Ethereum remains the leading blockchain for decentralized applications (dApps), powering everything from DeFi platforms like Uniswap to NFT marketplaces like OpenSea. However, Ethereum’s limitations—processing only 15-30 transactions per second (TPS) with gas fees that can spike above $50—create significant barriers for mainstream adoption.

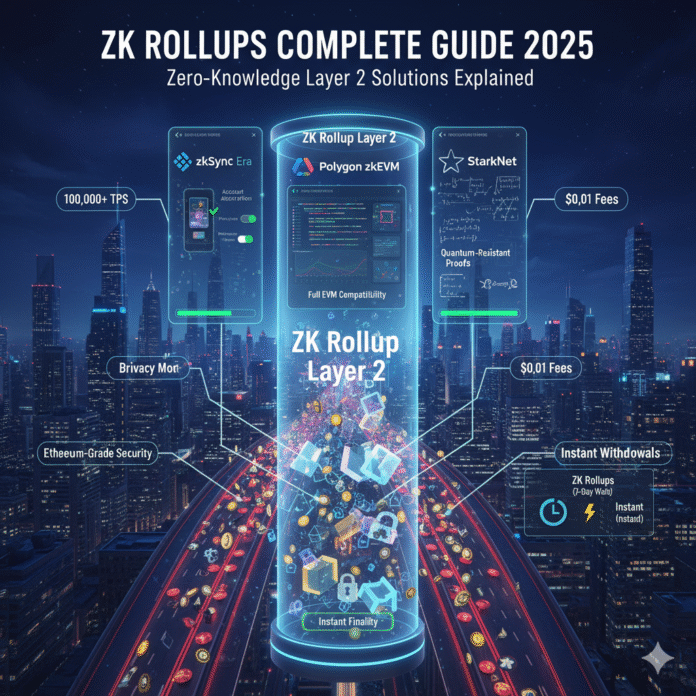

Zero-Knowledge Rollups (ZK Rollups) represent the most promising Layer 2 scaling solution, offering lightning-fast transactions, minimal fees, and Ethereum’s battle-tested security. Furthermore, this comprehensive guide explores ZK Rollups technology, leading projects like zkSync, Polygon zkEVM, and StarkNet, along with practical steps to get started. Additionally, we’ll examine real-world use cases and future developments in this rapidly evolving space.

What Are ZK Rollups?

ZK Rollups are advanced Layer 2 (L2) scaling solutions that process thousands of transactions off Ethereum’s main chain while maintaining full security through cryptographic proofs. Moreover, they “roll up” multiple transactions into single batches and submit compact summaries to Ethereum, using zero-knowledge proofs to verify correctness without revealing transaction details.

Key Advantages Over Competitors

Unlike Optimistic Rollups (Arbitrum, Optimism), which assume transactions are valid and require 7-day challenge periods, ZK Rollups prove validity upfront, thereby enabling instant withdrawals. In contrast, sidechains like Polygon PoS operate independently with reduced security, whereas ZK Rollups maintain tight integration with Ethereum’s consensus mechanism. Consequently, this architectural difference provides superior security guarantees for high-value transactions.

To understand the fundamental concepts behind this technology, check out our beginner’s guide to ZK Rollups.

Performance Metrics

Comparative Analysis:

- Ethereum L1: 15-30 TPS, $1-$50 fees

- ZK Rollups: 100-2,000 TPS, $0.01-$0.10 fees

- Theoretical Maximum: Up to 100,000 TPS with future optimizations

Learn more about Ethereum scaling solutions at the official documentation.

How ZK Rollups Work: Technical Deep Dive

Understanding ZK Rollup mechanics requires examining their multi-step process. Indeed, the technology represents one of the most sophisticated innovations in blockchain scalability.

Transaction Submission and Sequencing

Users submit transactions to the ZK Rollup network instead of Ethereum mainnet. Subsequently, a sequencer—specialized nodes responsible for transaction ordering—collects and organizes these transactions for batch processing. In essence, this creates an efficient queue management system for high-throughput operations.

Off-Chain Execution Environment

Transactions within ZK-Rollups are executed in separate computation environments, most often compatible with zkEVM (zero-knowledge Ethereum Virtual Machine). Notably, these environments replicate Ethereum’s rules but operate much faster. Furthermore, they do not require validation by thousands of mainnet validators, which dramatically reduces latency.

Transaction Batching and Compression

The sequencer aggregates hundreds or thousands of transactions into single batches. Additionally, advanced compression techniques reduce data requirements—for example, 1,000 token swaps might compress into just a few kilobytes of data. Therefore, this compression is crucial for maintaining cost-effectiveness at scale.

Zero-Knowledge Proof Generation

The technical core involves generating zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) or zk-STARKs (Scalable Transparent Arguments of Knowledge). Consequently, these proofs, typically just hundreds of bytes, mathematically verify that all batched transactions follow Ethereum’s consensus rules without revealing individual transaction details. Moreover, this cryptographic guarantee provides unparalleled security assurances.

For more details on how Layer 2 solutions function, read our comprehensive guide to how Ethereum Layer 2 works.

Ethereum Settlement Process

Two critical components are submitted to Ethereum:

- State Root: A cryptographic hash representing the new rollup state

- Validity Proof: The zero-knowledge proof confirming all transactions’ legitimacy

Verification and Finality

Ethereum’s smart contracts verify the ZK proof within seconds. As a result, upon successful verification, the batch achieves finality, updating user balances and contract states. Subsequently, this process eliminates challenge periods, thereby enabling near-instant withdrawals to Layer 1. In particular, this represents a massive improvement over Optimistic Rollup architectures.

For more technical details, visit Vitalik Buterin’s comprehensive explanation of rollup technology.

Zero-Knowledge Proofs Explained

Zero-knowledge proofs represent breakthrough cryptographic technology enabling privacy and scalability simultaneously. Indeed, they form the mathematical foundation of ZK Rollup security.

Core Concept and Philosophy

Imagine proving you solved a complex puzzle without revealing your solution method—only the correct answer. In essence, zero-knowledge proofs achieve exactly this: mathematically demonstrating statement validity without exposing underlying data. Furthermore, this property makes them invaluable for both privacy and scaling applications.

Read the original Zero-Knowledge Proof paper by Goldwasser, Micali, and Rackoff for deep theoretical insights.

Technical Implementation Types

zk-SNARKs Technology

- Used by: zkSync, Polygon zkEVM

- Advantages: Extremely small proof sizes, fast verification

- Considerations: Require trusted setup ceremonies for cryptographic parameter generation

- Security: Robust against classical computers, vulnerable to quantum attacks

zk-STARKs Innovation

- Used by: StarkNet, StarkEx

- Advantages: No trusted setup required, quantum-resistant architecture

- Trade-offs: Larger proof sizes compared to SNARKs

- Future-proofing: Better positioned for post-quantum cryptography era

Learn more at ZKProof Standards and StarkWare’s technical documentation.

Computational Requirements

Generating zero-knowledge proofs demands significant computational resources. Specifically, the process typically requires:

- Hardware: High-end GPUs or specialized ASICs

- Time: Seconds to minutes depending on batch size

- Cost: Currently the primary bottleneck for ZK Rollup economics

However, verification remains extremely efficient, allowing Ethereum to quickly validate proofs regardless of batch complexity. Moreover, ongoing hardware acceleration research promises to reduce these costs by 90%+ within the next 2-3 years.

Benefits of ZK Rollups

ZK Rollups deliver transformative improvements across multiple dimensions. Indeed, they represent the most comprehensive scaling solution available today.

Unmatched Scalability

In production environments, ZK-Rollups handle approximately 100–2,000 transactions per second (TPS), with theoretical limits exceeding 100,000 TPS. Remarkably, such performance rivals traditional payment networks like Visa (~24,000 TPS), thereby making real-time gaming, high-frequency trading, and large-scale consumer adoption possible. Furthermore, this scalability doesn’t compromise on security or decentralization.

Dramatic Cost Reduction

By batching thousands of transactions into single Ethereum submissions, ZK Rollups reduce fees to $0.01-$0.10 per transaction. Consequently, this cost structure makes microtransactions viable—purchasing coffee, small NFTs, or frequent DeFi interactions become economically feasible. In addition, users can finally engage with complex smart contracts without worrying about prohibitive gas fees.

Track live fee comparisons at L2Fees.info and CryptoFees.

Enhanced Security Model

Through mathematical proofs, ZK-Rollups inherit Ethereum’s full security model. As a result, invalid transactions cannot be included in any batch, and user funds stay safe even if rollup operators face downtime or act maliciously. Moreover, this security guarantee is cryptographically enforced rather than economically incentivized, providing stronger protection than fraud-proof based systems.

Compare security models at L2Beat for comprehensive analysis.

