Ever wondered if jumping into Bitcoin now could change your financial future, or if it’s just another hype train speeding toward a cliff?

Let’s face it – Bitcoin has been the talk of the town for years, but in 2025, with prices hovering around $95,000 to $100,000, you’re probably asking yourself the big question: Is Bitcoin a good investment right now? I’ve been reading about cryptocurrencies for over a decade, and I’ve seen the highs (like Bitcoin’s all-time high of over $125,000 in early October 2025) and the lows (dips back under $95,000 just weeks later). Trust me, it’s not as black and white as the headlines make it seem.

In this article, I’ll give you an honest, no-BS breakdown. We’ll look at Bitcoin’s history, what’s happening in 2025, the pros and cons, and whether it fits your portfolio. Whether you’re a complete beginner dipping your toes in or an intermediate investor eyeing your next move, I’ll keep it conversational – like we’re chatting over coffee. No jargon overload, just real talk with examples, stats, and my personal takes.

Here’s a quick preview of what you’ll learn:

- The basics of Bitcoin and why it’s still turning heads in 2025

- Historical performance with real numbers to show the rollercoaster ride

- Current trends, including adoption stats and regulatory shifts

- Pros and cons lists to weigh the good against the risky

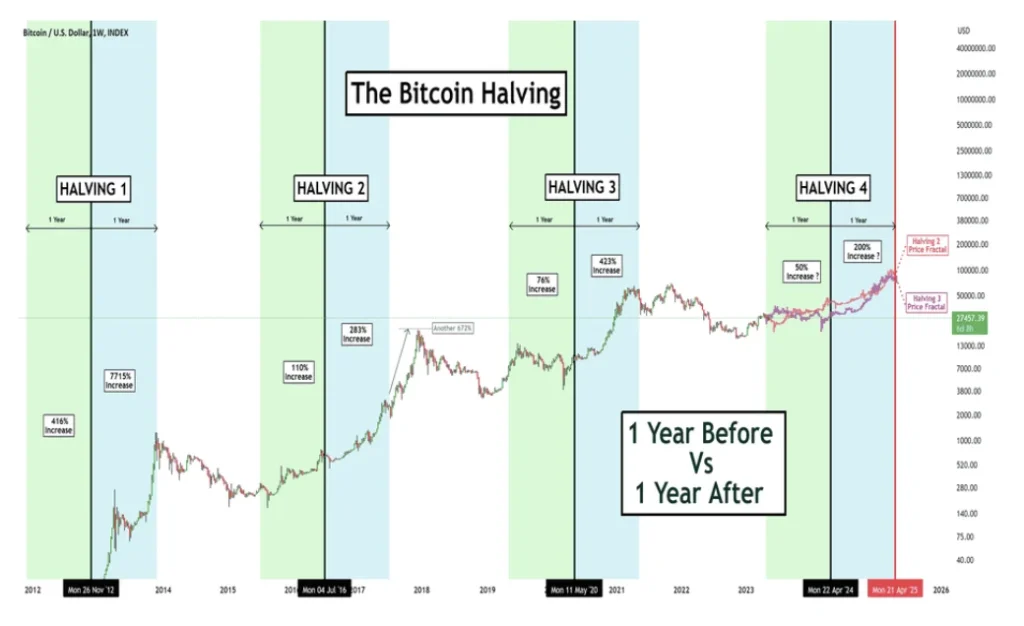

- Key factors like the 2024 halving’s impact on 2025 prices

- Safe ways to invest, plus alternatives if Bitcoin isn’t your vibe

- My honest opinion, based on years in the trenches

Before we dive in, a quick disclaimer: This isn’t financial advice. Investing in Bitcoin or any crypto involves risks, and you could lose money. Always do your own research and consult a pro if needed.

