DeFi is finance without the middleman: swapping, lending, borrowing, and earning yield through smart contracts. Your choice of blockchain determines fees, speed, reliability, security, and how many apps you can use. In 2025, three names dominate most conversations: Ethereum, Solana, and Polygon. Here’s a clean, fact-focused comparison.

TL;DR: Who “Wins” for DeFi in 2025?

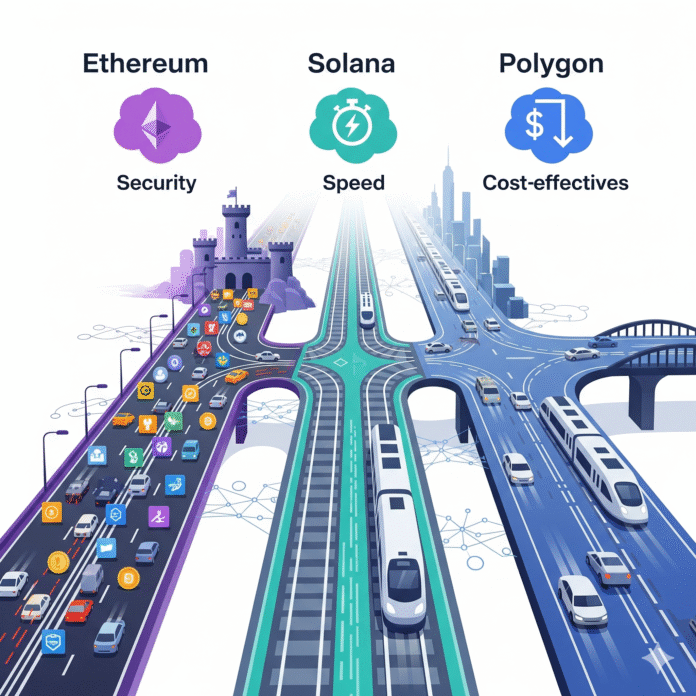

- Security & composability first: Ethereum (+ Layer 2 rollups)

- Speed + ultra-low fees on L1: Solana

- Cheap “Ethereum experience”: Polygon (PoS for simplicity; zkEVM for L2-grade security)

There’s no single winner for every DeFi use case—but there is a best fit for yours.

Why the Base Chain Matters for DeFi Applications

DeFi applications (dApps) live on smart contracts. The base blockchain controls:

- Transaction fees: What you pay per swap, stake, or transfer

- Throughput & latency: How many users the decentralized finance system can handle and transaction speed

- Network reliability: Uptime vs. downtime history

- Security & decentralization: Resistance to censorship and network attacks

- DeFi ecosystem depth: Number of audited protocols, total value locked (TVL), and integrations

For a detailed comparison of how these chains stack up on key metrics, see our comprehensive chain metrics analysis.

Ethereum: The Default Settlement Layer for Decentralized Finance

What it is: The original smart-contract platform with the largest DeFi ecosystem, including Uniswap, MakerDAO, Aave, and thousands more protocols.

Why Ethereum is Strong for DeFi

Security & network effects: Deepest liquidity pools, most security audits, and extensive protocol integrations across the decentralized finance landscape.

Energy-efficient Proof-of-Stake + scalable with Layer 2: Following the Merge and the Dencun (EIP-4844) upgrade, DeFi activity increasingly lives on rollups like Arbitrum, Base, Optimism, and zk-rollups where transaction fees are typically cents or less.

Composability: Moreover, DeFi protocols interlock like Lego—vital for advanced yield farming, flash loans, and multi-protocol strategies.

Ethereum Trade-offs

However, base-layer (L1) gas fees can still spike during network congestion—plan to use Layer 2 solutions for day-to-day DeFi transactions.

Additionally, user experience can be confusing for beginners (L1 vs L2, bridges, gas token management).

Best for: High-value DeFi use cases where security, liquidity, and composability matter most—stablecoins, major lending markets, and institutional DeFi workflows.

Solana: Speed and Tiny Fees on the Base Layer

What it is: A high-throughput Layer 1 blockchain using Proof-of-History + Proof-of-Stake to prioritize raw speed and low transaction costs.

Why Solana is Strong for DeFi

Fast finality, low latency, and very low fees: Transaction costs are fractions of a cent, making high-frequency DeFi trading economical.

Great UX for frequent actions: Consequently, it’s ideal for DEX trading, perpetual futures, and social/consumer apps with financial features.

Rich “retail-friendly” DeFi ecosystem: Furthermore, top DEX aggregators, derivatives platforms, and vibrant NFT markets thrive on Solana.

Solana Trade-offs

Nevertheless, past network outages are a known risk factor; reliability has improved but remains a monitoring point for DeFi users. Learn more about why Solana is rising but still can’t replace Ethereum.

The decentralization profile (validator count and network topology) differs from Ethereum’s security model.

Best for: High-frequency DeFi trading, consumer-focused decentralized finance applications, and apps where latency and cost dominate user experience.

Polygon: The Ethereum Companion for Scalable DeFi

What it is: A family of scaling solutions tied to Ethereum’s ecosystem.

- The PoS chain: An EVM-compatible sidechain with its own validator set; very low fees and easy onboarding for Ethereum DeFi users.

- The zkEVM solution: In contrast, a true Layer 2 rollup with zero-knowledge proofs that inherits Ethereum security; lower fees than L1 with full Solidity and tooling compatibility.

- Polygon 2.0 vision (AggLayer): An aggregated network of L2s with seamless cross-chain interoperability.

Why Polygon is Strong for DeFi

“Cheap Ethereum experience”: Familiar developer tooling, fast transactions, and inexpensive DeFi operations.

Choice of security model: Notably, PoS (cheapest and easiest) vs zkEVM (Layer 2-grade security inherited from Ethereum). For a deep dive into how zkEVM technology works, check out our complete guide to zk-rollups.

Polygon Trade-offs

However, security depends on which product you use: PoS relies on its own validator set; zkEVM inherits L1 Ethereum security but may cost slightly more than PoS.

Additionally, multiple products can create naming confusion (PoS vs zkEVM vs other Polygon chains).

Best for: Cost-sensitive DeFi users and teams who want EVM tools with low fees; zkEVM for those who want Layer 2 security guarantees.

Head-to-Head Comparison: Ethereum vs Solana vs Polygon for DeFi (2025)

| Factor | Ethereum | Solana | Polygon |

|---|---|---|---|

| Typical DeFi transaction fees | Low on L2, higher on L1 during peaks | Very low on L1 (fractions of a cent) | Very low on PoS; low on zkEVM |

| User-perceived speed | Fast on L2; L1 intentionally conservative | Very fast on L1 | Fast on PoS; L2-fast on zkEVM |

| Network reliability | Very high; mature multi-client stack | Past outages (improving), monitor status | PoS: depends on validator set; zkEVM inherits Ethereum |

| Security & decentralization | Highest overall (plus L2 inheritance) | Lower validator count vs. Ethereum | PoS lower than L1 Ethereum; zkEVM inherits L1 |

| DeFi ecosystem depth & liquidity | Largest TVL and most audited protocols | Rapid growth, strong trading stack | Broad EVM app availability; thriving “value” segment |

Note: Real-world DeFi user experience depends on the specific application, time of day, and network conditions. Therefore, always check current fees and network status before transacting.

Real-World DeFi Protocol Examples

Ethereum DeFi Protocols:

- Uniswap — The flagship decentralized exchange for EVM chains with billions in daily trading volume.

- MakerDAO — Collateralized stablecoin protocol behind DAI.

- Aave — Leading money market protocol for decentralized lending and borrowing.

Solana DeFi Protocols:

- Jupiter — Leading DEX aggregator on Solana with optimal routing.

- Raydium / Orca — Popular Solana DEXs with deep retail liquidity.

- Drift — Derivatives and perpetual futures trading platform.

Polygon DeFi Protocols:

- Aave on Polygon — Cheaper lending operations than Ethereum Layer 1.

- QuickSwap — EVM-compatible DEX with low-fee swaps on Polygon PoS.

- Polygon zkEVM — Growing ecosystem of Layer 2-secured EVM dApps.

Which Blockchain Should You Pick for DeFi?

Choose Ethereum (+ Layer 2) if you need the deepest liquidity, strongest security guarantees, and maximum DeFi composability for complex strategies.

Opt for Solana if you need fast, cheap transactions on Layer 1 for trading-heavy applications or consumer-style DeFi apps.

Select Polygon if you want EVM tools with low fees: PoS for maximum simplicity and cost savings; zkEVM if you want Layer 2 security inherited from Ethereum.

DeFi Blockchain Roadmaps Worth Watching in 2025

Ethereum: Further rollup-centric scaling (proto-danksharding and full danksharding), cheaper data availability through blob transactions, and improved UX across Layer 2 networks.

Solana: Meanwhile, continued work on network stability, error-handling improvements, and throughput optimization under real-world DeFi load.

Polygon: Similarly, Polygon 2.0 and AggLayer development to unify multiple Layer 2s with seamless cross-chain user experience.

Final Word: Choosing the Right Blockchain for DeFi

There’s no universal winner in the Ethereum vs Solana vs Polygon debate—only the right blockchain for your specific constraints.

When security and liquidity are your priorities, therefore build on Ethereum with Layer 2 rollups for optimal protection and deep market depth.

For applications demanding speed and minimal fees, then Solana becomes the natural choice with its ultra-fast Layer 1 and micro-transaction costs.

Teams seeking affordable EVM compatibility should consequently consider Polygon PoS for maximum cost savings or Polygon zkEVM for Layer 2-grade security inherited from Ethereum.

Ultimately, pick the blockchain that matches your DeFi app’s requirements, user base, and risk tolerance. The “best” chain is the one that serves your specific needs most effectively.

Related Resources: