Ever wondered how you can make your money work harder in crypto without riding the Bitcoin rollercoaster?

If you’re like most folks dipping their toes into crypto, you’ve probably heard about yield farming but figured it’s too complicated or risky. Here’s the deal: yield farming with stablecoins changes that game entirely. These digital dollars stay steady at around $1, letting you earn interest – sometimes double-digit APYs – while sleeping soundly at night. I’ve been writing about crypto for over a decade, and trust me, stablecoin yield farming has been my go-to for consistent passive income, especially in volatile markets like we’ve seen lately.

In this article, we’ll break it all down simply. You’ll learn what yield farming really means, the best stablecoins to use in 2025, top protocols for juicy yields, and how to get started without losing your shirt. We’ll cover risks head-on, share pro tips from my experience, and even throw in some real-world examples. By the end, you’ll have a clear plan to start earning yield on your stablecoins.

Here’s a quick preview of what you’ll learn:

The basics of yield farming and why stablecoins are perfect for beginners.

A comparison of top stablecoins like USDC, USDT, and DAI, with current APYs.

Step-by-step guides to popular protocols.

Common pitfalls and how to avoid them.

Future trends that could boost your returns in 2025.

Let’s dive in and turn your idle crypto into a money-making machine.

What Is Yield Farming and Why Stablecoins?

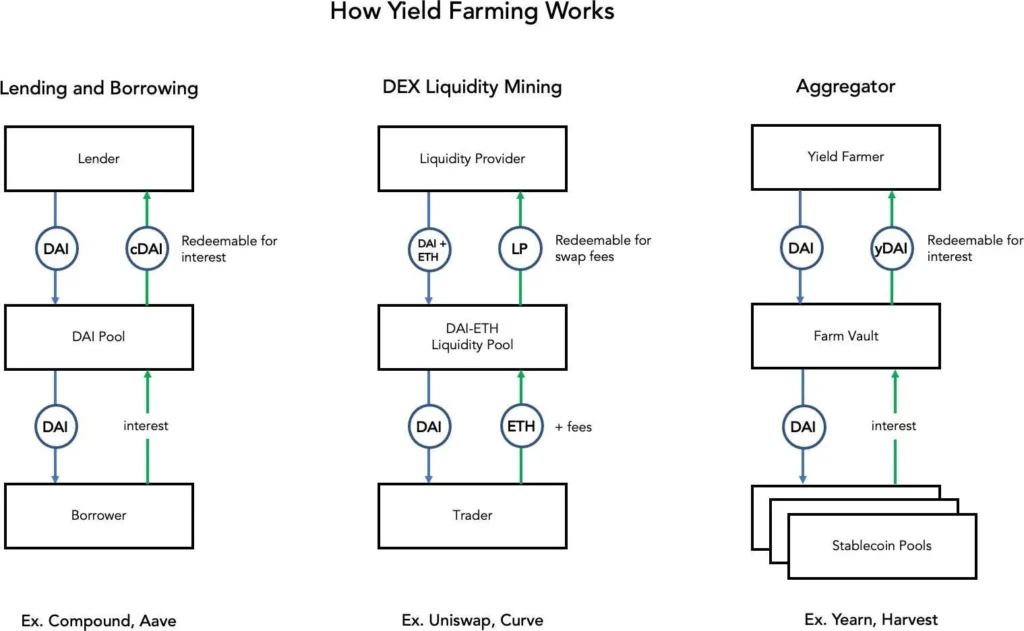

Yield farming? It sounds fancy, but it’s basically like putting your money in a high-interest savings account – on steroids, and powered by blockchain. You lend or provide liquidity with your crypto, and in return, you earn rewards, often in the form of interest or extra tokens. Think of it as being the bank yourself in the DeFi world. However, unlike traditional banks with their measly 0.5% rates, yield farming can net you 5–15% APY or more, depending on the setup.

Now, why stablecoins for yield farming? Simple: stability. Coins like Bitcoin can swing 10% in a day, but stablecoins like USDC or USDT are pegged to the dollar, so your principal stays safe from wild price drops. It’s like farming crops in a greenhouse instead of out in a storm – you get the yields without the weather risks. In my experience, when I first started yield farming back in 2020, I lost sleep over volatile pairs. Switching to stablecoins? Game-changer. It let me focus on the rewards, not the charts.

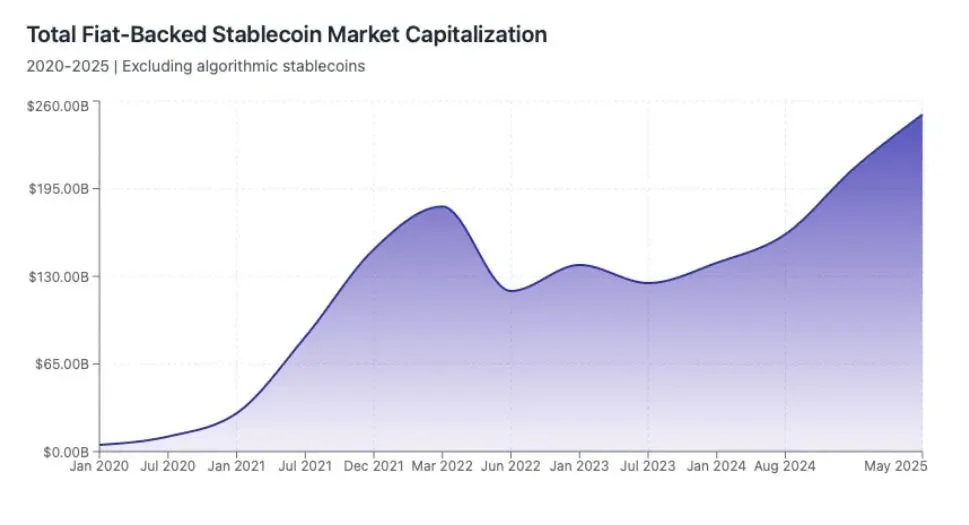

But here’s the thing: not all stablecoins are created equal. Some are backed by real cash reserves, others by algorithms or crypto collateral. For beginners, stick to the big ones – they’re audited and battle-tested. According to CoinGecko’s stablecoin research, the most liquid and reliable stablecoins consistently maintain their peg through various market conditions. If you want a detailed breakdown, our guide on stablecoins in 2025: DAI, USDC, USDT compared covers everything you need to know about choosing the right one.

Yield farming with stablecoins isn’t just for pros; even intermediates can jump in with $100 and see results. In 2025, with DeFi maturing, we’re seeing stablecoin APYs on mainstream platforms stabilize mostly in the mid-single digits (roughly 3–8%), with higher-risk or promotional strategies sometimes pushing into low double digits. For a comprehensive understanding of the mechanics, check out our complete guide to yield farming on Ethereum.

Let me explain with an analogy. Imagine your stablecoins as parked cars in a garage. Yield farming is like renting out spaces in that garage – you earn fees from people using it, without selling your cars. Easy, right? And with tools like DeFi aggregators, it’s gotten simpler over the years.

One pro tip here: Always check the protocol’s TVL (Total Value Locked). Higher TVL means more security and liquidity. For instance, platforms with billions locked in are generally less likely to rug pull than tiny, brand-new farms.

That wraps up the basics. Now, let’s look at the stars of the show – the best stablecoins for yield farming this year.

Top Stablecoins for Yield Farming in 2025

Alright, let’s get to the meat: which stablecoins should you use for yield farming in 2025? I’ve tested dozens over the years, and these three stand out for their reliability, liquidity, and yield potential. We’ll focus on USDC, USDT, and DAI – the holy trinity – but I’ll touch on emerging ones too.

USDC (USD Coin)

First up, USDC. Issued by Circle, it’s fully backed by cash and treasuries, making it super trustworthy. In 2025, USDC yields are hovering around roughly 3–6% on major DeFi lending platforms like Aave and Compound, and can be higher on certain CeFi platforms or during promotional periods. Why? High demand for lending. Pros: Transparent audits, easy to swap. Cons: Sometimes lower yields than riskier options. I remember parking $5,000 in USDC on Aave last year – it earned me about $300 in interest without a hitch.

Circle publishes monthly attestation reports showing their reserve composition, which adds an extra layer of transparency that institutional investors particularly appreciate. This backing makes USDC one of the most regulated stablecoins in the space. For an in-depth comparison of how USDC stacks up against other options, read our analysis of stablecoins on Ethereum: USDT vs USDC vs DAI.

USDT (Tether)

Next, USDT from Tether. It’s the most liquid stablecoin out there, with trillions in trading volume. Yields? Depending on platform and product, you can see anything from a few percent on more conservative flexible products to low-double-digit promotional rates (around 10–14%) on spots like Nexo or Bybit when you lock tokens or accept extra conditions. Pros: Everywhere in DeFi, great for quick moves. Cons: Past transparency issues, but they’ve improved. In my book, USDT’s ubiquity makes it a staple for yield farming – like the Swiss Army knife of stablecoins.

Despite historical controversies, USDT remains dominant due to its deep liquidity across countless trading pairs and DeFi protocols. According to CoinMarketCap’s stablecoin rankings, USDT consistently maintains the highest trading volumes globally. For more details on how stablecoins maintain their peg, check out our comprehensive guide on how do stablecoins maintain their peg.

DAI

Then there’s DAI, MakerDAO’s decentralized darling. Overcollateralized with crypto, it’s yield farming gold. In some markets, especially on protocols like Spark, yields on DAI or closely related stablecoins can briefly spike into low double digits, though more typical ranges are closer to mid-single digits. Pros: No central issuer, resistant to censorship. Cons: Peg can wobble in extreme markets. A real example: During the 2022 crash, DAI held steady while others flinched, letting farmers keep earning.

DAI’s decentralized nature comes from its overcollateralization model, where users lock up crypto assets worth more than the DAI they mint. This mechanism is managed through MakerDAO’s governance system, making it truly community-controlled. The protocol has been battle-tested through multiple market cycles, as detailed in MakerDAO’s transparency reports.

Yield-Bearing and Newer Stablecoins

Emerging players? Check USDY from Ondo Finance (around 4–6% from treasuries) or USDe from Ethena (historically ranging from mid-single to low-double-digit yields via hedging strategies, but highly variable and dependent on market funding rates). These yield-bearing stablecoins bake in returns automatically – no extra steps needed.

Pro Tip: For beginners, start with USDC on a CeFi platform like Coinbase. It’s regulated and user-friendly, easing you into yield farming before going full DeFi.

Overall, these stablecoins dominate because they’re versatile. Mix them in pools for balanced yields. But remember, yields fluctuate – check DeFiLlama or similar dashboards regularly.

Best DeFi Protocols for Stablecoin Yields

How to Build a DeFi Lending Platform Like Aave? Step-by-Step Guide / medium.com

Now that you’ve got your stablecoins, where do you farm them? In 2025, the protocol landscape is buzzing with options. I’ll highlight the top ones based on my trials and current data. For a comprehensive overview of the best platforms, see our guide to DeFi 2025: top 10 protocols across all chains.

Aave

Aave tops my list. It’s the OG lending protocol with around $40B in TVL across markets in 2025. Supply USDC or USDT, earn roughly 4–7% variable APY depending on the market and utilization. Why love it? Flash loans, multi-chain support. I once looped yields here for compounded gains – turned 5% into about 6.5% effectively.

Aave pioneered many DeFi lending innovations and operates across multiple chains including Ethereum, Polygon, Arbitrum, and Optimism. Their governance forum is highly active, constantly optimizing parameters for better yields and security. For a step-by-step walkthrough, check our detailed tutorial on Aave lending on Ethereum: how to earn interest with your crypto.

Compound

Compound is another solid pick. Similar to Aave, but with governance tokens (COMP) as bonuses. Yields for DAI can be in the mid-single digits on base APY, with total returns reaching higher single digits when you factor in COMP incentives in certain markets. Pros: Battle-tested since 2018. Cons: Higher gas fees on Ethereum.

The Compound protocol has processed billions in transactions without major hacks, establishing it as one of the most trusted lending platforms in DeFi. According to Compound’s transparency dashboard, the protocol maintains robust security practices and regular audits. Learn more about DeFi lending platforms on our dedicated comparison page.

Curve Finance

Curve Finance excels at stablecoin swaps. Provide liquidity to USDC/USDT pools, snag roughly 5–15% from fees and CRV rewards in many periods, with some niche pools occasionally going higher. It’s like a specialized exchange – low slippage means steady yields. Case study: In 2024, Curve farmers averaged around 8% on major stable pools during bull runs.

Curve’s innovative StableSwap algorithm is specifically designed for stablecoin trading, minimizing slippage and impermanent loss compared to traditional AMMs like Uniswap. The platform’s documentation provides detailed explanations of their bonding curves and pool mechanics.

Pendle

Pendle is for fixed or forward yields. Tokenize future yields on assets like USDe or sDAI and lock in returns that can reach low-double-digit APYs when markets are favorable. Advanced, but worth it for predictability if you know what you’re doing.

Pendle’s unique approach lets you separate yield from principal, enabling sophisticated strategies like yield trading and hedging that weren’t possible in traditional DeFi. Their analytics dashboard shows real-time yields across various assets and chains.

Balancer and Uniswap

Balancer and Uniswap for LP farming – certain stablecoin-heavy or incentivized pools can show 12–17% on paper, but you must always consider impermanent loss and reward token volatility.

Warning: Avoid new protocols with sky-high APYs (30%+) unless you deeply understand the risk. Those yields are often unsustainable and have historically been associated with schemes that later blew up.

These protocols offer the best mix of safety and returns. Start small, diversify.

Comparing Yields: A Handy Table

To make this easy, here’s a quick comparison table of top stablecoins and their typical 2025 yield ranges across major platforms. (Data as of late 2025; always verify live.)

| Stablecoin | Top Example Protocol / Platform | Typical APY Range (2025) | Pros | Cons |

|---|---|---|---|---|

| USDC | Aave, Coinbase | ~3–6% on major platforms, sometimes higher in promos | High liquidity, transparent reserves | Often lower APY than riskier options |

| USDT | Nexo, Bybit, Binance | ~4–10%, with some promos pushing into low teens | Ubiquitous, flexible products | Ongoing concerns about reserves for some users |

| DAI | Spark, Aave, OKX/Bybit | ~3–8%, with occasional spikes into low double digits in incentivized pools | Decentralized, MakerDAO-backed | Collateral and peg risks in stress events |

| USDY | Ondo | ~4–6% from Treasuries and deposits | Treasury-backed exposure, tokenized RWA | Lower upside; jurisdiction limits for some users |

| USDe | Ethena | ~4–10% depending on funding; can be higher at times but very variable | Hedged yield model, attractive when perp funding is rich | Complex, derivative risk and dependence on market conditions |

This table shows USDC for safety and simplicity, and DAI/USDe for potentially higher yields with extra risk. Real example: A friend farmed USDT on Bybit at around 8% – earned roughly $800 on $10K in a year, before fees and taxes.

Key takeaway: Match your risk tolerance to the stablecoin and platform.

Risks in Stablecoin Yield Farming (And How to Dodge Them)

Top 5 DeFi Liquidity Red Flags Beginners Must Spot / blog.bitunix.com

Yield farming isn’t risk-free – I’ve learned that the hard way. Smart contract bugs? They happen. In 2022, a hack wiped out millions on a lesser protocol. Solution: Stick to audited ones like Aave, Compound, or well-reviewed newer platforms. Always check DeFi Safety ratings before depositing funds.

Peg breaks: Rare, but USDT and even other “safe” stablecoins have briefly traded below $1 during market stress. The depeg of UST in 2022 serves as a stark reminder of algorithmic stablecoin risks. Mitigate by diversifying stablecoins and not chasing only the highest APY. For a comprehensive risk assessment, our article on yield farming on Ethereum covers all the potential pitfalls.

Impermanent loss in LPs: Like selling low, buying high automatically. Avoid that by using stable-only pools or products that minimize price divergence. For a deeper dive, read our article on understanding impermanent loss.

Regulatory risks in 2025? Governments are eyeing DeFi harder than ever. Some regions restrict access to certain platforms or products. The SEC’s ongoing scrutiny of DeFi protocols means you should pay attention to your local regulations and stay informed so you don’t accidentally break the rules. CoinTelegraph’s regulatory updates provide regular coverage of the evolving legal landscape.

Important: This isn’t financial advice. Crypto can lose value – only invest what you can afford to lose.

Address objections: “Is it too complicated?” It can look that way at first, but wallets like MetaMask, Rabby, and user-friendly CeFi platforms significantly lower the barrier.

Mini-conclusion: Risks exist, but with homework, stablecoin yield farming is generally less volatile than aggressive spot trading of altcoins.

Step-by-Step Guide: Starting Yield Farming Today

Crypto Basics: What Is Yield Farming? / medium.com

Ready to roll? Here’s how, step by step.

Get a wallet: Install MetaMask or Rabby. Both offer comprehensive setup guides for beginners.

Fund with stablecoins: Buy USDC/USDT/DAI via Coinbase, Binance, or another exchange, then send to your wallet.

Choose a protocol: Start with a blue-chip like Aave on Ethereum or a cheaper L2 like Base or Arbitrum. Our Aave lending guide walks you through the entire process.

