consumer

Features: Authenticity verification, logistics optimization

Examples: VeChain, OriginTrail, Walmart blockchain

Supply chain blockchains:

Decentralized Governance (DAOs)

Structure: Community-controlled organizations

Voting: Token-weighted decision making

Examples: MakerDAO, Compound governance, Uniswap governance

Learn about DAOs:

Regulatory Landscape Evolution

- Institutional Adoption: Banks exploring DeFi integration

- CBDC Development: Central bank digital currencies

- Compliance Tools: KYC/AML solutions for DeFi

Smart Contracts vs Traditional Finance: Comprehensive Comparison

| Feature | Smart Contracts | Traditional Finance |

|---|---|---|

| Operating Hours | 24/7/365 | Business hours only |

| Geographic Access | Global, permissionless | Restricted by location |

| Transaction Speed | Minutes to hours | Days to weeks |

| Fees | $1–100+ gas fees | $10–1000+ service fees |

| Intermediaries | None required | Banks, brokers, clearinghouses |

| Transparency | Fully open, auditable (bytecode on-chain; source if verified) | Limited visibility |

| Customization | Highly programmable | Standard products only |

| Regulatory Oversight | Minimal, evolving | Heavy regulation |

| Technical Requirements | Basic crypto knowledge | None for users |

| Custody | Self-custody options | Third-party custody |

Frequently Asked Questions (FAQ)

Do I need programming skills to use smart contracts?

No. Modern DeFi applications provide user-friendly interfaces. Basic cryptocurrency knowledge is sufficient for most users.

What’s the minimum amount needed to start?

$50–100 minimum recommended, including gas fees. Start with small amounts to learn without significant risk.

Can I lose all my money with smart contracts?

Yes, risks are substantial. Potential losses from hacks, bugs, impermanent loss, and market volatility. Never invest more than you can afford to lose.

Which smart contract platforms are most secure?

Battle-tested protocols: Uniswap, Aave, Compound, MakerDAO have years of operation and multiple security audits.

How do I avoid smart contract scams?

Due Diligence Checklist:

- Verify official contract addresses

- Check security audit reports

- Review team backgrounds

- Assess community activity and documentation

- Avoid “too good to be true” yields

What happens if Ethereum fails?

Multi-chain strategy: Diversify across blockchains (Ethereum, Polygon, Solana, Avalanche). Smart contract technology will persist across platforms.

Top Smart Contract Platforms in 2025

Ethereum — The Original Smart Contract Platform

Market Cap: ≈$500B (Oct 9, 2025 snapshot)

Advantages: Largest ecosystem, most developers, maximum decentralization

Challenges: High gas fees, network congestion

Best For: Established protocols, maximum security needs

Official resources:

BNB Smart Chain — Low-Cost Alternative

Transaction Costs: $0.10–1.00 per transaction (typical)

Advantages: Fast transactions, EVM compatibility

Trade-offs: More centralized than Ethereum

Best For: Cost-sensitive applications, beginners

Learn more:

Polygon — Ethereum Layer 2 / Sidechain Solution

Performance: High throughput with low fees. Polygon PoS operates as an EVM-compatible sidechain that checkpoints to Ethereum.

Growth: Major brand partnerships, enterprise adoption

Best For: Scaling Ethereum dApps

Official documentation:

Solana — High-Performance Blockchain

Speed: Up to ~50,000 TPS (theoretical capacity); block times ~400ms per Solana Foundation materials.

Innovation: Proof of History (a cryptographic timekeeping mechanism) combined with Proof-of-Stake — PoH is not a standalone “consensus,” it augments PoS.

Ecosystem: Growing DeFi and NFT platforms

Considerations: Historical stability concerns

Explore Solana:

Smart Contract Investment Strategies for 2025

Conservative Approach (Lower Risk)

Portfolio Allocation:

- 40% Blue-chip DeFi tokens (UNI, AAVE, COMP)

- 30% Stablecoins in lending protocols

- 20% Ethereum staking (post-Merge Ethereum; “ETH 2.0” naming is deprecated)

- 10% Layer 2 tokens (MATIC, OP, ARB)

Expected Returns: 8–15% annually

Risk Level: Moderate

Aggressive Growth Strategy (Higher Risk)

Portfolio Allocation:

- 25% Emerging DeFi protocols

- 25% Yield farming opportunities

- 20% Cross-chain bridge tokens

- 15% DAO governance tokens

- 15% NFT and GameFi projects

Expected Returns: 30–100%+ annually

Risk Level: High (possible 50%+ losses)

Dollar-Cost Averaging (DCA) Strategy

Method: Regular purchases regardless of price

Benefits: Reduces timing risk, builds positions gradually

Implementation: Weekly/monthly buys of major DeFi tokens

Timeframe: 12–24 months minimum

Conclusion: The Future Is Built on Smart Contracts

Smart contracts represent a fundamental shift in how we interact with financial systems, creating unprecedented opportunities for:

- Global Financial Inclusion: Access for the unbanked population

- Programmable Money: Custom financial logic and automation

- Disintermediation: Removing costly middlemen

- Innovation Acceleration: Rapid development of new financial products

Key Takeaways for 2025

- Mass Adoption: Institutional players entering DeFi space

- Infrastructure Maturation: Better UX, lower costs, higher security

- Regulatory Clarity: Clearer rules enabling mainstream adoption

- Cross-Chain Future: Multi-blockchain ecosystem integration

Your Next Steps

- Education: Continue learning about blockchain technology

- Practice: Start with small amounts on testnet or mainnet

- Community: Join Discord/Telegram groups of major protocols

- Patience: Build knowledge and positions gradually over time

Smart contracts are revolutionizing finance. Don’t miss the opportunity to be part of this transformation.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always conduct your own research (DYOR) before making financial decisions. Cryptocurrency investments carry substantial risk.

Additional Educational Resources: