As the leading smart-contract platform, Ethereum continues driving innovation in decentralized finance (DeFi), NFTs, and Web3 gaming. However, network congestion during peak periods can result in frustratingly slow transactions and gas fees ranging from $20 to $100. Fortunately, Ethereum sidechains offer a solution: independent blockchains running parallel to Ethereum that deliver faster speeds, lower costs, and improved scalability.

This comprehensive guide explores what Ethereum sidechains are, how they function, and examines three prominent networks in 2025: Polygon PoS, Gnosis Chain (formerly xDai), and Ronin. All information presented comes from verified sources including official project documentation and trusted blockchain analytics platforms.

What Are Ethereum Sidechains?

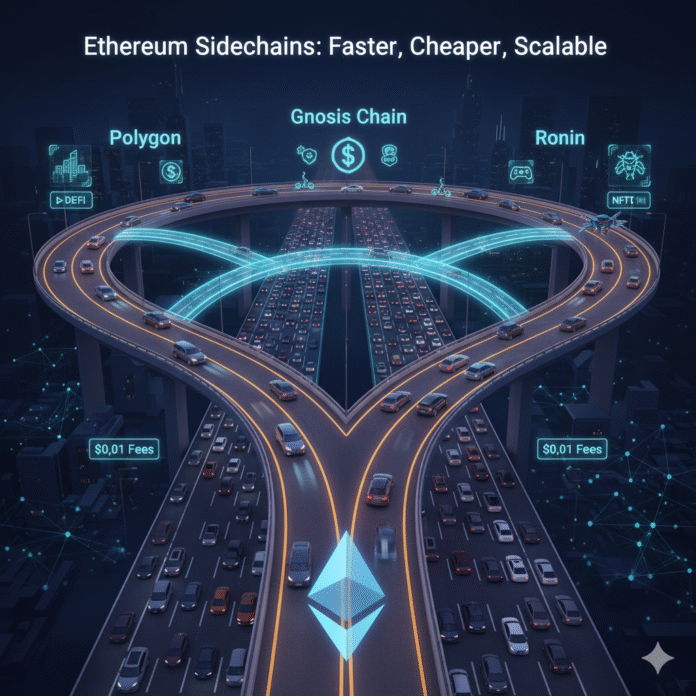

Imagine Ethereum as a major highway—highly secure but frequently congested. In contrast, sidechains function as parallel routes designed to ease traffic. These networks maintain their own validators, block production times, and consensus mechanisms. At the same time, they connect to Ethereum through bridge protocols that enable cross-chain asset transfers.

Unlike Layer-2 rollups such as Arbitrum or zkSync, which batch transactions and post them to Ethereum mainnet, sidechains operate with complete independence. Specifically, they handle their own block validation and security infrastructure. To understand the key differences between these approaches, check out our complete guide to rollups vs sidechains.

Key advantages include:

- Lower transaction costs: Typically, fees stay under $0.01 per transaction

- Enhanced speed: Moreover, processing capabilities reach hundreds to thousands of transactions per second (TPS)

- Greater flexibility: As a result, these networks are perfect for gaming, payments, and community apps where cost-efficiency and speed outweigh maximum decentralization

The security trade-off: On the flip side, sidechains use smaller validator sets compared to Ethereum, making them more prone to validator collusion or security breaches. Additionally, bridge issues can result in stolen funds, as shown by several high-profile exploits across the blockchain industry.

Learn more about blockchain scaling solutions at Ethereum.org.

How Ethereum Sidechains Function

In essence, sidechains interact with Ethereum through a four-step process:

- Asset bridging: First, a smart contract on Ethereum locks your ETH or tokens. Meanwhile, the sidechain mints matching wrapped assets for use on its network.

- Independent transaction processing: Next, the sidechain validates transactions through its own Proof-of-Stake or Delegated Proof-of-Stake consensus method.