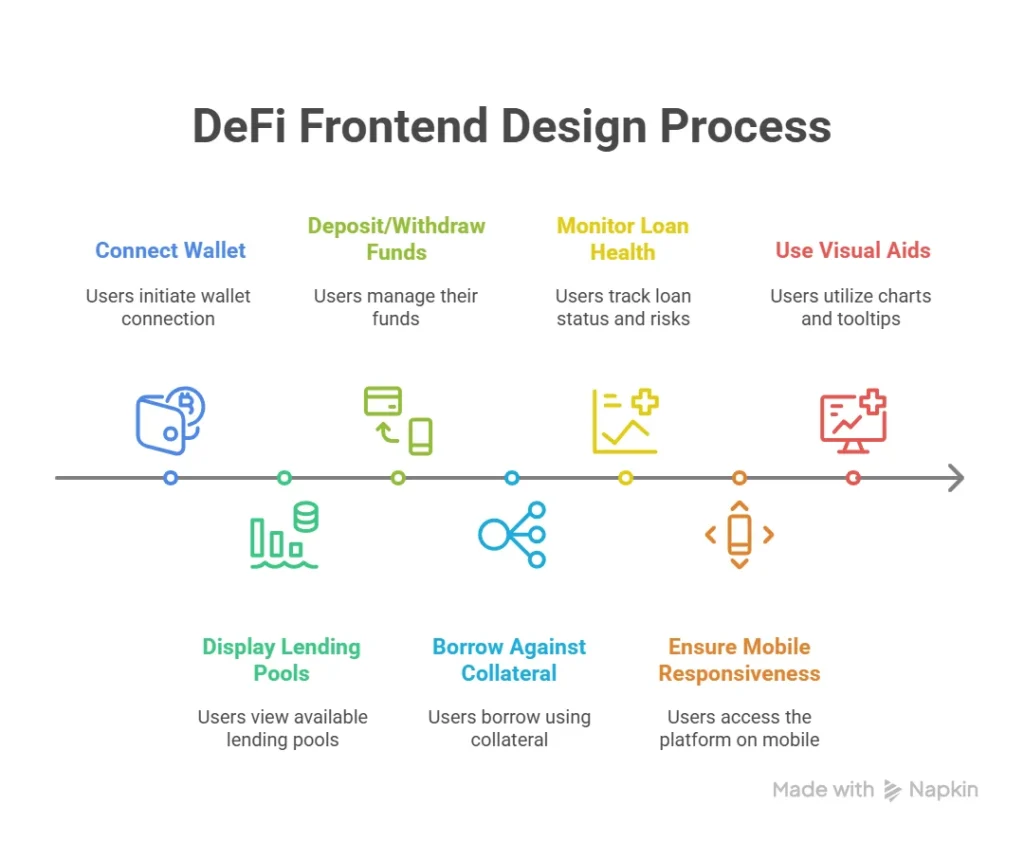

Connect wallet & supply stablecoins:

- Go to the dApp

- Connect your wallet

- Click “Supply” or “Deposit,” choose your stablecoin, approve, then confirm the transaction

Earn yields: Once supplied, you start accruing interest. You can withdraw anytime, subject to liquidity.

Example: Deposit $1,000 USDC on Compound, earn roughly $50/year at 5% – more or less, depending on the live APY.

Pro Tip: Use gas optimizers like Layer 2 chains (Base, Arbitrum, Optimism) to cut transaction fees dramatically compared to Ethereum mainnet. Check out our guide on Layer 2 scaling solutions for more details. L2Beat provides excellent comparisons of different L2 options.

For intermediates: Add auto-compounders like Yearn or Beefy Finance on top of your positions, if they support your chosen asset and chain.

CeFi route? Get started on Binance or Coinbase – they have built-in yield tools so you can earn on stablecoins without touching DeFi directly.

Advanced Strategies for Higher Yields

Once comfy, you can level up.

Loop lending: Borrow against your deposits and re-supply. I did this on Aave – boosted yields by ~20% relative to the base APY, but it also increased liquidation risk. This strategy is explained in detail on Aave’s documentation and in DeFi lending tutorials.

Cross-chain farming: Use bridges like Stargate Finance or LayerZero-powered dApps to move stablecoins to chains with better yields. Always verify bridge security through platforms like L2Beat before transferring large amounts.

Yield-bearing stables: Hold things like sDAI or onchain treasuries-backed products to earn a base yield automatically, then layer additional strategies on top. Our article on yield-bearing stablecoins covers this in depth. Spark Protocol’s documentation explains how sDAI generates native yields.

Warning: Higher yields = higher risks. Don’t over-leverage. A sudden peg wobble or rate spike can nuke an overextended position.

Case study: Combining Etherfi’s yield products (like LiquidUSD, which has advertised high-single-digit APY ranges) with card rewards via Etherfi Cash can push your effective yield into low double digits – but only if you understand the mechanics and are comfortable with smart contract and platform risks.

This kind of stacking can enhance returns, but you must monitor positions closely and be ready to de-risk when conditions change.

2025 Trends: What’s Next for Stablecoin Farming?

Stablecoins in 2025: Full Overview of the $230B Market / medium.com

Looking ahead, 2025 brings yield-bearing stables firmly into the mainstream. Ethena’s USDe and similar delta-hedged stablecoins have at times posted double-digit yields when perp funding is rich, but current rates have cooled into the mid-single to low-double digits and can change quickly. RWAs (real-world assets) like Treasuries and money market funds on-chain are providing more conservative, bond-like stablecoin yields through platforms like Ondo Finance and Maple Finance.

According to The Block’s RWA research, tokenized real-world assets have grown significantly in 2025, representing a major trend in stable yield generation. Messari’s DeFi reports provide excellent analysis of emerging yield opportunities.

AI optimizers? They’re arriving fast – bots and smart vaults that automatically rotate your stablecoins between protocols to chase better risk-adjusted yields. Projects like Yearn V3 are incorporating machine learning for portfolio optimization.

Hybrid CeFi–DeFi is also growing: platforms that abstract DeFi under the hood while giving you a CeFi-like UX. Read more about the convergence of CeFi and DeFi on our blog. For broader context on protocol developments, check our analysis of DeFi 2025: top 10 protocols.

Exciting times – but most serious analysts expect sustainable stablecoin yields to cluster around the mid-single digits on average, with occasional windows where you can lock in higher rates if you’re early and careful.

Last Updated: November 23, 2025

FAQ

What is yield farming? It’s earning rewards by providing liquidity or lending crypto in DeFi, usually via smart contracts.

How do people get 10–20% yields on stablecoins? By combining protocol rewards, fees, and sometimes leverage on platforms like Pendle, Curve, Balancer, or high-incentive CeFi campaigns. These rates are often temporary and come with higher risk.

Is yield farming safe? Safer with stablecoins than with volatile tokens, but risks like hacks, peg issues, and bad tokenomics exist. Using audited, established platforms helps reduce (not eliminate) risk.

What’s the difference between staking and yield farming? Staking usually secures a network or protocol, while yield farming is about providing liquidity or lending to earn fees and incentives. Learn more in our staking vs yield farming guide.

Can beginners do yield farming? Yes. Starting with a CeFi platform like Coinbase or Binance, or a simple DeFi deposit on Aave, is beginner-friendly.

What are the best stablecoins for beginners? USDC and USDT for simplicity and liquidity, with DAI for those who want a more decentralized option. Our stablecoins comparison guide breaks down all the differences.

How does impermanent loss work? In volatile pools, you can end up with fewer of the asset that rose in price and more of the one that fell, leaving you worse off than just holding – even if the pool earned fees.

Are yields taxable? In most jurisdictions, yes – yield is usually treated as income or capital gains. Always check your local laws or talk to a tax professional. The IRS has specific guidance on crypto taxation.

What’s the minimum to start? On CeFi, often as little as $10–50. On DeFi, gas fees make it more practical to start with a few hundred dollars.

How to track yields? Use dashboards like DeFiLlama, Zapper, or Zerion to track APYs and your own portfolio performance.

Conclusion

We’ve covered a lot – from yield farming basics to the best stablecoins like USDC, USDT, and DAI for 2025. You now know protocols, risks, and strategies to realistically earn something in the ~3–10% APY range on stablecoins, with occasional chances to go higher if you accept more risk.

Remember: start small, diversify, and stay educated.

Next steps: Open a wallet, buy stablecoins on Coinbase or Binance, and try a simple supply position on Aave or Compound. Track your portfolio weekly and don’t chase every shiny new farm.

If you’re serious, explore more advanced tools like Pendle, Spark, or yield-bearing stablecoins once you’re comfortable with the basics. For a complete understanding of the ecosystem, review our guides on stablecoins on Ethereum and yield farming strategies. For more strategies, check out our comprehensive guide on DeFi passive income strategies.

Yield farming with stablecoins can be a powerful tool for building real wealth over time – if you respect the risks and stay disciplined. Go make it happen.