Near-Instant Finality

Unlike Optimistic Rollups’ 7-day withdrawal periods, ZK Rollups offer near-instant finality. Therefore, users can withdraw funds to Ethereum Layer 1 within minutes, which is crucial for arbitrage opportunities and capital efficiency. Additionally, this eliminates the frustrating waiting periods that plague other Layer 2 solutions.

Privacy Features

Zero-knowledge technology inherently supports privacy-preserving transactions. Consequently, certain ZK Rollups enable users to conduct financial activities without exposing transaction details publicly. Furthermore, this privacy capability attracts institutional users requiring confidential business operations while maintaining regulatory compliance.

Ethereum Compatibility

The best ZK Rollups support EVM equivalence or compatibility, allowing developers to deploy existing Solidity smart contracts with minimal modifications. Therefore, this reduces development complexity and accelerates ecosystem growth. Additionally, tools like Hardhat and Foundry work seamlessly with compatible ZK Rollups.

Leading ZK Rollup Projects

The ZK Rollup landscape features several major players, each with unique strengths and ecosystems. Indeed, competition drives rapid innovation and improvement across all platforms.

zkSync Era: User-Friendly Scaling

zkSync Era, developed by Matter Labs, stands as one of the most mature ZK Rollup implementations. Notably, the platform emphasizes user experience and developer accessibility.

Technical Specifications:

- Technology: zk-SNARKs with recursive proof aggregation

- Throughput: 100+ TPS currently, scaling to 1,000+ TPS

- Transaction Costs: $0.01-$0.05 per transaction

- EVM Compatibility: Full EVM equivalence via custom zkEVM implementation

- Launch Date: March 2023 mainnet launch

Key Features:

- Account Abstraction: Native implementation enables social recovery, gasless transactions, and improved UX

- Privacy: Optional transaction privacy through encrypted mempools (in development)

- Developer Tools: Comprehensive SDK with TypeScript/JavaScript support, Hardhat plugins

- Ecosystem Growth: 200+ dApps including SyncSwap, Mute.io, and zkSync Name Service

Unique Advantages:

zkSync leads in account abstraction implementation, allowing smart contract wallets as first-class citizens. Moreover, this enables features impossible on other chains, such as paying gas fees in any token or enabling multisig wallets without additional complexity. Furthermore, zkSync’s Hyperchains framework allows launching interconnected ZK chains for specific use cases.

To compare zkSync with other leading solutions, explore our zkSync vs StarkNet comparison guide.

Ecosystem Projects:

- SyncSwap – Leading DEX with concentrated liquidity and yield farming

- Mute.io – Privacy-focused DEX and farming platform

- zkSync Name Service – Decentralized naming for wallets

- Orbiter Finance – Cross-rollup bridge with instant transfers

- SpaceFi – Multi-chain DeFi hub

Official Resources: zkSync.io and zkSync Documentation

Polygon zkEVM: Ethereum Equivalence

Polygon zkEVM, backed by Polygon Labs, prioritizes full Ethereum equivalence. Importantly, this approach minimizes development friction for existing Ethereum developers.

Technical Specifications:

- Technology: zk-SNARKs with innovative PIL (Polynomial Identity Language)

- Throughput: 100-300 TPS with ongoing optimizations

- Transaction Costs: $0.03-$0.08 per transaction

- EVM Compatibility: Type 2 zkEVM – nearly complete opcode equivalence

- Launch Date: March 2023 mainnet beta

Key Features:

- True EVM Equivalence: Supports virtually all Ethereum opcodes without modifications

- Developer Experience: Existing Ethereum tools (Remix, Hardhat, Truffle) work natively

- Security: Multiple audits by top firms including Hexens and Spearbit

- Interoperability: Seamless connection with Polygon PoS and broader Polygon ecosystem

Unique Advantages:

Polygon zkEVM’s greatest strength lies in its developer-first approach. Consequently, existing Ethereum dApps deploy with zero code changes in most cases. Furthermore, Polygon’s established ecosystem (53K+ deployed dApps) provides immediate network effects and liquidity. Additionally, Polygon’s aggressive partnership strategy brings major projects directly to zkEVM.

Ecosystem Projects:

- QuickSwap – High-performance DEX with concentrated liquidity

- Balancer – Automated portfolio manager and trading platform

- Gamma Strategies – Active liquidity management protocol

- Lens Protocol – Decentralized social graph (migrating from Polygon PoS)

- Aave – DeFi lending and borrowing (planned deployment)

Official Resources: Polygon zkEVM Website and Technical Documentation

StarkNet: Maximum Decentralization

StarkNet, developed by StarkWare, takes a unique approach with custom programming language Cairo and zk-STARK technology. Notably, this architecture prioritizes long-term scalability and decentralization.

Technical Specifications:

- Technology: zk-STARKs with transparent proofs (no trusted setup)

- Throughput: 100+ TPS currently, targeting 10,000+ TPS post-Regenesis

- Transaction Costs: $0.02-$0.10 per transaction

- EVM Compatibility: Limited – requires rewriting in Cairo language

- Launch Date: November 2021 alpha, February 2023 full decentralization

Key Features:

- Cairo Language: Purpose-built for provable computation with formal verification support

- Quantum Resistance: zk-STARKs secure against quantum computer attacks

- Progressive Decentralization: Community-governed with decentralized sequencers

- Native Account Abstraction: Built-in smart contract accounts for all users

Unique Advantages:

StarkNet’s quantum-resistant architecture provides unmatched future-proofing. Moreover, Cairo enables developers to write mathematically provable code, reducing bug risks significantly. Furthermore, StarkNet leads in decentralization efforts, with community governance and multiple sequencers reducing centralization risks. Additionally, StarkWare’s proven track record (powering dYdX, Immutable X, and Sorare) demonstrates enterprise-grade reliability.

Ecosystem Projects:

- JediSwap – Leading AMM with concentrated liquidity

- mySwap – Community-driven DEX with governance token

- StarkNet.id – Decentralized identity and naming service

- Braavos – Advanced smart contract wallet

- Argent X – User-friendly mobile and browser wallet

Official Resources: StarkNet.io and StarkNet Book Documentation

Comparing Leading ZK Rollup Platforms

Understanding the differences between major ZK Rollups helps users and developers choose the right platform for their needs. Indeed, each solution optimizes for different priorities.

For a comprehensive comparison of Layer 2 networks including fees and speed benchmarks, visit our Ethereum Layer 2 solutions guide.

Feature Comparison Matrix

| Platform | Technology | TPS | Fees | EVM Compatible | Quantum Resistant | Maturity |

|---|---|---|---|---|---|---|

| zkSync Era | zk-SNARKs | 100+ | $0.01-$0.05 | Full | No | High |

| Polygon zkEVM | zk-SNARKs | 100-300 | $0.03-$0.08 | Very High | No | High |

| StarkNet | zk-STARKs | 100+ | $0.02-$0.10 | Limited (Cairo) | Yes | Medium |

Security Considerations

All three platforms inherit Ethereum’s base security, but implementation details differ:

- zkSync: Multiple audits by OpenZeppelin and ABDK, $200K bug bounty

- Polygon zkEVM: Extensive security reviews by Hexens and Spearbit, $2M bug bounty

- StarkNet: Transparent cryptography (no trusted setup), formal verification tools, $1M bug bounty

Ecosystem Maturity

Development activity and Total Value Locked (TVL) indicate ecosystem health:

- zkSync Era: $800M TVL, 200+ dApps, strong retail adoption

- Polygon zkEVM: $200M TVL, 100+ dApps, enterprise partnerships

- StarkNet: $150M TVL, 80+ dApps, advanced developer community

Check live data on L2Beat and DeFiLlama.

Developer Experience

The learning curve and tooling quality vary significantly:

- zkSync Era: TypeScript/JavaScript SDKs, familiar Solidity development, comprehensive docs

- Polygon zkEVM: Identical to Ethereum development, seamless migration path

- StarkNet: Requires learning Cairo, unique architecture, excellent Cairo Book resource

For those interested in comparing blockchain ecosystems for DeFi applications, check out our Ethereum vs Solana vs Polygon comparison.

Choosing the Right Platform

Decision Framework:

- For Beginners: zkSync Era offers the smoothest onboarding experience

- For Existing Ethereum Developers: Polygon zkEVM requires zero learning curve

- For Maximum Decentralization: StarkNet provides quantum resistance and proven cryptography

- For Privacy: zkSync’s upcoming features lead in transaction privacy

- For Long-term Scalability: StarkNet’s architecture supports highest theoretical throughput

Real-World Use Cases

ZK Rollups enable applications previously impossible or impractical on Ethereum Layer 1. Indeed, numerous successful projects demonstrate production-ready scalability.

Decentralized Finance (DeFi)

DeFi represents the largest use case, where high throughput and low fees unlock new possibilities:

High-Frequency Trading

Platforms like zkSync’s SyncSwap and StarkNet’s JediSwap enable rapid trades without prohibitive gas costs. Consequently, arbitrage opportunities become accessible to retail users, not just well-funded bots. Moreover, complex trading strategies involving multiple swaps become economically viable.

Yield Farming Optimization

Low transaction costs allow users to compound yields daily or even hourly. Therefore, small investors can now compete with whales in yield optimization strategies. Additionally, gas costs no longer erode farming returns, making smaller positions profitable.

Lending Protocols

Platforms like Aave (deploying on Polygon zkEVM) benefit from instant finality. Consequently, liquidations occur more efficiently, reducing protocol risk. Furthermore, users can adjust collateral positions frequently without worrying about gas fees.

On-Chain Derivatives

Projects like dYdX (built on StarkEx) prove ZK technology’s capability for complex financial instruments. Specifically, perpetual swaps and options trading require millisecond-level performance. Moreover, ZK Rollups’ throughput makes these applications comparable to centralized exchanges while maintaining self-custody.

Non-Fungible Tokens (NFTs)

NFT ecosystems benefit dramatically from ZK Rollup efficiency:

High-Volume Minting

Projects launching 10,000+ NFT collections can mint entire collections for under $100 total cost. Consequently, creators no longer need to pass massive gas costs to buyers. Furthermore, dynamic NFTs that update frequently become practical.

Gaming Assets

Blockchain games require constant NFT transfers, trades, and updates. Therefore, ZK Rollups make in-game economies viable. Additionally, players can trade items between games seamlessly at minimal cost.

Fractional Ownership

Low fees enable fractional NFT trading, making expensive art accessible to more collectors. Moreover, frequent trading of fractions becomes economically sensible.

NFT Marketplaces

Platforms like Mintsu on zkSync and Element on StarkNet demonstrate marketplace viability. Specifically, listing, bidding, and purchasing NFTs cost mere cents. Furthermore, creators receive royalties automatically without expensive smart contract executions.

Gaming and Metaverse

Blockchain gaming demands performance impossible on Layer 1:

Real-Time Gaming

Games requiring instant transaction confirmation benefit from ZK finality. Consequently, player actions occur without noticeable delays. Moreover, competitive games can implement blockchain mechanics without compromising user experience.

In-Game Economies

ZK Rollups support thousands of daily microtransactions per player. Therefore, complex economic systems with frequent trades, crafting, and resource management become feasible. Additionally, play-to-earn mechanics distribute rewards efficiently.

Metaverse Interactions

Virtual world platforms require continuous state updates as users interact. Consequently, ZK Rollups enable persistent, blockchain-based metaverses with acceptable performance. Furthermore, interoperability between different virtual worlds becomes practical.

Payment Systems

ZK Rollups approach traditional payment network performance:

Microtransactions

Content creators can receive payments of cents for articles, videos, or digital goods. Consequently, subscription models charging per day or per use become viable. Moreover, tipping and small donations no longer lose value to fees.

Merchant Adoption

Businesses can accept cryptocurrency payments without worrying about volatility of transaction costs. Therefore, more merchants consider blockchain payments seriously. Additionally, instant finality improves cash flow certainty.

Remittances

International transfers cost dramatically less than traditional systems. Consequently, workers sending money home retain more of their earnings. Furthermore, transfers settle in minutes rather than days.

Getting Started with ZK Rollups

Entering the ZK Rollup ecosystem requires proper setup and understanding of best practices. Indeed, following security protocols ensures safe exploration.

Setting Up Your Wallet

Essential Wallet Options

MetaMask:

The most popular Ethereum wallet supports all major ZK Rollups. Importantly, MetaMask’s familiar interface reduces learning curve. Moreover, extensive browser extension and mobile app support provides flexibility.

Setup Steps:

- Install MetaMask extension or app from official website

- Create new wallet and securely store recovery phrase (12-24 words)

- Add ZK Rollup networks manually or via Chainlist

Network Configuration Details:

- zkSync Era: Network Name “zkSync Era”, RPC URL “https://mainnet.era.zksync.io“, Chain ID 324

- Polygon zkEVM: Network Name “Polygon zkEVM”, RPC URL “https://zkevm-rpc.com“, Chain ID 1101

- StarkNet: Requires dedicated wallet (see below)

Argent X (StarkNet):

StarkNet’s unique architecture requires specialized wallets. Consequently, Argent X provides the best mobile-first experience with built-in security features.

Features:

- Native account abstraction support

- Biometric authentication

- Social recovery (recover wallet using trusted contacts)

- Gas-free transactions (sponsors can cover fees)

Download from official Argent website.

Rabby Wallet:

Multi-chain wallet with excellent ZK Rollup support and security features.