- Periodic checkpointing: Furthermore, some sidechains send state snapshots to Ethereum for transparency purposes, though they work independently of Ethereum validators.

- Return bridging: Finally, when withdrawing, the sidechain burns wrapped tokens and the Ethereum bridge releases your original assets.

This design enables great speed and low costs while sacrificing some of Ethereum’s built-in security guarantees. For a deeper dive into zero-knowledge scaling alternatives, explore our beginner’s guide to zk-rollups.

Polygon PoS — The Multi-Purpose Sidechain Leader

Launch date: 2019 (initially as Matic Network)

Consensus mechanism: Proof of Stake

Active validators: Up to 105

Transaction fees: Approximately $0.001–$0.01

Polygon PoS ranks as the most widely used Ethereum sidechain. Importantly, full EVM compatibility allows developers to deploy Ethereum apps without changing code.

Technical Operations

- Bridge infrastructure: To begin, the Polygon PoS Bridge locks ETH or ERC-20 tokens on Ethereum and issues wrapped versions (WETH, USDC) on Polygon.

- Transaction throughput: In addition, it processes hundreds of TPS in real-world conditions, supporting DeFi platforms, NFT marketplaces, and gaming apps.

- Checkpoint system: Finally, state summaries post to Ethereum every few hours for easy auditing.

Ecosystem Overview

Notably, Polygon powers major platforms including Aave, QuickSwap, and OpenSea’s NFT marketplace. Beyond that, corporate projects like Reddit Collectible Avatars and Starbucks Odyssey have used Polygon infrastructure. For an in-depth comparison of how Polygon stacks up against other major chains, see our Ethereum vs Solana vs Polygon DeFi comparison.

Official documentation available at Polygon Technology.

Native Token

Currently, Polygon is moving from MATIC to POL under its Polygon 2.0 upgrade. As such, POL serves for gas fee payments and network staking.

Strengths and Limitations

Advantages: Wide ecosystem with strong developer support, plus seamless MetaMask integration

Considerations: On the other hand, PoS bridge withdrawals can take several hours, and a smaller validator set compared to Ethereum means lower security

Gnosis Chain (Formerly xDai) — The Stablecoin-Optimized Network

Launch date: 2018

Consensus mechanism: Proof of Stake (POSDAO, merged with Gnosis Beacon Chain in 2022)

Validator count: Tens of thousands (highly decentralized)

Transaction fees: Less than $0.001

Gnosis Chain was built for fast, clear transactions using xDAI, a USD-pegged stablecoin, as its native gas token.

Technical Framework

- Bridge protocols: To start, users move assets via the xDai Bridge or OmniBridge connecting Ethereum and Gnosis Chain.

- Stable gas mechanism: In addition, transactions paid in xDAI provide clear costs independent of ETH price swings.

- Governance structure: Meanwhile, validators stake GNO tokens for network security and governance input.

Application Ecosystem

Gnosis serves payment systems, DAOs, and community projects. Notable applications include Circles UBI, Honeyswap, and the widely-used Safe (formerly Gnosis Safe) multisig wallet.

Explore the network at Gnosis Chain.

Strengths and Limitations

Advantages: Extremely low and stable transaction fees, large post-merge validator network

Considerations: Smaller ecosystem compared to Polygon, primarily optimized for payments rather than high-volatility DeFi

Ronin — The Gaming-Focused Sidechain

Launch date: 2021 by Sky Mavis (Axie Infinity creators)

Consensus mechanism: Delegated Proof of Stake (DPoS)

Active validators: Approximately 22

Transaction fees: Near-zero for end users

Ronin was purpose-built for blockchain gaming, offering EVM compatibility designed to process massive volumes of in-game microtransactions without imposing prohibitive gas fees on players.

Technical Architecture

- Bridge system: Players transfer ETH and tokens through the Ronin Bridge.

- Transaction speed: Capable of exceeding 1,000 TPS in production environments, essential for real-time gaming experiences.

- Security enhancements: Following a 2022 bridge exploit resulting in approximately $600 million in losses, Ronin strengthened its validator model and implemented community governance.

Gaming Ecosystem

Ronin continues powering Axie Infinity and newer titles like Pixels, attracting millions of users through streamlined onboarding and the Ronin Wallet, which provides gas-free starter transactions.

Visit Roninchain.com for more information.

Strengths and Limitations

Advantages: Lightning-fast performance optimized for gamers, easy onboarding for Web2 players

Considerations: Smaller validator set increases trust requirements, limited utility beyond gaming applications

Comparative Analysis: Polygon vs Gnosis vs Ronin

| Feature | Polygon PoS | Gnosis Chain | Ronin |

|---|---|---|---|

| Primary use case | General-purpose DeFi, NFTs | Stablecoin payments, DAOs | Gaming |

| Consensus | Proof of Stake | Proof of Stake (POSDAO) | Delegated PoS |

| Validators | Approximately 105 | Tens of thousands | Approximately 22 |

| Fees | Under $0.01 | Under $0.001 | Near-zero |

| Security level | Medium | High | Lower |

| TVL (2025) | Approximately $4 billion | Approximately $0.5 billion | Approximately $1 billion |

For a comprehensive metrics comparison including TON Chain, visit our detailed chain metrics analysis.

Sidechains vs Layer-2 Rollups: Understanding the Difference

| Aspect | Sidechains | Layer-2 Rollups |

|---|---|---|

| Security model | Independent validators (reduced security) | Inherits Ethereum’s security |

| Speed and cost | Faster, cheaper | Now also affordable post-EIP-4844 |

| Bridge characteristics | Fast but higher risk | Slower, more secure |

| Optimal use cases | Gaming, payments, low-value transactions | High-value DeFi, enterprise applications |

Ethereum’s 2024 Dencun upgrade (EIP-4844) significantly reduced data costs for rollups, bringing many Layer-2 networks to near-sidechain pricing levels. However, sidechains maintain advantages in simplicity and architectural flexibility. Learn more about advanced zero-knowledge solutions in our complete zk-rollups guide for 2025.

Read about the Dencun upgrade at Ethereum Foundation Blog.

Critical Risk Factors

- Bridge vulnerabilities: Billions in losses have occurred from past exploits. Always utilize official bridges and limit exposure.

- Validator centralization: Fewer validators increase risks of collusion or network downtime.

- Misleading TPS claims: Theoretical figures like “7,000 TPS” or “100,000 TPS” often don’t reflect reality. Focus on verified real-world throughput and fee data.

- Ecosystem fragmentation: Each sidechain operates in isolation, making interoperability tools like Hop Protocol or LayerZero increasingly important.

The Evolution of Ethereum Sidechains

Sidechains continue rapid development. Projects such as Polygon zkEVM and zkSync Era blur traditional boundaries between sidechains and rollups, combining affordable fees with Ethereum-grade security. Meanwhile, cross-chain communication protocols are improving asset and data mobility between networks.

Expect hybrid architectures to dominate future scaling solutions—chains operating as independent sidechains while periodically anchoring cryptographic proofs to Ethereum for enhanced security.

Key Takeaways for 2025

Sidechains represent an essential component of Ethereum’s scaling infrastructure. They make blockchain applications accessible and affordable for mainstream users, despite not fully replicating Ethereum’s security model.

Recommendations for newcomers:

- For trading and DeFi: Start with Polygon

- For stable payments: Use Gnosis Chain

- For gaming: Explore Ronin

Important reminder: Always research bridge security, validator decentralization, and withdrawal timeframes before transferring significant funds. The Ethereum ecosystem continues advancing toward faster, more affordable transactions—and sidechains remain the frontier where innovation happens first.

For comprehensive blockchain education, visit CoinDesk Learn and Decrypt.