Ever wondered if you’re missing out on better deals or easier trading by sticking with the wrong crypto exchange?

Choosing the right crypto exchange can make or break your experience in the world of cryptocurrency. Whether you’re a complete beginner dipping your toes into Bitcoin for the first time or an intermediate investor looking to trade altcoins like ETH/USD, the options out there can feel overwhelming. That’s where this guide comes in. We’ll break down two giants: Coinbase and Binance. In 2025, Coinbase shines for its user-friendly setup and strong regulatory backing, making it ideal for newcomers. Binance, on the other hand, packs more features and lower fees, perfect if you’re ready for advanced trading.

By the end of this article, you’ll know exactly which one suits your style. Here’s a quick preview of what you’ll learn:

A head-to-head comparison table to see key differences at a glance.

In-depth looks at fees, security, and supported cryptocurrencies.

Pros, cons, and real-world examples to help you decide.

Tips for getting started, plus warnings on common pitfalls.

Trust me, I’ve been in your shoes—starting small and learning the hard way. Let’s make this simple so you can focus on what matters: growing your portfolio.

Overview of Coinbase and Binance

Let’s kick things off with the basics. Coinbase and Binance are two of the biggest names in the crypto exchange game, but they cater to slightly different crowds. Coinbase, founded back in 2012, is like that reliable friend who’s always got your back—especially if you’re new to this. It’s US-based, publicly traded on Nasdaq, and focuses on making crypto accessible. As of 2025, it boasts over 100 million users worldwide, with a strong emphasis on compliance and education.

Binance, launched in 2017, is the speed demon of exchanges. It’s the largest by trading volume according to CoinMarketCap, handling huge sums daily, and appeals to folks who want variety and low costs. With a user base exceeding 280 million, it’s global but has faced some regulatory hurdles in places like the US (hence Binance.US for Americans). Here’s the deal: If Coinbase is a cozy coffee shop, Binance is a bustling marketplace.

To give you a quick snapshot, check out this comparison table:

| Feature | Coinbase | Binance |

|---|---|---|

| Founded | 2012 | 2017 |

| User Base (2025) | 100+ million | 280+ million |

| Best For | Beginners, US users | Advanced traders, global users |

| Trading Volume (Recent) | Quarterly: $295 billion (Q3 2025) | Daily: ~$217 billion (June 2025, spot + futures) |

| Mobile App Rating | 4.7/5 (App Store) | 4.6/5 (App Store) |

| Key Strength | Simplicity and security | Low fees and features |

Binance vs. Coinbase: Which Is Truly Better? – Cryptopolitan / cryptopolitan.com

In my experience, starting with Coinbase felt less intimidating—I bought my first $50 of Bitcoin without breaking a sweat. But as I got more into trading pairs like ETH/USD, Binance’s options pulled me in. Which brings us to the next point: How easy are they to use?

User Interface and Ease of Use

Picture this: You’re excited about crypto but staring at a screen full of charts and jargon. That’s where user interface matters. Coinbase wins big here for beginners. Its app and website are clean, intuitive, and straightforward. You can buy, sell, or swap crypto in a few taps, with clear explanations every step. In 2025, they’ve updated their mobile app with even better navigation, including a “Learn” section with tutorials according to their official blog. It’s like having a guide holding your hand.

Binance? It’s powerful but can overwhelm newbies. The interface packs in advanced charts, order types, and tools—great if you’re intermediate, but a bit much otherwise. However, they’ve improved with a “Lite” mode for simpler trading as noted in Binance Academy. I remember switching to Binance and feeling like I’d upgraded from a bike to a motorcycle. Exciting, but I wiped out a couple of times on small trades.

For example, if you’re a beginner buying ETH, Coinbase quotes prices in USD right away, no fuss. On Binance, you might navigate through spot markets or futures. Rhetorical question: Do you want plug-and-play or customizable power? Most starters lean Coinbase, but as you grow, Binance’s depth shines.