Advantages:

- Automatic network detection

- Transaction simulation before signing

- Clear permission management

- Hardware wallet integration (Ledger, Trezor)

Official Site: Rabby.io

Wallet Security Best Practices

Hardware Wallet Integration

For amounts exceeding $1,000, use hardware wallets like Ledger or Trezor. Consequently, private keys never touch internet-connected devices. Moreover, transaction signing occurs on physical devices requiring button confirmation.

Recovery Phrase Protection

Write recovery phrases on paper or metal, never digitally. Therefore, store multiple copies in separate secure locations. Additionally, consider splitting phrases using Shamir’s Secret Sharing for maximum security.

Bridging Assets to ZK Rollups

Moving funds from Ethereum to ZK Rollups requires understanding bridge mechanics and security:

Official Bridges

zkSync Bridge:

- URL: bridge.zksync.io

- Deposit Time: 10-15 minutes

- Withdrawal Time: 15-30 minutes (no delay)

- Costs: Ethereum gas + minimal zkSync fee

- Security: Directly managed by zkSync team

Usage Instructions:

- Connect MetaMask to Ethereum mainnet

- Select token and amount to bridge

- Approve token spending (one-time per token)

- Confirm bridge transaction and wait for confirmation

- Funds appear in zkSync Era after finality

Polygon Bridge:

- URL: portal.polygon.technology

- Deposit Time: 10-20 minutes

- Withdrawal Time: 30-40 minutes

- Costs: Ethereum gas fees apply

- Security: Polygon-managed infrastructure

StarkGate:

- URL: starkgate.starknet.io

- Deposit Time: 10-20 minutes

- Withdrawal Time: 15-30 minutes

- Costs: Variable based on Ethereum congestion

- Security: StarkWare-operated bridge

Third-Party Bridge Aggregators

Bungee: Multi-chain bridge aggregator finding cheapest routes. Consequently, users save on cross-chain transfers. Moreover, supports direct bridges between different ZK Rollups.

Visit: Bungee.exchange

Orbiter Finance: Specialized in ZK Rollup bridging with instant transfers. Therefore, provides better user experience for frequent movers. Additionally, supports more exotic token pairs.

Visit: Orbiter.finance

Across Protocol: Optimistic bridge with capital-efficient design. Specifically, offers competitive rates for popular tokens. Furthermore, insurance fund protects against bridge failures.

Visit: Across.to

Bridge Security Considerations

URL Verification

Always verify bridge URLs match official documentation exactly. Consequently, avoid phishing sites impersonating legitimate bridges. Moreover, bookmark official URLs to prevent typos.

Amount Testing

Bridge small amounts first (e.g., $10-50) to verify correct operation. Therefore, learn the process without risking significant funds. Additionally, confirm receiving addresses are correct.

Contract Verification

Only interact with verified smart contracts on block explorers. Consequently, check Etherscan verification status before approving transactions.

Slippage Settings

Set appropriate slippage tolerance (0.5-1%) for DEX trades to prevent MEV attacks. Moreover, understand that wider slippage tolerances increase sandwich attack risk.

Approval Management

Regularly audit and revoke unnecessary token approvals via Revoke.cash. Consequently, reduce attack surface by removing unused permissions. Furthermore, use time-limited approvals when available.

Finding and Using dApps

Each ZK Rollup ecosystem offers diverse applications:

zkSync Ecosystem

DeFi:

- SyncSwap – Leading DEX with concentrated liquidity pools, yield farming

- Mute.io – Privacy-focused trading and liquidity provision

- Velocore – Next-gen AMM with single-sided liquidity

- Reactor Fusion – Leveraged yield farming protocol

NFT Platforms:

- Mintsu – NFT marketplace with no listing fees

- zkApes – PFP NFT collection with utility

- Era Name Service – Decentralized naming system

Bridges:

- Orbiter Finance – Fast cross-rollup transfers

- LayerSwap – CEX to L2 direct transfers

Discovery: Explore full ecosystem at zkSync Ecosystem Portal and DeFiLlama zkSync page.

Polygon zkEVM Ecosystem

DeFi:

- QuickSwap – High-performance DEX with limit orders

- Balancer – Weighted pool AMM and portfolio management

- Gamma Strategies – Automated liquidity management

- Gains Network – Decentralized leveraged trading

NFT & Gaming:

Infrastructure:

- Gelato Network – Automated smart contract execution

- Chainlink – Decentralized oracle services

Discovery: Visit Polygon zkEVM Ecosystem and L2Beat Polygon zkEVM Analytics.

