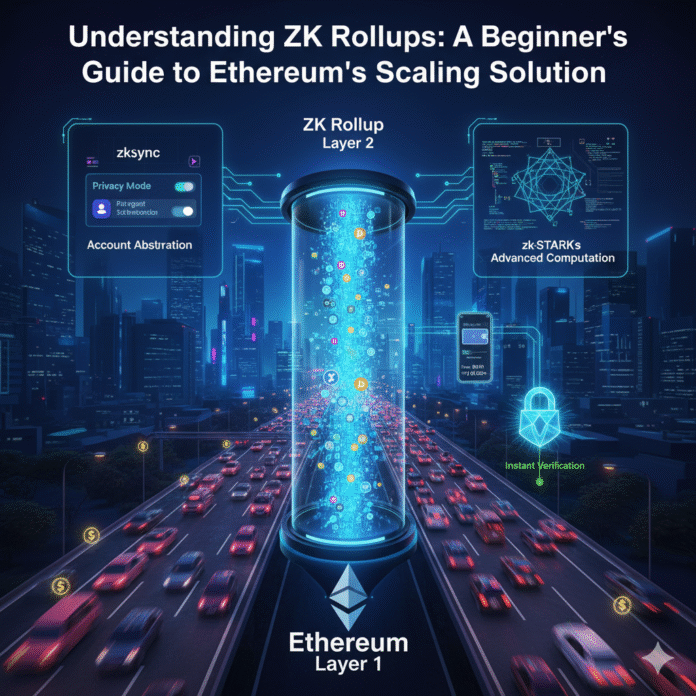

Ethereum has become the backbone of decentralized finance, NFTs, and countless blockchain experiments. But there’s a catch: the base layer prioritizes security over speed, which means during peak demand, transactions can crawl and fees can skyrocket. This is where Layer 2 solutions step in—and among them, Zero-Knowledge Rollups (ZK rollups) are stealing the spotlight.

ZK rollups handle the heavy computational lifting off Ethereum’s main chain, then prove everything was done correctly using advanced cryptographic methods. No trust required, just pure mathematics. Let’s break down how these systems work, why they’re transforming Ethereum’s scalability story, and what the leading platforms offer right now.

What Exactly Is a ZK Rollup?

Think of a ZK rollup as a smart delegation system. Instead of processing every transaction on Ethereum’s main network, a ZK rollup executes thousands of transactions off-chain, bundles them together, and then submits a compact validity proof along with minimal summary data back to Ethereum.

Ethereum doesn’t need to re-run every single transaction. It simply verifies the cryptographic proof—if the math checks out, the state update gets accepted. This architecture allows massive throughput improvements while maintaining Ethereum’s rock-solid security guarantees.

The “zero-knowledge” component is a cryptographic technique that proves something is valid without revealing all the underlying details. It’s a privacy-preserving method used far beyond blockchain applications, from secure authentication to confidential transactions.

Learn more: Ethereum.org’s rollup documentation

ZK Rollups vs. Optimistic Rollups vs. Sidechains

Understanding the L2 landscape requires knowing how different scaling solutions stack up:

Optimistic rollups take a “trust but verify” approach—they assume transactions are valid unless someone raises a challenge. This creates a withdrawal waiting period of roughly seven days. ZK rollups verify correctness upfront through mathematical proofs, enabling much faster withdrawals once the proof lands on Ethereum’s main chain.

Sidechains are entirely separate blockchains connected to Ethereum through bridges. They don’t inherit Ethereum’s security by default—they rely on their own validator sets. Rollups, by contrast, derive their security directly from Ethereum Layer 1.

Source: Medium’s comparison of rollup types

How ZK Rollups Work: The Technical Journey

Here’s the step-by-step process in plain language:

Transaction submission: Users send transactions to the rollup network, typically through a component called a “sequencer” that orders incoming transactions.

Off-chain execution: The rollup processes these transactions in a virtual machine environment—sometimes EVM-compatible, sometimes using custom languages like Cairo.

Batching: Thousands of individual transactions get bundled into a single batch, often called a “rollup block.”

Proof generation: The rollup generates a succinct cryptographic proof (either a zk-SNARK or zk-STARK) demonstrating that the entire batch was executed correctly.

Posting to Ethereum: The rollup publishes summary data and the validity proof to Ethereum’s main chain—typically a Merkle root plus the cryptographic proof.

Verification and finality: Ethereum verifies the proof mathematically. If valid, the rollup’s new state becomes finalized on Layer 1.

Because Ethereum handles only verification rather than execution, users get Layer 1 security with dramatically higher throughput and lower costs.

Technical details: Ethereum.org’s scaling documentation

Why ZK Rollups Matter in 2025

Dramatically lower fees: Ethereum’s Dencun upgrade in March 2024 introduced EIP-4844, which added “blob” space—a cheaper data availability option specifically for Layer 2 networks. Since then, transaction fees on ZK rollups have routinely dropped to the cents range, though exact figures fluctuate with network demand.

Faster withdrawals: Validity proofs eliminate the week-long challenge window that optimistic rollups require. Many ZK rollups finalize withdrawals in hours or less, depending on their proof aggregation schedule.

Security inheritance: Data and proofs get posted directly to Ethereum Layer 1, so you’re not trusting a separate validator committee like you would with sidechains.

Privacy potential: While most production ZK rollups today aren’t private by default, the underlying cryptographic techniques enable confidential transactions when explicitly designed for privacy.

Sources: Exodus on EIP-4844 impact, StarkWare on finality, Aztec’s privacy explainer

Leading ZK Rollups: The Current Landscape

The metrics below use Total Value Secured (TVS) from L2BEAT—the standard measurement for capital bridged or natively secured on Layer 2 networks. Data is current as of October 5, 2025.

zkSync Era (Matter Labs)

zkSync Era is a general-purpose ZK-EVM rollup with built-in account abstraction features. This means apps can subsidize user fees (through “paymasters”) or allow users to pay gas in tokens other than ETH. The proving infrastructure, called Boojum, generates validity proofs that Ethereum verifies on-chain.

Security and fees: Validity proofs ensure Ethereum-grade security. Post-Dencun blob data dramatically reduced transaction costs. Withdrawals are proof-dependent, typically completing within hours based on batch frequency.

Ecosystem: Total Value Secured is approximately $1.20 billion.

Token: ZK token launched in 2024 for governance.

Resources: zkSync documentation, Polygon technology overview, 21Shares research

Polygon zkEVM (Polygon Labs)

Polygon zkEVM delivers an EVM-equivalent experience, meaning Ethereum applications can migrate with minimal code changes. It’s part of the broader Polygon ecosystem, which underwent a token migration from MATIC to POL.

Ecosystem: Total Value Secured stands at approximately $19.8 million—notably smaller than Polygon PoS, which is a separate network entirely.

Why it matters: Developers get familiar Solidity tooling with zero-knowledge security. Fees typically range in the cents post-Dencun, varying with network load.

Resources: Polygon zkEVM documentation, GetBlock.io overview, CoinCentral POL migration guide

Starknet (StarkWare Foundation)

Starknet uses zk-STARKs—hash-based proofs that require no trusted setup and are widely considered post-quantum-resistant at the proof-system level. Rather than Solidity, Starknet uses the Cairo programming language for enhanced performance and flexibility.

Ecosystem: Total Value Secured is approximately $770.8 million. Note that dYdX v3 previously used StarkWare’s StarkEx technology, but dYdX migrated to its own Cosmos-based app-chain (v4) in 2023.

Withdrawal flow: Bridging happens through StarkGate, with finality tied to proof verification on Ethereum Layer 1.

Resources: Starknet documentation, Starknet starter guides, Figment’s Starknet overview

Data source: L2BEAT

Fees, Finality, and Timing: What to Expect

Transaction costs: Since EIP-4844’s implementation, Layer 2 data availability expenses dropped substantially. You’ll commonly see fees ranging from single-digit cents to low tens of cents on active ZK rollups, though prices fluctuate based on blob space demand and Ethereum Layer 1 gas costs. Always check live dashboards for current rates.

Withdrawal timing: Unlike optimistic rollups with their seven-day waiting periods, ZK rollups finalize much faster. zkSync documents typical finalization within hours, with variability based on network activity and proof aggregation cycles. Each network has its own cadence.

Sources: Exodus fee analysis, zkSync finality documentation

Real Risks and Trade-offs: Read Before Committing

Sequencer centralization: Most rollups currently operate a single sequencer, creating potential liveness and censorship vulnerabilities. Projects are actively developing decentralized sequencer networks and “escape hatches,” but these solutions remain works in progress. L2BEAT provides detailed risk assessments explaining operator assumptions for each network.

Privacy isn’t automatic: ZK technology enables privacy, but most production ZK rollups publish transaction data publicly for Layer 1 verification. Privacy requires explicit protocol-level design choices—projects like Aztec focus specifically on this.

Throughput reality check: Marketing materials often claim hundreds of thousands of transactions per second. Real-world throughput depends on proving capacity, data availability costs, and Layer 1 conditions. Always cross-reference with neutral analytics platforms.

Compatibility considerations: Starknet uses Cairo instead of Solidity, so porting applications requires engineering effort. Even zkEVMs that aim for EVM equivalence can differ in edge cases.

Sources: L2BEAT risk analysis, Aztec privacy documentation, arXiv research papers, SettleMint Cairo guide

Quick Comparison: Today’s Snapshot

Security model: All three platforms inherit Ethereum security through validity proofs verified on Layer 1.

Developer experience:

- zkSync Era: EVM-compatible with account abstraction features like paymasters and non-ETH gas payments

- Polygon zkEVM: EVM-equivalent architecture designed for seamless application migration

- Starknet: Cairo-first approach with powerful capabilities but distinct toolchain

Ecosystem capital (TVS as of October 5, 2025):

- zkSync Era: ~$1.20 billion

- Starknet: ~$770.8 million

- Polygon zkEVM: ~$19.8 million

For a detailed comparison of zkSync and Starknet, check out our comprehensive head-to-head analysis.

Data source: L2BEAT

Getting Started Safely: Beginner Checklist

Choose a compatible wallet: MetaMask works across most platforms. Argent X is popular for Starknet. Many networks offer native wallets or detailed setup guides in their official documentation.

Bridge with caution: Use only official bridges—zkSync’s native bridge, Polygon zkEVM’s bridge, or StarkGate for Starknet. Start with a small test transfer before moving significant funds.

Monitor costs in real-time: While post-Dencun fees are generally low, they remain dynamic. Check live fee trackers before initiating transactions.

Confirm finality: Don’t expect instant Layer 1 accessibility. Wait for proof verification to complete—check the bridge interface or block explorer for status updates.

Prioritize security: Use audited applications, monitor token approvals regularly, and review L2BEAT’s risk analysis for your chosen network.

Resources: Starknet wallet guides, Polygon technology bridges, CoinCentral guides

Critical Clarifications and Red Flags

“Privacy rollup” doesn’t mean private by default: ZK proofs can enable privacy, but most ZK Layer 2s publish transaction data for Layer 1 verification. Privacy requires specific architectural choices with different trade-offs.

dYdX statements may be outdated: dYdX v3 used StarkEx, but v4 has run on a Cosmos app-chain since 2023. Outdated claims still circulate.

TVS numbers change rapidly: Treat any figure as a point-in-time snapshot. Always verify current data on L2BEAT before citing statistics.

Sequencer centralization remains an issue: Most rollups still depend on a single sequencer today. The industry is researching decentralized alternatives and emergency withdrawal mechanisms, but these aren’t widely deployed yet.

Sources: Aztec privacy architecture, SettleMint dYdX history, arXiv sequencer research

The Bottom Line

ZK rollups scale Ethereum without sacrificing Ethereum’s security guarantees. Through validity proofs, they dramatically reduce costs, accelerate withdrawals, and create pathways to privacy-preserving applications when explicitly designed for that purpose.

In 2025, zkSync Era, Polygon zkEVM, and Starknet represent three major implementations, each with distinct trade-offs: EVM equivalence versus Cairo performance, ecosystem maturity versus cutting-edge technology, developer familiarity versus advanced features.

For beginners, the safest approach is straightforward: use official bridges, start with small amounts, monitor fees through live trackers, and rely on neutral analytics platforms like L2BEAT for risk assessments and TVS data.

To dive deeper into the world of zero-knowledge Layer 2 solutions, explore our complete guide to ZK rollups in 2025.

Essential Resources and Further Reading

- Ethereum Layer 2 and ZK-rollups documentation – Security models and rollup fundamentals

- EIP-4844 / Dencun upgrade details – Why Layer 2 data costs dropped in 2024

- L2BEAT – TVS tracking, activity metrics, and risk analysis across Layer 2 networks

- zkSync Era documentation – Account abstraction, paymasters, and ecosystem overview

- Polygon zkEVM resources – EVM-equivalent design and POL migration information

- Starknet documentation – Cairo language guides and STARK proof architecture