To kick things off, let’s compare Bitcoin’s performance to traditional investments. Here’s a simple table showing average annual returns over the past 5 years (roughly 2020–2025, using historical performance up to November 2025):

| Investment | Average Annual Return (2020–2025) | Volatility (Standard Deviation) |

|---|---|---|

| Bitcoin | ~100% | High (50–70%) |

| S&P 500 | ~15% | Medium (15–20%) |

| Gold | ~8% | Low (10–15%) |

| Bonds | ~4% | Very Low (5–10%) |

Source: Based on historical data from CoinMarketCap, Bitbo, Yahoo Finance and long-run asset return data

Bitcoin’s returns are eye-popping, but so is the risk – it fell nearly 10% in a single week in November 2025 and more than 20% from its October all-time high. Ready to dig deeper?

Understanding Bitcoin Basics

Alright, let’s start from square one. If you’re a beginner, Bitcoin might sound like some futuristic tech wizardry, but it’s simpler than you think.

Imagine Bitcoin as digital gold – scarce, valuable, and not controlled by any bank or government. Created in 2009 by the mysterious Satoshi Nakamoto, Bitcoin is the first cryptocurrency, running on a technology called blockchain. Think of blockchain as a super-secure, tamper-proof ledger that records every transaction ever made.

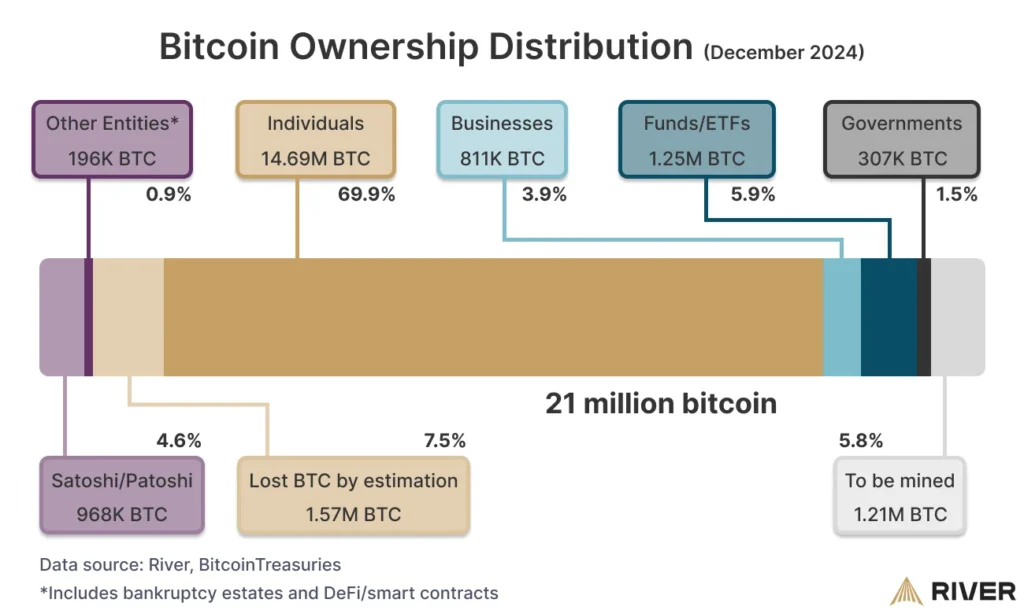

Here’s the deal: There will only ever be 21 million Bitcoins. That’s it – no more can be printed like fiat money. Miners use powerful computers to solve puzzles and add blocks to the chain, earning new Bitcoins as a reward. However, every four years, that reward halves (more on that later). After the April 2024 halving, the block reward dropped to 3.125 BTC per block. Right now, in 2025, about 19.8–19.9 million Bitcoins are in circulation.

Why does this matter for investors? Scarcity drives value.

A better analogy than Beanie Babies is gold. People hoard gold because it’s limited and useful. Bitcoin’s similar in spirit but digital. For intermediate investors, consider this: Bitcoin’s market cap climbed to over $2 trillion at its 2025 peak, making it more valuable than many major companies and even rivaling some large national economies.

Pro Tip: If you’re new, you don’t need to buy a whole Bitcoin. You can start with fractions – even $50 gets you a piece.

So, is Bitcoin complicated? Not really. Understanding the basics helps you spot hype from reality. Moving on, let’s see how it’s performed over time.

Bitcoin’s Historical Performance

Bitcoin’s ride has been wilder than a rollercoaster at an amusement park.

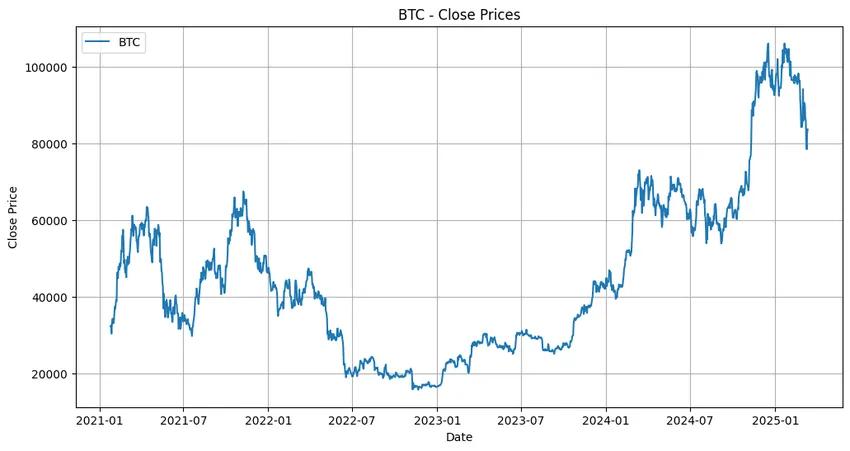

Back in 2010, one Bitcoin cost pennies. By 2017, it surged to around $20,000, then crashed to about $3,000 in 2018. In 2021, it hit around $69,000, driven by pandemic stimulus, institutional interest, and speculation.

Fast forward:

- In 2024, Bitcoin climbed to new highs around $73,000 before the halving and ETF-driven rally pushed it higher

- In 2025, it went parabolic, peaking at roughly $125,000 in early October 2025 before sliding back below $100,000 amid profit-taking and macro jitters

Overall, from 2020 to 2025, Bitcoin has delivered roughly ~100% average annual returns if you look at the sequence of yearly gains and losses (e.g., ~300% in 2020, ~60% in 2021, –64% in 2022, +155% in 2023, +120% in 2024 and a more modest ~low-double-digit gain so far in 2025). That absolutely crushes traditional assets over this specific window, but remember: averages hide pain.

Bitcoin’s volatility is brutal:

- In March 2020, it dropped around 30–40% in a couple of days during the COVID liquidity crunch

- In February 2025, it logged a 17.5% monthly loss, briefly entering a technical bear market (more than 20% off its then-record)

Case Study: The Long-Term Hold

If you invested $1,000 in Bitcoin in January 2020 when it was about $7,200, and held until around $95,000 in late 2025, that position would be worth on the order of $13,000–$15,000, depending on your exact entry and current price.

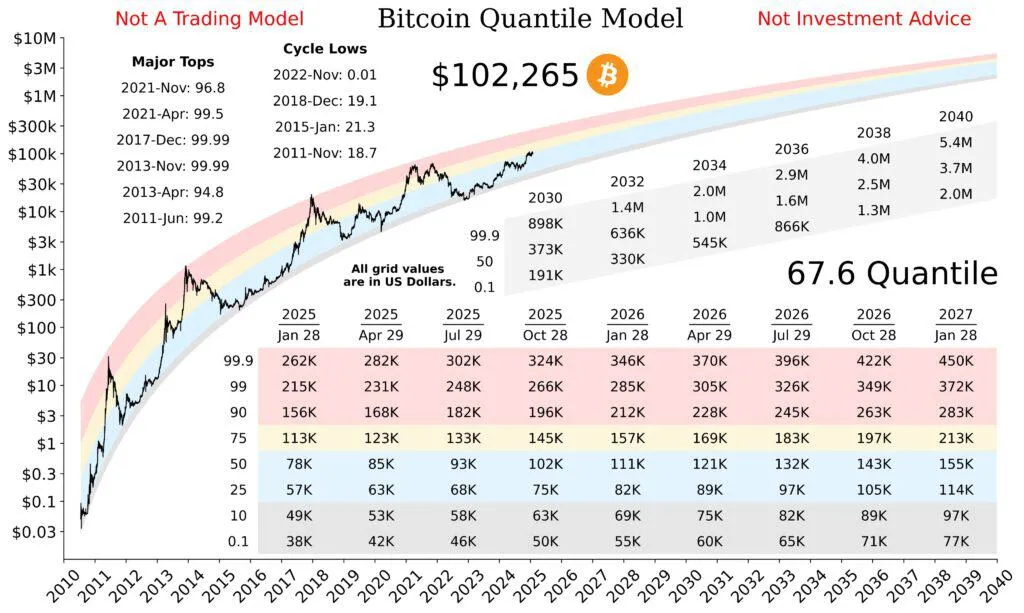

Bitcoin Price Predictions 2025 – Bitcoin Magazine / bitcoinmagazine.com

Compare that to $1,000 in the S&P 500 over the same period – you’d be closer to $2,000 or so, based on index-level total returns.

Key takeaway: Bitcoin rewards patience, but punishes panic sellers. Have you checked your risk tolerance lately?

Bitcoin Prices and Returns Comparison (2020-2025) / researchgate.net

The Current Bitcoin Landscape in 2025

As of mid-November 2025, Bitcoin is trading in the mid-$90,000s (roughly $95,000–$97,000 depending on the exchange) – down from its October peak above $120,000 but still up somewhere around 20% for the year 2025 so far.

Adoption is growing strongly, even if it’s not “everyone and their grandma” yet:

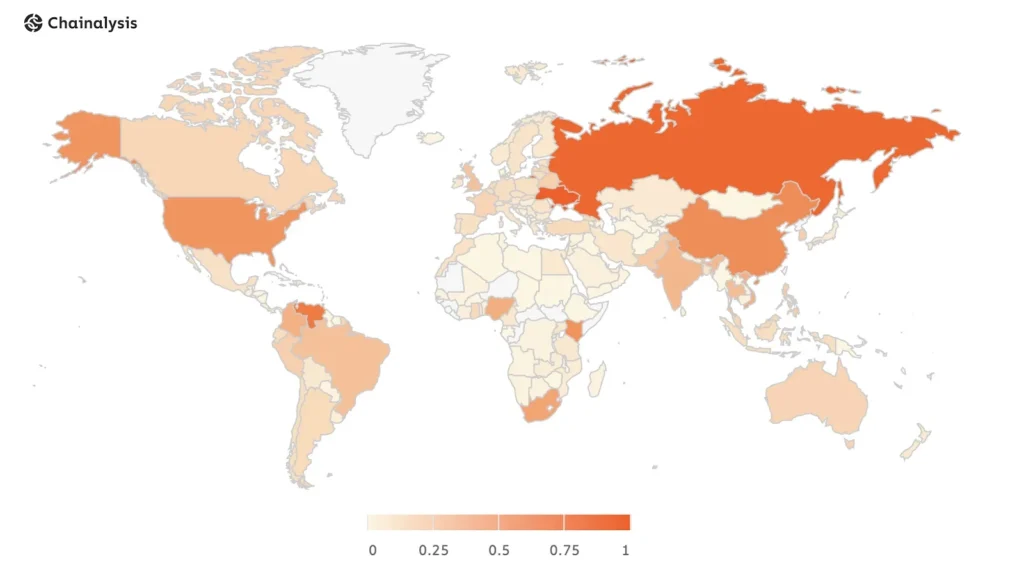

- Chainalysis’ Global Crypto Adoption Index shows that global crypto activity in 2024–2025 has exceeded the 2021 bull-market levels, with India, Nigeria and the U.S. among the top markets

- Recent IRS-linked data suggests over 2.78 million Americans actively participate in cryptocurrencies, with Bitcoin by far the most common asset

- Surveys show that about 28% of U.S. adults own some form of cryptocurrency, and among people who don’t own crypto, roughly 14% say they plan to buy in 2025

Institutions Are Piling In

- MicroStrategy alone holds nearly 500,000 BTC (tens of billions of dollars at current prices)

- Luxembourg’s Intergenerational Sovereign Wealth Fund has allocated about 1% of its assets into Bitcoin, signaling sovereign-level interest

ETFs?

U.S. spot Bitcoin ETFs have seen massive inflows since approval, helping drive Bitcoin above $100,000 for the first time and contributing to its move above $120,000 in 2025. These institutional investment vehicles have opened the floodgates for traditional investors seeking crypto exposure.

Bitcoin Adoption: Institutional FOMO – Chart Pilgrim / chartpilgrim.substack.com

Regulation is Shifting More Pro-Crypto

In the U.S., stablecoin legislation like the GENIUS Act, together with initiatives around a U.S. Strategic Bitcoin Reserve and proposals like the BITCOIN Act, are aimed at bringing digital assets inside a clearer regulatory framework and even into reserve discussions – though they don’t magically remove risk.

In short, 2025 feels like Bitcoin’s mainstream moment: ETFs, institutions, sovereign funds, and friendlier regulation. The big question is whether this is sustainable or euphoric. Let’s weigh the pros and cons.

Pros of Investing in Bitcoin

Bitcoin’s got some serious upsides. Here’s what makes it compelling:

1. Limited Supply

Only 21 million BTC ever, with ~19.8–19.9 million already mined. That hard cap is unlike fiat currencies, which central banks can print indefinitely. This scarcity is programmed into Bitcoin’s code, making it predictable and finite.

2. High Return Potential

- JPMorgan analysts argue Bitcoin’s “fair value” is around $170,000 in the next 6–12 months, based on comparisons with gold

- VanEck has reiterated a $180,000 price target for Bitcoin by year-end 2025

Are they guaranteed right? No. However, it shows how seriously large institutions are now modeling upside.

3. Decentralization

No central authority controls Bitcoin. Its monetary policy is coded – new issuance halves every ~4 years. This gives it a different profile from fiat currencies that can be devalued by policy choices. Unlike centralized alternatives, Bitcoin operates on a peer-to-peer network.

4. Potential Hedge Against Monetary Debasement

Over longer periods, particularly 2020–2021, Bitcoin significantly outpaced bonds and often stocks during phases of aggressive money printing and stimulus. In other periods (notably 2022), it has underperformed badly – so it’s not a perfect hedge, but it can behave as one in certain regimes.

5. Global Accessibility

You can send Bitcoin across borders without a bank, 24/7. Even though on-chain fees can spike at times, second-layer solutions like Lightning Network aim to make transfers cheaper and faster.

6. Growing Adoption & Institutionalization

- Hundreds of millions globally now hold some crypto, and Bitcoin is held by over 100 million people worldwide

- Surveys of hedge funds show 55% now invest in crypto, with average allocations around 7% of AUM (though many keep <2%)

Pro Tip: Many portfolio studies suggest allocating 5–10% to Bitcoin/crypto at most for diversification – enough to matter if it moons, but not enough to wreck you if it crashes.

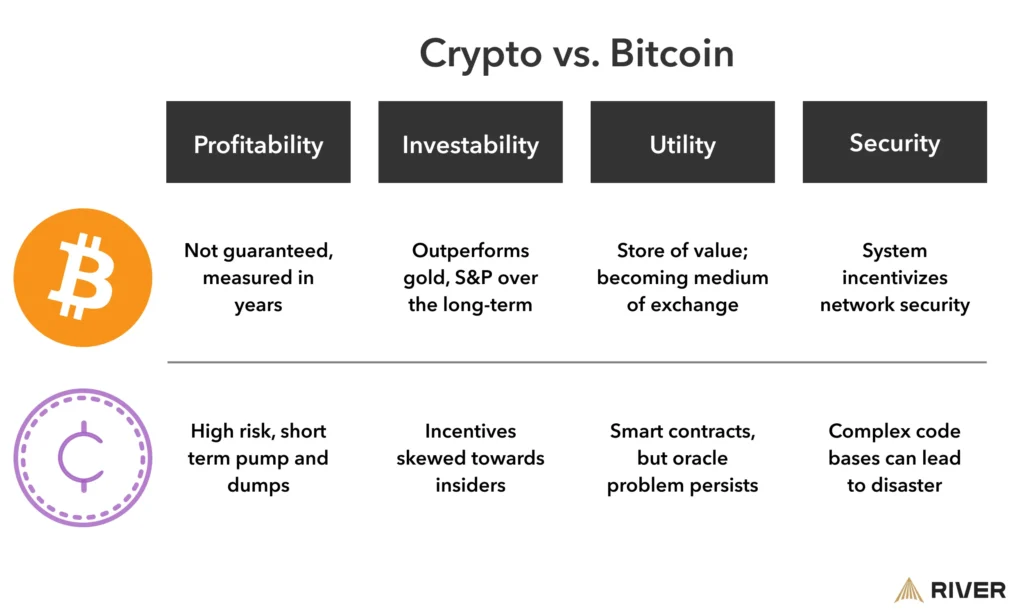

Crypto vs. Bitcoin: What You Need to Know / river.com

Cons and Risks of Bitcoin Investment

Here’s the honest part – Bitcoin isn’t a sure thing.

1. Extreme Volatility

Prices can swing wildly. We’ve seen:

- –17.5% in one month (February 2025)

- Double-digit percentage moves in a single day during crises

If a 30% overnight drawdown would make you panic-sell, Bitcoin can be dangerous for your nerves and your wallet.

2. Regulatory Uncertainty

Rules are evolving fast. While the direction in the U.S. lately is more supportive, new taxes, reporting rules, or restrictions could hit returns. Starting with the 2025 tax year, U.S. brokers must report customers’ digital asset transactions to the IRS on the new Form 1099-DA, increasing transparency and enforcement.

3. No Cash Flows / “Intrinsic Value” Debate

Bitcoin doesn’t produce earnings, dividends, or rent. Critics compare it to a speculative bubble or “digital tulips.” Whether you see it as “digital gold” or a “greater fool” game is ultimately a value judgment.

4. Energy and Environmental Concerns

Bitcoin mining consumes significant electricity. While an increasing share comes from renewables or otherwise-stranded energy, environmental concerns remain a live political and ESG risk.

5. Security & Operational Risks

- Exchanges have been hacked

- If you self-custody and lose your keys, your coins are gone. There is no “forgot password” button on the blockchain

6. Market Structure & Manipulation

Large holders (“whales”) and leveraged derivatives markets can amplify moves. Sudden liquidations can trigger cascading sell-offs.

Warning: Never invest money you can’t afford to lose. Bitcoin’s volatility can easily turn $10,000 into $2,000 on the wrong side of a cycle.

Mini-wrap: Risks are real, but if managed properly (position sizing, time horizon, risk tolerance), Bitcoin can still play a powerful role in a portfolio.

Key Factors Influencing Bitcoin in 2025

Several things could make or break Bitcoin this year and next:

1. 2024 Halving Aftereffects

The April 2024 halving cut miner rewards from 6.25 BTC to 3.125 BTC per block. Historically, price tends to move strongest 12–18 months after halvings, as supply entering the market is structurally reduced. 2025 sits right in that window.

2. Regulation and Policy

- The GENIUS Act and related U.S. stablecoin laws bring more clarity to dollar-pegged tokens used across crypto markets

- Initiatives like the U.S. Strategic Bitcoin Reserve and proposed BITCOIN Act highlight Bitcoin’s growing geopolitical role, even if details and long-term impacts are still debated

3. Spot Bitcoin ETF Flows

ETF inflows are a key driver: large net inflows mean constant buy pressure; outflows mean the opposite. Analysts frequently watch ETF flow data as a proxy for institutional appetite.

4. Macro Environment (Rates, Liquidity, Risk Appetite)

If interest rates fall, liquidity rises and risk assets tend to benefit – Bitcoin included. Conversely, a sharp tightening or risk-off shock could send Bitcoin down hard.

5. Adoption Metrics

- Global crypto ownership sits around 10% of the internet population (≈550–560 million people), with Bitcoin still the flagship asset

- Henley’s Crypto Adoption Index and Chainalysis reports show countries like Singapore, the U.S., UAE, India, and Nigeria emerging as major hubs

The 2020 Global Crypto Adoption Index: Cryptocurrency is a Global Phenomenon / chainanalysis.com

Pro Tip: If you want to track Bitcoin’s “health,” watch: ETF flows, on-chain activity, funding rates on futures, and macro headlines (especially Fed decisions and major regulatory announcements).

How to Invest in Bitcoin Safely

Ready to dip in? Here’s a simple, practical path:

1. Pick a Reputable On-Ramp (Exchange or Broker)

Examples include large, regulated platforms with strong security records and clear KYC/AML policies. Check for licensing in your jurisdiction and cold-storage practices. If you’re just starting out, our guide on the best crypto exchanges for buying top cryptocurrencies in 2025 can help you choose the right platform.

2. Enable Strong Security

- Turn on two-factor authentication (2FA)

- Use strong, unique passwords and a password manager

3. Choose a Storage Method

- Hardware wallet (e.g., Ledger, Trezor) for larger, long-term holdings

- Non-custodial software wallets if you want control but don’t yet need a hardware device

4. Consider Dollar-Cost Averaging (DCA)

Instead of going all-in at once, buy a fixed amount (say $50 or $100) on a regular schedule. This helps smooth out volatility over time.

Example: Sarah invests $100 every month regardless of price. Over years, she buys more BTC when it’s cheap and less when it’s expensive, averaging her cost.

5. Diversify

Don’t bet the farm on Bitcoin. Combine it with stocks, bonds, cash and maybe other assets depending on your situation. If you’re considering other cryptocurrencies, check out our Bitcoin vs Ethereum comparison guide to understand the differences.

6. Beware Scams and Over-Leverage

- Never share your seed phrase, ever

- Avoid “guaranteed returns,” signal groups, and random DMs

- Be cautious with leveraged products – they amplify losses as much as gains

If direct ownership feels intimidating, spot Bitcoin ETFs or publicly traded Bitcoin-exposed companies are another way to get price exposure without managing wallets yourself.

Bitcoin vs. Other Investments

How does Bitcoin stack up?

Bitcoin vs. Stocks (S&P 500)

Over 2020–2024, Bitcoin massively outperformed the S&P 500 in total return. However, it also had much deeper drawdowns (e.g., –64% in 2022). Stocks are far smoother and backed by earnings.

Bitcoin vs. Gold

Gold hit new highs above $3,700/oz in 2025 and remains the classic inflation hedge. Bitcoin has delivered far higher upside but far more volatility and risk. Some see BTC as “digital gold 2.0”; others think gold’s 5,000-year track record is irreplaceable.

Bitcoin vs. Bonds

Bonds provide income and (usually) lower volatility. Bitcoin has been more of a high-beta macro asset than a sleepy store of value, especially during risk-on periods.

Bitcoin vs. Ethereum

If you’re considering alternative cryptocurrencies, Ethereum offers different use cases with its smart contract platform. Our detailed Bitcoin or Ethereum investment comparison for 2025 breaks down which might suit your portfolio better. Additionally, institutional adoption through Ethereum ETFs is creating new opportunities in the crypto space.

Bitcoin vs. Altcoins

Altcoins (ETH, SOL, etc.) can outperform BTC in bull runs but are generally riskier and more prone to going to zero. Bitcoin remains the most battle-tested, most liquid, and the primary institutional entry point.

For a comprehensive look at how these two leading cryptocurrencies compare as investments, see our Bitcoin vs Ethereum complete investment guide for 2025.

Important: Bitcoin isn’t a replacement for everything. It’s a speculative, high-risk/high-reward asset that can complement, not substitute, a sane investment plan.

My Personal Opinion on Bitcoin in 2025

I’ve invested since 2015, and here’s my straight answer:

Yes, I think Bitcoin is a good investment in 2025 — for the right kind of investor and in the right size.

Adoption is increasing, regulation is maturing, and the 2024 halving plus ETF flows create a strong structural tailwind. Serious analysts (JPMorgan, VanEck, Bernstein, Fundstrat and others) are openly modeling $150k–$200k+ scenarios in the next cycle.

But:

- Volatility is still wild and unpredictable. You must be psychologically and financially prepared for 50% drawdowns

- Bitcoin is not “safe” in the way government bonds or savings accounts are

If you’re a beginner:

- Start tiny. Like “I won’t cry if I lose this” money

- Focus on learning first, FOMO later

If you’re an intermediate investor:

A 5–10% allocation in a diversified portfolio can make sense if you understand the risks and are playing a multi-year game.

Pro Tip: Follow a mix of bulls and skeptics (on-chain analysts, macro people, regulators, critics like the IMF or BIS). Echo chambers are dangerous in crypto.

Is it right for you? That depends on your time horizon, risk tolerance, and how you’d feel if Bitcoin halved again before going higher.

FAQ

Is Bitcoin still worth buying in 2025?

For many people, yes — in moderation. With growing institutional adoption, ETF access, and post-halving dynamics, analysts see potential for moves toward $150k–$200k in bullish scenarios. However, there are no guarantees, and you must be ready for big drawdowns.

What are the risks of investing in Bitcoin?

High volatility, regulatory changes, tax complexity, exchange or wallet hacks, self-custody mistakes, and the possibility that Bitcoin underperforms or never reaches the optimistic price targets.

How much should I invest in Bitcoin?

A common rule of thumb is 1–5% of your net worth if you’re cautious, maybe up to 10% if you really understand the asset and can tolerate risk. Never invest money you can’t afford to lose.

Is Bitcoin better than gold?

Depends on your priorities:

- Bitcoin → higher upside, higher risk, more volatility, more tech/regulatory uncertainty

- Gold → lower volatility, deep history, but lower long-term growth expectations

Will Bitcoin go up in 2025?

No one knows. Many models and forecasts point to upside (some into the $170k–$200k range), especially if ETF inflows and macro conditions cooperate. However, the same analysts warn of painful corrections along the way.

Is Bitcoin a bubble?

Some economists and traditional bankers say yes, pointing to the lack of cash flows and wild price swings. Others argue that Bitcoin’s scarcity, network effects, and growing institutional adoption justify its valuations. The truth may lie somewhere in the middle – it can be both overvalued and structurally important at the same time.

Can Bitcoin make you rich?

It has made some people very rich and wiped out others. It’s more like high-stakes venture capital than a savings account.

Is it too late to invest in Bitcoin?

Not necessarily. Global crypto adoption is still well under 20% of the world’s population, and in the U.S. only about 28% of adults own crypto at all, with about 14% of non-owners saying they plan to buy in 2025. The upside may be lower than in 2013, but so is the existential risk.

What is the future of Bitcoin?

Likely more regulation, deeper integration into traditional finance, central bank and sovereign-level conversations, and continued debates over energy and systemic risk.

How does Bitcoin halving affect price?

Halvings reduce the rate at which new Bitcoin enters circulation. Historically, the biggest bull runs have often happened after halvings, as reduced supply meets new waves of demand — but past performance is not a guarantee of future results.

How to Read and Interpret the Bitcoin Halving Price Chart / bitcoinmagazinepro.com

Conclusion

So, is Bitcoin a good investment in 2025?

Honestly: yes, for some people — and absolutely not for others.

If you:

- Have a multi-year time horizon

- Can handle big swings without panicking

- Treat Bitcoin as a high-risk slice of a diversified portfolio

…then Bitcoin can be a compelling asymmetric bet in 2025.

If you:

- Lose sleep over volatility

- Need your money in the next 6–12 months

- Want guarantees

…then Bitcoin is probably not your asset.

Next Steps:

- Assess your risk tolerance honestly

- Read more from both Bitcoin bulls and skeptics

- If you decide to invest, start small, use reputable platforms, and secure your holdings properly

Ready to act? Whether you open a spot Bitcoin ETF position or buy a tiny fraction of a coin directly, treat Bitcoin as a serious, high-risk investment — not a lottery ticket.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.