StarkNet Ecosystem

DeFi:

- JediSwap – Leading AMM with governance token

- mySwap – Community-driven DEX

- Ekubo – Advanced concentrated liquidity protocol

- ZKLend – Native lending and borrowing platform

- Haiko – Order book DEX for advanced traders

Infrastructure:

- StarkNet.id – Decentralized identity system

- Argent X – Smart contract wallet

- Braavos – Hardware wallet support

- Voyager – Block explorer and portfolio tracker

Gaming:

- Loot Realms – On-chain strategy game

- Influence – Space strategy MMO

- Briq – On-chain composable NFTs

Discovery: Explore StarkNet Ecosystem and StarkScan Explorer.

Ecosystem Discovery Tools

DeFi Dashboards:

- DeFiLlama – TVL tracking and protocol analytics

- L2Beat – Security analysis and statistics

- Dune Analytics – Custom queries and dashboards

dApp Discovery:

- DappRadar – Usage statistics across rollups

- State of the dApps – Comprehensive dApp directory

- Alchemy Dapp Store – Curated application lists

Best Practices for Users

Maximizing safety and efficiency requires following established guidelines:

Transaction Management

Gas Optimization

Batch multiple transactions when possible. Consequently, save on overhead costs. Moreover, use protocols supporting multicall functionality.

Timing Considerations

Execute transactions during low-activity periods for better rates. Therefore, avoid peak hours (US afternoon/evening). Additionally, monitor gas trackers like Etherscan Gas Tracker.

Confirmation Patience

Wait for full confirmation before assuming transaction success. Consequently, avoid double-spending attempts. Moreover, use block explorers to track transaction status.

Security Protocols

Wallet Hygiene

Use separate wallets for different activities:

- Hot Wallet: Small amounts for daily transactions

- Warm Wallet: Medium amounts for weekly usage

- Cold Wallet (Hardware): Long-term holdings and large amounts

Consequently, compromise of one wallet doesn’t affect others. Moreover, practice separation of concerns for different risk levels.

Smart Contract Interactions

- Contract Verification – Only interact with verified smart contracts on block explorers

- Slippage Settings – Set appropriate tolerance (0.5-1%) for DEX trades to prevent MEV attacks

- Revoke Approvals – Regularly audit and revoke token approvals via Revoke.cash

Smart Contract Security

Auditing Standards

Leading audit firms specializing in ZK Rollup security provide comprehensive reviews:

- Trail of Bits – Cryptographic and smart contract audits with formal verification

- ConsenSys Diligence – Ethereum security specialists with 300+ audits completed

- OpenZeppelin – Security-focused development tools and comprehensive audit services

- Certik – AI-powered security analysis with Skynet monitoring

- Zellic – Specialized in ZK circuit audits and cryptographic reviews

Bug Bounty Programs

Major ZK Rollup projects maintain active bug bounty programs with substantial rewards:

- zkSync on HackenProof – Up to $200,000 for critical vulnerabilities

- Polygon on Immunefi – Up to $2,000,000 for critical findings in zkEVM

- StarkNet on Immunefi – Up to $1,000,000 for severe security issues

Report bugs responsibly through Immunefi, HackenProof, and Code4rena.

Conclusion: The ZK Rollup Revolution

Zero-Knowledge Rollups represent the most promising path to Ethereum’s mass adoption, combining unprecedented scalability, minimal costs, and uncompromised security. As we progress through 2025, ZK technology is maturing rapidly, with leading projects like zkSync, Polygon zkEVM, and StarkNet demonstrating real-world viability at scale.

Key Takeaways for 2025

For Users: ZK Rollups enable affordable DeFi participation, instant NFT trading, and privacy-preserving applications previously impossible on Ethereum mainnet. Moreover, transaction costs have dropped 95%+ compared to Layer 1.

For Developers: Improving tooling and EVM compatibility make ZK Rollups increasingly attractive for dApp deployment, with massive scalability benefits. Furthermore, development grants exceeding $500M are available across ecosystems.

For Investors: The ZK Rollup ecosystem represents significant growth opportunity, with total value locked projected to exceed $50 billion by year-end. Additionally, institutional adoption is accelerating rapidly.

For the Future: ZK Rollups align perfectly with Ethereum’s roadmap, positioning them as the dominant scaling solution for the next decade. Subsequently, expect 100,000+ TPS within 3-5 years.

The zero-knowledge revolution is just beginning. As computational costs decrease, developer tooling improves, and ecosystems mature, ZK Rollups will transform not just Ethereum, but the entire blockchain landscape. Whether you’re a curious beginner or experienced developer, now is the perfect time to explore this transformative technology.

Stay Connected

Follow the ZK Community

Twitter/X: @zksync, @0xPolygon, @Starknet, @ethereum

Discord: Join official servers: zkSync Discord, Polygon Discord, StarkNet Discord

Reddit: r/zkSync, r/0xPolygon, r/StarkNet, r/ethereum

Telegram: Official announcement channels and active community groups

Research Resources

- Bankless – DeFi and Ethereum ecosystem analysis with premium newsletter

- The Defiant – DeFi news, insights, and investigative journalism

- Decrypt – Blockchain and cryptocurrency news with educational content

- Unchained Podcast – Leading crypto podcast by Laura Shin

- Epicenter Podcast – Technical deep dives with protocol founders

Frequently Asked Questions (FAQ)

General Questions

Q: What makes ZK Rollups better than Optimistic Rollups?

A: ZK Rollups provide instant withdrawal finality (minutes vs. 7 days), higher security through mathematical proofs rather than fraud proofs, and potential privacy features. However, Optimistic Rollups currently have larger ecosystems and easier development. Consequently, the choice depends on your specific priorities—security and speed versus ecosystem maturity. Furthermore, ZK Rollups are more future-proof with quantum resistance options.

Q: Are ZK Rollups safe to use?

A: Yes, ZK Rollups inherit Ethereum’s security model while adding cryptographic proof verification. Moreover, funds are secured by smart contracts on Ethereum, and invalid transactions cannot be processed due to zero-knowledge proof requirements. Nevertheless, always conduct your own research, start with small amounts, and use official bridges. Additionally, major projects have undergone multiple security audits by top firms like Trail of Bits and OpenZeppelin.

Q: Which ZK Rollup should I choose?

A: The choice depends on your needs:

- zkSync Era – Best for beginners, excellent wallet integration, privacy features, $0.01-$0.05 fees

- Polygon zkEVM – Ideal for developers, large ecosystem with 53K+ dApps, full EVM compatibility

- StarkNet – Suited for advanced applications, quantum-resistant, custom Cairo programming language

Furthermore, consider your specific needs: security priority, development ease, or cutting-edge features. Additionally, you can use multiple rollups simultaneously for different purposes.

Technical and Practical Questions

Q: How much do ZK Rollup transactions cost?

A: ZK Rollup fees typically range from $0.01 to $0.10 per transaction, compared to $1-$50 on Ethereum mainnet. However, exact costs depend on network congestion and transaction complexity. Additionally, simple transfers cost less than complex smart contract interactions. Moreover, costs have decreased 90% since the Dencun upgrade. Track live fees at L2Fees.info and CryptoFees.

Q: Can I lose money using ZK Rollups?

A: While ZK Rollups are generally secure, risks include smart contract bugs, bridge vulnerabilities, and user errors. Therefore, always start with small amounts, use official bridges like zkSync Bridge or StarkGate, and never share private keys. Moreover, understand that all crypto investments carry inherent risks. Furthermore, enable 2FA, use hardware wallets for large amounts, and regularly review approvals on Revoke.cash.

Q: What is the future of ZK Rollups?

A: ZK Rollups are positioned to become the dominant Ethereum scaling solution. Furthermore, with Ethereum’s upcoming upgrades (full danksharding by 2026-2027), ZK Rollups will achieve even greater performance exceeding 100,000 TPS. Consequently, major institutions like Coinbase, Fidelity, and enterprises are increasingly adopting this technology for long-term scalability. Additionally, quantum-resistant zk-STARKs provide future-proofing against quantum computing threats.

Q: How do I bridge funds to ZK Rollups?

A: Use official bridges for maximum security: zkSync Bridge, Polygon Bridge, or StarkGate. Alternatively, consider aggregators like Bungee, Orbiter Finance, or Across Protocol. However, always verify URLs match official documentation exactly. Moreover, start with small test amounts before bridging large sums.

Additional Resources

- Ethereum Foundation Research – Official Ethereum research and development updates

- Vitalik Buterin’s Blog – Deep technical insights from Ethereum’s co-founder

- Week in Ethereum – Weekly newsletter covering all Ethereum developments

- ETHResear.ch – Ethereum research forum with cutting-edge discussions

- Dune Analytics – On-chain data analytics and dashboards

Disclaimer: This guide is for educational purposes only. Always conduct your own research and consult with financial advisors before making investment decisions.