Pro Tip: Start with Coinbase’s free trial of Coinbase One for zero fees on basic trades—it’s a game-changer for testing the waters according to Bankrate’s review.

In fact, user reviews on sites like Trustpilot give Coinbase around 4.0/5 overall, while Binance sits closer to about 1.4/5, often citing issues with support and withdrawals rather than just the learning curve. But don’t let that scare you; both have solid apps.

Making web3 more accessible and intuitive / coinbase.com

Mini-conclusion: If simplicity is key, go Coinbase. Ready for more? Binance awaits.

Supported Cryptocurrencies and Trading Options

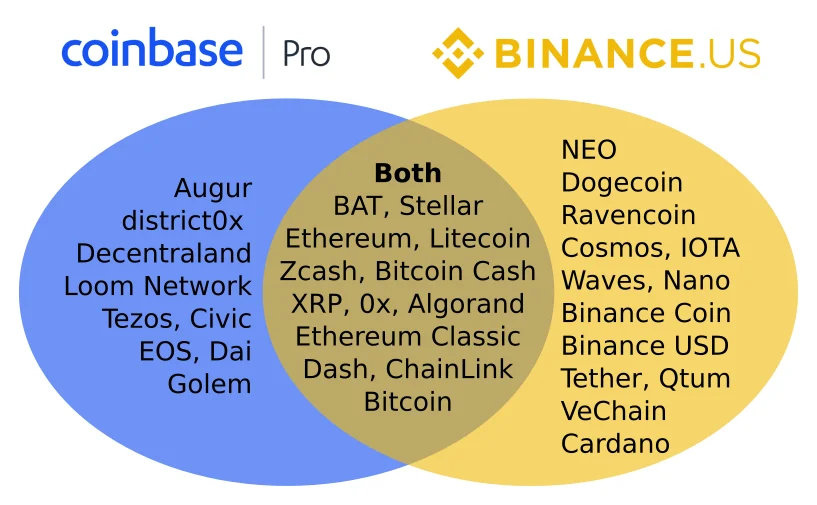

Variety is the spice of crypto life, right? Binance crushes it here with over 500 cryptocurrencies supported in 2025, including rarities like BNB, Solana, and more than 1,500 trading pairs according to their markets page. You can dive into spot trading, futures, options—even NFTs and staking. It’s perfect for intermediate investors hunting altcoins or leveraging trades.

Coinbase supports around 275+ assets, focusing on established ones like Bitcoin, Ethereum, and XRP as listed on their prices page. They’ve added more in 2025, but it’s curated—think quality over quantity. Trading options include basic buys/sells, advanced charting on Coinbase Advanced, and staking for rewards.

Real example: Want to trade a hot new token? Binance often lists it first. But for safe, regulated options, Coinbase has you covered. I once missed a pump on a meme coin because Coinbase didn’t list it—lesson learned.

Warning: Always check availability in your region; Binance.US has fewer options due to US regulations set by the SEC.

Pros for Binance: More pairs mean more opportunities, like ETH/USD futures with up to 125x leverage. Coinbase cons: Limited to 350+ pairs, but safer for beginners.

In short, if you’re exploring beyond basics, Binance expands your world. And remember, once you’ve chosen your exchange, you’ll want to think about secure wallet storage for your Ethereum and other assets.

Fees and Costs: Where You’ll Save Money

Fees can eat into your profits faster than you think—trust me, I’ve felt that sting. In 2025, Binance keeps things cheap: Spot trading at 0.1% (drops to 0.075% with BNB), futures at around 0.02%/0.05%. No deposit fees, withdrawals vary by coin (e.g., 0.0005 BTC). For high-volume traders, VIP tiers slash it further according to Binance’s fee schedule.

Coinbase? Higher for retail: Up to 1.49% plus spread on buys, but Advanced Trade drops to 0–0.6%. Coinbase One ($29.99/month) zeros out trading fees and boosts staking. Deposits free, withdrawals have network fees.

Case study: Buying $1,000 ETH on Coinbase might cost $14.90; on Binance, under $1. Huge difference for frequent trades.

Pro Tip: Use BNB on Binance for 25% fee discounts—it’s like getting cash back according to Binance Support.

However, Coinbase’s transparency helps newbies avoid surprises. Address objections: “Binance is cheaper, but is it safe?” We’ll cover that next.

Overall, Binance saves money long-term, but Coinbase’s structure suits casual users.

Security Features: Keeping Your Assets Safe

Security isn’t sexy, but losing your crypto? Nightmare. Both exchanges are solid, but Coinbase edges out with USD cash balances held in U.S. bank accounts that are eligible for FDIC insurance up to $250,000 per depositor, and cold storage for about 98% of customer crypto assets according to Coinbase’s security page. In 2025, they’ve added multi-signature wallets and biometric logins.

Binance uses two-factor authentication, address allowlisting for withdrawal security, and a SAFU fund (from fees) covering hacks—proven in past incidents. They’ve had breaches, like the 2019 hack where 7,000 BTC were stolen, but users were reimbursed from SAFU according to Binance’s official statement.

Analogy: Coinbase is a bank vault; Binance a high-tech safe with alarms.

How to Build Trust Through Crypto Exchange Security / debutinfotech.com

Important: Enable 2FA and use hardware wallets for big holdings—don’t leave everything on exchanges. Check out our guide on the best Ethereum wallets for additional security options.

I’ve never had issues, but stories of phishing keep me vigilant. Mini-wrap: Both secure, but Coinbase’s compliance gives peace of mind—especially for US users.

Advanced Tools and Features

If you’re past basics, tools matter. Binance offers everything: Margin trading, Launchpool for new tokens, auto-invest, and even crypto loans. In 2025, their AI-powered analytics help predict trends—super useful for ETH/USD swings according to Binance Research.

Coinbase has Advanced Trade with charts, order books, and perpetual futures. Plus, Coinbase Wallet for DeFi. But it’s not as feature-packed.

Example: Staking ETH on Binance yields up to 10% APY with low commissions; Coinbase takes a 35% cut of staking rewards but offers education and simplicity in return according to their staking FAQ. If you’re serious about maximizing your staking returns, check out our comprehensive comparison of the top 5 staking platforms for ETH.

Pro Tip: Try Binance’s demo mode to practice futures without risk according to Binance Futures Guide.

For intermediates, Binance feels like an upgrade. But if you’re beginner-leaning, Coinbase’s tools suffice without overload.

Regulatory Compliance and Global Availability

Regulations shape access. Coinbase is fully licensed in the US, EU, and more—after the SEC agreed to dismiss its 2023 lawsuit in 2025, its regulatory standing looks much stronger according to Reuters. It’s available in 100+ countries according to their supported countries list, but restricted in some.

Binance is global (180+ countries) but the main platform is not available to U.S. residents, who have to use Binance.US instead. They’ve improved compliance but past fines and settlements with the CFTC and FinCEN still linger according to U.S. Department of Justice announcements.

Objection: “Binance risky?” Not really for most users, but Coinbase feels safer for US folks and those who care about strict regulation.

In essence, your location decides.

Customer Support and Community

Need help? Coinbase offers 24/7 chat, phone, and guides—response times under 10 minutes in my tests according to Coinbase Support.

Binance has live chat, but wait times vary. Their Academy is gold for learning with comprehensive tutorials on everything from basic trading to advanced DeFi concepts.

Community: Both active on X (Twitter), but Binance’s forums and Binance Square buzz more with active discussions and market insights.

Warning: Scam alerts—never share keys. Always verify you’re on the official site according to FBI Internet Crime Complaint Center.

Support-wise, Coinbase edges for beginners.

Pros and Cons of Each Exchange

Coinbase Pros:

- Beginner-friendly interface

- Strong security and regulatory compliance

- Educational resources through Coinbase Learn

Coinbase Cons:

- Higher fees for retail users

- Fewer cryptocurrencies and trading pairs

Binance Pros:

- Low fees with BNB discounts

- Vast options (500+ coins, 1,500+ pairs)

- Advanced features (futures, options, AI tools)

Binance Cons:

- Steeper learning curve for newcomers

- Regulatory issues in some areas

Cryptocurrency Investment Guide: Steps and Strategies for Beginners / investopedia.com

Which Crypto Exchange Should You Choose?

It depends on your experience level and goals:

Beginners → pick Coinbase. Its intuitive design and educational resources make it the perfect starting point. Check out our guide on how to buy Bitcoin to get started.

Advanced / active traders → Binance is usually the better fit with its comprehensive toolset and lower fees. Our complete Binance tutorial walks you through everything you need to know.

Pro Tip: Use both—Coinbase for easy fiat on-ramps and long-term holds, Binance for active trading and altcoins. This strategy lets you leverage the strengths of each platform.

Ready? Get Started with Coinbase or Try Binance Now.

Last Updated: November 17, 2025

FAQ

Is Binance better than Coinbase?

Not universally. Binance wins on fees and features; Coinbase wins on simplicity, regulation, and perceived safety (especially in the US). Your choice depends on whether you prioritize cost savings or regulatory security.

Which is safer, Coinbase or Binance?

Both are large, established exchanges with strong security measures. Coinbase has the edge on regulatory clarity and USD cash balances that are eligible for FDIC insurance up to $250,000 via partner banks according to Coinbase’s terms.

Why is Binance so much cheaper?

Binance optimizes for high-volume, low-fee trading using a maker/taker model and BNB discounts, while Coinbase’s retail product bakes in higher convenience pricing for its simpler interface according to Investopedia’s analysis.

Can I use Binance in the US?

You can’t use the main Binance.com exchange as a U.S. resident; you have to use Binance.US, which has fewer coins and features due to regulatory requirements.

What are the fees on Coinbase vs Binance?

Coinbase: up to ~1.49% for simple buys, 0–0.6% on Advanced Trade, or zero trading fees with Coinbase One (subscription). Binance: around 0.1% spot (less with BNB) and low futures fees according to their respective fee schedules.

Which exchange has more cryptocurrencies?

Binance by a wide margin (500+ vs 275+ on Coinbase) according to CoinGecko data. For a broader look at exchange options, see our best crypto exchange picks.

Is Coinbase good for beginners?

Yes. Clean UI, strong compliance, and lots of educational content make it beginner-friendly according to reviews on PCMag and NerdWallet.

Does Binance have better customer support?

Not necessarily. User reviews often rate Coinbase higher overall on Trustpilot, while Binance gets more mixed feedback on support response times and resolution quality.

Can I stake on both exchanges?

Yes, but fee structures differ. Coinbase typically takes a 25–35% commission on staking rewards; Binance’s effective cut is usually lower but varies by product. For detailed comparisons, check our guide on top staking platforms for ETH.

What happened to Binance in 2025?

In 2025, Binance kept its spot as the largest exchange by volume according to CoinGecko while continuing to adjust products and leverage limits, and it remains under closer regulatory scrutiny in the U.S. and EU compared to Coinbase according to Bloomberg coverage.

Conclusion

Wrapping up, Coinbase and Binance both rock as crypto exchanges in 2025, but Coinbase suits beginners with its ease and security, while Binance wins for features and savings. Key takeaway: Start small, research, and diversify your approach.

Next steps: Sign up for Coinbase if you’re new, or Binance for depth. Not investment advice—DYOR (Do Your Own Research).

Get Started with Coinbase today or Learn More about Binance. Questions? Drop them below!